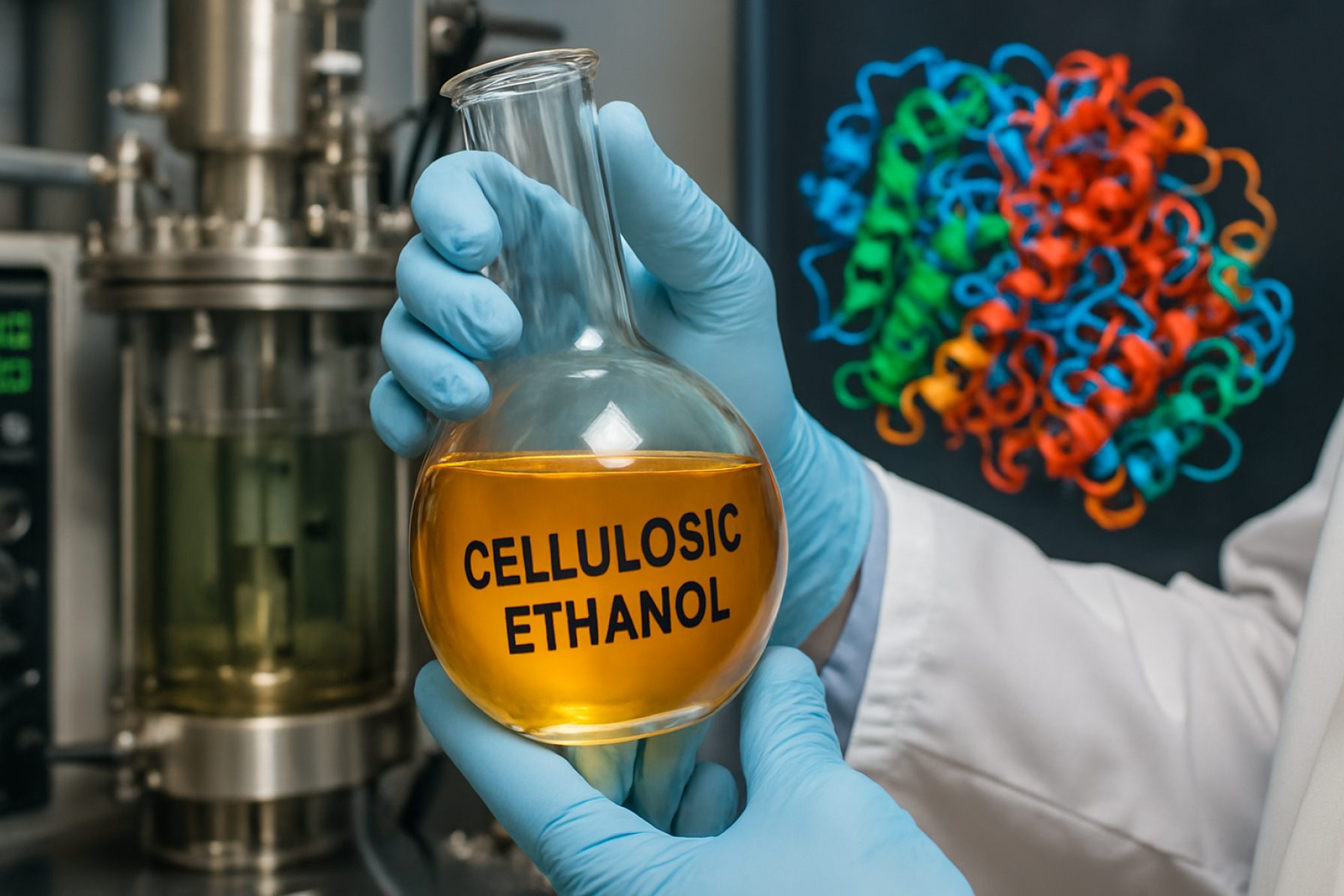

Cellulosic Ethanol Enzyme Engineering in 2025: Unleashing Advanced Biocatalysts to Transform Sustainable Fuel Markets. Explore the Innovations, Market Dynamics, and Future Trajectory of Enzyme-Driven Biofuel Production.

- Executive Summary: Key Trends and Market Outlook (2025–2030)

- Global Market Forecasts: Growth Drivers and Regional Hotspots

- Technological Innovations in Enzyme Engineering for Cellulosic Ethanol

- Leading Companies and Strategic Partnerships (e.g., novozymes.com, dupont.com, dsm.com)

- Feedstock Advances: Lignocellulosic Sources and Supply Chain Developments

- Process Optimization: Enzyme Performance, Yield, and Cost Reduction

- Regulatory Landscape and Industry Standards (e.g., bio.org, ethanolrfa.org)

- Sustainability Impact: Carbon Footprint and Circular Economy Integration

- Investment Trends, Funding, and M&A Activity

- Future Outlook: Disruptive Technologies and Market Opportunities to 2030

- Sources & References

Executive Summary: Key Trends and Market Outlook (2025–2030)

Cellulosic ethanol enzyme engineering is poised for significant advancements between 2025 and 2030, driven by the urgent need for sustainable biofuels and the maturation of industrial biotechnology. The sector is witnessing a convergence of genetic engineering, high-throughput screening, and artificial intelligence to optimize enzyme cocktails for efficient lignocellulosic biomass conversion. Key industry players, including Novozymes (now part of Novonesis), DSM (now part of dsm-firmenich), and DuPont (through its subsidiary Genencor), are intensifying R&D investments to enhance enzyme performance, thermostability, and cost-effectiveness.

Recent years have seen the deployment of next-generation enzyme blends capable of breaking down complex plant polymers such as cellulose and hemicellulose with higher yields and lower enzyme loadings. For example, Novozymes has introduced advanced cellulase and hemicellulase formulations tailored for specific feedstocks, while DSM has focused on enzyme systems that operate efficiently under industrial fermentation conditions. These innovations are critical for reducing the overall cost of cellulosic ethanol production, a key barrier to commercial viability.

The integration of enzyme engineering with process optimization is also accelerating. Companies are leveraging data analytics and machine learning to predict enzyme-substrate interactions and rapidly iterate enzyme designs. This approach is expected to yield more robust enzymes that can withstand harsh pretreatment conditions and variable biomass qualities, further improving process economics. Additionally, partnerships between enzyme developers and biofuel producers are becoming more common, as seen in collaborations involving Novozymes and major ethanol producers in North America and Asia.

Looking ahead to 2030, the market outlook for cellulosic ethanol enzyme engineering is optimistic. Regulatory support for low-carbon fuels, particularly in the US, EU, and China, is expected to drive demand for advanced biofuels. The expansion of biorefinery infrastructure and the diversification of feedstock sources—ranging from agricultural residues to municipal solid waste—will further stimulate innovation in enzyme engineering. Industry leaders are also exploring the integration of enzyme technology with carbon capture and utilization, aiming to create negative-emission biofuel pathways.

In summary, the period from 2025 to 2030 will likely see cellulosic ethanol enzyme engineering transition from incremental improvements to transformative breakthroughs, underpinned by cross-disciplinary innovation and strong policy tailwinds. The sector’s trajectory will be shaped by the ability of leading companies such as Novozymes, DSM, and DuPont to deliver scalable, cost-effective enzyme solutions that unlock the full potential of cellulosic biofuels.

Global Market Forecasts: Growth Drivers and Regional Hotspots

The global market for cellulosic ethanol enzyme engineering is poised for significant growth in 2025 and the following years, driven by a convergence of technological advancements, supportive policy frameworks, and increasing demand for sustainable biofuels. The sector’s expansion is underpinned by the urgent need to decarbonize transportation and industrial sectors, as well as the push for energy security in major economies.

A primary growth driver is the rapid improvement in enzyme efficiency and cost-effectiveness. Leading enzyme manufacturers such as Novozymes and DSM (now part of dsm-firmenich) have invested heavily in the development of next-generation cellulases and hemicellulases, which are tailored to break down a wider range of lignocellulosic feedstocks with higher yields and lower enzyme loading. These innovations are expected to reduce the overall cost of cellulosic ethanol production, making it more competitive with first-generation biofuels and fossil fuels.

Regionally, North America remains a hotspot, with the United States leading in both installed capacity and ongoing R&D. The U.S. Department of Energy’s Bioenergy Technologies Office continues to fund pilot and demonstration projects, while commercial-scale plants—such as those operated by POET and Abengoa—are increasingly integrating advanced enzyme cocktails to boost process efficiency. Canada is also emerging as a key player, leveraging its abundant agricultural residues and supportive provincial policies.

In Europe, the European Union’s Renewable Energy Directive and national mandates are spurring investments in advanced biofuels. Companies like Clariant are scaling up their proprietary enzyme technologies, with flagship plants in countries such as Romania and Germany. The region’s focus on circular economy principles and waste valorization further accelerates the adoption of cellulosic ethanol technologies.

Asia-Pacific is anticipated to see the fastest growth rate, particularly in China and India, where government initiatives target both rural development and air quality improvement. Local firms are collaborating with global enzyme leaders to deploy tailored solutions for region-specific feedstocks, such as rice straw and bagasse.

Looking ahead, the market outlook for 2025 and beyond is robust. The combination of falling enzyme costs, expanding feedstock availability, and tightening carbon regulations is expected to drive double-digit annual growth in cellulosic ethanol enzyme engineering. Strategic partnerships between enzyme developers, biofuel producers, and agricultural stakeholders will be crucial in scaling up production and meeting global renewable energy targets.

Technological Innovations in Enzyme Engineering for Cellulosic Ethanol

Cellulosic ethanol production relies on the efficient breakdown of lignocellulosic biomass into fermentable sugars, a process fundamentally dependent on advanced enzyme engineering. In 2025, the sector is witnessing significant technological innovations aimed at improving enzyme performance, reducing costs, and enabling commercial-scale viability. The primary focus is on optimizing cellulases and hemicellulases—key enzymes that hydrolyze cellulose and hemicellulose, respectively—through protein engineering, directed evolution, and synthetic biology approaches.

Leading enzyme manufacturers such as Novozymes and DSM (now part of dsm-firmenich) have been at the forefront of developing next-generation enzyme cocktails tailored for diverse feedstocks and process conditions. Novozymes, for example, has introduced enzyme blends with enhanced thermostability and activity at lower pH, which are critical for integration into consolidated bioprocessing (CBP) and for reducing the need for costly pretreatment steps. DSM has focused on engineering enzymes with improved tolerance to inhibitors commonly present in pretreated biomass, thereby increasing overall sugar yields and process robustness.

Recent advances in computational protein design and high-throughput screening have accelerated the discovery and optimization of novel enzyme variants. Companies are leveraging machine learning algorithms to predict beneficial mutations and to design enzymes with higher catalytic efficiency and substrate specificity. This is exemplified by collaborative efforts between enzyme producers and biofuel developers to create custom enzyme solutions for specific biomass types, such as agricultural residues or energy crops.

Another notable trend is the integration of enzyme engineering with metabolic engineering in host microorganisms. By expressing optimized enzyme sets directly in industrial microbes, companies aim to streamline the conversion of biomass to ethanol, reducing the need for external enzyme addition. This approach is being explored by several industrial biotechnology firms in partnership with enzyme specialists.

Looking ahead, the outlook for cellulosic ethanol enzyme engineering remains promising. The continued decline in enzyme costs, coupled with improvements in enzyme performance, is expected to drive down the overall cost of cellulosic ethanol production. Industry bodies such as the Biotechnology Innovation Organization anticipate that these innovations will play a pivotal role in scaling up commercial cellulosic ethanol facilities and expanding the range of viable feedstocks. As the sector moves toward 2030, further integration of artificial intelligence, automation, and synthetic biology is likely to yield even more robust and cost-effective enzyme solutions, supporting the broader adoption of cellulosic biofuels in the global energy mix.

Leading Companies and Strategic Partnerships (e.g., novozymes.com, dupont.com, dsm.com)

The landscape of cellulosic ethanol enzyme engineering in 2025 is shaped by a handful of global biotechnology leaders, each leveraging advanced enzyme platforms and strategic partnerships to drive commercial viability. The sector is characterized by ongoing innovation in enzyme cocktails, process integration, and collaborative ventures aimed at reducing costs and improving yields from lignocellulosic biomass.

Novozymes A/S remains a dominant force in industrial enzyme development, with a dedicated focus on bioenergy solutions. The company’s Cellic® enzyme series, specifically tailored for cellulosic ethanol production, continues to set industry benchmarks for efficiency and robustness. Novozymes has established long-term supply agreements with major biofuel producers and is actively involved in joint development projects to optimize enzyme performance for diverse feedstocks. In 2024 and 2025, Novozymes has expanded its partnerships with both established ethanol producers and emerging biorefinery startups, aiming to accelerate the commercialization of second-generation biofuels (Novozymes A/S).

DuPont (now operating its industrial biosciences division under IFF following the 2021 merger) continues to play a pivotal role in enzyme engineering for cellulosic ethanol. The company’s proprietary enzyme blends, such as Accellerase®, are widely used in pilot and commercial-scale biorefineries. DuPont/IFF has focused on improving enzyme thermostability and substrate specificity, enabling more efficient conversion of agricultural residues and energy crops. Strategic collaborations with technology licensors and ethanol producers have been central to their approach, with ongoing projects in North America, Europe, and Asia targeting both process optimization and cost reduction (DuPont).

DSM, now part of DSM-Firmenich after its 2023 merger, is another key player, offering enzyme solutions under the eBOOST™ brand. DSM-Firmenich’s approach emphasizes integrated bioprocessing, combining enzyme engineering with yeast strain development to maximize ethanol yields. The company has entered into several joint ventures and licensing agreements with global biofuel producers, particularly in Brazil and China, to deploy its advanced enzyme technologies at scale. DSM-Firmenich’s R&D pipeline in 2025 includes next-generation enzymes designed for challenging feedstocks and harsh process conditions (DSM).

Looking ahead, the next few years are expected to see intensified collaboration between enzyme developers, biorefinery operators, and agricultural stakeholders. The focus will be on tailoring enzyme solutions to regional biomass types, further reducing enzyme dosage requirements, and integrating digital tools for process monitoring. These efforts are anticipated to lower production costs and enhance the competitiveness of cellulosic ethanol in the global biofuels market.

Feedstock Advances: Lignocellulosic Sources and Supply Chain Developments

Cellulosic ethanol production relies on the efficient breakdown of lignocellulosic biomass into fermentable sugars, a process fundamentally dependent on advanced enzyme engineering. In 2025, the sector is witnessing significant progress in the development and deployment of tailored enzyme cocktails, designed to address the recalcitrance of diverse feedstocks such as agricultural residues, energy crops, and forestry byproducts. The focus is on optimizing enzyme performance for specific biomass types, reducing enzyme loading, and improving overall process economics.

Key industry players are driving innovation through both in-house R&D and strategic collaborations. Novozymes, a global leader in industrial biotechnology, continues to expand its portfolio of cellulases, hemicellulases, and accessory enzymes. Their latest enzyme blends are engineered for higher thermostability and activity under industrial conditions, enabling more robust hydrolysis of pretreated biomass. Similarly, DSM (now part of dsm-firmenich) is advancing enzyme formulations that target specific bottlenecks in lignin-rich feedstocks, leveraging protein engineering and high-throughput screening to enhance enzyme-substrate affinity and reduce inhibition by lignin-derived compounds.

Another notable contributor, DuPont (operating its industrial biosciences division under IFF), has focused on developing multi-enzyme systems that synergistically degrade cellulose, hemicellulose, and pectin fractions. Their recent efforts emphasize the integration of enzyme engineering with process optimization, such as simultaneous saccharification and fermentation (SSF), to streamline production and lower costs. These advances are being validated in commercial-scale biorefineries, with ongoing data collection to inform further enzyme refinement.

The supply chain for cellulosic ethanol is also benefiting from enzyme engineering. Improved enzyme efficiency allows for the use of a broader range of feedstocks, including those with higher lignin content or variable composition, thus enhancing feedstock flexibility and supply chain resilience. Companies are increasingly collaborating with feedstock suppliers and biorefinery operators to tailor enzyme solutions to local biomass characteristics, as seen in partnerships between enzyme manufacturers and agricultural cooperatives.

Looking ahead, the next few years are expected to bring further reductions in enzyme costs, driven by advances in protein engineering, microbial expression systems, and process integration. The deployment of next-generation enzymes will be critical for scaling up cellulosic ethanol production and achieving cost parity with first-generation biofuels. As regulatory and market pressures for low-carbon fuels intensify, enzyme engineering will remain a cornerstone of the cellulosic ethanol value chain, supporting both technological and commercial milestones.

Process Optimization: Enzyme Performance, Yield, and Cost Reduction

Cellulosic ethanol production hinges on the efficient conversion of lignocellulosic biomass into fermentable sugars, a process fundamentally dependent on the performance of specialized enzymes. In 2025, enzyme engineering remains a focal point for process optimization, with leading industrial biotechnology companies intensifying efforts to enhance enzyme activity, stability, and cost-effectiveness. The primary goals are to increase ethanol yield, reduce enzyme loading, and lower overall production costs, thereby improving the commercial viability of cellulosic ethanol.

Recent advancements have centered on the development of enzyme cocktails tailored to specific feedstocks and pretreatment methods. Companies such as Novozymes and DSM (now part of dsm-firmenich) have introduced next-generation cellulases and hemicellulases with improved thermostability and resistance to inhibitors commonly present in pretreated biomass. These innovations enable more robust hydrolysis under industrial conditions, translating to higher sugar yields and reduced enzyme dosages. For instance, Novozymes’ latest enzyme blends are reported to achieve up to 20% higher conversion rates on challenging substrates compared to previous formulations, directly impacting ethanol output per ton of biomass.

Cost reduction remains a critical driver. Enzyme production itself has become more efficient through advances in microbial strain engineering and fermentation technology. Companies are leveraging synthetic biology to design microbial hosts that secrete higher titers of target enzymes, while also optimizing fermentation parameters to minimize resource inputs. DSM and Novozymes have both reported significant reductions in enzyme manufacturing costs over the past two years, with further improvements anticipated as new strains and process controls are implemented.

Another trend is the integration of enzyme engineering with process modeling and digitalization. Real-time monitoring and predictive analytics are being used to fine-tune enzyme dosing and process conditions, maximizing yield while minimizing waste. This data-driven approach is expected to become standard practice in the next few years, as producers seek to extract maximum value from every batch.

Looking ahead, the outlook for cellulosic ethanol enzyme engineering is promising. The continued collaboration between enzyme suppliers and ethanol producers is expected to yield further gains in process efficiency and cost competitiveness. As more commercial-scale cellulosic ethanol plants come online, feedback from operational data will drive iterative improvements in enzyme design and deployment, supporting the broader adoption of cellulosic biofuels in the global energy mix.

Regulatory Landscape and Industry Standards (e.g., bio.org, ethanolrfa.org)

The regulatory landscape for cellulosic ethanol enzyme engineering in 2025 is shaped by evolving standards, sustainability mandates, and the drive for commercial viability. Regulatory agencies and industry bodies are increasingly focused on ensuring that enzyme technologies used in cellulosic ethanol production meet stringent safety, efficacy, and environmental criteria. In the United States, the Environmental Protection Agency (EPA) continues to play a central role by setting Renewable Volume Obligations (RVOs) under the Renewable Fuel Standard (RFS), which directly impact the demand for advanced biofuels, including those produced using engineered enzymes. The EPA’s annual rulemakings influence the pace of innovation and commercialization in enzyme development, as producers must align with the latest definitions and sustainability requirements for cellulosic biofuels.

Industry organizations such as the Biotechnology Innovation Organization (BIO) and the Renewable Fuels Association (RFA) are actively engaged in advocacy and standard-setting. BIO, representing biotechnology companies including enzyme developers, works to ensure that regulatory frameworks support innovation while maintaining rigorous safety and environmental standards. The RFA, representing ethanol producers, collaborates with regulatory agencies to streamline the approval process for new enzyme technologies and to ensure that industry standards reflect the latest scientific advancements.

A key regulatory focus in 2025 is the traceability and documentation of enzyme production processes, particularly for genetically engineered strains. Regulatory bodies require detailed dossiers on the genetic modifications, containment measures, and environmental impact assessments. This is especially relevant as companies such as Novozymes and DuPont (now part of IFF) continue to introduce next-generation enzyme cocktails designed for higher efficiency and broader substrate specificity. These companies must demonstrate compliance with both domestic and international biosafety and trade regulations, as their products are distributed globally.

Industry standards are also evolving to address the integration of enzyme engineering with digitalization and process automation. Organizations are developing best practices for data integrity, process validation, and quality assurance in enzyme manufacturing. The adoption of voluntary certification schemes, such as those promoted by BIO, is expected to increase, providing additional assurance to downstream users and regulators regarding the sustainability and safety of enzyme-enabled cellulosic ethanol production.

Looking ahead, the regulatory environment is expected to become more harmonized internationally, with increased collaboration between North American, European, and Asian regulatory bodies. This will facilitate the global deployment of advanced enzyme technologies and support the scaling of cellulosic ethanol as a key component of low-carbon fuel strategies. Industry stakeholders anticipate that ongoing engagement with regulators and standards organizations will be critical to maintaining momentum in enzyme innovation and commercialization through the remainder of the decade.

Sustainability Impact: Carbon Footprint and Circular Economy Integration

Cellulosic ethanol enzyme engineering is poised to play a pivotal role in advancing the sustainability profile of biofuels, particularly as the world intensifies efforts to decarbonize transportation and industrial sectors in 2025 and beyond. The core sustainability impact of this technology lies in its ability to convert non-food lignocellulosic biomass—such as agricultural residues, forestry byproducts, and dedicated energy crops—into ethanol, thereby reducing reliance on fossil fuels and minimizing competition with food resources.

A key driver of reduced carbon footprint in cellulosic ethanol production is the ongoing optimization of enzyme cocktails. Leading enzyme manufacturers, including Novozymes (now part of Novonesis) and DSM (now part of dsm-firmenich), have developed advanced cellulases and hemicellulases that significantly improve the efficiency of biomass hydrolysis. These innovations lower the energy and chemical inputs required for pretreatment and saccharification, directly translating to lower greenhouse gas (GHG) emissions per unit of ethanol produced. For example, Novozymes reports that their latest enzyme solutions can reduce the carbon intensity of cellulosic ethanol by up to 90% compared to gasoline, depending on feedstock and process integration.

Circular economy principles are increasingly being integrated into cellulosic ethanol facilities. Modern biorefineries are designed to valorize all biomass fractions, not just the fermentable sugars. Lignin-rich residues, for instance, are being converted into biochemicals, renewable power, or advanced materials, closing resource loops and maximizing value extraction. Companies such as POET and Clariant are at the forefront of this approach, with commercial-scale plants that utilize enzyme-engineered processes to convert agricultural waste into ethanol and co-products, supporting local circular economies and reducing overall waste.

Looking ahead to the next few years, the sustainability impact of cellulosic ethanol enzyme engineering is expected to deepen as enzyme formulations become more robust, cost-effective, and tailored to diverse feedstocks. The integration of digital tools and artificial intelligence in enzyme design is anticipated to accelerate the discovery of novel biocatalysts with enhanced performance and stability, further reducing process emissions and costs. Additionally, policy frameworks in the US, EU, and Asia are increasingly recognizing the carbon and circularity benefits of cellulosic ethanol, providing incentives for wider adoption and continuous improvement.

In summary, cellulosic ethanol enzyme engineering is central to reducing the carbon footprint of biofuels and embedding circular economy practices in the sector. As technology and policy converge, the next few years are likely to see expanded deployment of enzyme-optimized biorefineries, delivering measurable sustainability gains across the value chain.

Investment Trends, Funding, and M&A Activity

The cellulosic ethanol enzyme engineering sector is experiencing a dynamic phase in investment, funding, and M&A activity as of 2025, driven by the global push for decarbonization and sustainable fuels. Major industrial biotechnology firms and enzyme manufacturers are at the forefront, leveraging both internal R&D and strategic partnerships to accelerate innovation and scale.

In recent years, significant capital has flowed into enzyme engineering, with leading players such as Novozymes and DSM (now part of dsm-firmenich) maintaining robust investment in advanced enzyme platforms tailored for cellulosic feedstocks. These companies have consistently reported increased R&D budgets, focusing on improving enzyme efficiency, thermostability, and substrate specificity to reduce the cost of cellulosic ethanol production. Novozymes, for example, has highlighted ongoing investments in enzyme cocktails that enable higher yields from agricultural residues and energy crops.

Mergers and acquisitions have also shaped the landscape. The 2023 merger of DSM’s and Firmenich’s bioscience divisions into dsm-firmenich created a powerhouse with expanded capabilities in enzyme innovation, signaling a trend toward consolidation to achieve scale and cross-disciplinary expertise. Similarly, DuPont (now part of IFF’s Nourish division) has continued to invest in enzyme technology, with a focus on both in-house development and external collaborations.

Venture capital and strategic corporate investments are increasingly targeting startups and scale-ups specializing in enzyme engineering for cellulosic ethanol. Companies such as Genomatica and Amyris (though Amyris has faced restructuring challenges) have attracted funding rounds aimed at commercializing novel enzyme systems and bioprocesses. The sector has also seen public-private partnerships, with government-backed initiatives in the US, EU, and Asia supporting pilot and demonstration projects to de-risk technology deployment.

Looking ahead to the next few years, the outlook remains positive. The anticipated tightening of carbon regulations and the expansion of low-carbon fuel standards are expected to further stimulate investment. Industry analysts expect continued consolidation among enzyme suppliers, as well as increased collaboration between technology developers and large-scale ethanol producers. The focus will likely remain on reducing enzyme costs, improving process integration, and scaling up production to meet the growing demand for sustainable fuels.

Overall, the cellulosic ethanol enzyme engineering sector in 2025 is marked by active investment, strategic M&A, and a strong pipeline of innovation, positioning it as a critical enabler of the global bioeconomy.

Future Outlook: Disruptive Technologies and Market Opportunities to 2030

Cellulosic ethanol enzyme engineering is poised for significant advancements through 2025 and into the latter part of the decade, driven by both technological innovation and the urgent need for low-carbon fuels. The core challenge remains the efficient and cost-effective breakdown of lignocellulosic biomass into fermentable sugars, a process heavily reliant on specialized enzyme cocktails. Recent years have seen a surge in research and commercial activity aimed at optimizing these enzymes for industrial-scale deployment.

Key industry players such as Novozymes (now part of Novonesis following its merger with Chr. Hansen), DuPont (through its subsidiary Genencor), and BASF are at the forefront of enzyme innovation. Novozymes has consistently introduced new generations of cellulases and hemicellulases, focusing on higher activity, thermostability, and reduced enzyme loading, which directly impacts the economics of cellulosic ethanol production. Their latest enzyme blends are tailored for diverse feedstocks, including agricultural residues and energy crops, and are being tested in pilot and commercial plants worldwide.

The integration of advanced protein engineering and directed evolution techniques is accelerating the development of more robust enzymes. Companies are leveraging high-throughput screening and artificial intelligence to identify mutations that enhance enzyme performance under industrial conditions. For example, DuPont has reported progress in engineering enzymes with improved tolerance to inhibitors commonly found in pretreated biomass, a key bottleneck in the process.

Another disruptive trend is the emergence of consolidated bioprocessing (CBP), where enzyme production, biomass hydrolysis, and fermentation occur in a single step. Startups and established firms alike are exploring genetically engineered microbes capable of secreting optimized enzyme mixtures directly during fermentation, potentially eliminating the need for separate enzyme manufacturing. This approach, if scaled successfully, could dramatically reduce costs and simplify logistics.

Looking ahead to 2030, the market for cellulosic ethanol enzymes is expected to benefit from tightening carbon regulations and growing demand for sustainable aviation fuel (SAF). The U.S. Department of Energy and the European Union are both supporting demonstration projects and commercial deployments, creating a favorable policy environment. As enzyme costs continue to decline and process yields improve, cellulosic ethanol could achieve cost parity with first-generation biofuels, unlocking new market opportunities and supporting global decarbonization goals.

In summary, the next few years will likely see a convergence of enzyme engineering breakthroughs, process integration, and supportive policy frameworks, positioning cellulosic ethanol as a key player in the renewable fuels landscape.

Sources & References

- DSM

- DuPont

- DSM

- POET

- Biotechnology Innovation Organization

- Biotechnology Innovation Organization

- POET

- Clariant

- Amyris

- BASF