Rock Mechanics Simulation Software Development in 2025: Unleashing Next-Gen Modeling for Geotechnical Engineering. Explore How Advanced Simulation Tools Are Transforming the Industry’s Future.

- Executive Summary & Key Findings

- Market Size, Growth Rate, and 2025–2030 Forecasts

- Major Players and Competitive Landscape

- Technological Innovations: AI, Cloud, and HPC Integration

- Emerging Applications in Mining, Civil, and Energy Sectors

- Regulatory Standards and Industry Guidelines

- User Adoption Trends and Barriers

- Case Studies: Real-World Implementations

- Strategic Partnerships and M&A Activity

- Future Outlook: Opportunities and Challenges Ahead

- Sources & References

Executive Summary & Key Findings

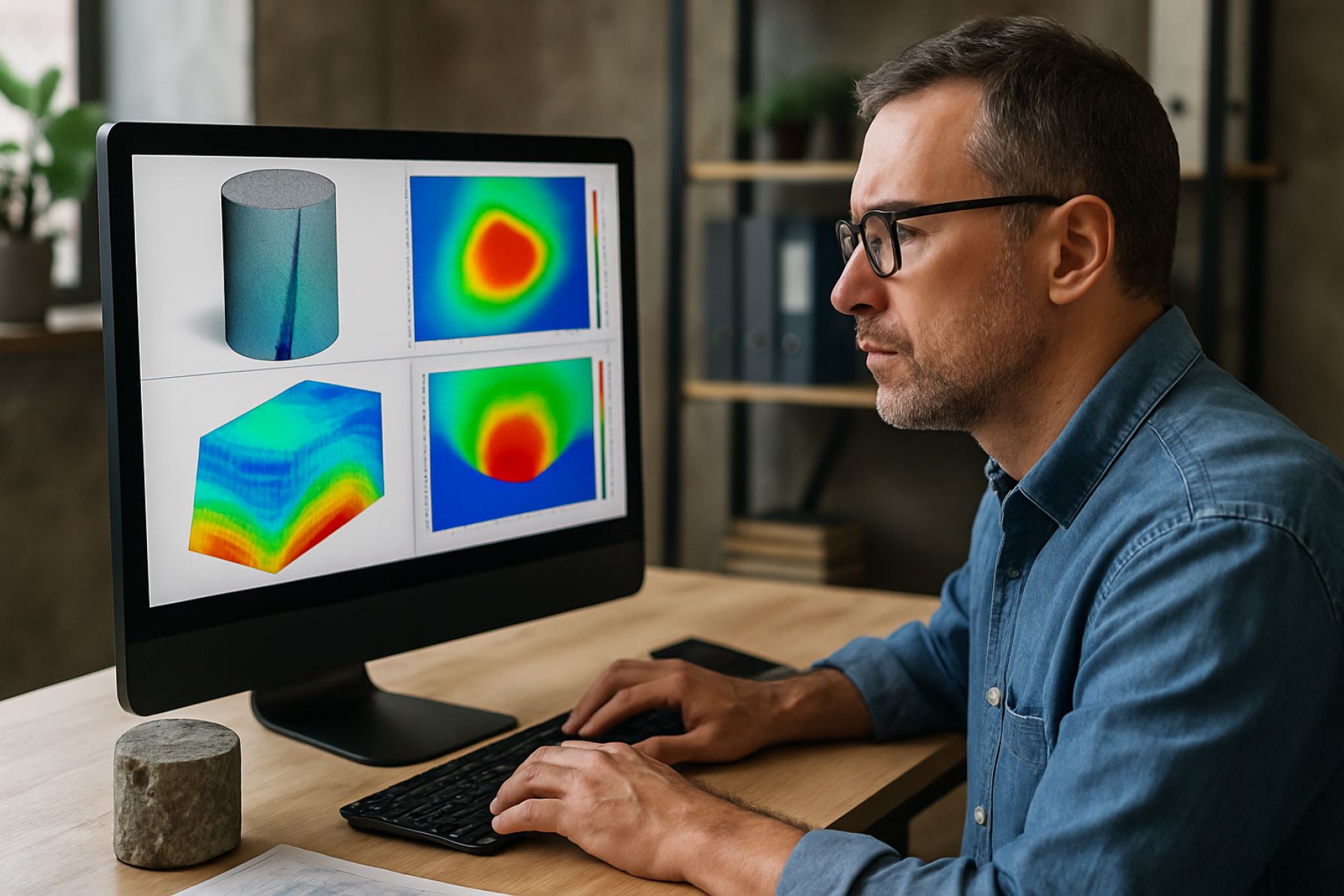

The development of rock mechanics simulation software is experiencing significant momentum in 2025, driven by the increasing complexity of mining, tunneling, and civil engineering projects worldwide. The sector is characterized by rapid advancements in computational modeling, integration of artificial intelligence (AI), and the adoption of cloud-based platforms. These trends are enabling more accurate, scalable, and user-friendly solutions for simulating rock behavior under various geological and engineering conditions.

Key industry players such as Rocscience, Itasca Consulting Group, and Dassault Systèmes (through its Abaqus suite) continue to lead innovation by enhancing their software with advanced numerical methods, improved user interfaces, and expanded interoperability with other engineering tools. For example, Rocscience has recently introduced updates to its suite, including RS3 and Slide3, focusing on 3D finite element and limit equilibrium analysis, while Itasca’s FLAC3D and 3DEC platforms are increasingly used for large-scale, nonlinear, and discontinuum modeling in both research and industry applications.

A notable trend in 2025 is the integration of AI and machine learning algorithms to automate parameter calibration, uncertainty quantification, and predictive analytics. This is reducing the time and expertise required for complex simulations, making advanced rock mechanics modeling accessible to a broader range of users. Cloud-based deployment is also gaining traction, with companies like Rocscience and Itasca Consulting Group exploring web-based licensing and collaborative platforms, which facilitate remote work and global project collaboration.

The demand for simulation software is further fueled by stricter regulatory requirements for safety and environmental impact assessments in mining and infrastructure projects. This is prompting software developers to incorporate more robust geomechanical modeling capabilities, including coupled hydro-mechanical and thermo-mechanical analyses, to address the needs of modern engineering challenges.

Looking ahead, the outlook for rock mechanics simulation software development remains highly positive. Continued investment in R&D, the proliferation of digital twins, and the convergence of geotechnical data with real-time monitoring systems are expected to drive further innovation. The next few years will likely see increased adoption of open-source frameworks and interoperability standards, fostering greater collaboration between academia, industry, and software vendors. As a result, the sector is poised for sustained growth, with software solutions playing a pivotal role in optimizing design, risk management, and operational efficiency across geotechnical disciplines.

Market Size, Growth Rate, and 2025–2030 Forecasts

The global market for rock mechanics simulation software is experiencing robust growth, driven by increasing demand for advanced modeling tools in mining, civil engineering, tunneling, and energy sectors. As of 2025, the market is estimated to be valued at several hundred million USD, with projections indicating a compound annual growth rate (CAGR) of approximately 8–10% through 2030. This expansion is fueled by the need for more accurate geomechanical analysis, risk mitigation in large-scale infrastructure projects, and the integration of digital technologies such as cloud computing and artificial intelligence.

Key players in the sector include Rocscience, a Canadian company renowned for its suite of geotechnical and rock mechanics simulation tools, and Itasca Consulting Group, which offers advanced numerical modeling software like FLAC3D and UDEC. Both companies have reported increased adoption of their products in emerging markets and among major engineering firms, reflecting the global nature of infrastructure development and resource extraction. Rocscience has also expanded its cloud-based offerings, enabling collaborative workflows and remote access, which are increasingly demanded by multinational project teams.

Another significant contributor is Dassault Systèmes, whose ABAQUS platform is widely used for finite element analysis in rock mechanics, particularly in oil & gas and underground construction. The company continues to invest in simulation-driven design and digital twin technologies, which are expected to further drive market growth through 2030. Additionally, Bentley Systems provides integrated geotechnical modeling solutions that are being adopted in large infrastructure projects worldwide, supporting the trend toward digitalization in engineering workflows.

The Asia-Pacific region is anticipated to be the fastest-growing market, propelled by extensive infrastructure development in China, India, and Southeast Asia. North America and Europe remain significant markets due to ongoing investments in mining, tunneling, and energy storage projects. The adoption of simulation software is also being accelerated by stricter regulatory requirements for safety and environmental impact assessments, necessitating more sophisticated modeling capabilities.

Looking ahead, the market outlook for 2025–2030 is characterized by continued innovation, with vendors focusing on enhanced user interfaces, interoperability with BIM and GIS platforms, and the incorporation of machine learning for predictive analytics. As digital transformation deepens across engineering disciplines, the demand for advanced rock mechanics simulation software is expected to remain strong, supporting safer and more efficient project delivery worldwide.

Major Players and Competitive Landscape

The rock mechanics simulation software sector in 2025 is characterized by a dynamic competitive landscape, with several established and emerging players driving innovation and market growth. The field is dominated by a handful of global engineering software companies, each offering specialized solutions for geomechanical modeling, numerical simulation, and analysis of rock behavior under various stress conditions.

Among the most prominent companies is Rocscience, a Canadian firm renowned for its suite of geotechnical and rock mechanics software tools. Rocscience’s products, such as RS2 (finite element analysis) and RS3 (3D finite element analysis), are widely adopted in mining, civil, and tunneling projects worldwide. The company continues to expand its capabilities, integrating cloud-based collaboration and advanced visualization features to meet the evolving needs of engineers and researchers.

Another key player is Itasca Consulting Group, headquartered in the United States, which specializes in advanced numerical modeling software for geomechanics and hydrogeology. Itasca’s flagship products, including FLAC3D and PFC, are extensively used for simulating complex rock and soil behavior, with ongoing development focusing on improved computational efficiency and user interface enhancements. The company also provides consulting services, leveraging its software for large-scale mining and civil engineering projects.

Rock Science (not to be confused with Rocscience) and GEOSLOPE International are also notable contributors. GEOSLOPE, now part of Bentley Systems, offers the GeoStudio suite, which includes tools for slope stability, groundwater flow, and stress-deformation analysis. Bentley’s acquisition of GEOSLOPE has enabled deeper integration of geotechnical modeling within broader infrastructure design workflows, reflecting a trend toward holistic digital twin solutions in the sector.

In addition, Dassault Systèmes (through its SIMULIA brand) and ANSYS provide multiphysics simulation platforms that are increasingly being adapted for rock mechanics applications, particularly in oil & gas and underground construction. These platforms offer high-performance computing capabilities and interoperability with other engineering tools, supporting complex, large-scale simulations.

Looking ahead, the competitive landscape is expected to intensify as companies invest in artificial intelligence, machine learning, and cloud-based simulation to enhance predictive accuracy and user accessibility. Strategic partnerships, acquisitions, and the integration of real-time field data are likely to shape the next phase of innovation, with established players and agile startups vying for leadership in this technically demanding domain.

Technological Innovations: AI, Cloud, and HPC Integration

The landscape of rock mechanics simulation software is undergoing rapid transformation in 2025, driven by the integration of artificial intelligence (AI), cloud computing, and high-performance computing (HPC) technologies. These innovations are enabling more accurate, scalable, and efficient modeling of complex geomechanical phenomena, which is critical for sectors such as mining, civil engineering, and energy.

AI and machine learning are increasingly embedded within simulation platforms to automate parameter calibration, optimize mesh generation, and enhance predictive capabilities. For example, leading software providers are leveraging AI to analyze large datasets from field measurements and laboratory tests, improving the reliability of rock mass behavior predictions. This trend is exemplified by companies like Rocscience, which has begun incorporating AI-driven features into its suite of geotechnical analysis tools, and Itasca Consulting Group, known for its advanced numerical modeling software that is exploring AI-assisted workflows for faster scenario analysis.

Cloud computing is another major driver of innovation, offering scalable resources for computationally intensive simulations. By migrating simulation workloads to the cloud, users can access powerful hardware on demand, collaborate in real time, and manage large datasets more efficiently. Bentley Systems has expanded its cloud-based offerings, enabling geotechnical engineers to run simulations remotely and integrate results with other infrastructure design tools. Similarly, Rocscience is developing cloud-enabled platforms to facilitate distributed computing and data sharing among project teams.

HPC integration is pushing the boundaries of what is possible in rock mechanics modeling. The adoption of GPU acceleration and parallel processing allows for the simulation of larger and more complex geological systems with higher resolution. Itasca Consulting Group has been at the forefront of this movement, optimizing its software to leverage multi-core and GPU architectures, which significantly reduces computation times for large-scale discrete element and finite element models.

Looking ahead, the convergence of AI, cloud, and HPC is expected to further democratize access to advanced simulation capabilities, enabling smaller firms and research institutions to tackle challenging geomechanical problems. Industry stakeholders anticipate that by 2027, these technologies will be standard features in most commercial rock mechanics simulation packages, fostering greater innovation and collaboration across the sector.

Emerging Applications in Mining, Civil, and Energy Sectors

Rock mechanics simulation software is experiencing rapid evolution in 2025, driven by the increasing complexity of projects in mining, civil engineering, and energy sectors. The demand for accurate, scalable, and user-friendly simulation tools is being propelled by the need to optimize resource extraction, ensure infrastructure safety, and support the transition to sustainable energy systems.

In mining, the adoption of advanced simulation platforms is enabling companies to model complex geomechanical behavior, predict ground stability, and design safer excavation strategies. Leading software providers such as Rocscience and Itasca Consulting Group are at the forefront, offering suites like RS2, 3DEC, and FLAC3D, which are widely used for slope stability, underground excavation, and seismic risk analysis. These tools are increasingly integrating machine learning algorithms and cloud-based computation, allowing for real-time data assimilation and scenario testing. The mining sector is also leveraging digital twin technology, where virtual replicas of mine sites are continuously updated with sensor data to improve predictive maintenance and operational efficiency.

In civil engineering, the focus is on infrastructure resilience and risk mitigation. Simulation software is being used to assess the stability of tunnels, dams, and foundations under varying load and environmental conditions. Companies such as Bentley Systems are expanding their geotechnical modeling capabilities, integrating rock mechanics modules into broader civil design platforms. This integration supports multidisciplinary collaboration and streamlines workflows from site investigation to construction and monitoring. The increasing frequency of extreme weather events and seismic activity is further driving demand for robust simulation tools that can model complex interactions between geological materials and engineered structures.

The energy sector, particularly in geothermal and underground energy storage projects, is emerging as a significant application area for rock mechanics simulation. Accurate modeling of subsurface stress, fracture propagation, and fluid flow is critical for the safe and efficient development of these resources. Schneider Electric and SLB (formerly Schlumberger) are investing in simulation platforms that support the design and monitoring of underground energy systems, including carbon capture and storage (CCS) and hydrogen storage. These developments are aligned with global decarbonization goals and the need for secure, long-term energy storage solutions.

Looking ahead, the next few years are expected to see further convergence of rock mechanics simulation with artificial intelligence, cloud computing, and IoT-enabled monitoring. This will enable more adaptive, data-driven decision-making across mining, civil, and energy projects, supporting both operational efficiency and sustainability objectives.

Regulatory Standards and Industry Guidelines

The regulatory landscape for rock mechanics simulation software is evolving rapidly in 2025, driven by increasing demands for safety, environmental stewardship, and digitalization in mining, civil engineering, and energy sectors. Regulatory standards and industry guidelines are being updated to reflect advances in simulation capabilities, data integration, and interoperability, with a focus on ensuring that software tools meet rigorous requirements for accuracy, transparency, and traceability.

Key international standards, such as those from the International Organization for Standardization (ISO), continue to influence software development. ISO 9001 for quality management and ISO 14001 for environmental management are frequently referenced in the certification processes of leading software vendors. Additionally, the ISO 19450 standard for object process methodology is increasingly relevant as simulation platforms integrate more complex data structures and workflows.

In 2025, regulatory bodies in major mining and infrastructure markets—such as the United States, Canada, Australia, and the European Union—are emphasizing the need for validated and auditable simulation results. This is particularly evident in the context of permitting processes for large-scale projects, where authorities require that digital models used for geomechanical risk assessment adhere to recognized best practices and are developed using software that complies with industry standards. For example, the U.S. Mine Safety and Health Administration (MSHA) and the Canadian Standards Association (CSA Group) are both actively updating their guidelines to address the use of advanced simulation tools in design and operational safety reviews.

Industry organizations such as the International Society for Rock Mechanics and Rock Engineering (ISRM) and the International Tunnelling and Underground Space Association (ITA-AITES) are also playing a pivotal role by publishing technical guidelines and recommended practices for the application of simulation software in rock engineering. These guidelines increasingly call for transparent documentation of model assumptions, calibration procedures, and validation against field data.

Looking ahead, the outlook for regulatory standards in rock mechanics simulation software is one of increasing harmonization and digital integration. Efforts are underway to develop unified data exchange formats and to incorporate requirements for artificial intelligence and machine learning modules, reflecting the growing sophistication of simulation platforms. Software developers such as Rocscience, Itasca Consulting Group, and GEOSLOPE are actively engaging with standards bodies and industry groups to ensure their products remain compliant and at the forefront of regulatory expectations.

User Adoption Trends and Barriers

The adoption of rock mechanics simulation software is experiencing a steady upward trajectory in 2025, driven by the increasing complexity of mining, tunneling, and civil engineering projects. As digital transformation accelerates across the geotechnical sector, end-users are seeking advanced simulation tools to optimize design, reduce risk, and comply with stringent safety regulations. Leading software providers such as Rocscience, Itasca Consulting Group, and Dassault Systèmes (with its GEOVIA suite) are reporting heightened demand for their products, particularly in regions with active infrastructure development and resource extraction.

A key trend in 2025 is the shift toward cloud-based and high-performance computing (HPC) solutions, which enable users to run large-scale, complex simulations without the need for significant on-premises hardware investment. This is lowering the entry barrier for smaller engineering firms and academic institutions, broadening the user base. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) algorithms is enhancing predictive capabilities and automating aspects of model calibration, as seen in recent updates from Rocscience and Itasca Consulting Group.

Despite these advances, several barriers to adoption persist. High software licensing costs remain a significant concern, particularly for small and medium-sized enterprises (SMEs) and organizations in developing economies. The steep learning curve associated with advanced simulation platforms also limits uptake, as users require specialized training to fully leverage the software’s capabilities. In response, vendors are expanding their training offerings and user support, with Rocscience and Itasca Consulting Group both investing in online learning platforms and certification programs.

Interoperability with other engineering and geological software remains a technical challenge, as users increasingly demand seamless data exchange between modeling, design, and monitoring tools. Industry leaders are addressing this by adopting open data standards and developing APIs, but full integration is still a work in progress. Furthermore, data quality and availability—especially for subsurface conditions—continue to impact the reliability of simulation outputs, underscoring the need for improved site investigation technologies and data management practices.

Looking ahead, user adoption is expected to accelerate as software becomes more user-friendly, affordable, and integrated with broader digital engineering ecosystems. The ongoing collaboration between software developers, industry bodies, and end-users will be crucial in overcoming current barriers and unlocking the full potential of rock mechanics simulation in the coming years.

Case Studies: Real-World Implementations

In 2025, the field of rock mechanics simulation software continues to evolve rapidly, with several notable real-world implementations highlighting both the technological advancements and the practical benefits of these tools. Mining, civil engineering, and energy sectors are at the forefront of adopting advanced simulation platforms to optimize design, improve safety, and reduce costs.

One prominent example is the deployment of Rocscience software in large-scale tunneling projects across Europe and Asia. Rocscience’s suite, including RS2 and RS3, has been instrumental in simulating complex geomechanical behavior for underground excavations, slope stability, and support design. In 2024–2025, several metro and hydropower tunnel projects in Scandinavia and Southeast Asia reported significant reductions in unplanned downtime and improved risk management by integrating Rocscience’s 3D finite element modeling into their workflows. These case studies underscore the growing reliance on advanced numerical modeling to predict ground response and optimize support systems in challenging geological conditions.

Similarly, Itasca Consulting Group has seen its FLAC3D and PFC software widely adopted in mining operations in Australia and South America. In 2025, a major copper mine in Chile utilized FLAC3D to simulate caving processes and assess the stability of underground chambers, leading to a 15% increase in ore recovery and a measurable reduction in ground control incidents. The mine’s engineering team credited the software’s ability to model complex, nonlinear rock mass behavior and dynamic loading scenarios as key to their operational improvements.

In the oil and gas sector, SLB (Schlumberger) continues to integrate rock mechanics simulation into its digital reservoir modeling platforms. In 2025, SLB’s Petrel platform, enhanced with geomechanical modules, was deployed in unconventional shale plays in North America. Operators reported improved wellbore stability predictions and optimized hydraulic fracturing designs, resulting in lower non-productive time and enhanced hydrocarbon recovery. These outcomes demonstrate the value of coupling geomechanical simulation with reservoir engineering for complex subsurface environments.

Looking ahead, the next few years are expected to see further integration of artificial intelligence and cloud computing into rock mechanics simulation workflows. Companies such as Rocscience and Itasca Consulting Group are investing in cloud-based platforms and machine learning algorithms to automate model calibration and scenario analysis, aiming to make advanced simulation more accessible and efficient for a broader range of users. These developments are poised to accelerate the adoption of simulation-driven design and decision-making across the geotechnical and energy industries.

Strategic Partnerships and M&A Activity

Strategic partnerships and mergers & acquisitions (M&A) are shaping the competitive landscape of rock mechanics simulation software development in 2025, as industry players seek to expand capabilities, integrate advanced technologies, and access new markets. The sector, which underpins mining, civil engineering, and energy projects, is witnessing increased collaboration between software developers, hardware manufacturers, and end-user organizations.

One of the most prominent companies in this space is Rocscience, a Canadian firm renowned for its suite of geotechnical and rock mechanics simulation tools. In recent years, Rocscience has actively pursued partnerships with academic institutions and industry leaders to enhance its software’s analytical power and interoperability. For example, collaborations with universities have led to the integration of advanced numerical modeling techniques, while alliances with hardware providers are enabling more seamless data transfer from field instruments to simulation environments.

Another key player, Itasca Consulting Group, has a global presence and is known for its FLAC and PFC software products. Itasca has engaged in strategic partnerships with mining companies and engineering consultancies to co-develop customized simulation modules tailored to specific project needs. These collaborations are often formalized through joint development agreements, allowing for rapid prototyping and deployment of new features that address emerging challenges in underground construction and resource extraction.

M&A activity is also on the rise, as larger engineering software conglomerates seek to consolidate their positions. Bentley Systems, a major provider of infrastructure engineering software, has a history of acquiring niche simulation technology firms to broaden its portfolio. While no major acquisitions specific to rock mechanics simulation have been publicly announced in 2025, industry analysts anticipate that Bentley and similar firms will continue to target innovative startups and established players to integrate rock mechanics capabilities into their broader digital twin and infrastructure modeling platforms.

Additionally, partnerships between software developers and equipment manufacturers are becoming more common. These alliances aim to create end-to-end solutions that link real-time sensor data from drilling or tunneling equipment directly with simulation software, enabling predictive maintenance and risk assessment. Such integration is expected to accelerate as the industry moves toward more automated and data-driven project delivery.

Looking ahead, the outlook for strategic partnerships and M&A in rock mechanics simulation software remains robust. As digital transformation accelerates across mining and civil engineering, companies that can offer comprehensive, interoperable solutions through collaboration or acquisition are likely to gain a competitive edge.

Future Outlook: Opportunities and Challenges Ahead

The future of rock mechanics simulation software development is poised for significant transformation as the mining, civil engineering, and energy sectors increasingly demand more accurate, scalable, and user-friendly modeling tools. In 2025 and the coming years, several key opportunities and challenges are expected to shape the trajectory of this specialized software domain.

One of the most prominent opportunities lies in the integration of artificial intelligence (AI) and machine learning (ML) algorithms into simulation platforms. These technologies promise to enhance predictive capabilities, automate parameter calibration, and enable real-time data assimilation from field sensors. Leading software providers such as Rocscience and Itasca Consulting Group are actively investing in AI-driven modules to streamline complex geomechanical analyses and reduce manual intervention. The adoption of cloud computing is another major trend, allowing for high-performance simulations and collaborative workflows across geographically dispersed teams. Companies like Rocscience have already begun offering cloud-based licensing and computation, signaling a shift toward more flexible and scalable deployment models.

Interoperability and open data standards are also gaining traction, as project stakeholders increasingly require seamless integration between rock mechanics software and other engineering tools, such as Building Information Modeling (BIM) and Geographic Information Systems (GIS). Industry organizations, including the International Society for Soil Mechanics and Geotechnical Engineering (ISSMGE), are advocating for standardized data formats to facilitate cross-disciplinary collaboration and data exchange.

However, several challenges persist. The complexity of simulating heterogeneous and anisotropic rock masses, especially under dynamic loading or coupled hydro-mechanical-thermal conditions, continues to test the limits of current numerical methods. While advanced finite element and discrete element codes are evolving, the computational demands remain high, necessitating ongoing investment in algorithm optimization and hardware acceleration. Furthermore, the shortage of skilled professionals proficient in both geomechanics and advanced simulation software presents a bottleneck for widespread adoption, particularly in emerging markets.

Looking ahead, the sector is expected to see increased collaboration between software developers, academic researchers, and end-users to co-develop next-generation tools tailored to evolving industry needs. The push for digital twins and real-time monitoring in underground construction and resource extraction will further drive innovation. As regulatory requirements for safety and environmental stewardship tighten, robust and transparent simulation capabilities will become indispensable, positioning rock mechanics software as a cornerstone of future geotechnical engineering practice.