Table of Contents

- Executive Summary: The 2025 Landscape for Maxwell Waveform Analysis in Pulsed Power

- Market Drivers: Demand, Applications, and Industry Forces

- Key Technologies: Advances in Maxwell Waveform Measurement and Analysis

- Leading Players and Innovators: Company Profiles and Strategic Initiatives

- Emerging Use Cases: From Defense to Medical and Industrial Pulsed Power

- Challenges and Barriers: Technical Hurdles and Standardization Efforts

- Regulatory Environment and Industry Standards (Citing ieee.org)

- Market Forecast: Growth Projections and Segment Analysis (2025–2029)

- Competitive Landscape: Collaboration, IP, and R&D Trends

- Future Outlook: Upcoming Breakthroughs and Long-Term Impact

- Sources & References

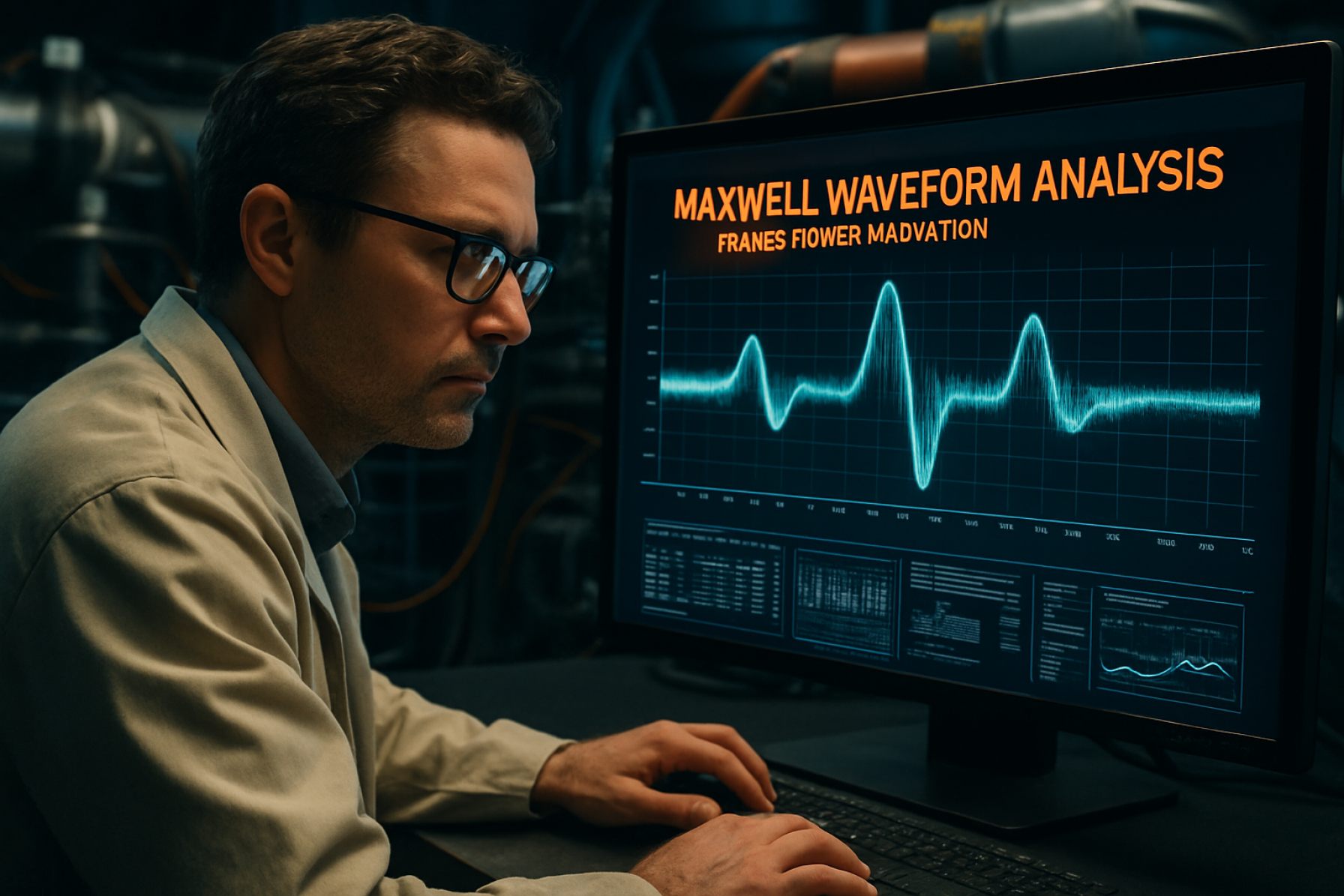

Executive Summary: The 2025 Landscape for Maxwell Waveform Analysis in Pulsed Power

Maxwell waveform analysis has emerged as a critical enabler for advancing pulsed power systems, especially as applications in defense, medical devices, and industrial processing demand higher precision and reliability. As of 2025, the integration of Maxwell’s equations into real-time waveform analytics is seeing increased adoption, driven by the need to optimize energy transfer, switching efficiency, and pulse fidelity in high-voltage systems. The evolution of digital simulation tools and high-speed data acquisition hardware is facilitating deeper insight into electromagnetic transients, enabling more accurate modeling and predictive diagnostics.

Across sectors such as defense and aerospace, companies are investing in Maxwell waveform analysis to enhance the performance of directed energy weapons, electromagnetic launchers, and radar systems. Industry leaders like Northrop Grumman and Raytheon Technologies have been reported to incorporate advanced modeling and waveform analytics in their pulsed power platforms, leveraging in-house computational electromagnetics and partnerships with simulation tool providers. This trend aligns with ongoing governmental and defense modernization programs worldwide.

The medical sector continues to benefit from Maxwell waveform analysis, particularly in the refinement of pulsed electric field (PEF) therapies and non-invasive ablation technologies. Companies such as BIOTRONIK and Smith+Nephew are actively exploring electromagnetic pulse shaping for improved treatment efficacy and safety, relying on advanced waveform modeling to meet stringent regulatory requirements.

On the technology front, the availability of high-bandwidth oscilloscopes and real-time data acquisition systems from manufacturers such as Tektronix and Keysight Technologies has significantly improved the ability to capture, analyze, and validate complex Maxwell waveforms under dynamic load conditions. These advances are complemented by simulation environments from companies like ANSYS and COMSOL, which allow researchers and engineers to visualize electromagnetic propagation and optimize pulsed power designs before physical prototyping.

Looking ahead, the next few years are expected to bring further convergence of AI-driven analytics with Maxwell waveform analysis, enabling autonomous anomaly detection, predictive maintenance, and real-time optimization in pulsed power systems. Increased cross-disciplinary collaboration and the miniaturization of pulsed power modules will further accelerate innovation, positioning Maxwell waveform analysis as foundational for the next generation of high-performance, high-reliability applications.

Market Drivers: Demand, Applications, and Industry Forces

The global market for Maxwell waveform analysis in pulsed power systems is experiencing notable momentum as 2025 approaches, propelled by expanding applications and industry demands across defense, medical, and energy sectors. Pulsed power systems, which rely on the precision control of high-voltage, high-current pulses, are increasingly central to modern technologies such as electromagnetic launchers, plasma generation, and advanced medical imaging. Accurate waveform analysis—grounded in Maxwell’s equations—is essential for optimizing system performance, ensuring safety, and enabling innovation.

A key market driver is the heightened investment in advanced defense systems. Countries are accelerating development of electromagnetic railguns, directed energy weapons, and pulse-driven radar, all of which require sophisticated waveform analysis to maximize energy transfer and minimize system losses. Companies like Lockheed Martin and Northrop Grumman are actively integrating advanced waveform analytics to improve the reliability and lethality of pulsed power-based weaponry. The demand for real-time, high-precision waveform monitoring in these systems is expected to rise sharply through the next few years as new prototypes enter field trials and eventual deployment.

Another major application area is in the medical field, specifically in pulsed power devices for cancer treatment (such as pulsed electric field ablation) and advanced imaging modalities. Accurate Maxwell waveform analysis allows for optimized pulse shaping, reducing collateral tissue damage and improving therapeutic outcomes. Medical equipment manufacturers, including Siemens Healthineers, are investing in next-generation pulsed power systems that rely on robust waveform diagnostics to meet increasingly stringent regulatory and clinical requirements.

The movement toward renewable and sustainable energy sources is also fueling demand. Pulsed power is pivotal in inertial confinement fusion and advanced grid protection devices. Industry leaders like General Atomics are working on fusion systems where precise Maxwell waveform characterization is crucial for plasma stability and containment. Grid modernization efforts, particularly in regions investing in smart grid resilience, depend on fast-acting pulsed power components whose reliability hinges on detailed waveform analysis.

Looking ahead, the market outlook for Maxwell waveform analysis in pulsed power systems remains robust. As digitalization, artificial intelligence, and high-speed digital oscilloscopes become more embedded in industry practices, the ability to capture, analyze, and act on complex electromagnetic waveforms will be a defining factor in competitive differentiation. The next few years are expected to see further integration of waveform analytics into system design, testing, and predictive maintenance protocols, consolidating its role as a foundational technology across multiple high-growth sectors.

Key Technologies: Advances in Maxwell Waveform Measurement and Analysis

Maxwell waveform analysis is central to modern pulsed power systems, as it enables detailed characterization of electromagnetic field dynamics under high-voltage, high-current conditions. The 2025 landscape shows a marked increase in both the precision and speed of waveform measurement and analysis, driven by advancements in digital instrumentation and real-time data processing. Manufacturers of pulsed power equipment are integrating high-bandwidth oscilloscopes and transient recorders capable of multi-gigahertz sampling rates, supporting accurate reconstruction of nanosecond-scale events. For example, leading suppliers such as Tektronix and Keysight Technologies have introduced oscilloscopes with enhanced vertical resolution and multi-channel synchronization, allowing the direct observation of transient Maxwell field behavior in complex pulsed power networks.

A key trend is the deployment of advanced sensors, including high-frequency Rogowski coils and B-dot probes, designed for minimally invasive measurement of rapidly changing currents and magnetic fields. Recent products from Pearl Electronics and Teledyne LeCroy demonstrate improved immunity to electromagnetic interference and faster response, enabling better fidelity in Maxwell waveform capture. Sensor integration with high-speed digitizers and real-time analytics platforms is reducing latency in measurement feedback loops, a requirement in research facilities and industries where pulse-to-pulse adjustment is critical.

On the analysis front, the adoption of field-programmable gate arrays (FPGAs) and machine learning algorithms is accelerating. These technologies allow for real-time waveform classification and anomaly detection, reducing the need for manual post-processing and supporting predictive maintenance. For instance, NI (National Instruments) has expanded its FPGA-enabled data acquisition systems for pulsed power labs, offering users the ability to implement custom Maxwell equation solvers on hardware for instant analysis.

Looking ahead to 2025 and beyond, the outlook for Maxwell waveform analysis in pulsed power systems is strong. Ongoing collaboration between industry and research institutions is expected to yield even higher bandwidth sensors and AI-driven analysis tools, with emphasis on cyber-physical system integration. Furthermore, initiatives in renewable energy storage, fusion research, and advanced defense applications are likely to drive demand for more robust and scalable waveform analysis platforms. Companies such as ABB and Siemens are positioning to provide end-to-end solutions that integrate Maxwell waveform analytics with system-level controls, aiming to enhance reliability, efficiency, and safety across the pulsed power sector.

Leading Players and Innovators: Company Profiles and Strategic Initiatives

In 2025, the field of Maxwell waveform analysis in pulsed power systems is being shaped by a cohort of established industry leaders and innovative newcomers. These companies are leveraging advanced computational tools and specialized hardware to address the growing demands of high-speed, high-precision waveform characterization essential for applications ranging from medical imaging to defense and industrial processing.

Among the foremost players, Tektronix continues to set benchmarks with its high-bandwidth oscilloscopes and real-time signal processing technologies, directly supporting detailed Maxwell waveform analysis in laboratory and field environments. Their latest instruments, featuring enhanced sampling rates and AI-driven analytics, enable users to resolve sub-nanosecond pulse features with unprecedented clarity, a critical requirement for modern pulsed power diagnostics.

Teledyne LeCroy has also advanced the state-of-the-art through modular digitizers and waveform analysis software platforms. Their strategic collaborations with defense and energy sector partners facilitate custom solutions tailored to analyze complex electromagnetic phenomena in pulsed power setups, focusing on Maxwell-derived field interactions and transient effects.

In Europe, Rohde & Schwarz maintains a leadership position by integrating Maxwell waveform analysis capabilities into their test and measurement ecosystems. Their recent product launches underscore a commitment to cross-domain compatibility, supporting both traditional pulsed power laboratories and emerging quantum and photonic applications.

Emerging innovators such as Keysight Technologies are increasingly focused on the integration of cloud-based waveform analytics with hardware instrumentation. Keysight’s strategic initiatives in 2025 emphasize seamless workflow automation, from data acquisition to Maxwell-based computational modeling, thereby accelerating research cycles and enabling scalable deployment in industrial settings.

On the supplier front, NI (National Instruments) continues to expand its modular hardware and LabVIEW-based analysis suites, offering real-time Maxwell waveform processing for rapid prototyping and iterative testing in pulsed power applications. Their ecosystem approach is particularly attractive to R&D teams seeking flexibility and customization.

Looking ahead, these companies are investing in AI-assisted waveform recognition, integration of digital twins for predictive analysis, and enhanced interoperability with high-performance computing clusters. Such strategic initiatives are expected to shape the evolution of Maxwell waveform analysis, driving innovations that will meet the increasingly stringent requirements of pulsed power systems in the coming years.

Emerging Use Cases: From Defense to Medical and Industrial Pulsed Power

Maxwell waveform analysis—rooted in Maxwell’s equations—has become critical in advancing pulsed power system performance across defense, medical, and industrial sectors. As we move into 2025, the heightened demand for precision and reliability in energy delivery is driving the adoption of sophisticated waveform analysis techniques for both system design and real-time diagnostics.

In the defense sector, the integration of pulsed power with directed energy weapons, electromagnetic launchers, and advanced radar is accelerating. Here, Maxwell waveform analysis is foundational for modeling electromagnetic field propagation, minimizing electromagnetic interference, and optimizing pulse shaping for maximum effect. For instance, organizations such as Northrop Grumman and Lockheed Martin are actively developing high-powered pulsed systems where waveform fidelity and reproducibility are paramount to operational effectiveness and safety.

Medical applications, particularly in advanced imaging and non-invasive therapies, are leveraging Maxwell waveform analysis to enhance the control and predictability of pulsed electromagnetic fields. The trend towards miniaturized, portable devices—such as pulsed electric field (PEF) ablation tools and compact MRI systems—requires robust modeling of transient waveforms to ensure patient safety and clinical efficacy. Companies like Siemens Healthineers and GE HealthCare are pushing the envelope in this regard, employing Maxwell-based simulation platforms to optimize electromagnetic exposure and reduce artifact generation.

Industrial pulsed power systems are undergoing transformation through increased automation, machine learning integration, and the use of Maxwell waveform analysis to monitor and control high-voltage processes. Applications such as materials processing, sterilization, and water treatment depend on repeatable, well-characterized pulses to achieve regulatory compliance and energy efficiency. Manufacturers like Thales Group are investing in advanced diagnostics and simulation tools that incorporate Maxwell’s equations for real-time waveform validation and fault detection.

Looking forward to the next several years, the convergence of Maxwell waveform analysis with digital twin platforms and AI-driven analytics promises to deliver further gains in pulsed power reliability, miniaturization, and adaptability. Standardization efforts, supported by industry bodies such as the IEEE, are expected to streamline cross-sector adoption, fostering interoperability and accelerating innovation. Ultimately, Maxwell waveform analysis will remain at the heart of pulsed power advancements, shaping new use cases and enabling safer, more efficient applications in critical domains.

Challenges and Barriers: Technical Hurdles and Standardization Efforts

Maxwell waveform analysis plays a crucial role in advancing pulsed power systems, yet several technical hurdles and standardization challenges persist as of 2025. One primary technical barrier is the accurate real-time measurement and interpretation of rapidly changing electromagnetic fields inherent to pulsed power applications. The high amplitude, short-duration pulses generated in modern systems—such as those used in medical devices, industrial lasers, and defense technologies—demand sensors and digitizers capable of capturing nanosecond-scale events with high fidelity. However, issues like electromagnetic interference (EMI), signal distortion, and limited bandwidth in current measurement hardware continue to restrict the full exploitation of Maxwell waveform analysis.

Despite continuous improvements, developing robust electromagnetic compatibility (EMC) protocols remains an ongoing challenge. Pulsed power systems generate intense transients that can adversely affect nearby electronics, necessitating advanced shielding and grounding techniques. Industry leaders such as Tektronix and Keysight Technologies are actively enhancing their hardware-software integration to address these issues, focusing on improved oscilloscope bandwidth and real-time analytics to reduce noise and ensure measurement integrity.

Another significant hurdle lies in the modeling and simulation of Maxwell waveforms under extreme conditions. The nonlinearities and parasitic effects present in high-power circuits complicate predictive simulations, often requiring iterative calibration with empirical data. Companies like Ansys and COMSOL are advancing multiphysics simulation platforms, but the integration of accurate materials data and high-speed solvers is still evolving.

Standardization is another area where the industry faces barriers. The lack of universally accepted methods for waveform characterization, calibration procedures, and data interchange limits interoperability and benchmarking between systems. Organizations such as the IEEE and the International Electrotechnical Commission (IEC) are working toward establishing clearer guidelines and standards for pulsed power waveform measurement and reporting. However, harmonizing these efforts globally is slow due to varying regulatory frameworks and the proprietary nature of some pulsed power applications.

Looking ahead, collaborative initiatives between research institutions and industry are expected to accelerate the development of standard protocols and novel measurement solutions by 2027. As new components—such as wide-bandgap semiconductors and high-speed data converters—enter the market, the technical landscape of Maxwell waveform analysis in pulsed power systems is poised for significant improvements, though overcoming current technical and standardization hurdles remains a critical focus for stakeholders.

Regulatory Environment and Industry Standards (Citing ieee.org)

The regulatory environment and industry standards surrounding Maxwell waveform analysis in pulsed power systems are evolving rapidly, reflecting both technological advances and increasing application demands in sectors such as defense, medical devices, and high-voltage industrial equipment. As of 2025, the key standards and guidelines influencing the development and deployment of these systems are predominantly shaped by international bodies, with the IEEE serving as the primary authority in defining measurement and safety protocols for electromagnetic waveform analysis.

Currently, the IEEE revises and maintains several standards directly relevant to Maxwell waveform analysis within pulsed power systems. Notably, the IEEE Standard for Pulsed Power Terminology (IEEE Std 1010) and the IEEE Standard for High-Power Pulse Testing (IEEE Std 1156.4) establish definitions, measurement practices, and performance criteria for components and systems utilizing high-voltage, fast-rise-time pulses. These standards ensure consistency in waveform characterization, facilitating interoperability and safety across different manufacturers and end users. In 2024 and early 2025, working groups within the IEEE Power & Energy Society and the IEEE Dielectrics and Electrical Insulation Society have been actively updating technical guides to accommodate trends such as greater system miniaturization and digital waveform analytics.

Compliance with these standards is increasingly vital for companies seeking to commercialize pulsed power systems, especially as regulatory scrutiny intensifies in applications with heightened safety implications, such as medical imaging and plasma generation. Many national regulatory bodies and certification agencies, including Underwriters Laboratories and the International Electrotechnical Commission, rely on IEEE standards as benchmarks for conformity assessment. This harmonization streamlines global market access while reducing the risk of technical incompatibility or safety incidents.

Looking ahead, the regulatory landscape is expected to place greater emphasis on electromagnetic compatibility (EMC) and environmental sustainability. Revised IEEE guidelines anticipated in late 2025 will likely address emerging issues, such as the integration of artificial intelligence for adaptive waveform control and the need for robust cybersecurity measures in networked pulsed power systems. Continued collaboration between industry stakeholders and standards organizations will be crucial to ensure that Maxwell waveform analysis keeps pace with the evolving complexity of pulsed power technologies, supporting safe, reliable, and innovative system development worldwide.

Market Forecast: Growth Projections and Segment Analysis (2025–2029)

The market for Maxwell waveform analysis in pulsed power systems is poised for robust growth from 2025 through 2029, driven by expanding applications in defense, medical, and industrial sectors. The demand for precise waveform analysis stems from the increasing adoption of advanced pulsed power technologies, such as high-power microwave sources, electromagnetic pulse (EMP) generators, and medical imaging devices. These applications require rigorous analysis and control of Maxwellian electromagnetic waveforms to ensure efficient energy transfer, system reliability, and compliance with evolving regulatory standards.

Segment-wise, the defense and aerospace sectors are expected to dominate market share, propelled by ongoing investments in electromagnetic warfare, directed energy weapons, and pulse-powered radar systems. Leading defense contractors are intensifying their R&D efforts to enhance waveform analysis capabilities, with companies such as Northrop Grumman and Lockheed Martin demonstrating increased focus on electromagnetic spectrum management and resilient system architectures. This trend will likely boost demand for advanced analysis software and hardware solutions tailored for Maxwell waveform characterization.

In the medical segment, pulsed power devices leveraging Maxwell waveform analytics are gaining traction for applications in non-invasive surgery, advanced imaging, and targeted therapies. Manufacturers like Siemens Healthineers and GE HealthCare are expected to integrate more sophisticated waveform analysis tools into their next-generation medical systems, enhancing diagnostic precision and therapeutic outcomes. The industrial sector, encompassing plasma processing, materials testing, and high-voltage switching, will also contribute to steady market expansion as manufacturers seek to optimize process control and equipment safety.

Geographically, North America and Europe will maintain leadership positions due to established defense initiatives and strong healthcare infrastructure. However, rapid industrialization and increased investments in research are positioning Asia-Pacific as a high-growth region, especially in countries investing in dual-use pulsed power technologies for both civilian and defense applications.

Looking ahead, the market outlook from 2025 to 2029 suggests a compounded annual growth rate (CAGR) in the mid-to-high single digits, underpinned by technological advancements in real-time waveform analytics, integration of AI-driven signal processing, and the emergence of modular, scalable pulsed power platforms. Industry stakeholders are expected to prioritize partnerships and in-house development to address the growing need for robust, standards-compliant Maxwell waveform analysis solutions across all application segments.

Competitive Landscape: Collaboration, IP, and R&D Trends

The competitive landscape for Maxwell waveform analysis in pulsed power systems is rapidly evolving, reflecting the growing complexity and strategic importance of advanced waveform modeling in high-voltage and high-current switching technologies. As of 2025, collaborations between research institutions, component manufacturers, and system integrators are shaping the industry’s direction, with a particular focus on intellectual property (IP) development and accelerated research and development (R&D) cycles.

Major players in pulsed power—including ABB, Siemens, and General Electric—are actively investing in both proprietary and collaborative R&D initiatives targeting Maxwell waveform analysis. These efforts aim to improve simulation fidelity, real-time monitoring, and predictive maintenance for pulsed power apparatus used in sectors such as fusion energy, medical imaging, and advanced manufacturing. Collaborative frameworks are increasingly common, with leading universities and national laboratories partnering with industry to accelerate the translation of mathematical models into deployable tools.

IP generation continues to be a core competitive factor. Companies are filing patents related to waveform analysis algorithms, high-speed data acquisition systems, and machine learning integration for waveform diagnostics. For example, Teledyne Technologies and Analog Devices have expanded their patent portfolios around signal analysis hardware and software, crucial for decoding complex Maxwellian waveforms in fast-pulsed environments. These patented technologies underpin differentiation in system performance, reliability, and scalability.

R&D trends in 2025 increasingly emphasize interdisciplinary approaches. Notably, the integration of high-performance computing and artificial intelligence is enabling the real-time analysis of massive waveform datasets. Partnerships between digital solution providers and hardware manufacturers, such as those involving NI (National Instruments) and Texas Instruments, are resulting in platforms capable of adaptive waveform optimization and anomaly detection. Open-source initiatives and industry consortia are also gaining momentum, fostering pre-competitive collaboration on data formats and verification methodologies, while still protecting proprietary algorithmic advancements.

Looking forward, the competitive landscape is expected to intensify as demand for precise Maxwell waveform analysis grows in applications like pulsed power fusion drivers and next-generation medical accelerators. Companies that effectively balance collaboration with robust IP strategies—while leveraging AI-driven analytics—are likely to lead the sector over the next few years. This dynamic environment is poised to accelerate the commercialization of advanced pulsed power systems, supported by ongoing R&D investments from both established industry leaders and innovative new entrants.

Future Outlook: Upcoming Breakthroughs and Long-Term Impact

Looking ahead to 2025 and the coming years, the field of Maxwell waveform analysis in pulsed power systems is poised for notable breakthroughs and growing industrial significance. Recent advances in high-speed digitization, real-time data analytics, and sensor technologies are driving a new era of precision in the measurement and interpretation of electromagnetic waveforms governed by Maxwell’s equations. These technical evolutions are expected to enable more accurate modeling, control, and optimization of pulsed power systems across defense, medical, industrial, and research domains.

Key industry players are investing in fast data acquisition hardware and enhanced computational tools to capture and analyze complex transient electromagnetic phenomena. For instance, companies such as Tektronix and Keysight Technologies are developing next-generation oscilloscopes and waveform analyzers with bandwidths exceeding 100 GHz, allowing for the detailed capture of high-frequency pulsed events. This capability is critical for advanced pulsed power applications including directed-energy systems, high-voltage switching, and electromagnetic launchers.

In parallel, the integration of artificial intelligence and machine learning algorithms into waveform analysis is forecast to significantly enhance anomaly detection, predictive maintenance, and real-time system optimization. Organizations like NI (National Instruments) are actively exploring AI-driven analytics platforms that can process large datasets from pulsed power experiments, identifying subtle waveform distortions or instabilities that could compromise system performance.

The fusion of advanced simulation tools, such as 3D electromagnetic modeling software, with live measured data is another anticipated development. This approach, adopted by companies including ANSYS, enables rapid prototyping and validation of new pulsed power architectures by correlating Maxwell-based simulations with real-world operational data, reducing design cycles and improving reliability.

- In defense and aerospace, waveform analysis advancements are likely to accelerate the deployment of electromagnetic pulse (EMP) protection and high-power microwave systems, as agencies seek robust, real-time diagnostic capabilities for mission-critical assets.

- In the medical sector, higher-fidelity waveform analysis is expected to drive safer and more effective applications of pulsed power, such as in advanced imaging and non-invasive therapies.

- Industrial applications, including materials processing and energy storage, will benefit from improved control and efficiency enabled by next-generation waveform analytics.

As pulsed power systems become more integral to emerging technologies, the long-term impact of Maxwell waveform analysis will be seen in enhanced operational safety, increased system resilience, and accelerated innovation cycles. With continued investment from established instrumentation leaders and the integration of digital intelligence, the next few years are set to redefine the boundaries of what is possible in electromagnetic waveform diagnostics and control.