Unlocking the Future of Downwell Microseismic Monitoring Systems in 2025: How Advanced Sensing and Analytics Are Transforming Subsurface Operations and Driving Market Expansion

- Executive Summary: Key Trends and Market Drivers in 2025

- Technology Overview: Innovations in Downwell Microseismic Monitoring

- Market Size and Forecast: 2025–2030 Projections

- Competitive Landscape: Leading Companies and Strategic Initiatives

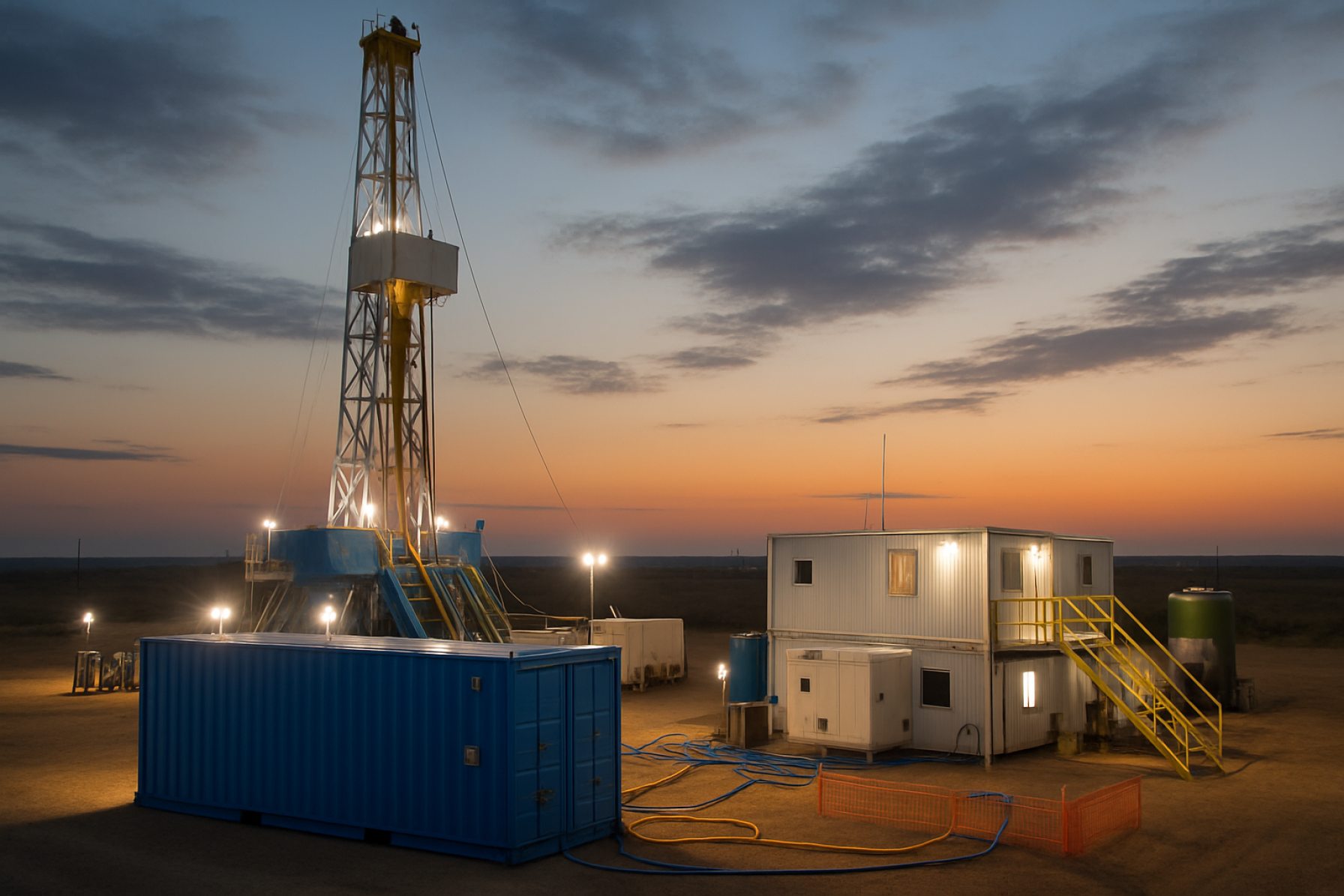

- Application Sectors: Oil & Gas, Geothermal, Mining, and Beyond

- Regulatory Environment and Industry Standards

- Integration with Digital Platforms and Data Analytics

- Challenges and Barriers to Adoption

- Emerging Opportunities and Investment Hotspots

- Future Outlook: Evolution of Downwell Microseismic Monitoring Systems

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

Downwell microseismic monitoring systems are poised for significant growth and technological advancement in 2025, driven by the increasing demand for real-time subsurface data in oil & gas, geothermal, and carbon capture and storage (CCS) operations. These systems, which deploy geophones or accelerometers in boreholes to detect and analyze microseismic events, are critical for reservoir characterization, hydraulic fracturing optimization, and monitoring induced seismicity. The market is being shaped by several key trends and drivers that are expected to define its trajectory over the next few years.

A primary driver is the global push for enhanced reservoir management and environmental stewardship. Operators are under mounting pressure to maximize hydrocarbon recovery while minimizing environmental impact, particularly in unconventional plays and CCS projects. Downwell microseismic monitoring provides high-resolution data on fracture propagation and reservoir response, enabling more precise control of stimulation activities and early detection of unwanted seismicity. This is especially relevant as regulatory scrutiny intensifies in North America and Europe, where real-time seismic monitoring is increasingly mandated for hydraulic fracturing and CO2 injection projects.

Technological innovation is another major trend. Leading manufacturers such as SLB (formerly Schlumberger), Halliburton, and Baker Hughes are investing in next-generation downhole sensor arrays with improved sensitivity, broader frequency response, and enhanced survivability in harsh environments. These advancements are enabling more accurate event localization and characterization, even in deep or high-temperature wells. Additionally, the integration of artificial intelligence and cloud-based analytics is streamlining data processing and interpretation, allowing operators to make faster, data-driven decisions.

The market outlook for 2025 and beyond is robust, with increased adoption expected in both mature and emerging energy sectors. In oil & gas, the focus remains on optimizing unconventional resource development and extending the productive life of aging fields. In parallel, the expansion of geothermal energy and CCS projects is creating new demand for downwell microseismic monitoring, as these applications require continuous, high-fidelity subsurface surveillance to ensure operational safety and regulatory compliance. Companies such as Sercel and Avalon Sciences are also expanding their offerings to address these evolving needs.

In summary, the downwell microseismic monitoring systems market in 2025 is characterized by technological progress, regulatory momentum, and diversification into new energy domains. As operators seek to balance productivity with environmental responsibility, the demand for advanced, reliable, and real-time downhole monitoring solutions is set to accelerate, shaping the industry’s outlook for the next several years.

Technology Overview: Innovations in Downwell Microseismic Monitoring

Downwell microseismic monitoring systems are at the forefront of subsurface imaging and reservoir management, providing real-time data on fracture propagation, reservoir stimulation, and geomechanical behavior. As of 2025, the technology landscape is characterized by rapid innovation in sensor design, data acquisition, and analytics, driven by the increasing complexity of unconventional resource development and the growing need for precise subsurface monitoring in carbon capture and storage (CCS), geothermal, and mining applications.

Modern downwell microseismic systems typically employ arrays of high-sensitivity geophones or accelerometers deployed in boreholes, often at great depths and under challenging temperature and pressure conditions. Leading manufacturers such as Schlumberger and Baker Hughes have developed robust, retrievable, and permanent downhole sensor packages capable of withstanding harsh environments while delivering high-fidelity seismic data. These systems are increasingly integrated with fiber-optic distributed acoustic sensing (DAS) technologies, which allow for continuous, real-time monitoring along the entire wellbore, significantly enhancing spatial resolution and event detection capabilities.

Recent years have seen the deployment of hybrid systems that combine conventional geophones with DAS, enabling operators to capture both low- and high-frequency seismic events. Companies like Halliburton and Silixa are at the forefront of this trend, offering solutions that leverage advanced signal processing and machine learning algorithms to distinguish microseismic events from background noise and operational activity. These innovations are particularly valuable in complex environments such as multi-stage hydraulic fracturing, where accurate event localization and characterization are critical for optimizing stimulation strategies and ensuring well integrity.

Data management and interpretation have also advanced, with cloud-based platforms and edge computing enabling near real-time analysis and visualization of microseismic data. This allows operators to make informed decisions during field operations, reducing non-productive time and improving safety. The integration of microseismic data with other subsurface datasets—such as pressure, temperature, and production logs—provides a more comprehensive understanding of reservoir dynamics.

Looking ahead, the outlook for downwell microseismic monitoring systems is shaped by the increasing adoption of digital oilfield technologies and the expansion of monitoring requirements in CCS and geothermal projects. Industry leaders are investing in further miniaturization of sensors, improved power efficiency, and enhanced data analytics, aiming to deliver more cost-effective and scalable solutions. As regulatory and environmental scrutiny intensifies, the demand for high-resolution, reliable subsurface monitoring is expected to grow, positioning downwell microseismic systems as a critical component of future energy and resource management strategies.

Market Size and Forecast: 2025–2030 Projections

The global market for downwell microseismic monitoring systems is poised for steady growth from 2025 through 2030, driven by increasing demand for real-time subsurface monitoring in oil & gas, geothermal, and carbon capture and storage (CCS) applications. As operators seek to optimize reservoir management, ensure well integrity, and comply with evolving regulatory frameworks, the adoption of advanced microseismic technologies is expected to accelerate.

Key industry players such as SLB (formerly Schlumberger), Baker Hughes, and Halliburton continue to invest in the development and deployment of high-sensitivity downhole geophone arrays and fiber-optic distributed acoustic sensing (DAS) systems. These companies are expanding their service portfolios to include permanent and retrievable monitoring solutions, catering to both unconventional and conventional reservoirs. For instance, SLB has reported increased field deployments of its microseismic monitoring services in North America and the Middle East, reflecting a broader industry trend toward continuous reservoir surveillance.

The market outlook for 2025–2030 is shaped by several factors:

- Unconventional Resource Development: The ongoing expansion of shale gas and tight oil projects, particularly in North America and China, is expected to drive demand for downwell microseismic systems to monitor hydraulic fracturing and optimize stimulation programs.

- Geothermal and CCS Growth: The global push for decarbonization is spurring investment in geothermal energy and CCS projects, both of which require robust subsurface monitoring to ensure safety and efficiency. Companies like Baker Hughes are actively involved in providing microseismic solutions for these emerging sectors.

- Technological Advancements: The integration of fiber-optic DAS and machine learning analytics is enhancing the resolution and interpretability of microseismic data, enabling more precise event localization and characterization.

- Regulatory and ESG Pressures: Stricter environmental and safety regulations, especially in Europe and North America, are compelling operators to adopt continuous monitoring systems to detect induced seismicity and mitigate operational risks.

While the market remains concentrated among a few major service providers, regional players and technology specialists are emerging, particularly in Asia-Pacific and the Middle East. The overall market size is projected to grow at a moderate compound annual growth rate (CAGR) through 2030, with the highest adoption rates anticipated in regions with active unconventional resource development and large-scale CCS initiatives. As digitalization and automation continue to transform the energy sector, downwell microseismic monitoring systems are set to become an integral component of subsurface asset management strategies worldwide.

Competitive Landscape: Leading Companies and Strategic Initiatives

The competitive landscape for downwell microseismic monitoring systems in 2025 is characterized by a blend of established geophysical technology providers, oilfield service giants, and specialized sensor manufacturers. These companies are driving innovation through advanced sensor arrays, real-time data analytics, and integrated digital platforms, responding to the growing demand for precise subsurface monitoring in unconventional oil and gas, geothermal, and carbon capture and storage (CCS) projects.

Among the global leaders, SLB (formerly Schlumberger) continues to set benchmarks with its comprehensive suite of downhole microseismic solutions. SLB’s systems leverage high-sensitivity geophones and fiber-optic distributed acoustic sensing (DAS) to deliver real-time event detection and reservoir characterization. The company’s strategic focus includes expanding digital integration and cloud-based analytics, as well as partnerships with operators to optimize hydraulic fracturing and reservoir management.

Halliburton remains a key competitor, offering its proprietary downhole microseismic arrays and advanced processing software. Halliburton’s recent initiatives emphasize automation and machine learning to enhance event location accuracy and reduce operational costs. The company is also investing in modular, retrievable sensor systems to support multi-stage monitoring and reusability, aligning with sustainability and cost-efficiency trends.

Baker Hughes is another major player, with a strong portfolio of downhole seismic and microseismic monitoring technologies. Baker Hughes is focusing on expanding its fiber-optic sensing capabilities and integrating microseismic data with broader reservoir surveillance platforms. The company’s strategic collaborations with digital technology firms aim to deliver actionable insights for both hydrocarbon and low-carbon energy projects.

Specialized firms such as Sercel (a subsidiary of CGG) and Geospace Technologies are also prominent, supplying high-performance downhole seismic sensors and digital acquisition systems. Sercel’s recent product launches highlight ultra-sensitive, ruggedized geophone strings designed for deep and high-temperature wells, while Geospace Technologies is advancing wireless and cableless downhole sensor solutions to improve deployment flexibility and data fidelity.

Looking ahead, the competitive landscape is expected to intensify as operators seek more cost-effective, scalable, and environmentally responsible monitoring solutions. Strategic initiatives across the sector include the integration of artificial intelligence for automated event detection, the adoption of cloud-based data platforms, and the development of multi-physics monitoring systems that combine microseismic with pressure, temperature, and chemical sensing. These trends are likely to drive further collaboration between technology providers, oilfield operators, and digital innovators, shaping the evolution of downwell microseismic monitoring through 2025 and beyond.

Application Sectors: Oil & Gas, Geothermal, Mining, and Beyond

Downwell microseismic monitoring systems are increasingly pivotal across several resource extraction sectors, notably oil & gas, geothermal energy, and mining. These systems, which involve the deployment of sensitive geophones or accelerometers in boreholes, enable real-time detection and analysis of microseismic events—small-scale seismic occurrences often induced by subsurface operations. Their application is central to optimizing resource recovery, ensuring operational safety, and meeting regulatory requirements for environmental stewardship.

In the oil & gas sector, downwell microseismic monitoring is primarily used to map hydraulic fracture propagation, assess reservoir stimulation effectiveness, and monitor for unintended fault activation. Major service providers such as SLB (formerly Schlumberger), Halliburton, and Baker Hughes offer integrated microseismic solutions, combining downhole sensor arrays with advanced data analytics. In 2025, the trend is toward permanent or semi-permanent installations, enabling continuous monitoring throughout the life of the well. This is driven by both regulatory pressure and the need for more granular data to optimize unconventional reservoir development.

The geothermal industry is also adopting downwell microseismic systems to monitor induced seismicity during reservoir stimulation and production. Companies such as SLB and Ikon Science are active in this space, providing tailored solutions for Enhanced Geothermal Systems (EGS) projects. The ability to detect and characterize microseismicity is critical for both operational safety and public acceptance, especially as geothermal projects expand into new regions with stricter seismicity regulations.

In mining, downwell microseismic monitoring is used to track rock mass response to excavation, assess ground stability, and provide early warning of potential rockbursts or collapses. Companies like Instantel and Sercel supply ruggedized downhole systems designed for harsh underground environments. The mining sector is expected to see increased adoption of these systems through 2025 and beyond, particularly in deep or high-stress mines where seismic risk is elevated.

Looking ahead, the outlook for downwell microseismic monitoring is robust. Advances in sensor miniaturization, wireless telemetry, and cloud-based analytics are making systems more cost-effective and easier to deploy. Cross-sector interest is also growing in applications such as carbon capture and storage (CCS), underground energy storage, and even civil engineering projects involving deep tunneling or subsurface infrastructure. As regulatory frameworks tighten and the demand for real-time subsurface intelligence grows, downwell microseismic monitoring is poised to become a standard tool across a widening array of industries.

Regulatory Environment and Industry Standards

The regulatory environment for downwell microseismic monitoring systems is evolving rapidly as the oil and gas, geothermal, and carbon capture industries intensify their focus on subsurface safety, environmental stewardship, and operational transparency. In 2025, regulatory agencies in North America and Europe are increasingly mandating the deployment of advanced microseismic monitoring in hydraulic fracturing, enhanced geothermal systems, and underground gas storage to detect and mitigate induced seismicity risks.

In the United States, the U.S. Department of the Interior and its sub-agencies, such as the Bureau of Land Management, have updated guidelines requiring operators to implement real-time seismic monitoring in sensitive areas. These requirements are particularly stringent in regions with a history of induced seismicity, such as Oklahoma and Texas. The U.S. Geological Survey continues to provide technical guidance and seismic hazard assessments, influencing both federal and state-level regulations.

In Canada, the Canada Energy Regulator and provincial authorities like the Alberta Energy Regulator have established protocols for microseismic monitoring during unconventional resource development. These protocols specify minimum sensor density, data reporting intervals, and thresholds for operational shutdowns in response to detected seismic events.

The European Union, through directives coordinated by the European Commission Directorate-General for Energy, is harmonizing standards for seismic monitoring in geothermal and carbon capture projects. The EU’s focus is on cross-border data sharing and the adoption of best practices, with member states such as Germany and the Netherlands implementing national requirements for continuous downwell microseismic surveillance.

Industry standards are also being shaped by organizations such as the American Petroleum Institute (API), which is updating its recommended practices for subsurface monitoring, and the Society of Petroleum Engineers (SPE), which is developing technical guidelines for data quality and event interpretation. These standards are increasingly referenced in regulatory frameworks and procurement specifications.

Leading manufacturers and service providers, including SLB (formerly Schlumberger), Baker Hughes, and Halliburton, are actively participating in industry working groups to ensure their downwell microseismic systems comply with emerging standards. These companies are also investing in certification and interoperability initiatives to facilitate regulatory acceptance and cross-operator data integration.

Looking ahead, the regulatory landscape is expected to become more prescriptive, with real-time data transmission, automated event detection, and transparent public reporting likely to become standard requirements. The convergence of regulatory and industry standards will drive further innovation in sensor technology, data analytics, and system reliability, positioning downwell microseismic monitoring as a critical component of responsible subsurface resource management through the remainder of the decade.

Integration with Digital Platforms and Data Analytics

The integration of downwell microseismic monitoring systems with advanced digital platforms and data analytics is rapidly transforming subsurface operations in oil and gas, geothermal, and carbon storage sectors. As of 2025, operators are increasingly leveraging real-time data acquisition, cloud-based analytics, and machine learning to enhance the value and responsiveness of microseismic monitoring.

Leading manufacturers such as Sercel, SLB (Schlumberger), and Halliburton have developed downhole sensor arrays capable of streaming high-fidelity seismic data directly to digital platforms. These systems are designed for seamless integration with proprietary and third-party analytics suites, enabling operators to visualize fracture propagation, reservoir response, and induced seismicity in near real-time. For example, SLB offers digital microseismic solutions that combine downhole geophone arrays with cloud-based interpretation tools, allowing for rapid decision-making during hydraulic fracturing and reservoir stimulation.

The adoption of open data standards and interoperability protocols is also accelerating. Companies like Baker Hughes and Sercel are supporting integration with industry-standard platforms such as OSDU (Open Subsurface Data Universe), which facilitates secure data sharing and advanced analytics across multiple vendors and disciplines. This trend is expected to continue, with more microseismic monitoring systems offering plug-and-play compatibility with digital twins and asset management platforms.

On the analytics front, machine learning and artificial intelligence are being increasingly applied to microseismic datasets to automate event detection, improve location accuracy, and extract actionable insights from large volumes of continuous data. Halliburton and SLB are investing in AI-driven workflows that can identify subtle seismic signatures associated with fracture complexity or fault activation, supporting safer and more efficient field operations.

Looking ahead to the next few years, the outlook for digital integration in downwell microseismic monitoring is robust. The convergence of edge computing, 5G connectivity, and scalable cloud infrastructure is expected to further reduce latency and enable more sophisticated, real-time analytics. As regulatory and ESG (Environmental, Social, and Governance) requirements tighten, the ability to rapidly analyze and report on subsurface seismicity will become a critical differentiator for operators. The ongoing collaboration between equipment manufacturers, digital platform providers, and industry consortia will likely drive further innovation and standardization in this space.

Challenges and Barriers to Adoption

Downwell microseismic monitoring systems are increasingly recognized as critical tools for real-time subsurface imaging and reservoir management, particularly in unconventional oil and gas, geothermal, and carbon sequestration projects. However, their widespread adoption faces several technical, operational, and economic challenges that are expected to persist into 2025 and the following years.

One of the primary barriers is the complexity and cost of deploying downhole sensor arrays. These systems require robust, high-sensitivity geophones or accelerometers capable of withstanding extreme downhole temperatures and pressures. The installation process often necessitates well intervention or dedicated monitoring wells, which can significantly increase project costs. Leading manufacturers such as Schlumberger and Baker Hughes have developed advanced permanent and retrievable downhole seismic tools, but the capital and operational expenditures remain substantial, especially for smaller operators.

Data management and interpretation present additional hurdles. Downwell microseismic systems generate vast volumes of high-frequency data, requiring advanced telemetry, storage, and real-time processing capabilities. The integration of this data with surface seismic and other reservoir datasets is technically demanding, often necessitating specialized software and expertise. Companies like Halliburton and Sercel are investing in digital platforms and cloud-based analytics to streamline data workflows, but interoperability and standardization across different hardware and software ecosystems remain ongoing challenges.

Reliability and longevity of downhole equipment are also significant concerns. Harsh downhole environments can lead to sensor drift, cable failures, or complete system breakdowns, resulting in costly repairs or data loss. The industry is responding with innovations in sensor packaging, fiber-optic technologies, and wireless telemetry, as seen in offerings from Silixa and Avalon Sciences. However, field validation and long-term performance data are still being accumulated, and operators remain cautious about large-scale deployments.

Finally, regulatory and stakeholder pressures around induced seismicity, particularly in regions with active hydraulic fracturing or geothermal development, are driving demand for more comprehensive monitoring. However, the lack of clear regulatory frameworks and standardized monitoring protocols can delay project approvals and complicate system design.

Looking ahead to 2025 and beyond, the outlook for downwell microseismic monitoring systems will depend on continued advances in sensor durability, data analytics, and cost reduction. Collaboration between operators, service companies, and regulatory bodies will be essential to overcome these barriers and enable broader adoption of these critical subsurface monitoring technologies.

Emerging Opportunities and Investment Hotspots

Downwell microseismic monitoring systems are rapidly gaining traction as essential tools for real-time subsurface imaging and risk management in oil and gas, geothermal, and carbon capture and storage (CCS) projects. As of 2025, the sector is witnessing a surge in both technological innovation and investment, driven by the need for enhanced reservoir characterization, regulatory compliance, and environmental stewardship.

A key emerging opportunity lies in the integration of advanced fiber-optic sensing technologies, such as Distributed Acoustic Sensing (DAS), with traditional geophone-based arrays. Companies like SLB (Schlumberger) and Baker Hughes are at the forefront, offering downhole systems capable of capturing high-resolution microseismic data across extended well intervals. These systems enable operators to monitor hydraulic fracturing, reservoir stimulation, and induced seismicity with unprecedented detail, supporting both operational optimization and regulatory reporting.

The expansion of unconventional resource development in North America, the Middle East, and China is fueling demand for robust downwell microseismic solutions. In the United States, the Permian Basin and Appalachian Basin remain investment hotspots, with operators deploying permanent and retrievable downhole arrays to maximize production and minimize environmental impact. Similarly, the Middle East is seeing increased adoption of microseismic monitoring in tight gas and enhanced oil recovery (EOR) projects, with national oil companies partnering with global service providers to implement state-of-the-art systems.

Another significant driver is the global push for carbon neutrality, which is accelerating the deployment of microseismic monitoring in CCS and geothermal projects. Companies such as Halliburton and TGS are expanding their offerings to support the safe and efficient storage of CO2 and the sustainable development of geothermal resources. These applications require continuous, high-sensitivity monitoring to detect microseismic events that could indicate caprock integrity issues or fluid migration.

Looking ahead, the next few years are expected to bring further convergence of microseismic monitoring with digital platforms and artificial intelligence. Real-time data analytics, cloud-based visualization, and automated event detection are becoming standard features, enabling faster decision-making and reducing operational costs. Investment is also flowing into modular, scalable systems that can be rapidly deployed and reconfigured to meet evolving project needs.

In summary, the downwell microseismic monitoring sector in 2025 is characterized by robust growth, technological advancement, and expanding application scope. Key investment hotspots include unconventional oil and gas plays, CCS, and geothermal projects, with leading service companies and technology providers driving innovation and market adoption.

Future Outlook: Evolution of Downwell Microseismic Monitoring Systems

Downwell microseismic monitoring systems are poised for significant evolution in 2025 and the coming years, driven by advances in sensor technology, data analytics, and the growing demand for real-time subsurface intelligence. These systems, which deploy geophones or accelerometers in boreholes to detect and locate microseismic events, are critical for applications such as hydraulic fracturing, geothermal reservoir management, and carbon capture and storage (CCS).

A key trend is the shift toward higher-density sensor arrays and digital downhole tools, enabling more precise event localization and improved signal-to-noise ratios. Leading manufacturers such as SLB (Schlumberger) and Halliburton are investing in next-generation downhole seismic tools that offer enhanced sensitivity and broader frequency response. These advancements allow operators to monitor smaller magnitude events and gain a more detailed understanding of fracture propagation and reservoir behavior.

Another major development is the integration of fiber-optic distributed acoustic sensing (DAS) with traditional geophone-based systems. Companies like Baker Hughes and Silixa are pioneering the deployment of DAS in downhole environments, providing continuous, real-time seismic data along the entire wellbore. This technology is expected to become more prevalent as operators seek to maximize data coverage and reduce the operational footprint of monitoring campaigns.

Data management and interpretation are also undergoing transformation. The volume of microseismic data generated by modern arrays necessitates advanced analytics, including machine learning and automated event detection. Industry leaders are developing cloud-based platforms and edge computing solutions to process and visualize microseismic data in near real-time, facilitating faster decision-making during operations. For example, SLB (Schlumberger) and Halliburton are both expanding their digital service offerings to include integrated microseismic monitoring and interpretation workflows.

Looking ahead, regulatory and environmental considerations are likely to further shape the evolution of downwell microseismic monitoring. As scrutiny of induced seismicity increases, particularly in unconventional oil and gas and CCS projects, operators will be required to implement more robust and transparent monitoring systems. This is expected to drive further innovation in sensor deployment, data quality assurance, and automated reporting.

In summary, the future of downwell microseismic monitoring systems will be characterized by higher-resolution sensing, real-time analytics, and greater integration with digital platforms. The ongoing efforts of major service companies and technology innovators will ensure that these systems remain at the forefront of subsurface monitoring, supporting safer and more efficient resource development.

Sources & References

- SLB

- Halliburton

- Baker Hughes

- Sercel

- Avalon Sciences

- Schlumberger

- Silixa

- Geospace Technologies

- Instantel

- U.S. Department of the Interior

- Canada Energy Regulator

- European Commission Directorate-General for Energy

- American Petroleum Institute

- Society of Petroleum Engineers

- TGS