Table of Contents

- Executive Summary: Key Trends in Wetland Peat Analysis for 2025–2029

- Global Market Forecast: Growth Drivers, Challenges, and Regional Hotspots

- Emerging Technologies: Cutting-Edge Tools and Analytical Methods

- Regulatory Landscape: Compliance, Environmental Policy, and Standards

- Major Players: Profiles and Innovations from Leading Providers

- Application Sectors: From Carbon Accounting to Biodiversity Assessment

- Sustainability and Climate Impact: Peat Analysis in Net Zero Strategies

- Investment and Funding Landscape: M&A, Startups, and Venture Capital

- Case Studies: Real-World Wetland Restoration and Monitoring Successes

- Future Outlook: Opportunities, Threats, and Strategic Recommendations

- Sources & References

Executive Summary: Key Trends in Wetland Peat Analysis for 2025–2029

Wetland peat analysis services are undergoing significant transformation as climate change, environmental monitoring, and sustainable land management drive demand for advanced analytical capabilities. Between 2025 and 2029, several key trends are shaping this sector, including the adoption of digital tools, expansion of carbon credit markets, and increasing regulatory oversight.

A central trend is the integration of cutting-edge technologies such as remote sensing, GIS, and high-resolution laboratory instrumentation. These advancements enable more precise mapping and characterization of peatland composition, hydrology, and carbon stocks. Leading environmental testing companies and equipment manufacturers are investing in automated soil and peat analysis systems, improving throughput and data accuracy. For example, Agilent Technologies and Thermo Fisher Scientific continue to expand their portfolios of analytical instruments suitable for peat carbon, nutrient, and contaminant analyses.

A second major driver is the growth of carbon markets and climate mitigation initiatives. Peatlands are increasingly recognized for their critical role in carbon sequestration, and accurate analysis of peat properties is essential for verifying carbon stocks and assessing restoration progress. Service providers are developing standardized protocols for sampling, analysis, and reporting to meet requirements set by international frameworks such as the UNFCCC and voluntary carbon market standards. This is encouraging cross-sector partnerships, with organizations like DNV offering validation and verification services for peatland carbon projects.

Regulatory frameworks are also becoming more stringent. Governments in Europe, North America, and Southeast Asia are mandating regular monitoring and reporting on wetland health, peat extraction, and restoration outcomes. This is fueling demand for third-party analysis services with robust quality assurance and accreditation. Industry groups such as the SGS and Bureau Veritas are expanding their environmental testing and certification portfolios to support compliance and transparency.

Looking ahead, the sector is expected to see continued investment in data integration platforms, mobile sampling technologies, and AI-driven analytics, enabling more rapid and cost-effective wetland assessments. As global attention remains focused on climate and biodiversity goals, wetland peat analysis services will play a pivotal role in supporting both public policy and private sector sustainability commitments through 2029 and beyond.

Global Market Forecast: Growth Drivers, Challenges, and Regional Hotspots

The global market for wetland peat analysis services is positioned for steady growth through 2025 and the subsequent years, propelled by mounting environmental regulations, heightened focus on carbon sequestration, and the need for precise ecosystem monitoring. Governments and corporations are increasingly required to quantify peatland carbon stocks and greenhouse gas emissions to meet international climate commitments. This demand is spurring investments in advanced analytical technologies and service capabilities.

Key growth drivers include the expansion of climate policy frameworks such as the European Union’s Green Deal and the United Nations’ REDD+ initiatives, which prioritize wetland conservation and restoration. These policies have led to increased funding for peatland mapping, sampling, and laboratory analysis, particularly in Europe and Southeast Asia—regions with substantial peatland coverage. For example, the Netherlands’ ongoing national peatland monitoring program, in collaboration with organizations like Wageningen University & Research, is fostering demand for comprehensive analysis of peat composition, hydrology, and carbon fluxes.

Technological advancements are also shaping the sector. The adoption of remote sensing, drone-based sampling, and automated laboratory instrumentation is improving the accuracy and scalability of peat analysis services. Companies such as SGS and Bureau Veritas are expanding their environmental service portfolios to include specialized peatland assessments, capitalizing on global interest in sustainable land use and reporting.

However, the market faces challenges. The heterogeneity of peatlands, logistical difficulties in remote or waterlogged areas, and the need for standardized methodologies can constrain analysis quality and comparability. Additionally, the high cost of comprehensive field and laboratory work may limit uptake among smaller landholders or in developing regions.

Regionally, Europe remains a hotspot for wetland peat analysis services due to strong regulatory drivers and established research networks. Southeast Asia—especially Indonesia and Malaysia—continues to be a critical market due to the scale of tropical peatlands and ongoing restoration projects linked to palm oil and forestry sectors. North America is expected to see moderate growth as wetland restoration gains momentum in the United States and Canada, supported by initiatives from agencies like the U.S. Environmental Protection Agency.

Looking ahead, the outlook for wetland peat analysis services remains positive, with double-digit annual growth expected in key regions. Expansion will be underpinned by increasing climate reporting requirements, restoration funding, and advancements in sampling and analytical technologies.

Emerging Technologies: Cutting-Edge Tools and Analytical Methods

The field of wetland peat analysis is undergoing significant transformation as emerging technologies enhance the accuracy, speed, and scope of data collection and interpretation. In 2025, several advanced tools and analytical methods are gaining traction among environmental laboratories and service providers. These innovations are driven by stricter regulatory demands, the need for comprehensive carbon accounting, and global commitments to monitor and restore wetland ecosystems.

One of the most prominent developments is the integration of high-resolution remote sensing, including LiDAR and hyperspectral imaging, to map peatland extent and assess peat depth and condition at landscape scales. These technologies enable the collection of spatially continuous data, which, when combined with ground-truthing by field teams, provides a robust foundation for peat inventory and monitoring. Organizations like Leica Geosystems and Trimble are at the forefront, supplying advanced instrumentation for such surveys.

In laboratory settings, next-generation sequencing (NGS) is being increasingly utilized to characterize microbial communities within peat soils. This is crucial, as microbial processes largely dictate greenhouse gas fluxes in peatlands. Service providers are adopting NGS platforms from manufacturers such as Illumina to deliver detailed biogeochemical analyses, revealing shifts in ecosystem function in response to restoration or disturbance.

Automated gas flux chambers, paired with real-time data loggers, are also seeing widespread deployment for the quantification of carbon dioxide, methane, and nitrous oxide emissions from peat surfaces. Companies like Campbell Scientific supply monitoring solutions that enable high-frequency, long-term gas flux measurements, supporting more accurate greenhouse gas inventories and informing carbon credit schemes.

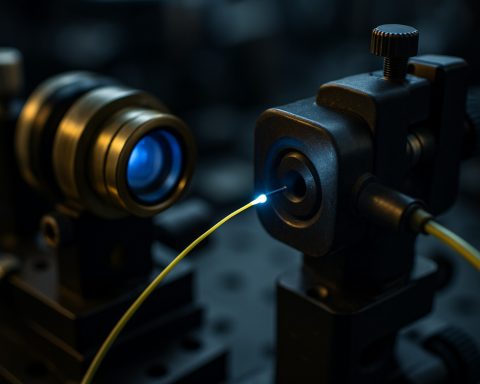

Furthermore, advancements in portable spectrometry and in situ probe technology are making it possible to assess peat properties—such as organic content, moisture, and nutrient status—directly in the field. These methods reduce sample degradation and speed up the delivery of actionable data. Equipment from Metrohm and Thermo Fisher Scientific is increasingly featured in the toolkit of wetland assessment teams.

Looking ahead, the integration of artificial intelligence for pattern recognition and predictive modeling is expected to further revolutionize peat analysis. By leveraging large datasets from these new tools, service providers will enhance their capacity to monitor, protect, and restore wetland peatlands, supporting both regulatory compliance and global climate objectives.

Regulatory Landscape: Compliance, Environmental Policy, and Standards

The regulatory landscape surrounding wetland peat analysis services is becoming increasingly complex and stringent as environmental policy, climate action, and ecosystem protection rise in global importance. In 2025 and the immediate years ahead, regulatory requirements for wetland and peatland assessment are being strengthened at both national and international levels, directly impacting service providers and stakeholders in this sector.

Key drivers of this evolving regulatory environment include commitments under the Paris Agreement, which recognize the significant carbon storage potential of peatlands and their role in global greenhouse gas (GHG) mitigation. As a result, governments and regulatory bodies are updating environmental standards and compliance frameworks to ensure accurate monitoring, reporting, and verification (MRV) of wetland and peatland conditions. For example, the Ramsar Convention on Wetlands continues to promote best practices and international standards for wetland inventory, assessment, and monitoring, directly informing national policies and guidelines.

In the European Union, the European Green Deal and the EU Biodiversity Strategy for 2030 are translating into stricter national regulations for peatland restoration, with requirements for baseline surveys, ongoing monitoring, and GHG flux quantification. These policies require that wetland peat analysis services adhere to standardized methodologies such as those recommended by the Intergovernmental Panel on Climate Change (IPCC) for GHG inventories and the International Organization for Standardization (ISO) for environmental sampling and laboratory practices.

In North America, regulatory agencies such as the United States Environmental Protection Agency (EPA) and Environment and Climate Change Canada are expanding requirements for wetland delineation and peat characterization, particularly in relation to land-use change, infrastructure development, and carbon offset projects. These regulations increasingly reference the use of advanced analytical techniques such as remote sensing, soil coring, and laboratory peat composition analysis, necessitating service providers to demonstrate compliance with evolving technical standards.

Looking ahead, the outlook for wetland peat analysis services is shaped by the anticipated tightening of policies related to carbon accounting, ecosystem restoration, and biodiversity conservation. Service providers are expected to invest in new technologies and certification to remain compliant, while clients—including government agencies, developers, and conservation organizations—face heightened due diligence obligations. As regulatory frameworks continue to evolve, alignment with globally recognized standards and transparent, auditable data practices will be essential for all stakeholders in the wetland peat analysis sector.

Major Players: Profiles and Innovations from Leading Providers

The wetland peat analysis services sector in 2025 is characterized by advanced analytical techniques and a growing emphasis on climate-smart solutions. Several leading environmental and laboratory service providers are at the forefront, delivering high-resolution peat characterization, carbon content analysis, and environmental impact assessments tailored to regulatory and restoration needs.

One of the major players, Bureau Veritas, has expanded its suite of peat and soil analysis services, integrating digital data management and real-time reporting capabilities. Their innovations focus on supporting restoration projects and carbon credit verification, leveraging accredited laboratory protocols for organic matter content, trace metals, and greenhouse gas flux measurements.

Another significant provider, Eurofins Scientific, continues to develop specialized methodologies for the quantification of peat carbon stocks and the tracking of nutrient cycling within wetland ecosystems. In 2025, their laboratories are increasingly collaborating with government agencies and conservation groups to deliver data that informs both policy and on-the-ground management, utilizing proprietary techniques for minimal-disturbance core sampling and rapid turnaround on analytical results.

In North America, SGS remains a key innovator, offering comprehensive peatland monitoring services that combine geospatial analysis with field sampling. Their recent initiatives involve integrating remote sensing data and drone-based mapping with laboratory peat characterization, enabling large-scale spatial assessments crucial for restoration planning and compliance with evolving carbon markets.

The role of non-profit organizations and public research institutes also continues to expand. Entities such as the United States Geological Survey (USGS) actively collaborate with service providers to refine protocols for peat sampling and carbon sequestration assessments, ensuring scientific rigor and comparability of results across projects and regions.

- Innovation Outlook: The next few years will likely see further integration of artificial intelligence in peat data interpretation, automation of lab workflows, and enhanced field-to-lab connectivity for near-real-time monitoring.

- Regulatory Alignment: As international standards for wetland carbon accounting mature, service providers are quickly updating their offerings to meet verification requirements for climate finance and biodiversity credits.

- Global Collaboration: Cross-sector partnerships—linking laboratories, tech firms, and conservation organizations—are expected to accelerate, supporting scalable and standardized wetland monitoring solutions worldwide.

These trends position leading wetland peat analysis service providers as pivotal contributors to climate action, ecosystem restoration, and sustainable land management strategies through 2025 and beyond.

Application Sectors: From Carbon Accounting to Biodiversity Assessment

Wetland peat analysis services are becoming increasingly crucial across multiple application sectors, notably in carbon accounting and biodiversity assessment. As climate change mitigation and environmental stewardship intensify on national and international agendas, the demand for robust, science-based data from wetland peatlands is expected to grow markedly through 2025 and the following years.

The primary application sector is carbon accounting. Peatlands store immense amounts of carbon, and accurate quantification of this carbon stock is essential for compliance with regulatory frameworks such as the Paris Agreement and voluntary carbon markets. Companies providing wetland peat analysis facilitate measurement, reporting, and verification (MRV) of greenhouse gas (GHG) emissions and removals. This supports organizations and governments in their net-zero commitments and enables participation in carbon credit generation projects. Market leaders and research organizations, such as VTTI and DNV, are developing and applying advanced sampling, remote sensing, and modeling techniques to deliver accurate peatland carbon assessments.

Biodiversity assessment is another sector experiencing a surge in demand for wetland peat analysis. Peatlands are hotspots for unique flora and fauna, many of which are threatened. Services that analyze peat composition, hydrology, and habitat quality are now integral to environmental impact assessments (EIAs), conservation planning, and ecosystem restoration projects. Organizations such as RSPB and IUCN utilize peat analysis data to inform biodiversity monitoring and restoration strategies, ensuring that conservation interventions are evidence-based and effective.

Emerging application sectors include land-use planning and climate adaptation. Wetland peat analysis informs sustainable land management decisions, helping authorities identify areas where development or drainage would risk significant carbon release or biodiversity loss. This is particularly relevant as governments and private landowners seek to align their operations with ESG (Environmental, Social, and Governance) criteria and evolving regulatory requirements.

Looking ahead, the outlook for wetland peat analysis services is strong. Advances in analytical technologies—such as in situ sensors, drone-based lidar, and AI-driven data interpretation—are expected to expand the scope and reduce the cost of peatland monitoring. As stakeholders increase their commitments to climate action and biodiversity protection, the integration of wetland peat analysis into broader environmental and sustainability programs will likely accelerate, solidifying its role as a foundational tool across multiple application sectors.

Sustainability and Climate Impact: Peat Analysis in Net Zero Strategies

As global climate commitments intensify in 2025, the importance of wetland peat analysis services is growing rapidly within sustainability and net zero strategies. Peatlands, which cover only about 3% of the world’s land surface, store nearly one-third of global soil carbon, making their management and restoration critical to achieving carbon neutrality targets. Recent policy developments, such as the continued implementation of the Paris Agreement and the European Union’s Fit for 55 package, are driving both governmental and private entities to seek accurate, verifiable data on peatland carbon stocks and greenhouse gas fluxes.

Wetland peat analysis services encompass a suite of field sampling, laboratory testing, remote sensing, and modeling solutions to assess peat composition, carbon content, water table levels, and emissions profiles. Companies specializing in environmental testing and peatland monitoring are expanding their offerings in response to increasing demand for robust data to underpin carbon accounting, conservation, and restoration projects. For example, organizations such as SGS and Bureau Veritas provide accredited laboratory services for organic matter analysis, carbon quantification, and trace gas measurements, supporting carbon credit validation and ecosystem service assessments.

In 2025, a major trend is the integration of advanced remote sensing and artificial intelligence to enhance the spatial and temporal resolution of peatland maps. Satellite and drone technologies, combined with machine learning algorithms, are being deployed to monitor peatland extent, detect drainage or degradation, and estimate carbon loss or sequestration potential. This technological evolution enables continuous, large-scale monitoring aligned with regulatory and voluntary reporting frameworks, such as those outlined by the Intergovernmental Panel on Climate Change and national greenhouse gas inventories.

Looking ahead, demand for wetland peat analysis services is expected to accelerate as countries and corporations recognize the dual benefits of climate mitigation and biodiversity conservation. International funding mechanisms—including those administered by the United Nations Environment Programme—are likely to channel more resources toward peatland restoration and monitoring, further elevating the role of high-quality peat analysis. The sector is also seeing increased collaboration between environmental service providers and land managers, ensuring that the scientific rigor of peat analysis translates into actionable strategies for net zero and nature-positive outcomes.

Investment and Funding Landscape: M&A, Startups, and Venture Capital

The investment and funding landscape for wetland peat analysis services in 2025 is evolving rapidly, driven by the intersection of climate policy, carbon markets, and ecosystem restoration initiatives. As governments and industries seek to quantify and mitigate greenhouse gas emissions from peatlands, demand for accurate peat analysis accelerates, attracting both strategic investment and venture capital.

Major environmental consulting and analytical services firms have continued to strengthen their portfolios through acquisitions and strategic partnerships. Notably, leading global entities such as SGS and Bureau Veritas have expanded their environmental divisions to include specialized peat sampling and carbon stock assessment solutions. These companies are investing in advanced laboratory infrastructure and remote sensing technologies to provide comprehensive wetland analysis services, reflecting a trend toward consolidation in the sector as demand for third-party verification grows.

Alongside established players, a new wave of startups is emerging, often supported by cleantech accelerators and climate-focused venture capital. These agile companies are developing innovative data analytics platforms, drone-based sampling, and AI-driven peatland monitoring systems, aiming to deliver cost-effective and scalable analysis. In Europe and North America, where peatland restoration projects are integral to national climate strategies, startups have attracted seed and Series A funding from investors prioritizing environmental impact and carbon market opportunities.

Government-backed funding is also shaping the market outlook. For example, programs under the European Union’s Green Deal and the U.S. Department of Agriculture’s conservation initiatives are allocating resources toward peatland mapping and measurement, directly benefiting service providers that offer robust analysis capabilities. This public sector investment not only supports R&D but also de-risks private capital participation.

- Mergers and acquisitions are predominantly driven by the need for integrated, end-to-end peat analysis solutions, with larger firms seeking to onboard niche expertise through targeted deals.

- Venture capital is flowing into startups that offer remote sensing, automation, and data analytics tailored for peat carbon accounting and reporting.

- Strategic partnerships between analysis firms and carbon offset registries are emerging, enabling standardized verification of peatland restoration and carbon sequestration credits.

Looking ahead, the outlook for investment and funding in wetland peat analysis services remains robust, buoyed by regulatory momentum, voluntary carbon market expansion, and increased corporate responsibility for nature-based solutions. The coming years are expected to see continued capital inflows, especially as verification standards tighten and the need for scientifically rigorous peat analysis intensifies.

Case Studies: Real-World Wetland Restoration and Monitoring Successes

In recent years, wetland peat analysis services have become a cornerstone for restoration and monitoring projects, driven by the urgent need to understand carbon sequestration and ecosystem health. By 2025, these services are leveraging advanced laboratory methods, in-situ sensor networks, and remote sensing to deliver comprehensive data for environmental decision-making.

One notable case is the restoration of peatlands in the United Kingdom, where wetland peat analysis underpins national efforts to restore degraded sites. Through partnerships with organizations such as British Geological Survey, restoration teams have utilized peat core sampling, organic carbon testing, and water table monitoring to guide their interventions. Data collected have directly informed rewetting strategies, resulting in significant improvements in peatland hydrology and biodiversity, as well as measurable increases in carbon storage capacity.

In North America, projects led by entities like Ducks Unlimited have showcased the value of peat analysis in wetland management. For example, extensive sampling and laboratory analysis of peat composition, bulk density, and nutrient content have enabled more targeted restoration on former agricultural lands. By tracking changes in peat properties over time, practitioners have demonstrated the gradual recovery of wetland function and resilience to climate variability.

The deployment of real-time monitoring technology is also reshaping the sector. Service providers are increasingly integrating field-deployable sensors that continuously log moisture, temperature, and gas fluxes within peat profiles. This approach, adopted by several European and North American restoration projects, allows for adaptive management, as data streams can quickly signal the need for intervention or validate the success of rewetting efforts.

Looking ahead, the outlook for wetland peat analysis services is robust. Policy drivers such as the UN Decade on Ecosystem Restoration and expanding carbon offset markets are incentivizing investment in peatland science. Companies specializing in environmental analysis are scaling up their capabilities to meet demand for high-resolution peat carbon assessments and greenhouse gas flux measurements. The ongoing refinement of laboratory analytics, combined with satellite-based mapping from organizations like European Space Agency, is expected to further enhance the precision and utility of wetland monitoring.

These case studies illustrate a growing recognition of peat analysis as critical infrastructure for wetland restoration and carbon accounting, with rapid technological progress and institutional support poised to accelerate advances in the coming years.

Future Outlook: Opportunities, Threats, and Strategic Recommendations

The future outlook for wetland peat analysis services through 2025 and the following years is shaped by a confluence of environmental, regulatory, and technological factors. Opportunities are expanding as governments and organizations worldwide intensify their focus on peatland conservation, carbon accounting, and sustainable land management. The United Nations and various national agencies have highlighted the pivotal role of peatlands in carbon sequestration and climate mitigation, pushing demand for precise peat analysis for inventory and restoration projects.

A major opportunity arises from the integration of advanced analytical techniques and remote sensing technologies into peat assessment protocols. Companies like SGS and Eurofins Scientific are expanding their environmental testing portfolios to include comprehensive peat characterization, combining laboratory analysis with geospatial data. Such innovation enables stakeholders to monitor peat composition, greenhouse gas fluxes, and hydrological changes with improved accuracy, supporting compliance with evolving regulatory frameworks and voluntary carbon markets.

Additionally, wetland restoration initiatives, increasingly funded by public and private sectors, present a robust growth avenue for service providers. Agencies such as the U.S. Geological Survey collaborate with analytical laboratories to support peatland mapping and rehabilitation, ensuring that restoration projects are evidence-based and measurable. The trend toward nature-based solutions for climate adaptation further amplifies demand for baseline peat data and ongoing monitoring.

However, there are notable threats. Regulatory uncertainty in some jurisdictions, especially where peat extraction persists, can create market volatility. The cost and logistical complexity of in-situ sampling in remote or protected wetlands also represent ongoing challenges. Moreover, the sector faces the risk of commoditization, as routine peat analyses become more standardized and competition increases, potentially squeezing profit margins for service providers.

Strategically, providers should invest in R&D to differentiate their offerings—developing proprietary analytical methods, leveraging artificial intelligence for data interpretation, and integrating real-time remote sensing. Building partnerships with technology developers, academic institutions, and government agencies can help secure long-term contracts and access to large-scale restoration projects. Lastly, maintaining rigorous quality standards and transparent reporting, in alignment with international guidelines such as those from the Ramsar Convention on Wetlands, will be critical for sustaining trust and demonstrating value in an increasingly scrutinized environmental services sector.

Sources & References

- Thermo Fisher Scientific

- DNV

- SGS

- Wageningen University & Research

- Trimble

- Illumina

- Campbell Scientific

- Metrohm

- Ramsar Convention on Wetlands

- Intergovernmental Panel on Climate Change

- International Organization for Standardization

- Environment and Climate Change Canada

- VTTI

- IUCN

- British Geological Survey

- Ducks Unlimited

- European Space Agency