Table of Contents

- Executive Summary: Key Insights for 2025–2029

- Industry Overview: Cyanogenic Glycosides and Their Strategic Value

- Current Extraction Technologies: From Conventional to Cutting-Edge

- Innovative Methods: Enzyme-Assisted, Supercritical, and Green Extractions

- Leading Players and Technology Providers (Company Profiles & Official Links)

- Market Size, Trends, and 2025–2029 Forecasts

- Regulatory Landscape: Global Standards and Compliance Initiatives

- Emerging Applications: Pharmaceuticals, Food Safety, and Beyond

- Challenges: Scale-Up, Purity, and Environmental Concerns

- Future Outlook: Disruptive Technologies and Investment Opportunities

- Sources & References

Executive Summary: Key Insights for 2025–2029

The landscape for cyanogenic glycoside extraction technologies is poised for significant transformation between 2025 and 2029, driven by increasing demand for plant-based pharmaceuticals, food safety solutions, and regulatory scrutiny over cyanogenic compounds in agricultural products. As of 2025, advanced extraction techniques—ranging from supercritical fluid extraction to enzymatic hydrolysis—are being rapidly adopted to improve yield, selectivity, and environmental sustainability. Key players in the plant extraction and processing sector are investing in scalable and energy-efficient systems to meet both industrial and regulatory needs.

One of the main drivers is the global focus on food safety, particularly in crops such as cassava, almonds, and sorghum, which contain naturally occurring cyanogenic glycosides. Enhanced extraction and detection technologies are being implemented to reduce residual cyanide levels and ensure compliance with evolving international standards. Industry leaders, including GEA Group and BÜCHI Labortechnik, are offering modular extraction platforms and analytical solutions to streamline processing, minimize solvent use, and achieve higher purity of isolates.

Recent technological developments, such as the integration of membrane separation, microwave-assisted extraction, and continuous flow systems, are expected to dominate the market by 2027, delivering higher throughput and reduced operational costs. These innovations are particularly relevant for companies involved in the large-scale processing of cyanogenic plants for nutraceutical, food, and chemical manufacturing applications. The adoption of such technologies is further fueled by partnerships between equipment suppliers and leading agrifood processors.

With mounting regulatory pressure from international food safety agencies, there is a marked shift toward traceable, automated extraction processes that facilitate compliance certification. Key industry organizations, such as the International Flavors & Fragrances Inc. (IFF), are increasingly investing in digitalization and process control technologies, further aligning extraction processes with sustainable development goals.

Looking ahead to 2029, the sector is expected to experience robust growth, underpinned by the dual imperatives of maximizing extraction efficiency and ensuring product safety. The convergence of automation, green chemistry principles, and data-driven process optimization is likely to reshape the competitive landscape, enabling a new generation of high-purity, low-residue cyanogenic glycoside products for global markets.

Industry Overview: Cyanogenic Glycosides and Their Strategic Value

Cyanogenic glycoside extraction technologies are experiencing notable advancement in 2025, driven by heightened demand for both industrial and pharmaceutical applications. Cyanogenic glycosides, naturally occurring in a range of plants such as cassava, almonds, and sorghum, require efficient extraction and detoxification processes due to their inherent toxicity and their utility in specialty chemicals and bioactive compounds. The current landscape features a blend of traditional solvent-based extraction and more recent innovations in green and scalable processing.

Conventional extraction often relies on water or ethanol as solvents, with subsequent hydrolysis or enzymatic treatment to separate cyanogenic glycosides from plant matrices. However, these processes have limitations regarding selectivity, environmental impact, and scalability. In response, the industry is increasingly adopting advanced methods such as supercritical fluid extraction (SFE), pressurized liquid extraction (PLE), and membrane-based separation. These newer technologies offer enhanced selectivity, reduced solvent usage, and finer control over product purity, aligning with sustainability goals and stricter regulatory standards.

For example, BÜCHI Labortechnik AG has developed scalable extraction and purification equipment suited for cyanogenic glycosides, emphasizing process automation and solvent recovery to minimize environmental footprint. Similarly, GEA Group provides integrated extraction and downstream processing solutions for the food and pharmaceutical sectors, supporting efficient removal and recovery of cyanogenic compounds from large-scale biomass streams.

In the next few years, a significant focus will be on continuous extraction systems and process intensification, aiming to reduce energy consumption and waste generation. Industry players are also exploring enzymatic biotransformation, using immobilized enzymes or engineered microbial strains for selective glycoside hydrolysis, which can enable simultaneous extraction and detoxification. This approach is particularly relevant for cassava processing, where safe food and feed production are paramount.

Furthermore, regulatory trends in major markets such as the European Union and North America are pushing for lower allowable cyanogenic glycoside residues in food ingredients, prompting processors to invest in more robust detection and removal technologies. Equipment manufacturers and process solution providers, including Sartorius AG and Eppendorf SE, are responding with advanced analytical and process control tools to support compliance and traceability.

Looking ahead, the outlook for cyanogenic glycoside extraction technologies is shaped by a convergence of sustainability, safety, and technological innovation. As demand for plant-based ingredients and bioactive compounds grows, the sector is poised for continued investment in green extraction platforms and integrated processing lines, ensuring both efficiency and product safety in the evolving regulatory environment.

Current Extraction Technologies: From Conventional to Cutting-Edge

Cyanogenic glycosides are naturally occurring compounds found in a wide range of plants, including cassava, almonds, and sorghum. Their extraction is crucial in industries ranging from food safety and pharmaceuticals to chemical manufacturing. As of 2025, extraction technologies for cyanogenic glycosides are witnessing a significant evolution, moving from conventional solvent-based approaches toward more efficient and sustainable methods.

Traditionally, the extraction of cyanogenic glycosides has relied on solvent extraction using water, ethanol, or methanol, often combined with acid or alkaline hydrolysis. These conventional methods, while effective, pose challenges such as high solvent consumption, energy intensity, and potential for incomplete recovery or degradation of target compounds. Such limitations have driven research and industry toward innovative alternatives that improve yield, selectivity, and environmental compatibility.

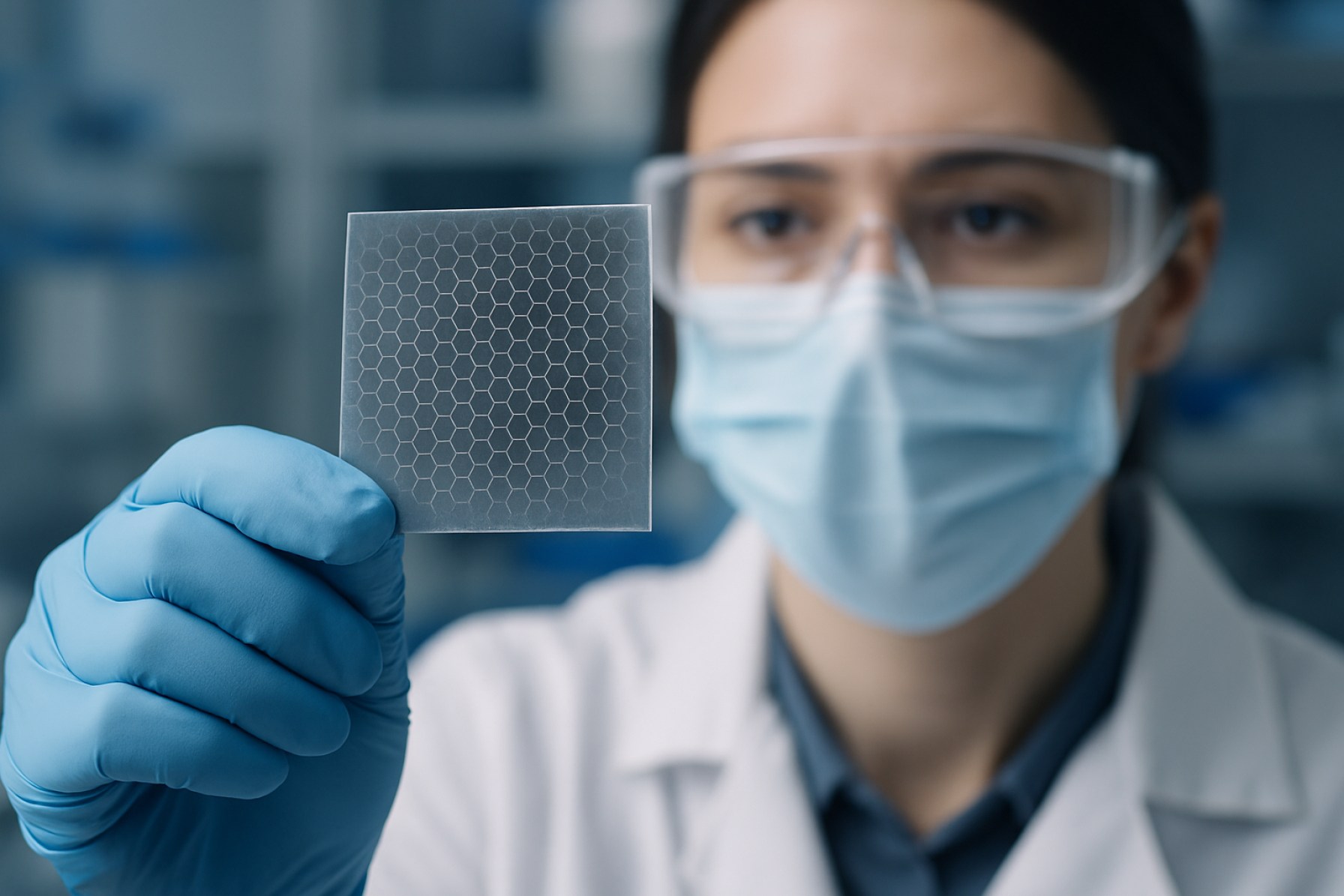

Among the most promising advancements in 2025 are enzymatic extraction and membrane-based separation technologies. Enzymatic extraction leverages specific enzymes to hydrolyze plant tissues, releasing cyanogenic glycosides under controlled conditions that minimize thermal degradation. Companies like Novozymes continue to develop tailored enzyme solutions that enhance extraction efficiency while reducing solvent use and processing time. These approaches are being adopted in both laboratory-scale and industrial settings, particularly in the processing of cassava and other high-cyanogen crops.

Membrane technologies, including nanofiltration and reverse osmosis, are also gaining traction due to their ability to selectively separate glycosides from complex plant matrices. Leading filtration technology providers such as Pall Corporation are actively expanding their membrane portfolio for bioactive compound extraction, offering systems that reduce energy requirements and solvent waste.

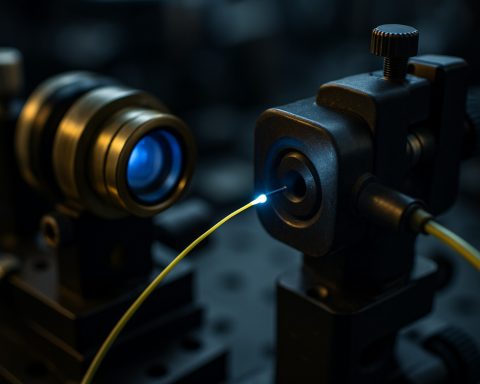

Additionally, supercritical fluid extraction (SFE) using carbon dioxide is attracting attention for its efficiency and environmental benefits. Companies like NATEx are pioneering SFE systems suitable for extracting thermolabile compounds such as cyanogenic glycosides, with process conditions that preserve compound integrity and facilitate downstream purification.

Looking ahead to the next few years, the integration of automation, process intensification, and green chemistry principles is expected to further transform cyanogenic glycoside extraction. Industry stakeholders are increasingly focused on scaling up these technologies to meet regulatory standards for food and pharmaceutical safety, while reducing environmental impact. The convergence of enzymatic, membrane, and supercritical fluid approaches signals a shift toward more sustainable and economically viable extraction processes in the cyanogenic glycoside sector.

Innovative Methods: Enzyme-Assisted, Supercritical, and Green Extractions

As the demand for safer and more sustainable extraction of cyanogenic glycosides from plants intensifies in 2025, innovative methods are being rapidly integrated into industrial and research workflows. Traditional solvent-based extraction, while effective, poses challenges including solvent toxicity, high energy input, and limited selectivity. In response, enzyme-assisted extraction (EAE), supercritical fluid extraction (SFE), and a suite of “green extraction” technologies are gaining traction, emphasizing selective, efficient, and environmentally responsible processes.

Enzyme-assisted extraction leverages specific hydrolytic enzymes such as β-glucosidases to target cyanogenic glycosides within plant matrices, enhancing yield while limiting co-extraction of unwanted compounds. This method is particularly advantageous for food and nutraceutical applications, where product purity and minimal processing residues are priorities. Recent investments in biocatalyst development by companies such as Novozymes and DSM underscore the commercial viability and scalability of EAE, with both entities expanding their portfolios of food-grade processing enzymes suitable for glycoside-rich crops.

Supercritical fluid extraction (SFE), especially using supercritical CO2, is emerging as a transformative technology in cyanogenic glycoside extraction. The adjustable solvating power of supercritical CO2 allows for selective extraction, often obviating the need for harmful organic solvents. Equipment suppliers such as Thar Process and Natex have reported increased inquiries and orders for scalable SFE solutions tailored for botanical matrices containing cyanogenic compounds. In 2025, ongoing collaborations between extraction equipment manufacturers and food safety organizations are expected to accelerate adoption, driven by regulatory emphasis on cleaner production methods.

Green extraction encompasses a broader range of emerging techniques, including ultrasonic-assisted extraction (UAE), microwave-assisted extraction (MAE), and use of natural deep eutectic solvents (NADES). These methods focus on minimizing energy consumption, reducing solvent use, and enhancing selectivity. Equipment innovators such as BÜCHI Labortechnik and CEM Corporation are rolling out modular extraction platforms that support these green technologies, targeting both research and commercial-scale operations.

Looking ahead, the next few years will likely see increased synergy between these innovative methods, with hybrid systems combining enzyme, supercritical, and advanced solvent technologies. This convergence is positioned to meet stringent safety and sustainability requirements, aligning with global trends in food, pharmaceutical, and agricultural processing.

Leading Players and Technology Providers (Company Profiles & Official Links)

The extraction and processing of cyanogenic glycosides—naturally occurring plant compounds with both toxicological and potential pharmaceutical significance—has attracted increasing industrial interest. As of 2025, several companies and technology providers are emerging as key players in the development of safe, efficient, and scalable extraction technologies. Innovations focus on mitigating the inherent risks of these compounds while harnessing their bioactive potential for food, feed, and pharmaceutical applications.

- BUCHI Labortechnik AG: As a leading supplier of laboratory equipment, BUCHI Labortechnik AG offers rotary evaporators, automated solvent extraction systems, and preparative chromatography platforms widely adopted in the isolation and purification of plant secondary metabolites, including cyanogenic glycosides. Their scalable solutions support both R&D and pilot-scale extraction, helping ensure safety and reproducibility in processing cassava, almonds, and other cyanogenic crops.

- GEA Group AG: GEA Group AG provides industrial-scale extraction and downstream processing equipment, such as decanters, separators, and membrane filtration systems. Their technologies are increasingly integrated into processing lines for detoxification and fractionation of cyanogenic glycoside-containing materials, especially in the food and beverage sector.

- IKA-Werke GmbH & Co. KG: IKA-Werke GmbH & Co. KG manufactures high-shear mixers, homogenizers, and laboratory reactors utilized by researchers and processors for efficient cell disruption and extraction of plant-based glycosides. Their modular platforms allow rapid adaptation for both analytical and preparative workflows.

- FOSS: Specialized in analytical solutions for the food and agricultural sectors, FOSS supplies near-infrared (NIR) and reference chemistry analyzers for rapid quantification of cyanogenic compounds during extraction and processing, supporting process control and regulatory compliance.

- Evonik Industries AG: Through its advanced separation and purification technologies, Evonik Industries AG enables downstream processing of natural extracts, including cyanogenic glycosides, for pharmaceutical and specialty ingredient applications.

Looking ahead, industry collaborations with academic and agricultural partners are expected to accelerate technology transfer and scale-up efforts, with a keen focus on safety and sustainability. As regulatory scrutiny over cyanogenic content in food and feed tightens, integrated solutions from these leading providers are poised to shape the future landscape of cyanogenic glycoside extraction through 2025 and beyond.

Market Size, Trends, and 2025–2029 Forecasts

The market for cyanogenic glycoside extraction technologies is experiencing steady growth in 2025, driven by increased research into plant-derived bioactives, rising demand for natural food safety solutions, and the need for efficient detoxification methods in the agri-food and pharmaceutical sectors. Cyanogenic glycosides, present in crops like cassava, almonds, and flaxseed, require careful extraction and quantification to ensure food safety and compliance with evolving regulatory standards.

Recent advancements have centered on the adoption of greener, more efficient extraction techniques. Traditional solvent-based methods are gradually being supplanted by technologies such as pressurized liquid extraction (PLE), supercritical fluid extraction (SFE), and enzymatic hydrolysis. These approaches improve extraction yields, reduce solvent usage, and enable better scalability for industrial applications. For instance, companies specializing in analytical and process instrumentation, such as Agilent Technologies and Shimadzu Corporation, have introduced integrated systems tailored for precise cyanogenic glycoside quantification, supporting both research and industrial needs.

Emerging trends in 2025 include the integration of automated sample preparation, online monitoring, and advanced detection platforms—such as HPLC-MS/MS—into cyanogenic glycoside extraction workflows. This shift enables faster, high-throughput screening of raw materials and processed foods, reducing analysis turnaround and supporting compliance with safety limits set by regulatory bodies. Additionally, industry leaders like PerkinElmer are collaborating with food manufacturers to implement in-line extraction and detection solutions, which facilitate real-time monitoring during processing and bolster traceability.

Looking ahead to 2029, the market is forecasted to expand at a moderate CAGR, underpinned by growing applications in nutraceuticals, pharmaceuticals, and functional foods. The increasing prevalence of plant-based diets, coupled with consumer awareness about food toxins, is anticipated to sustain demand for robust extraction technologies. Investment in sustainable and automated extraction platforms is likely to accelerate, as both global and regional processors seek cost-effective solutions to comply with stricter residue limits and embrace circular economy practices.

- Key market drivers include regulatory tightening, technological innovation, and the expansion of plant-based food processing.

- Leading technology suppliers—such as Thermo Fisher Scientific—continue to invest in developing versatile equipment adaptable to diverse matrices and throughput requirements.

- Asia-Pacific and Latin America are poised for above-average growth, given the prevalence of cyanogenic crops and investments in food safety infrastructure.

Overall, the cyanogenic glycoside extraction technologies market in 2025 and beyond is characterized by a transition toward automation, sustainability, and tighter integration with quality control processes, setting the stage for resilient growth through the end of the decade.

Regulatory Landscape: Global Standards and Compliance Initiatives

The regulatory landscape for cyanogenic glycoside extraction technologies in 2025 is shaped by a combination of food safety imperatives, environmental concerns, and harmonization efforts across major markets. Cyanogenic glycosides, naturally occurring in crops such as cassava, sorghum, and flaxseed, present toxicity risks unless efficiently extracted or detoxified. As such, regulatory bodies have increasingly focused on setting maximum permissible limits for cyanogenic compounds in food and feed, as well as codifying approved extraction and processing methods.

Within the European Union, updated legislation under the General Food Law and specific regulations for novel foods and contaminants continue to govern the allowable presence of cyanogenic glycosides in commercial products. The European Commission maintains a strict monitoring framework, requiring manufacturers to employ validated extraction and detoxification technologies for products such as cassava flour, marzipan, and certain cereals. In 2025, the EU is expected to review and potentially tighten these standards, building on ongoing risk assessments by the European Food Safety Authority.

In the United States, the U.S. Food and Drug Administration oversees compliance through its food additive and contaminant policies, with specific guidance on cyanogenic glycoside content in imported and domestic products. The FDA emphasizes the use of extraction technologies that reliably reduce cyanide content to safe levels, referencing technological benchmarks established by leading equipment providers and validated in industry-academic collaborations.

At the international level, the Food and Agriculture Organization (FAO) and the Codex Alimentarius Commission are spearheading efforts to harmonize cyanogenic glycoside limits and methods of analysis. Their ongoing initiatives include the development of standardized analytical protocols and the endorsement of safe extraction processes, facilitating smoother trade and compliance for exporters and processors globally.

Manufacturers and technology suppliers are responding to these evolving requirements by investing in advanced extraction solutions, including enzymatic hydrolysis, membrane filtration, and supercritical fluid extraction. Companies such as BÜCHI Labortechnik AG and GEA Group are expanding their portfolios to include automated, scalable systems designed for regulatory compliance, traceability, and process efficiency.

Looking ahead, the regulatory outlook for cyanogenic glycoside extraction technologies is expected to prioritize increased transparency, digital traceability, and continuous optimization of extraction efficacy. This is likely to drive further innovation and industry collaboration, ensuring that both consumer safety and international trade requirements are met across the value chain.

Emerging Applications: Pharmaceuticals, Food Safety, and Beyond

The extraction of cyanogenic glycosides—naturally occurring plant compounds that can release hydrogen cyanide—has become increasingly significant in emerging applications spanning pharmaceuticals, food safety, and biotechnology. In 2025, the sector is witnessing rapid innovation, driven by both regulatory demands and the search for potent bioactive compounds.

Recent developments in extraction technologies have focused on enhancing yield, selectivity, and safety. Traditional solvent extraction methods are being increasingly replaced or supplemented by advanced techniques such as supercritical fluid extraction (SFE), ultrasound-assisted extraction (UAE), and microwave-assisted extraction (MAE). These methods offer the advantages of reduced solvent consumption, improved extraction efficiency, and minimized thermal degradation, which is crucial for maintaining the structural integrity of labile cyanogenic glycosides. Companies such as BÜCHI Labortechnik AG are supplying scalable laboratory and industrial-scale extraction systems designed to optimize these processes, catering to both research and production needs.

In the pharmaceutical sector, interest in cyanogenic glycosides is being propelled by their potential anticancer and anti-inflammatory properties. Pharmaceutical manufacturers are collaborating with equipment providers to develop processes that enable the selective extraction and purification of these compounds from plant sources—most notably from almonds, cassava, and flaxseed. For instance, GEA Group is actively developing modular extraction and purification lines that integrate solid-liquid extraction with downstream chromatographic separation, ensuring compliance with pharmaceutical-grade quality standards.

Food safety is another major driver for technological advancements. As concerns about cyanide toxicity persist, food and ingredient manufacturers are adopting rapid, high-throughput extraction and quantification methods to monitor and reduce cyanogenic glycoside content in edible products. Technologies integrating solid-phase extraction (SPE) and automated detection systems are being implemented in quality control laboratories worldwide. Industrial solution providers such as Metrohm AG offer analytical platforms supporting regulatory compliance for cyanogenic glycoside testing in food matrices.

Looking ahead, the next few years are expected to see greater automation, digital integration, and the use of green solvents—such as supercritical CO2—in cyanogenic glycoside extraction. As the demand for plant-based pharmaceuticals and safer foods grows, the sector will likely witness further partnerships between ingredient producers, technology developers, and regulatory bodies to harmonize extraction standards and improve traceability across supply chains.

Challenges: Scale-Up, Purity, and Environmental Concerns

The extraction of cyanogenic glycosides (CGs) from plant materials remains a critical operation in food, pharmaceutical, and biochemical industries. As of 2025, the sector is grappling with challenges related to scaling up laboratory processes, achieving high purity, and minimizing environmental impact.

One of the foremost hurdles is the scale-up of extraction technologies to meet industrial demand. Traditional solvent extraction methods, though well-understood, often require large volumes of organic solvents, raising both cost and safety concerns at larger scales. Companies engaged in botanicals and natural extracts, such as Naturex and Indena, have reported ongoing investments in process intensification and automation to streamline operations, but maintaining consistent yields and reproducibility across large batches remains a challenge.

Purity is another significant concern. Cyanogenic glycosides, being structurally similar to other plant metabolites, are difficult to separate using conventional chromatography or precipitation techniques. Impurities, including residual solvents and other glycosides, can compromise product safety—especially in food and nutraceutical applications. Industry players such as MilliporeSigma are working on expanding access to high-resolution chromatographic resins and membrane filtration solutions, but the cost and complexity of such technologies can be prohibitive for mid-sized processors.

Environmental sustainability is increasingly central to technology choices. The use of toxic solvents and the generation of chemical waste in CG extraction present regulatory and reputational risks. In response, companies are exploring greener alternatives, including supercritical CO₂ extraction and water-based enzymatic processes. Organizations such as BÜCHI Labortechnik AG are promoting closed-loop systems and solvent recovery units to reduce emissions and waste. However, the widespread adoption of such systems is hampered by high initial capital outlay and the need for specialized technical know-how.

Looking forward, the industry outlook for 2025 and the coming years points toward intensified collaboration between equipment manufacturers, ingredient producers, and regulatory bodies to address these challenges. Advances in process analytical technology and digital monitoring are expected to improve batch-to-batch consistency and traceability. Nevertheless, balancing the imperatives of scale, purity, and environmental stewardship will require ongoing innovation and cross-sector engagement as consumer and regulatory scrutiny increases.

Future Outlook: Disruptive Technologies and Investment Opportunities

The landscape for cyanogenic glycoside extraction technologies in 2025 is poised for considerable transformation, shaped by emerging disruptive innovations and shifting investment patterns. As the demand for naturally derived compounds in pharmaceuticals, food safety, and agro-industrial applications grows, companies are advancing extraction methods to enhance efficiency, scalability, and environmental compatibility.

One of the most promising developments is the adoption of green extraction techniques, such as supercritical fluid extraction (SFE) and pressurized liquid extraction (PLE), which use fewer hazardous solvents and reduce energy consumption. These technologies enable higher selectivity and purity of cyanogenic glycosides, addressing both regulatory and quality requirements. Major equipment suppliers and technology providers, including BUCHI Labortechnik AG and GEA Group, are actively upgrading their extraction platforms to meet the needs of bioactive compound producers, including those working with cyanogenic glycosides.

Enzyme-assisted extraction is another area attracting significant R&D investment. By leveraging specific enzymes to hydrolyze plant matrices, this approach can improve extraction yields and reduce process times. Companies with strong portfolios in bioprocessing and enzyme technologies, such as Novozymes, are expected to play a pivotal role in commercializing these solutions for the cyanogenic glycoside sector in the coming years.

Automation and digitalization are further accelerating the pace of innovation. Integrated systems that combine online process monitoring, data analytics, and remote operation are becoming standard among advanced processing facilities. This enables real-time optimization of extraction parameters, ensuring consistent quality and compliance with increasingly stringent regulations regarding cyanide content in food and pharmaceutical products. Industry leaders such as Sartorius AG and Thermo Fisher Scientific are investing in modular extraction units equipped with advanced sensor technology to support scalable and reproducible extraction processes.

Looking forward, the sector is attracting new investment from both strategic industry players and venture capital, spurred by the potential for safer, cleaner, and more traceable supply chains. The growing emphasis on sustainable production and the circular bioeconomy is expected to further drive innovation, especially in upcycling agricultural by-products rich in cyanogenic glycosides. Partnerships between technology providers, plant breeders, and ingredient manufacturers are anticipated to intensify, fostering a new wave of integrated solutions that could redefine the extraction and application of cyanogenic glycosides across multiple industries.

Sources & References

- GEA Group

- BÜCHI Labortechnik

- Sartorius AG

- Eppendorf SE

- Pall Corporation

- NATEx

- DSM

- Thar Process

- CEM Corporation

- FOSS

- Evonik Industries AG

- Shimadzu Corporation

- PerkinElmer

- Thermo Fisher Scientific

- European Commission

- Food and Agriculture Organization

- Metrohm AG

- Indena

- BUCHI Labortechnik AG

- GEA Group

- Sartorius AG

- Thermo Fisher Scientific