Table of Contents

- Executive Summary: Key Trends in Zinc Oxynitride Thin-Film Semiconductor Manufacturing

- Technology Overview: Properties and Advantages of Zinc Oxynitride

- Manufacturing Process Innovations in 2025

- Market Size and Growth Forecasts Through 2030

- Leading Players and Strategic Partnerships (Sources: samsung.com, lg.com, ieee.org)

- Application Spotlight: Display Technologies, Sensors, and Power Devices

- Competitive Landscape: Zinc Oxynitride Versus IGZO and Other Semiconductors

- Challenges: Scalability, Cost, and Supply Chain Issues

- Regulatory and Environmental Considerations (Sources: ieee.org, semiconductors.org)

- Future Outlook: Key Opportunities and Disruptive Potential to 2030

- Sources & References

Executive Summary: Key Trends in Zinc Oxynitride Thin-Film Semiconductor Manufacturing

Zinc oxynitride (ZnON) thin-film semiconductor manufacturing is experiencing rapid development as the industry seeks alternatives to conventional amorphous silicon (a-Si) and indium gallium zinc oxide (IGZO) for next-generation displays, sensors, and flexible electronics. As of 2025, several key trends are shaping the landscape, driven by the material’s favorable electronic properties, earth-abundant constituents, and compatibility with low-temperature processes.

- Adoption in Advanced Display Technologies: Display manufacturers are increasingly exploring ZnON as a channel material for thin-film transistors (TFTs) due to its high electron mobility and visible transparency. Companies such as LG Display and Samsung Display have ongoing R&D programs focused on zinc-based oxynitride semiconductors for potential use in OLED and microLED backplanes, aiming to improve resolution and response speeds while maintaining low power consumption.

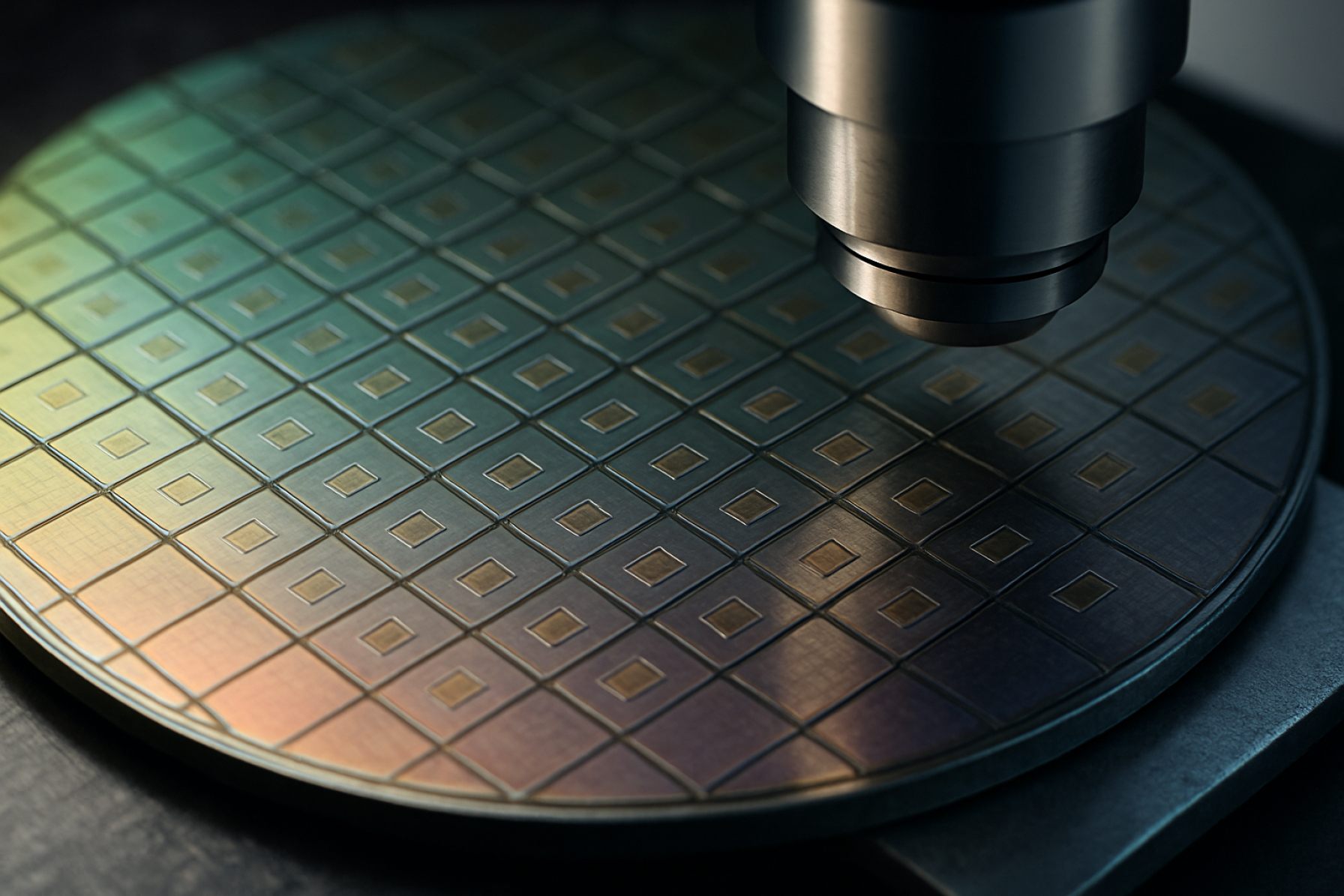

- Process Integration and Manufacturing Scalability: Equipment suppliers like Applied Materials and ULVAC are optimizing physical vapor deposition and reactive sputtering systems for precise control of oxygen and nitrogen incorporation during ZnON film growth. These process advancements are essential for achieving uniformity and reproducibility at Gen 6 and larger panel sizes, directly impacting mass production feasibility.

- Material Sourcing and Sustainability: The zinc-based composition of ZnON alleviates critical raw material dependency concerns, as zinc is more abundant and less costly than indium. This aligns with the sustainability goals of supply chain leaders such as Novaled and SDI, who are evaluating ZnON for eco-friendly device architectures.

- Device Performance and Reliability: Collaborative research with organizations like National Institute for Materials Science (NIMS) is focusing on the improvement of stability under bias stress and environmental conditions, a critical parameter for commercial deployment in high-end electronics.

Looking ahead to the late 2020s, the outlook for ZnON thin-film semiconductor manufacturing is positive. Industry roadmaps indicate continued investment in pilot lines and early commercial deployments, particularly in premium display segments and emerging applications such as transparent electronics and wearable devices. As process maturity increases and device reliability benchmarks are met, ZnON is poised to play a significant role in diversifying the semiconductor material ecosystem.

Technology Overview: Properties and Advantages of Zinc Oxynitride

Zinc oxynitride (ZnON) thin-film semiconductors are rapidly gaining attention as a next-generation material for electronic device manufacturing, particularly for applications requiring high mobility, transparency, and low-temperature processing. The unique properties of ZnON stem from its ternary composition, combining zinc oxide (ZnO) and zinc nitride (Zn3N2), resulting in a tunable bandgap (typically 1.0–3.3 eV) and superior electrical characteristics compared to conventional amorphous silicon or metal oxide semiconductors.

A key advantage of ZnON is its high electron mobility, which can surpass 40 cm2/Vs at room temperature—significantly higher than that of amorphous indium gallium zinc oxide (a-IGZO) commonly used in current display technologies. This performance boost enables faster switching speeds and lower power consumption in thin-film transistors (TFTs), making ZnON an attractive candidate for advanced display backplanes, logic circuits, and sensor arrays.

ZnON also offers excellent optical transparency in the visible spectrum, rendering it suitable for transparent electronics and optoelectronic devices. Its wide bandgap and tunable electronic properties support the design of transparent TFTs, solar cells, and UV photodetectors. Moreover, the low-temperature fabrication compatibility (often below 200°C) allows ZnON films to be deposited on flexible plastic substrates, facilitating the manufacturing of flexible and wearable electronic devices.

From a manufacturing perspective, ZnON thin films can be deposited using established techniques such as reactive sputtering or pulsed laser deposition, both of which are scalable for industrial production. Leading equipment providers like ULVAC, Inc. and Oxford Instruments are actively developing sputtering and plasma-enhanced deposition systems optimized for ternary oxynitride materials, enabling precise control over film composition and thickness.

Another critical property is ZnON’s environmental stability and compatibility with existing semiconductor process flows. Unlike some alternative materials, ZnON demonstrates robust chemical durability and resistance to moisture and oxygen ingress, a key requirement for device longevity, particularly in display and sensor applications.

The outlook for ZnON thin-film semiconductor manufacturing in 2025 and the coming years is promising. With ongoing investments from major display and semiconductor manufacturers, such as LG Display and Samsung Display, and the continued optimization of deposition technologies by equipment suppliers, ZnON is poised to play a significant role in next-generation electronics, offering a favorable balance of performance, manufacturability, and cost.

Manufacturing Process Innovations in 2025

Zinc oxynitride (ZnON) thin-film semiconductors are gaining traction in the semiconductor industry due to their high electron mobility and tunable properties, making them promising for applications in next-generation displays, transparent electronics, and high-frequency devices. As of 2025, manufacturing innovations are focused on improving material quality, process scalability, and device integration.

One of the most significant advances is the adoption of low-temperature deposition techniques, such as plasma-enhanced atomic layer deposition (PEALD) and pulsed laser deposition (PLD), which enable high-quality ZnON films to be fabricated on flexible and sensitive substrates. ULVAC, Inc., a leading equipment supplier, has expanded its portfolio to include advanced sputtering and PEALD systems tailored for oxide and oxynitride thin-film production, facilitating large-area and uniform ZnON coatings crucial for flat panel display manufacturing.

Simultaneously, there is a trend toward in-line monitoring and process automation. This is exemplified by Applied Materials, which has integrated real-time plasma diagnostics and substrate temperature control into its thin-film deposition platforms. Such capabilities are essential for ensuring the precise oxygen and nitrogen stoichiometry that dictates ZnON’s electronic properties. These process controls are being adopted by fabrication facilities to achieve repeatable and reliable electronic characteristics at scale.

Materials innovation is also underway. Companies like Tosoh Corporation have introduced higher-purity zinc and nitrogen precursors that reduce contamination and enhance carrier mobility in ZnON films. The integration of these specialty materials is enabling device manufacturers to push the performance of ZnON-based thin-film transistors (TFTs) closer to that of amorphous silicon and indium gallium zinc oxide (IGZO), but with lower cost and improved environmental stability.

Looking ahead, the next few years will likely see further collaboration between deposition equipment providers and display panel manufacturers, such as LG Display, who are actively exploring alternative semiconductor channels for advanced display backplanes. Process innovations—including roll-to-roll deposition for flexible electronics and combinatorial sputtering for rapid material screening—are expected to move from pilot lines to high-volume manufacturing.

Altogether, the synergy between equipment, material, and device innovation is set to solidify ZnON’s role in thin-film semiconductor technology, with 2025 marking a pivotal year for the maturation of scalable, high-performance ZnON manufacturing processes.

Market Size and Growth Forecasts Through 2030

The market for zinc oxynitride (ZnON) thin-film semiconductors, while still emerging, is poised for considerable growth through 2030 as demand for advanced display technologies, flexible electronics, and high-performance thin-film transistors (TFTs) accelerates. ZnON offers a unique combination of high electron mobility, optical transparency, and compatibility with low-temperature processing, positioning it as a promising alternative to traditional amorphous silicon and even indium gallium zinc oxide (IGZO) semiconductors.

Recent industry developments in 2024 and early 2025 indicate a broadening commercialization of ZnON-based technologies. Companies such as ULVAC, Inc. and Applied Materials, Inc. are actively engaged in the development and supply of advanced sputtering and plasma-enhanced chemical vapor deposition (PECVD) systems, which are essential for the scalable production of ZnON thin films. The integration of ZnON into display backplanes and sensor applications is being explored by leading display panel manufacturers, including LG Display Co., Ltd., who have publicly demonstrated interest in next-generation oxide semiconductors for high-resolution and energy-efficient displays.

While precise market sizing data specific to ZnON thin-film semiconductors remains limited due to the technology’s nascency, related oxide semiconductor segments offer insight into potential trajectories. The global oxide TFT market—a segment where ZnON is expected to gain share—was valued at several hundred million USD in 2023 and is projected to surpass USD 2 billion by 2030, driven by surging demand for OLED and microLED displays, as well as advanced sensor arrays. ZnON’s superior electrical properties and reduced reliance on critical metals (such as indium) further enhance its attractiveness amid supply chain and sustainability considerations.

Looking ahead, the adoption rate of ZnON thin films is anticipated to accelerate from 2025 onward, as pilot lines transition to volume manufacturing and device qualification cycles shorten. Industry roadmaps from TCL CSOT and Sharp Corporation suggest ZnON-based TFTs could begin appearing in commercial display panels and sensor arrays as early as 2026–2027. This transition is likely to be enabled by ongoing process optimization, improvements in film uniformity, and demonstrated long-term device stability.

By 2030, ZnON thin-film semiconductor manufacturing is expected to capture a significant market share within the broader oxide semiconductor ecosystem, supported by continued investment from equipment suppliers, materials companies, and display manufacturers. As supply chains mature and production yields improve, ZnON’s cost-performance benefits are likely to drive further market expansion across consumer electronics, automotive displays, and industrial sensing platforms.

Leading Players and Strategic Partnerships (Sources: samsung.com, lg.com, ieee.org)

The zinc oxynitride (ZnON) thin-film semiconductor landscape in 2025 is characterized by the emergence of major electronics manufacturers and strategic collaborations aimed at scaling production and optimizing device performance. Samsung continues to lead in research and development, leveraging its expertise in thin-film transistor (TFT) technology for advanced display applications. Building on previous investments in oxide semiconductors, Samsung is integrating ZnON as a channel material to enhance electron mobility and enable high-resolution, low-power displays, with pilot manufacturing lines targeting OLED and quantum-dot displays.

LG is similarly active, focusing on ZnON-based TFTs for large-area displays and next-generation transparent electronics. In 2024, LG established a partnership with materials suppliers and equipment manufacturers to streamline ZnON deposition processes using advanced sputtering and atomic layer deposition (ALD) techniques. This collaboration aims to reduce defect density and improve film uniformity, positioning LG to meet the rising demand for ultra-high-definition panels and flexible devices in 2025 and beyond.

Strategic alliances are also evident in joint research and standardization efforts. The IEEE—through its Electron Devices Society and technical symposia—has fostered cross-industry working groups focused on ZnON device reliability, scalability, and environmental impact. In 2025, these initiatives are expected to yield new guidelines for ZnON integration in commercial processes, facilitating broader adoption across consumer electronics and emerging sectors such as automotive heads-up displays and wearable biosensors.

Looking ahead, the next few years will likely see intensified collaboration between display manufacturers, equipment suppliers, and academic partners. Key objectives include optimizing ZnON thin-film uniformity at production scale, lowering processing temperatures for compatibility with flexible substrates, and developing proprietary compositions that further boost carrier mobility. As ZnON technology matures, leading players like Samsung and LG are well-positioned to capitalize on increased consumer demand for energy-efficient, high-performance electronic displays, while industry bodies such as IEEE play a pivotal role in setting the stage for standardized, reliable implementation across global markets.

Application Spotlight: Display Technologies, Sensors, and Power Devices

Zinc oxynitride (ZnON) thin-film semiconductors are emerging as a compelling material choice for advanced electronics, particularly in display technologies, sensor platforms, and power devices. As of 2025, the drive for higher mobility, enhanced transparency, and low-temperature processing is accelerating ZnON adoption across multiple sectors.

In display technologies, ZnON thin films are gaining traction as active channel materials for next-generation thin-film transistors (TFTs), which are critical in high-resolution OLED and LCD panels. Leading display manufacturers such as LG Display and Samsung Display are actively exploring oxide semiconductor alternatives, including ZnON, due to their superior electron mobility compared to amorphous silicon and better uniformity than IGZO at lower production temperatures. This transition supports the fabrication of ultra-high-definition, flexible, and energy-efficient displays, with pilot production lines expected to ramp up through 2025 and beyond.

Sensors represent another promising application area. ZnON’s tunable bandgap and strong chemical sensitivity make it suitable for gas, photodetector, and biosensing devices. Companies specializing in integrated sensor solutions, such as TDK Corporation and Murata Manufacturing, are evaluating ZnON’s properties for high-performance environmental and medical sensors, leveraging its compatibility with large-area deposition and low thermal budgets. Innovations in atomic layer deposition (ALD) and sputtering—deposition techniques supported by suppliers like ULVAC, Inc.—are enabling precise control of ZnON film composition and thickness, which is critical for device reproducibility and sensitivity.

Power device manufacturers are also investigating ZnON as an alternative to conventional silicon and wide-bandgap materials for thin-film transistors and diodes. Panasonic Holdings Corporation and KYOCERA Corporation have reported research into ZnON-based device architectures for low-power and transparent electronic applications. The high breakdown voltage and efficient charge transport of ZnON are particularly attractive for transparent power electronics and circuit integration in smart windows and IoT devices.

Looking ahead, the ZnON thin-film semiconductor manufacturing sector is poised for steady growth, buoyed by advancements in deposition equipment, material purity, and integration processes. Cross-industry collaborations between materials suppliers, device manufacturers, and equipment providers are expected to accelerate commercialization. The coming years will likely see ZnON firmly establish itself in the supply chain for displays, sensors, and power devices, as production scales and device reliability metrics are further validated.

Competitive Landscape: Zinc Oxynitride Versus IGZO and Other Semiconductors

The competitive landscape for zinc oxynitride (ZnON) thin-film semiconductor manufacturing is rapidly evolving, especially as display and electronics manufacturers seek alternatives to indium gallium zinc oxide (IGZO) and other oxide semiconductors. ZnON offers several potential advantages over IGZO, including higher electron mobility, tunable electronic properties, and the use of more earth-abundant elements, which could lead to lower long-term material costs and improved supply chain resilience.

In 2025, IGZO remains the dominant material for advanced thin-film transistors (TFTs) in large-area displays, with manufacturers such as Sharp Corporation and LG Display scaling IGZO-based OLED and LCD panels to mass production. IGZO’s stability, high mobility (typically 10–20 cm²/V·s), and established process integration with existing amorphous silicon fabrication lines continue to drive its broad adoption in high-end TVs and mobile displays.

However, ZnON is gaining attention as a next-generation alternative, with research and pilot-scale manufacturing activities intensifying. Companies like Toray Industries, Inc. have announced advancements in ZnON sputtering targets and deposition processes, aiming to achieve high mobility (potentially exceeding 30 cm²/V·s) and uniformity suitable for large substrates. Furthermore, ZnON’s reduced reliance on indium and gallium addresses concerns about critical raw material supply, especially as the electronics industry anticipates increased demand for these elements.

Equipment suppliers such as Applied Materials, Inc. and ULVAC, Inc. are reportedly collaborating with display manufacturers and material suppliers to develop scalable ZnON deposition and annealing equipment, targeting integration with existing TFT process flows. These partnerships are expected to accelerate ZnON’s process maturity over the next two to three years, with pilot production lines projected to begin operation by 2026.

Beyond displays, ZnON is also being evaluated for sensor and transparent electronics applications, with organizations like Novaled GmbH exploring its use in organic electronic devices. The next few years are likely to see increased competition between ZnON and IGZO, with ZnON’s commercial viability hinging on overcoming challenges related to defect control, long-term reliability, and compatibility with industry-standard manufacturing equipment.

Overall, while IGZO maintains its commercial advantage in 2025 due to process maturity and supply chain infrastructure, the competitive landscape is poised for disruption as ZnON thin-film technology approaches commercial readiness. Industry observers anticipate that successful pilot lines, coupled with demonstrated cost and performance benefits, could enable ZnON to capture market share in advanced display and flexible electronics applications by the late 2020s.

Challenges: Scalability, Cost, and Supply Chain Issues

Zinc oxynitride (ZnON) thin-film semiconductors have garnered significant attention for their potential in next-generation electronics and optoelectronics. However, as the industry moves toward broader commercialization in 2025 and beyond, several challenges persist relating to scalability, cost, and the stability of supply chains.

Scalability remains a core issue as most ZnON thin-film fabrication is currently limited to laboratory and pilot-scale processes. High-throughput and large-area deposition techniques, such as sputtering and atomic layer deposition (ALD), are being explored; however, achieving uniform film quality and reproducibility across large substrates is still a challenge. Equipment manufacturers such as Oxford Instruments and ULVAC, Inc. are progressively developing next-generation deposition platforms to enable mass production, but integration into existing semiconductor fabs is slow due to stringent process controls required for ZnON films.

Cost factors are closely tied to scalability. The current reliance on high-purity zinc and nitrogen precursors, along with the need for precise process control, drives up production expenses. Furthermore, the lack of established supply chains for key ZnON-specific precursors and targets means prices remain volatile. Device manufacturers, such as Sharp Corporation, have reported that while ZnON offers superior mobility over amorphous silicon, its processing costs are not yet competitive for high-volume applications such as display backplanes and transparent electronics.

Supply Chain Issues are also emerging as critical. The semiconductor industry has faced widespread disruptions in the supply of specialty gases and metals since 2020, a situation that remains unresolved for niche materials such as those required for ZnON synthesis. Suppliers like American Elements and Alfa Aesar are expanding their catalogues of high-purity zinc, oxygen, and nitrogen compounds, but the global supply remains concentrated and vulnerable to geopolitical and logistical disruptions.

Looking ahead through 2025 and the ensuing years, industry stakeholders are prioritizing the establishment of more resilient and diversified supply chains, as well as investing in research to reduce process complexity and costs. Progress in the standardization of ZnON material specifications and process parameters is anticipated, with industry consortia such as SEMI beginning to address these needs. Despite these efforts, the transition of ZnON thin-film semiconductors from pilot lines to mainstream manufacturing will likely be gradual, dictated by ongoing developments in scalability, cost reduction, and supply chain robustness.

Regulatory and Environmental Considerations (Sources: ieee.org, semiconductors.org)

The regulatory and environmental landscape for zinc oxynitride (ZnON) thin-film semiconductor manufacturing is evolving rapidly as the industry responds to increasing governmental scrutiny and sector-wide sustainability initiatives. In 2025, manufacturers of advanced semiconductors face heightened expectations for transparency, chemical safety, and lifecycle management, especially as ZnON’s potential for large-area electronics and transparent devices brings new materials into mainstream production.

Regulatory frameworks in key markets—such as the European Union’s REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and the United States’ TSCA (Toxic Substances Control Act)—are shaping the adoption and processing of zinc oxynitride. These rules require thorough characterization of precursor chemicals, effluents, and byproducts, prompting manufacturers to invest in advanced environmental monitoring and reporting systems. The Semiconductor Industry Association has highlighted ongoing industry efforts to proactively identify and mitigate risks associated with novel thin-film materials, including ZnON, by collaborating with regulators and standard-setting bodies.

Environmental considerations are also driving process innovation. ZnON manufacturing typically involves reactive sputtering or plasma-enhanced chemical vapor deposition—processes that may emit nitrogen oxides, ozone, and trace metal particulates. Companies are therefore implementing abatement systems and closed-loop recycling for process gases and metal targets, aligning with the sector’s broader commitment to reducing greenhouse gas emissions and hazardous waste, as outlined by IEEE working groups on sustainable semiconductor manufacturing.

Looking ahead, the next few years are expected to see the adoption of stricter voluntary guidelines and standards for ZnON fabrication. Industry consortia are developing best-practice protocols for material sourcing, energy usage, and end-of-life treatment, with a view toward minimizing the environmental footprint and ensuring regulatory compliance as ZnON adoption scales. The emphasis on circular economy principles—especially the recycling of indium-free transparent conductors—positions ZnON as an attractive alternative to more resource-intensive materials, provided manufacturers can demonstrate safe, sustainable production at scale.

In summary, regulatory and environmental considerations in ZnON thin-film semiconductor manufacturing are intensifying in 2025 and beyond, with industry stakeholders collaborating closely with government and standards organizations to ensure responsible material stewardship, emissions control, and process transparency.

Future Outlook: Key Opportunities and Disruptive Potential to 2030

Zinc oxynitride (ZnON) thin-film semiconductors are poised to reshape multiple electronic and optoelectronic markets through 2030, capitalizing on their unique bandgap tunability, high electron mobility, and compatibility with large-area, low-temperature processing. As of 2025, several avenues of innovation and industrial adoption are emerging, driven by the demand for advanced display backplanes, high-speed logic devices, and environmentally friendlier alternatives to indium-based materials.

- Display Backplanes: Key display manufacturers are intensifying efforts to integrate ZnON thin films into active-matrix backplanes for AMOLED and microLED displays. The material’s high carrier mobility (often exceeding 30 cm2/Vs) supports faster switching and higher resolution, surpassing traditional amorphous silicon and approaching the performance of IGZO. Companies such as LG Display and Samsung Display are scaling up pilot production lines for oxide semiconductor backplanes, with ZnON considered a next-generation candidate due to its improved process flexibility and cost structure.

- Low-Temperature Processing and Flexible Electronics: ZnON’s ability to be deposited via sputtering or atomic layer deposition at temperatures below 200°C opens new opportunities in flexible and wearable electronics. This property facilitates integration with plastic substrates and roll-to-roll manufacturing, areas under active exploration by companies such as JX Nippon Mining & Metals, a global supplier of advanced sputtering targets and thin-film materials.

- Sustainability and Resource Security: As the electronics industry seeks alternatives to indium- and gallium-based materials, ZnON’s reliance on abundant elements aligns with corporate sustainability goals. Leading materials suppliers such as Umicore are investing in zinc-based compound semiconductor technologies, anticipating increased demand from display, sensor, and power electronics sectors.

- Integration with Emerging Technologies: ZnON is under evaluation for use in transparent electronics, neuromorphic computing, and next-generation sensors. Its tunable electronic properties and compatibility with established fabrication infrastructure position it as a potential enabler for disruptive device architectures through 2030.

Looking forward, the outlook for ZnON thin-film semiconductor manufacturing is robust, with pilot-scale deployments expected to transition to commercial-scale production by 2027–2028. Continued collaboration between materials suppliers, equipment manufacturers, and device integrators will be pivotal in overcoming scalability and process uniformity challenges. As industry leaders iterate on ZnON deposition and device integration, the material is expected to play a foundational role in the evolution of displays, flexible electronics, and beyond.