Table of Contents

- Executive Summary & Key Insights for 2025

- Market Size, Growth Projections & Forecasts Through 2030

- Cutting-Edge Technologies in Polysaccharide Enzyme Characterization

- Leading Companies and Strategic Partnerships (with Official Sources)

- Emerging Applications Across Biotech, Pharma, Food, and Bioenergy

- Regulatory Landscape and Global Standards

- Recent Breakthroughs in Enzyme Discovery & Engineering

- Challenges: Technical Barriers, Scalability, and Data Integrity

- Investment Hotspots & Funding Outlook (2025–2030)

- Future Outlook: Innovation Roadmap and Key Opportunities

- Sources & References

Executive Summary & Key Insights for 2025

The characterization of polysaccharide-degrading enzymes is poised for significant advancements in 2025, driven by the growing demand for biotechnological solutions across food, biofuel, pharmaceutical, and environmental sectors. Enzymes such as cellulases, amylases, pectinases, and xylanases remain central to industrial applications, with their precise characterization underpinning improvements in efficiency, specificity, and sustainability. This year, a key industry trend is the integration of high-throughput screening platforms and advanced analytical techniques—such as mass spectrometry and nuclear magnetic resonance (NMR)—to accelerate enzyme discovery and optimize performance parameters.

Leading biotechnology and enzyme manufacturers are investing in state-of-the-art facilities and collaborative R&D programs to refine enzyme characterization methods. For instance, Novozymes and DSM are actively expanding their enzyme portfolios, leveraging data-driven approaches and artificial intelligence for enzyme engineering and functional annotation. These initiatives are expected to yield enzymes with higher substrate specificity, improved thermostability, and robust activity under industrial conditions, catering to evolving market requirements.

In 2025, regulatory emphasis on sustainable processes continues to propel the demand for enzyme solutions that minimize chemical usage and energy consumption. This, in turn, amplifies the need for comprehensive enzyme profiling—encompassing substrate binding, catalytic efficiency, and product formation. Companies like BASF and DuPont are enhancing their enzyme characterization capabilities to support greener manufacturing and circular economy initiatives. Collaborative efforts between industry leaders and academic institutions are accelerating the development of standardized protocols and open-access databases, further enabling cross-sector applications and innovation.

Looking ahead, the enzyme characterization landscape is expected to benefit from the integration of machine learning, automation, and synthetic biology tools. These technologies will facilitate the rapid identification and tailoring of novel polysaccharide-degrading enzymes for customized industrial processes. The outlook for 2025 and the following years indicates a shift toward more precise, data-centric enzyme profiling, enabling manufacturers to deliver enhanced products for food processing, bioenergy, textile, and waste valorization sectors.

Overall, the global focus on sustainability, coupled with technological advancements, positions polysaccharide enzyme characterization as a pivotal area of growth and innovation. Stakeholders investing in improved analytical capabilities and collaborative ecosystems are likely to gain competitive advantages as enzyme-driven bioprocessing cements its role in the transition to a bio-based economy.

Market Size, Growth Projections & Forecasts Through 2030

The global market for polysaccharide enzyme characterization is positioned for robust expansion through 2030, driven by escalating demand across biotechnology, pharmaceuticals, food and beverage, and biofuel industries. The increasing utilization of enzymes such as cellulases, amylases, xylanases, and pectinases for the breakdown, modification, and analysis of complex polysaccharides underscores the growing need for advanced characterization technologies. In 2025, the adoption of high-throughput screening methods and next-generation sequencing platforms is expected to accelerate, enabling more efficient identification and profiling of novel enzymes with tailored substrate specificities.

Key industry participants—including Novozymes, BASF, and DuPont—are investing significantly in R&D to enhance enzyme characterization capabilities and to address stringent regulatory requirements regarding food safety, sustainability, and environmental impact. Technological advancements, such as automated microfluidic platforms and AI-driven data analytics, are also expected to reduce time-to-market for newly characterized enzymes, further fueling market growth.

Market size estimates for 2025 suggest the global polysaccharide enzyme characterization sector will surpass the $1.5 billion threshold, with a compound annual growth rate (CAGR) projected in the range of 7–10% through 2030. This is supported by increasing demand for customized enzyme solutions in starch processing, biomass conversion, and specialty food ingredient manufacturing. The Asia-Pacific region, led by China and India, is anticipated to witness the fastest growth, attributed to expanding industrial biotechnology sectors and rising investments in enzyme research infrastructure.

Emerging applications in functional foods, nutraceuticals, and precision medicine are expected to stimulate further demand for sophisticated enzyme characterization services and products. Strategic collaborations between enzyme producers and technology innovators—such as those between Novozymes and leading academic institutes—are fostering the rapid development and commercialization of novel polysaccharide-degrading enzymes. Regulatory bodies and industry consortia, such as the Biotechnology Innovation Organization, are anticipated to play a pivotal role in shaping market standards and ensuring the safe deployment of characterized enzymes across sectors.

Looking ahead, the polysaccharide enzyme characterization market is poised for continued growth as companies prioritize sustainable production processes and the circular bioeconomy. The integration of omics technologies and machine learning for enzyme discovery and functional annotation is likely to become mainstream by the decade’s end, reinforcing the sector’s innovation trajectory.

Cutting-Edge Technologies in Polysaccharide Enzyme Characterization

The field of polysaccharide enzyme characterization is undergoing rapid transformation, driven by innovations in analytical instrumentation, high-throughput screening, and advanced computational approaches. In 2025, a significant focus lies in leveraging next-generation sequencing and proteomics to elucidate enzyme structures, mechanisms, and substrate specificities with unprecedented detail. The integration of mass spectrometry-based methods, such as MALDI-TOF and LC-MS/MS, has become central to identifying post-translational modifications and mapping catalytic residues of glycoside hydrolases and polysaccharide lyases.

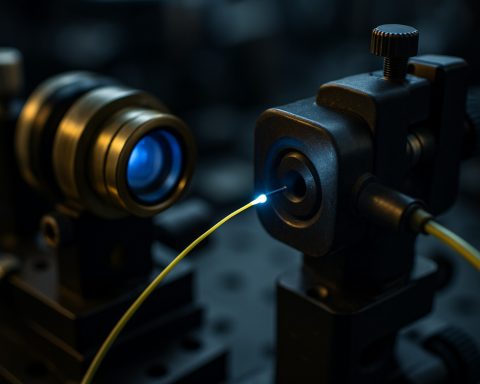

Recent advancements in automated high-throughput screening platforms enable the parallel analysis of enzyme libraries against diverse polysaccharide substrates. Robotic systems, coupled with microplate-based assays, accelerate the functional profiling of enzymes sourced from bacteria, fungi, and engineered microbial hosts. Companies like Thermo Fisher Scientific and Agilent Technologies have expanded their portfolios of analytical instrumentation, offering solutions tailored for carbohydrate-active enzyme assays, including fluorogenic substrate panels and multiplexed readouts.

Nuclear magnetic resonance (NMR) and X-ray crystallography remain indispensable for structural elucidation, but recent enhancements in cryo-electron microscopy (cryo-EM) are enabling the visualization of large, complex enzyme-substrate assemblies at near-atomic resolution. Leading instrument manufacturers such as Bruker and JEOL are at the forefront of integrating these technologies into workflows specifically designed for polysaccharide-active enzymes.

On the computational front, artificial intelligence (AI) and machine learning models are being actively deployed to predict enzyme function, substrate specificity, and stability. The use of AI-driven protein structure prediction tools, following the success of AlphaFold, is facilitating the in silico screening and rational design of novel polysaccharide-degrading enzymes. This computational revolution is further supported by cloud-based bioinformatics platforms offered by organizations such as European Bioinformatics Institute (EMBL-EBI), which provide access to curated enzyme databases and modeling services.

Looking ahead, the convergence of automated high-content screening, advanced structural biology, and predictive informatics is set to further accelerate polysaccharide enzyme discovery and engineering. These technologies are expected to support applications in biorefining, food processing, and sustainable materials, where tailored enzyme cocktails offer significant process advantages. The ongoing expansion of collaborative efforts between industry, instrument suppliers, and bioinformatics providers signals a robust outlook for continued innovation in this sector over the coming years.

Leading Companies and Strategic Partnerships (with Official Sources)

The landscape of polysaccharide enzyme characterization in 2025 is defined by a dynamic interplay of established biotechnology leaders, emerging innovators, and a rising number of strategic alliances. As industries spanning food, pharmaceuticals, biofuels, and materials increasingly depend on precise enzyme function and substrate specificity, leading companies are intensifying their efforts in both proprietary enzymology and collaborative research.

Key global enzyme manufacturers such as Novozymes, DSM, and BASF continue to be central players in polysaccharide enzyme discovery and characterization. Novozymes has expanded its enzymatic platforms to address the characterization of cellulases, xylanases, and pectinases, investing in advanced analytical infrastructure and data-driven enzyme profiling. Similarly, DSM has integrated high-throughput screening technologies and bioinformatics, enabling rapid identification of novel enzyme variants with improved activity and selectivity for industrial polysaccharide conversion.

Strategic partnerships are shaping the competitive environment. For instance, BASF maintains collaborations with academic and technology partners to accelerate the functional annotation and structural analysis of carbohydrate-active enzymes. In 2024 and into 2025, DuPont continues its focus on enzyme innovation, leveraging alliances with food and beverage manufacturers for the targeted characterization of amylases and other starch-modifying enzymes, facilitating clean-label and sustainable processing solutions.

In addition, specialized enzyme technology companies such as Megazyme (now part of Neogen) are recognized for their high-purity polysaccharide substrates and analytical kits, supplying researchers and industrial labs with the tools necessary for precise enzyme activity assays and kinetic measurements. Their commercial partnerships with instrumentation providers and research consortia enable the cross-validation of enzyme characterization platforms, fostering industry-wide standardization.

The outlook for the next several years indicates increasing integration of artificial intelligence and automation in enzyme screening, with companies like Novozymes and DSM investing in digitalization initiatives and expanding open innovation programs. These efforts are expected to yield more robust characterization data, accelerate time-to-market for novel enzyme products, and widen the industrial applicability of polysaccharide-active enzymes. As sustainability targets grow more ambitious, strategic partnerships—particularly those bridging industrial and academic expertise—will be essential in driving innovation in enzyme characterization and deployment.

Emerging Applications Across Biotech, Pharma, Food, and Bioenergy

Polysaccharide enzyme characterization is rapidly evolving, fueling a new wave of innovation across biotechnology, pharmaceuticals, food science, and bioenergy industries in 2025 and beyond. Advanced analytical techniques are being deployed to decode the structure-function relationships of carbohydrate-active enzymes (CAZymes), enabling more precise tailoring of enzymatic processes to sector-specific needs.

In biotechnology, high-throughput platforms and next-generation sequencing are accelerating the identification of novel polysaccharide-degrading enzymes, especially from extremophilic microorganisms and engineered microbial systems. Companies specializing in enzyme discovery and manufacturing, such as Novozymes and DSM, are expanding their enzyme portfolios with potent cellulases, xylanases, and pectinases, characterized for optimal activity, stability, and substrate specificity. These efforts support the development of tailored enzyme cocktails for bioprocessing, bioremediation, and green chemistry applications, with a focus on improving yield and lowering environmental footprint.

In the pharmaceutical sector, detailed enzyme characterization underpins the creation of glycosylation-modifying biocatalysts, vital for producing next-generation biologics and novel drug candidates. Companies such as BASF are developing enzymatic platforms that offer precise control over glycan structures, contributing to improved drug efficacy and reduced immunogenicity. The integration of machine learning and structural bioinformatics is further streamlining the rational design and optimization of these enzymes, fostering faster development cycles and more predictable outcomes through 2025 and into the next few years.

Food industry stakeholders are leveraging advanced characterization to refine enzymatic solutions for texture modification, flavor enhancement, and dietary fiber conversion. For instance, DuPont (now part of IFF) is deploying characterized amylases and hemicellulases to optimize baking, brewing, and plant-based product formulations. The demand for clean-label and functional foods is driving the adoption of highly specific, well-characterized enzyme preparations, ensuring safety, efficacy, and regulatory compliance.

In bioenergy, enzyme characterization is at the core of efficient biomass-to-biofuel conversion. Leading players like Abengoa and Clariant are integrating newly characterized enzyme blends to enhance saccharification rates and reduce overall process costs. The ongoing characterization of lignocellulosic-degrading enzymes—particularly lytic polysaccharide monooxygenases (LPMOs)—is expected to further boost conversion efficiencies and sustainability metrics in biorefineries through 2026 and beyond.

Looking forward, the convergence of multi-omics, AI-driven protein engineering, and robust industrial partnerships is set to accelerate the pace of polysaccharide enzyme characterization, unlocking transformative applications across biotech, pharma, food, and bioenergy sectors.

Regulatory Landscape and Global Standards

The regulatory landscape for polysaccharide enzyme characterization is evolving rapidly in 2025, as global demand for high-purity enzymes in food, pharmaceuticals, and industrial applications continues to rise. Regulatory authorities and international standards organizations are focusing on harmonizing requirements for enzyme safety, purity, and performance, with significant implications for manufacturers and users of polysaccharidases.

Key regulatory bodies such as the European Food Safety Authority (EFSA) and U.S. Food and Drug Administration (FDA) maintain rigorous frameworks for enzyme characterization, particularly for those intended for food processing and pharmaceuticals. In 2025, both agencies have reinforced requirements for detailed analytical data on enzyme origin, structure, activity, and absence of contaminants, including allergens and genetically modified organisms. EFSA’s updated scientific guidance on food enzymes emphasizes comprehensive molecular characterization, substrate specificity, and batch-to-batch consistency, mandating advanced analytical techniques such as mass spectrometry and high-performance liquid chromatography.

In parallel, global standards bodies like the International Organization for Standardization (ISO) are finalizing updates to technical standards governing enzyme assay methodologies and reporting. ISO’s forthcoming revisions are expected to standardize protocols for activity measurement, purity assessment, and impurity profiling, facilitating international trade and regulatory acceptance. These standards are increasingly referenced by national agencies in Asia-Pacific and Latin America, contributing to a more unified global regulatory environment.

Manufacturers such as Novozymes and DuPont are actively engaging with regulatory authorities and standards groups to ensure compliance with evolving requirements. These companies have reported ongoing investments in advanced characterization technologies and quality systems to maintain certifications and market access in multiple jurisdictions. Industry organizations, including those represented by the Association of Manufacturers and Formulators of Enzyme Products (AMFEP), continue to provide guidance to members on emerging regulatory expectations and best practices for documentation and traceability.

Looking ahead, the regulatory outlook for polysaccharide enzyme characterization is expected to tighten further, with greater emphasis on transparency, digital traceability, and environmental impact assessment. Initiatives to develop unified digital submission platforms and cross-recognition of enzyme dossiers between major regulatory regions are likely to accelerate, reducing time-to-market for innovative polysaccharidases while maintaining robust safety and quality assurance.

Recent Breakthroughs in Enzyme Discovery & Engineering

Recent years have seen significant advancements in the characterization of polysaccharide-degrading enzymes, driven by the increasing demand for bio-based materials, sustainable food processing, and advanced biorefinery applications. In 2025, the field is marked by breakthroughs in high-throughput screening, structural biology, and machine-learning-guided enzyme engineering, setting new standards for precision and efficiency.

A pivotal development is the integration of automated microfluidic platforms and robotics for rapid functional screening of enzyme libraries. Leading enzyme manufacturers such as Novozymes and DSM have reported the adoption of these systems to accelerate the discovery of novel glycoside hydrolases, lyases, and transferases from metagenomic sources. These approaches allow researchers to screen thousands of enzyme variants in parallel, dramatically shortening the timeline from discovery to industrial application.

Structural characterization has also seen a leap forward, with cryo-electron microscopy (cryo-EM) and advanced X-ray crystallography providing unprecedented resolution of enzyme-substrate complexes. This progress is crucial for understanding the mechanistic details of polysaccharide recognition, binding, and catalysis. Companies like BASF have publicly highlighted the use of structural insights to optimize enzyme stability and substrate specificity for applications ranging from food texture modification to textile processing.

Machine learning and AI are increasingly being deployed to predict enzyme function and engineer improved variants. In collaboration with biotechnology partners, DuPont is leveraging proprietary data sets and deep learning approaches to design enzymes with enhanced performance for starch and cellulose breakdown, focusing on reducing process energy requirements and improving yield.

Another notable trend is the characterization of extremophilic polysaccharide enzymes, which are stable under harsh industrial conditions. Organizations such as Amyris and Genencor (a DuPont subsidiary) are actively exploring enzymes sourced from thermophilic and halophilic microorganisms for applications in biofuels and specialty chemicals.

Looking ahead, the convergence of data-driven enzyme design, high-throughput experimentation, and advanced analytics is expected to further accelerate enzyme characterization workflows. Industry leaders anticipate that by 2027, these advances will enable the rapid, cost-effective tailoring of polysaccharide-active enzymes for bespoke industrial processes, meeting the growing demand for greener and more efficient solutions.

Challenges: Technical Barriers, Scalability, and Data Integrity

Polysaccharide enzyme characterization remains a cornerstone for advances in bioprocessing, food, biofuels, and medical sectors, but faces significant technical and operational challenges as of 2025. A primary technical barrier is the intrinsic complexity and heterogeneity of polysaccharide substrates, which complicates reproducible enzyme-substrate interactions and impedes standardization of assays. Enzymes such as cellulases, xylanases, and pectinases often require precise substrate specificity, yet plant-derived polysaccharides can vary widely in composition and structure. This variability can lead to inconsistent results across laboratories and platforms, undermining the reliability of comparative studies and hindering the development of robust enzyme products.

Scalability presents another major challenge. While high-throughput screening platforms have improved, translating bench-scale findings to industrial-scale processes remains fraught with difficulties. Reaction conditions optimized in microplate assays frequently fail to translate directly to bioreactor or continuous flow systems due to differences in mixing, substrate availability, and enzyme stability. Leading enzyme manufacturers such as Novozymes and DSM invest heavily in process development, yet even with such resources, scaling up enzymatic processes for diverse feedstocks remains a limiting step, especially for emerging applications like bioplastics and advanced biofuels.

Data integrity and reproducibility are additional concerns, especially as the sector employs increasingly complex analytical tools including mass spectrometry, nuclear magnetic resonance (NMR), and advanced chromatography. Data generated from these platforms are vast and require rigorous quality control. Discrepancies in sample preparation, instrument calibration, and data interpretation can introduce significant variability. Industry organizations such as the Sigma-Aldrich division of Merck KGaA and Thermo Fisher Scientific are addressing these issues by providing standardized reagents and offering validation protocols, but sector-wide adoption of harmonized standards remains incomplete.

Looking forward to the next few years, the outlook hinges on enhanced collaboration between enzyme producers, instrumentation companies, and end-users to develop and adopt unified protocols for substrate preparation, enzyme assay calibration, and data reporting. The emergence of digital lab management and cloud-based data storage may help address data integrity, provided robust cybersecurity and traceability measures are implemented. Overcoming technical barriers and ensuring data reliability will be essential for the successful characterization and industrial application of polysaccharide enzymes as the global market continues to expand.

Investment Hotspots & Funding Outlook (2025–2030)

The landscape of investment in polysaccharide enzyme characterization is poised for significant transformation between 2025 and 2030, driven by escalating demand for precision biocatalysts in industries such as food processing, biofuels, pharmaceuticals, and sustainable packaging. Investors are increasingly attracted to this sector due to the central role that polysaccharide-active enzymes play in unlocking new bio-based value chains and enabling the efficient conversion of renewable feedstocks.

Key investment hotspots are emerging in regions with strong biotechnology clusters, particularly in North America, Western Europe, and parts of Asia-Pacific. The United States, for example, continues to be a global leader, with major research initiatives and industry partnerships originating from both established enzyme manufacturers and innovative startups. Companies such as Novozymes and DuPont (now part of International Flavors & Fragrances Inc.) are expanding their R&D capabilities with new facilities devoted to high-throughput enzyme screening, protein engineering, and advanced analytics. In Europe, Denmark and Germany are consolidating their positions as hubs for enzymology, with coordinated efforts between industry and academia supporting commercialization pathways.

Asia-Pacific, particularly China and Japan, is witnessing rapid growth fueled by government incentives for green chemistry and industrial biotechnology. Chinese biotechnology firms are increasing their investments in enzyme discovery platforms and partnerships with global players, focusing on enzymes optimized for local biomass and process conditions. Japan’s focus on sustainable materials and biorefinery infrastructure is translating into funding for enzyme characterization, particularly in relation to cellulose, hemicellulose, and starch-degrading enzymes.

Funding outlook for 2025–2030 is robust, with a blend of public research grants, venture capital, and strategic corporate investment. The European Union is providing substantial support through initiatives such as Horizon Europe, targeting enzymatic solutions for climate-neutral processes. Simultaneously, companies like BASF and DSM-Firmenich are increasing their direct investments and forming alliances to accelerate the translation of enzyme characterization breakthroughs into scalable industrial applications.

Looking ahead, the sector is expected to benefit from convergence with artificial intelligence and automation, which are reducing the time and cost of enzyme screening and functional annotation. These trends are likely to spur further deal activity, including mergers, acquisitions, and licensing agreements, as stakeholders seek to secure proprietary enzyme portfolios and process know-how. Overall, polysaccharide enzyme characterization stands out as a key investment hotspot within the broader bioeconomy for the next five years.

Future Outlook: Innovation Roadmap and Key Opportunities

The characterization of polysaccharide-degrading enzymes is poised for transformative advances in 2025 and the years ahead, driven by the convergence of high-throughput screening technologies, artificial intelligence, and expanding industrial applications. As the demand for sustainable bioprocessing and bio-based materials accelerates, enzyme characterization emerges as a strategic focal point for innovation and competitive differentiation.

A major trend shaping the field is the integration of automated, miniaturized platforms for enzyme screening and substrate profiling. Leading biotechnology companies are investing in robotic systems and microfluidic technologies to expedite the discovery and functional analysis of novel polysaccharide-active enzymes. For example, Novozymes and DuPont have highlighted ongoing developments in high-throughput enzyme characterization, targeting applications that include biomass conversion, food processing, and textile innovation. These platforms enable rapid assessment of enzyme specificity, stability, and activity, providing critical data for tailoring enzyme cocktails to complex polysaccharide substrates.

Artificial intelligence and machine learning are anticipated to play a pivotal role in the innovation roadmap. By leveraging vast datasets generated from enzyme libraries and substrate interactions, AI-driven models are being developed to predict enzyme-substrate compatibility, activity profiles, and even guide protein engineering efforts. Industry leaders such as BASF are actively exploring AI for enzyme optimization, aiming to enhance efficiency and sustainability in industrial biocatalysis.

Another key opportunity emerges from the push for greener and more efficient bioprocesses. Enzyme characterization is essential for unlocking the value of renewable feedstocks, such as lignocellulosic biomass and food industry side streams. Companies like DSM are advancing the development of enzyme solutions tailored to these complex feedstocks, with ongoing projects focused on improving enzyme robustness under industrial conditions and expanding the spectrum of degradable polysaccharides.

Looking forward, cross-sector collaboration is expected to intensify, bringing together enzyme developers, process engineering firms, and end users in food, feed, textiles, and bioenergy. Regulatory bodies and industry alliances are also likely to standardize characterization protocols and data reporting, fostering greater transparency and interoperability. As these initiatives mature, polysaccharide enzyme characterization will continue to underpin the shift toward circular bioeconomies, with significant commercial and environmental benefits anticipated by 2030.