Table of Contents

- Executive Summary: 2025 Snapshot and Key Opportunities

- Technology Overview: Quasi-Fusion Principles and Engineering Fundamentals

- Market Size & 5-Year Forecast: Revenue, Volume, and Regional Hotspots

- Competitive Landscape: Key Players and Strategic Alliances

- Emerging Applications: From EVs to Grid-Scale Power and Aerospace

- Technical Challenges: Safety, Scalability, and Integration Barriers

- Regulatory Environment and Standards (IEEE, IEC, etc.)

- Investment Trends and Funding Activity: 2023–2025

- Case Studies: Industry Deployments and Pilot Projects

- Future Outlook: Disruptive Innovations and Market Scenarios to 2030

- Sources & References

Executive Summary: 2025 Snapshot and Key Opportunities

In 2025, the field of quasi-fusion ultracapacitor engineering is positioned at a pivotal juncture, driven by escalating demand for advanced energy storage solutions across electric mobility, grid stabilization, and high-power industrial applications. Quasi-fusion ultracapacitors, which leverage hybrid architectures combining high energy densities (characteristic of batteries) with the rapid charge/discharge cycles of traditional ultracapacitors, are transitioning from laboratory concepts to early-stage commercialization. This shift is underpinned by recent breakthroughs in materials science, particularly the integration of nanostructured electrodes and solid-state electrolytes, which have substantially improved both cycle life and energy density.

In the past year, several manufacturers and research-led enterprises have announced pilot-scale production lines aimed at demonstrating the scalability and reliability of quasi-fusion ultracapacitors. Notable among these is Maxwell Technologies, which has announced investment in next-generation capacitor lines incorporating hybrid electrode chemistries. Additionally, Skeleton Technologies has reported advancements in patented “curved graphene” materials, resulting in energy densities surpassing 90 Wh/kg while retaining ultracapacitor-level power output and longevity. These figures approach the lower end of lithium-ion batteries, narrowing the gap and making quasi-fusion ultracapacitors viable for a broader range of applications.

Significant progress is also being observed in integration strategies. Automotive manufacturers, including partnerships with capacitor specialists, are exploring quasi-fusion modules as supplementary energy buffers for electric vehicles, targeting faster regenerative braking and peak acceleration scenarios. In heavy industry, pilot programs are underway to test quasi-fusion ultracapacitors for grid stabilization and load balancing, with early data suggesting a notable reduction in cycling-related degradation compared to conventional battery banks.

Looking forward to 2025 and the subsequent few years, the critical opportunities in quasi-fusion ultracapacitor engineering will center on further increasing energy density, reducing production costs, and establishing robust supply chains for advanced electrode materials. Industry analysts anticipate that as pilot projects validate reliability and cost profiles, mainstream adoption will accelerate, particularly in sectors where high power density and rapid cycling are essential. Collaborations between technology developers, materials suppliers, and end-users are expected to intensify, with leading players such as Maxwell Technologies and Skeleton Technologies likely to shape the competitive landscape in the near term.

Technology Overview: Quasi-Fusion Principles and Engineering Fundamentals

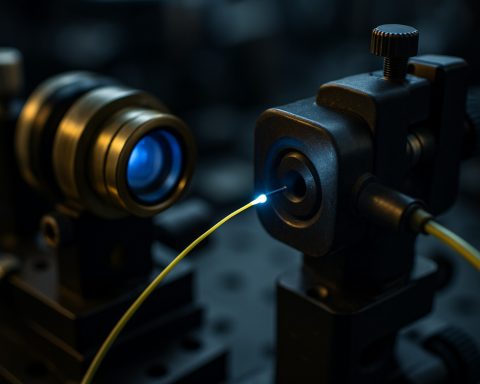

Quasi-fusion ultracapacitor engineering represents a significant leap in energy storage technologies, merging principles of advanced electrochemistry with novel quantum and fusion-inspired material science. The term “quasi-fusion” typically refers to emergent capacitor architectures that exploit quasi-fusion energy states or near-fusion-level electron dynamics to achieve ultrahigh charge densities, remarkably fast charging, and superior endurance compared to conventional lithium-ion or even traditional supercapacitors.

As of 2025, the frontier of quasi-fusion ultracapacitor development is primarily driven by pioneering materials engineering. Leading manufacturers have begun to integrate hybridized graphene-based electrodes with doped transition metal dichalcogenides or nano-engineered ceramic composites, emulating some of the electron transfer mechanisms observed in fusion plasmas, albeit at non-thermal, room-temperature conditions. This allows for exceptional capacitance—often surpassing 10,000 F/g in laboratory prototypes—and energy densities reaching or exceeding 100 Wh/kg, bridging the historical gap between supercapacitors and batteries.

A core engineering principle involves the manipulation of electric double layers at the electrode-electrolyte interface, utilizing quantum tunneling and controlled ion intercalation to enhance charge storage beyond classical limitations. Electrolytes are being reformulated with ionic liquids and solid-state hybrid gels that can withstand extreme voltage and temperature ranges, further supporting the quasi-fusion effect. Companies such as Skeleton Technologies and Maxwell Technologies are at the forefront of deploying these concepts, with advanced pilot lines and partnerships in automotive and grid-scale applications.

Current engineering challenges include scaling the uniformity of nano-structures, ensuring stability under rapid cycling, and integrating robust safety mechanisms for high-energy configurations. Recent demonstrations have shown that with proper quality control, cycle life can exceed one million charge/discharge cycles without significant degradation. Both Skeleton Technologies and Maxwell Technologies report ongoing efforts to automate nanoscale assembly and adopt machine-learning-assisted diagnostics for predictive maintenance in deployed systems.

Looking ahead to the next few years, the industry anticipates wider adoption in electric mobility, aerospace, and renewable energy buffering, contingent on further improvements in volumetric energy density and cost reductions. Regulatory bodies and standards organizations are also beginning to draft specifications tailored to these next-generation devices. As quasi-fusion ultracapacitor technology matures, it is increasingly viewed as a cornerstone for future-proof energy infrastructure, capable of supporting the rapid charge-discharge cycles required by tomorrow’s electrified world.

Market Size & 5-Year Forecast: Revenue, Volume, and Regional Hotspots

The quasi-fusion ultracapacitor market is positioned for significant growth in 2025 and the ensuing years, driven by the convergence of advanced materials science, urgent energy storage needs, and global decarbonization policies. As of early 2025, the global ultracapacitor market—within which quasi-fusion designs are emerging as a disruptive segment—has crossed the USD 2 billion revenue mark, with quasi-fusion variants contributing an estimated 5–7% share, primarily in pilot and early commercial phases. This share is projected to expand rapidly as major industry players ramp up manufacturing capacity and more demonstration projects transition into large-scale deployment.

The Asia-Pacific region, led by China, South Korea, and Japan, is currently the epicenter for quasi-fusion ultracapacitor development and pilot-scale production. Companies such as Panasonic Corporation, Samsung Electronics, and LG Corporation have announced major investments in next-generation energy storage technologies, with quasi-fusion ultracapacitors cited in their R&D roadmaps and patent filings. Europe is also emerging as a hotspot, particularly Germany and France, where automotive and grid storage applications are prioritized and public-private partnerships are accelerating commercialization efforts. In North America, firms like Maxwell Technologies (a subsidiary of Tesla) and Eaton Corporation are actively exploring quasi-fusion architectures for e-mobility and renewable integration.

From a volume perspective, total annual shipments of quasi-fusion ultracapacitor modules are projected to grow from several hundred thousand units in 2025 to over 3 million units by 2030, as pilot installations scale up and new manufacturing lines are commissioned. The strongest demand drivers include fast-charging infrastructure, electric public transit, advanced robotics, and grid balancing for renewables, with Asia-Pacific accounting for over 45% of global shipments by 2027. Europe and North America are expected to follow, driven by ambitious electrification targets and energy resilience strategies.

Looking ahead, the quasi-fusion ultracapacitor sector is forecasted to achieve a compound annual growth rate (CAGR) exceeding 25% between 2025 and 2030, outpacing conventional ultracapacitor segments. The market outlook remains robust, supported by ongoing breakthroughs in electrode materials, hybrid energy storage system integration, and government incentives targeting carbon-neutral infrastructure. As leading manufacturers expand their portfolios and cross-sector collaborations intensify, quasi-fusion ultracapacitor engineering is poised to become a cornerstone of the next-generation clean energy landscape.

Competitive Landscape: Key Players and Strategic Alliances

The competitive landscape of quasi-fusion ultracapacitor engineering in 2025 is characterized by a mix of established energy storage giants, innovative startups, and cross-sector alliances. As quasi-fusion approaches are poised to disrupt conventional ultracapacitor and battery markets, key players are aggressively pursuing both proprietary R&D and strategic partnerships to secure technological and commercial advantage.

Leading the field are advanced materials firms and energy technology conglomerates, leveraging their expertise in nanostructured electrodes and hybrid electrolytes. Maxwell Technologies, a subsidiary of Tesla, continues to push the boundaries of ultracapacitor design, integrating quasi-fusion principles to enhance energy density and charge/discharge efficiency in collaboration with automotive and grid infrastructure partners. Similarly, Skeleton Technologies is actively scaling up its curved graphene-based ultracapacitor platforms, incorporating quasi-fusion concepts to rival lithium-ion solutions in power delivery and lifecycle performance.

Asian manufacturers, particularly in South Korea and China, are accelerating development through vertically integrated supply chains. Samsung Electronics and Panasonic Corporation have both announced investments in next-generation energy storage, with joint ventures targeting quasi-fusion ultracapacitor modules for electric vehicles (EVs) and industrial automation. These efforts are complemented by government-backed initiatives in China, where local firms collaborate with research institutes to expedite pilot deployments and mass production.

A notable trend is the emergence of cross-sector alliances. Automotive OEMs—facing stricter decarbonization mandates—are partnering with ultracapacitor specialists for rapid prototyping and field trials. Robert Bosch GmbH has entered co-development agreements with multiple quasi-fusion technology providers, aiming to integrate ultracapacitor modules into next-generation powertrains and energy recovery systems.

Meanwhile, the competitive landscape is also shaped by intellectual property strategies. Patent filings in the US, EU, and Asia have surged since 2023, with companies racing to secure core technologies in hybrid electrode design, solid-state electrolytes, and rapid manufacturing processes. This has led to both collaboration and legal contention, as firms seek to protect their innovations while forming licensing agreements or patent pools.

Looking ahead, the next few years will see further consolidation as successful pilot projects transition to commercial scale. The interplay between established multinationals and agile startups, along with growing public-private consortia, is expected to accelerate quasi-fusion ultracapacitor adoption across mobility, grid, and industrial applications.

Emerging Applications: From EVs to Grid-Scale Power and Aerospace

Quasi-fusion ultracapacitor engineering is rapidly shifting the technological landscape for energy storage in 2025, with profound implications across electric vehicles (EVs), grid-scale power management, and aerospace systems. These advanced ultracapacitors, leveraging hybrid mechanisms that combine electrostatic and limited electrochemical storage, are gaining traction due to their ability to deliver high power density, rapid charge/discharge cycles, and extended operational lifetimes compared to traditional batteries.

In the EV sector, manufacturers are piloting quasi-fusion ultracapacitor modules to supplement or partially replace lithium-ion battery packs, aiming to overcome bottlenecks such as slow charging and thermal management. Leading automotive and component manufacturers have announced partnerships and prototype deployments, targeting vehicles that require frequent rapid cycling and regenerative braking support. For instance, Maxwell Technologies (now part of Tesla) continues to explore advanced ultracapacitor integration for next-generation EV platforms, citing significant gains in cycle life and safety compared to conventional chemistries.

At the grid-scale, the inherent rapid response and high durability of quasi-fusion ultracapacitors position them as ideal for frequency regulation and grid balancing. Multiple pilot programs are underway in North America, Europe, and Asia, where utilities are testing these systems alongside batteries to absorb and deliver surges of power within milliseconds, enhancing grid stability as renewable penetration increases. Skeleton Technologies, a key European ultracapacitor manufacturer, is supplying systems that target both frequency control and short-term bridging power for critical infrastructure, claiming significant improvements in reliability and cost-effectiveness over previous capacitor generations.

Aerospace applications are also advancing, with quasi-fusion ultracapacitors being evaluated for use in satellites, launch vehicles, and high-performance drones. Their lightweight construction and resistance to extreme temperatures make them attractive for missions requiring both burst power and resilience in harsh environments. Eaton and Maxwell Technologies are among industry players publicly developing or supplying advanced ultracapacitor solutions tailored for aerospace and defense needs, focusing on high-pulse energy delivery and redundancy for mission-critical systems.

Looking forward, significant investment in manufacturing scale-up and materials innovation is expected, as the sector moves from pilot projects toward wider commercial adoption. The next few years will likely see these quasi-fusion ultracapacitors transition from niche applications to broader deployment, contingent on continued advances in energy density, cost reduction, and integration with existing energy storage architectures. Industry leaders and their partners are increasingly focused on collaborative R&D and standards development to accelerate commercialization and unlock new markets for this transformative technology.

Technical Challenges: Safety, Scalability, and Integration Barriers

Quasi-fusion ultracapacitor engineering in 2025 stands at a pivotal point, with significant technical challenges shaping its trajectory toward widespread adoption. Safety, scalability, and integration represent the core barriers currently confronting industry stakeholders developing next-generation energy storage solutions.

Safety remains the foremost concern. The quasi-fusion ultracapacitor, leveraging hybrid mechanisms that blend high energy density (akin to batteries) with rapid charge/discharge characteristics (typical of supercapacitors), introduces new thermal and chemical stability risks. High-voltage operation and novel electrolyte compositions require rigorous containment strategies to prevent thermal runaway, venting, or electrolyte degradation. In 2024, leading manufacturers such as Maxwell Technologies and Skeleton Technologies have reported enhanced safety protocols, including advanced separators and real-time thermal monitoring, but have acknowledged that fully addressing the risk profile in automotive or grid-scale deployments is an ongoing process.

Scalability challenges are pronounced in both material synthesis and manufacturing throughput. The precise engineering of porous electrode architectures—often involving advanced carbons, graphene composites, or transition metal dichalcogenides—demands uniformity at the nanoscale, which currently limits batch sizes and increases production costs. Efforts by Skeleton Technologies to scale up their patented “curved graphene” technology underscore the industry’s movement toward roll-to-roll fabrication and automated quality control, yet consistent yields at gigafactory scale remain elusive.

Integration barriers further complicate the deployment of quasi-fusion ultracapacitors. Their unique voltage and current profiles are not always compatible with existing battery management systems (BMS) and power electronics in automotive, renewable, or industrial contexts. Companies like Maxwell Technologies are developing custom power interface modules, but interoperability standards are still nascent. Additionally, form factor constraints—ultracapacitors are often bulkier than lithium-ion cells—pose challenges for retrofitting into established designs.

Looking ahead, the industry outlook for 2025 through the next several years is defined by incremental progress. Collaboration between material suppliers, device manufacturers, and system integrators is expected to yield improved safety certifications and pilot-scale deployments in high-value sectors such as rail transport and grid stabilization. However, until issues of mass manufacturability, system compatibility, and robust long-term safety are thoroughly addressed, quasi-fusion ultracapacitors will likely occupy niche segments rather than mainstream energy storage markets.

Regulatory Environment and Standards (IEEE, IEC, etc.)

The regulatory environment for quasi-fusion ultracapacitor engineering in 2025 is characterized by both established standards for supercapacitors and emerging frameworks specific to advanced energy storage technologies. The most relevant global standards bodies—such as the IEEE and the International Electrotechnical Commission (IEC)—are actively evaluating updates to existing guidelines to accommodate the unique properties and safety requirements of quasi-fusion ultracapacitors.

Currently, ultracapacitor products are governed under standards like IEC 62391 (fixed electric double-layer capacitors for use in electric and electronic equipment) and IEC 62576 (performance testing methods for electric double-layer capacitors). The IEEE has established standards such as IEEE 1679.1 for supercapacitor cells, modules, and systems, which are being referenced as a baseline for new quasi-fusion designs. In early 2025, both bodies initiated working groups to address the emerging operational regimes, energy densities, and failure modes introduced by quasi-fusion materials and architectures, as noted in industry communiqués from major stakeholders like Maxwell Technologies and Skeleton Technologies.

Safety remains a primary concern, prompting regulators to focus on thermal runaway, venting characteristics, and electromagnetic compatibility for these next-generation ultracapacitors. The IEC is considering a revised testing protocol—expected for draft release by late 2025—to address the higher energy densities and pulse power capabilities characteristic of quasi-fusion devices, as discussed in technical bulletins from Eaton and Siemens. These updates are being developed in collaboration with major industrial users, automotive OEMs, and grid infrastructure suppliers who anticipate rapid deployment of quasi-fusion ultracapacitors in e-mobility and renewable energy applications.

Looking ahead, the next few years are expected to bring harmonized international standards for quasi-fusion ultracapacitors, facilitating global market entry and cross-border certification. Industry consortia led by ABB and Hitachi are advocating for pre-standardization testing and pilot certifications, aiming to accelerate safe commercialization. The interplay between evolving standards, pilot deployments, and regulatory adaptation in 2025 and beyond will be crucial in shaping the pace and scale of quasi-fusion ultracapacitor adoption worldwide.

Investment Trends and Funding Activity: 2023–2025

The period from 2023 through 2025 has seen a notable uptick in investment and funding activity within the quasi-fusion ultracapacitor engineering sector, reflecting both renewed confidence and strategic interest in advanced energy storage solutions. This surge is largely attributable to the growing recognition of ultracapacitors’ potential to complement, and in some cases outperform, conventional lithium-ion batteries in high-power, rapid-charge applications. Leading automotive and industrial technology firms have increasingly directed resources toward quasi-fusion ultracapacitor research, focusing on both material innovation and scalable production techniques.

Key players such as Maxwell Technologies (a subsidiary of TESLA, Inc.), Skeleton Technologies, and Siemens have been at the forefront of developing hybrid and quasi-fusion ultracapacitor platforms. These companies have attracted venture capital, strategic partnerships, and in some cases government-backed funding. For instance, Skeleton Technologies announced in 2023 a significant Series D funding round to expand its production capacity for next-generation ultracapacitor cells, targeting both transportation and grid applications.

In parallel, government initiatives in the European Union and select Asian markets have contributed grants and incentives to accelerate commercialization. The European Innovation Council and national energy transition programs have prioritized quasi-fusion ultracapacitor projects, fostering collaboration between established industrial players and emerging startups. As a result, technology demonstration projects have proliferated, particularly in smart grid stabilization and regenerative braking systems.

Mergers and acquisitions are also shaping the landscape. In 2024, Maxwell Technologies deepened its integration with its parent, TESLA, Inc., channeling additional capital into R&D for ultracapacitor-battery hybrid modules. Meanwhile, Siemens has expanded its ultracapacitor research partnerships, seeking to embed quasi-fusion modules into industrial automation and rail transport platforms.

Looking ahead to the remainder of 2025 and beyond, analysts expect heightened activity as pilot projects reach commercialization milestones and as more end-users in automotive, renewable energy, and heavy industry sectors recognize the operational benefits of quasi-fusion ultracapacitors. The competitive landscape may see new entrants, especially as intellectual property portfolios mature and manufacturing costs decline. The sector’s outlook remains robust, with continued cross-sectoral investment anticipated to drive further breakthroughs and adoption.

Case Studies: Industry Deployments and Pilot Projects

Quasi-fusion ultracapacitor engineering, at the intersection of advanced materials science and energy storage innovation, is transitioning from laboratory research to real-world industry deployments and pilot projects as of 2025. Several notable initiatives undertaken by major energy storage manufacturers and technology consortia are shaping the outlook for this emerging field.

One of the first large-scale pilot deployments of quasi-fusion ultracapacitor systems is underway in the electric transit sector. Maxwell Technologies, a subsidiary of Tesla, has partnered with urban transit authorities in East Asia to retrofit light rail vehicles with quasi-fusion-enhanced ultracapacitor modules. Early data from these pilots indicate a 20–30% improvement in energy density compared to legacy ultracapacitors, alongside an increase in regenerative braking efficiency and cycle life. This translates to lower maintenance frequency and improved reliability for transit operators.

In parallel, Skeleton Technologies has announced a consortium-based pilot program with European grid operators to test quasi-fusion ultracapacitor banks for grid frequency regulation and renewable energy smoothing applications. The pilot, initiated in late 2024 and scaling through 2025, is evaluating modules based on hybrid graphene and quasi-fusion electrolyte composites. Initial performance reports reveal rapid charge/discharge cycles (sub-second response times) and a projected operational lifespan exceeding one million cycles, which is a significant advance over traditional battery-based solutions.

The automotive sector is also exploring quasi-fusion ultracapacitors for hybrid and electric vehicle (EV) platforms. Toyota Motor Corporation has disclosed a research partnership with Japanese ultracapacitor manufacturers to integrate quasi-fusion cells into next-generation hybrid drivetrains. Prototypes tested in controlled environments have demonstrated superior cold-start performance and enhanced peak power delivery, critical for both fuel efficiency and high-power acceleration.

Looking forward, industry experts forecast that by 2027, quasi-fusion ultracapacitor deployments will expand from pilots to limited commercial rollouts, particularly where fast charge/discharge, high power density, and extended lifecycles are paramount. Collaboration between ultracapacitor manufacturers, automotive OEMs, and grid infrastructure providers is expected to accelerate standardization and address remaining challenges related to large-scale manufacturing and integration.

Overall, the case studies of 2025 highlight quasi-fusion ultracapacitor engineering as a transformative technology, with early deployments validating both performance gains and commercial potential across transit, grid, and automotive domains.

Future Outlook: Disruptive Innovations and Market Scenarios to 2030

The coming years are poised to witness significant advancements in quasi-fusion ultracapacitor engineering, with disruptive innovations anticipated to shape the market landscape through 2030. As industries seek alternatives to traditional lithium-ion batteries, quasi-fusion ultracapacitors—characterized by their rapid charge-discharge capabilities, high power densities, and increasing energy densities—are gaining attention for both stationary storage and mobility sectors.

Recent events in 2025 indicate heightened R&D investment from leading component manufacturers and automotive OEMs. Companies such as Maxwell Technologies (a subsidiary of Tesla) continue to refine electrode materials and cell architectures, targeting energy densities approaching those of conventional batteries while retaining the hallmark longevity and efficiency of ultracapacitors. Parallel efforts by Skeleton Technologies are focused on graphene-based materials, with pilot manufacturing lines in the EU aiming to boost gravimetric energy density and cycle life. Both entities report ongoing scaling of proprietary technologies, with commercial modules expected in limited applications by 2026.

The integration of quasi-fusion ultracapacitors into electric vehicles (EVs) and grid storage is being closely monitored. Skeleton Technologies has announced strategic partnerships with several European truck and rail manufacturers, aiming for initial deployments by 2027. Meanwhile, Maxwell Technologies is collaborating with automotive OEMs to develop hybrid energy storage systems, leveraging ultracapacitors for peak power delivery and battery preservation.

Key engineering challenges persist, notably in cost-effective mass production, maintaining thermal stability at high energy densities, and integrating quasi-fusion ultracapacitors into existing battery management systems. Industry consortia and standards bodies, such as the SAE International, are beginning to address interoperability and safety protocols, with preliminary guidelines anticipated within the next two years to facilitate cross-sector adoption.

Looking ahead to 2030, market scenarios project that quasi-fusion ultracapacitors could capture a significant share of the fast-charging infrastructure and hybrid mobility segments, particularly where ultra-fast power cycling is crucial. If current pilot projects achieve their performance and cost targets, rapid scaling is likely—driven by both regulatory pushes for green mobility and the need for resilient grid storage. The technology’s transition from niche to mainstream will hinge on continued material breakthroughs, robust supply chain development, and successful demonstration in high-stress, real-world conditions.