XFP Optical Transceiver Module Manufacturing in 2025: Navigating Innovation, Market Expansion, and Competitive Dynamics. Discover how next-gen technologies and global demand are reshaping this critical sector.

- Executive Summary: Key Trends and 2025 Outlook

- Market Size, Share, and 2025–2030 Growth Forecasts

- Technological Innovations in XFP Module Design and Manufacturing

- Key Players and Competitive Landscape (Citing Finisar, Cisco, Lumentum, etc.)

- Supply Chain Dynamics and Regional Production Hubs

- Application Segments: Data Centers, Telecom, and Beyond

- Regulatory Standards and Industry Compliance (Referencing ieee.org)

- Sustainability and Environmental Considerations in Manufacturing

- Challenges, Risks, and Barriers to Entry

- Future Outlook: Disruptive Trends and Strategic Opportunities Through 2030

- Sources & References

Executive Summary: Key Trends and 2025 Outlook

The XFP (10 Gigabit Small Form Factor Pluggable) optical transceiver module manufacturing sector is experiencing a period of transition in 2025, shaped by evolving data center architectures, telecom network upgrades, and the ongoing shift toward higher-speed optical connectivity. While XFP modules—introduced in the early 2000s—are increasingly being supplemented by newer form factors such as SFP+ and QSFP, they remain relevant in legacy systems and specific telecom applications, particularly where 10G Ethernet and SONET/SDH interfaces are still in demand.

Key manufacturers, including FS, NeoPhotonics (now part of Lumentum), Lumentum, Coherent Corp. (formerly II-VI Incorporated), and Advanced Optoelectronic Technology Inc., continue to support XFP production, often focusing on specialized variants such as DWDM, long-reach, and tunable modules. These companies leverage mature manufacturing processes and established supply chains, ensuring cost-effective production for customers maintaining 10G infrastructure.

In 2025, the XFP market is characterized by several key trends:

- Stable Demand in Niche Applications: While hyperscale data centers are rapidly adopting higher-speed modules, XFPs remain essential in metro networks, enterprise backbones, and telecom systems where equipment lifecycles are long and backward compatibility is critical.

- Manufacturing Optimization: Leading manufacturers are streamlining XFP production lines, often consolidating facilities or automating assembly to maintain profitability as volumes decline. Companies like Lumentum and FS are known for their efficient, high-quality module assembly and rigorous testing protocols.

- Component Sourcing and Supply Chain Resilience: The global semiconductor and optoelectronic component supply chain remains under pressure, but established XFP suppliers have largely secured reliable sources for key components such as lasers, photodiodes, and ICs, often through long-term partnerships with upstream vendors.

- Regulatory and Environmental Compliance: Manufacturers are increasingly focused on RoHS, REACH, and other environmental standards, as well as ensuring interoperability with a wide range of legacy and new network equipment.

Looking ahead, the XFP manufacturing sector is expected to see a gradual decline in overall volume through the late 2020s, but with continued pockets of demand in telecom and industrial markets. Manufacturers with flexible production capabilities and strong customer support—such as FS and Lumentum—are well positioned to serve these segments. The sector’s outlook is one of managed contraction, with a focus on reliability, cost control, and support for legacy infrastructure.

Market Size, Share, and 2025–2030 Growth Forecasts

The global market for XFP (10 Gigabit Small Form Factor Pluggable) optical transceiver modules is expected to experience moderate but steady growth from 2025 through 2030, driven by ongoing demand in data center, telecom, and enterprise networking applications. XFP modules, while facing competition from newer form factors such as SFP+ and QSFP, remain relevant due to their established deployment in legacy 10G networks and certain specialized applications.

As of 2025, the XFP transceiver market is characterized by a mix of established manufacturers and a growing presence of Asian suppliers. Major players such as FS, NeoPhotonics (now part of Lumentum), Lumentum, Coherent Corp. (formerly II-VI Incorporated), and Applied Optoelectronics, Inc. continue to supply XFP modules to global customers. These companies leverage advanced manufacturing processes, automated assembly lines, and rigorous quality control to maintain competitiveness and meet international standards.

The market size for XFP modules in 2025 is estimated to be in the low hundreds of millions of US dollars, with Asia-Pacific accounting for the largest share due to the concentration of manufacturing facilities and the region’s ongoing investments in telecom infrastructure. China, in particular, is home to several high-volume manufacturers such as Huawei and ZTE, which not only use XFP modules in their own equipment but also supply to global OEMs.

Despite the gradual shift toward higher-speed modules (25G, 40G, 100G, and beyond), XFP modules are expected to maintain a stable demand in network upgrades, maintenance, and cost-sensitive deployments. The transition to next-generation networks is not uniform across all regions, and many operators continue to rely on 10G infrastructure, especially in metro and access networks. This trend supports a forecasted compound annual growth rate (CAGR) in the low single digits for XFP module manufacturing through 2030.

Looking ahead, the XFP market will likely see incremental innovation, such as improved power efficiency and extended temperature ranges, to address niche requirements. However, the overall share of XFP modules in the broader optical transceiver market is expected to decline as newer, denser, and more energy-efficient form factors gain traction. Nevertheless, established manufacturers with strong quality assurance and global distribution networks are well-positioned to capture ongoing replacement and upgrade cycles in legacy networks.

Technological Innovations in XFP Module Design and Manufacturing

The XFP (10 Gigabit Small Form Factor Pluggable) optical transceiver module sector is experiencing a wave of technological innovation in design and manufacturing as the industry adapts to evolving data center, telecom, and enterprise network demands in 2025 and beyond. Key manufacturers are focusing on miniaturization, power efficiency, and integration of advanced digital diagnostics, while also responding to the need for higher data rates and improved interoperability.

One of the most significant trends is the adoption of more advanced semiconductor processes for the development of XFP module integrated circuits. Leading companies such as Coherent Corp. (formerly II-VI Incorporated) and Lumentum Holdings Inc. are leveraging silicon photonics and indium phosphide (InP) technologies to enhance optical performance and reduce power consumption. These innovations enable XFP modules to support longer reach and higher reliability, which are critical for metro and long-haul applications.

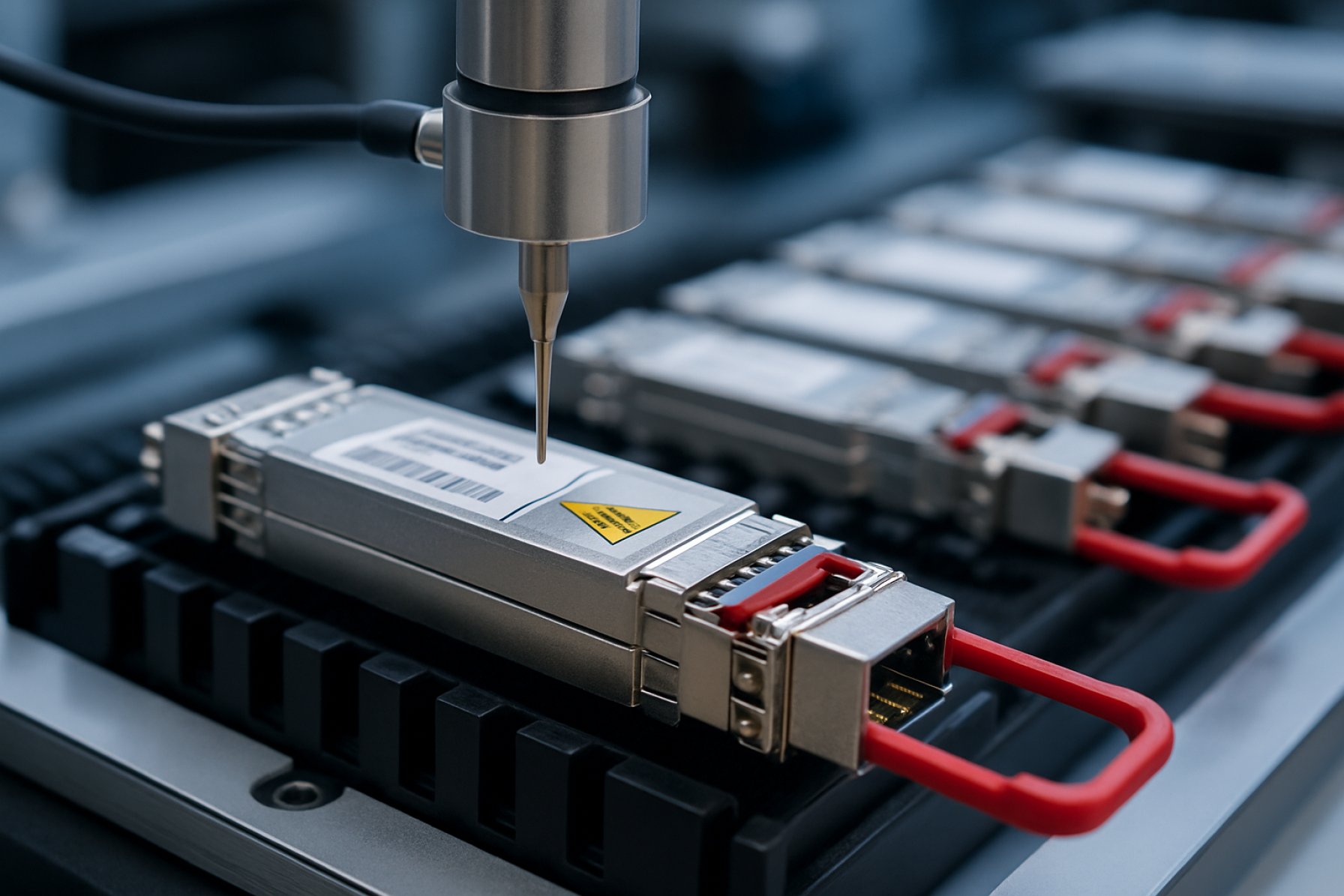

Manufacturing processes are also being refined to improve yield and consistency. Automation and precision robotics are increasingly used in the assembly and testing of XFP modules, reducing human error and ensuring tighter tolerances. Companies like FS.COM and NeoPhotonics Corporation (now part of Lumentum) have invested in advanced manufacturing lines that integrate real-time quality monitoring and automated optical alignment, which are essential for maintaining high production volumes and meeting stringent industry standards.

Another area of innovation is the integration of enhanced digital diagnostic monitoring (DDM) features. Modern XFP modules now provide real-time feedback on parameters such as temperature, voltage, and optical power, allowing network operators to proactively manage performance and reliability. This is particularly important as networks become more complex and require greater visibility for predictive maintenance.

Looking ahead, the XFP module market is expected to see further convergence with emerging standards such as 25G and 100G, as well as increased compatibility with wavelength-division multiplexing (WDM) systems. Manufacturers are developing XFP modules that can be flexibly deployed in both legacy and next-generation networks, ensuring investment protection for operators. Companies like Oclaro, Inc. (now part of Lumentum) and Broadcom Inc. are at the forefront of these developments, driving interoperability and multi-vendor support.

In summary, the XFP optical transceiver module manufacturing landscape in 2025 is characterized by rapid technological advancement, with a focus on miniaturization, efficiency, and intelligent diagnostics. These innovations are positioning XFP modules to remain relevant in a market increasingly defined by higher speeds, greater integration, and the need for robust, scalable optical connectivity.

Key Players and Competitive Landscape (Citing Finisar, Cisco, Lumentum, etc.)

The XFP optical transceiver module market in 2025 is characterized by a competitive landscape dominated by a handful of global manufacturers with extensive experience in optical networking components. Among the most prominent players is Finisar, now part of II-VI Incorporated, which has long been recognized for its innovation in high-speed optical transceivers, including XFP modules. Finisar’s manufacturing capabilities and broad product portfolio have enabled it to maintain a significant share in the global market, supplying to major telecom and data center operators.

Another key player is Cisco Systems, Inc., which not only integrates XFP modules into its networking equipment but also develops and manufactures its own optical transceivers. Cisco’s vertical integration strategy ensures tight quality control and compatibility across its product lines, making it a preferred supplier for enterprise and carrier-grade applications. The company’s ongoing investments in optical networking technologies are expected to sustain its competitive position through 2025 and beyond.

Lumentum Holdings Inc. is also a major force in the XFP module sector, leveraging its expertise in photonic components and subsystems. Lumentum’s focus on high-performance and energy-efficient optical modules aligns with the growing demand for scalable and cost-effective solutions in data centers and metropolitan networks. The company’s global manufacturing footprint and R&D investments position it well to address evolving customer requirements in the coming years.

Other notable manufacturers include NeoPhotonics Corporation, which specializes in advanced high-speed optical modules, and Applied Optoelectronics, Inc., known for its vertically integrated production of optical transceivers for data center and telecom markets. Both companies have expanded their XFP offerings to support higher data rates and longer reach, responding to the ongoing transition to 100G and beyond in optical networks.

The competitive landscape is further shaped by the presence of established Asian manufacturers such as OECE and Accelink Technologies Co., Ltd., which have increased their global market share through cost-competitive manufacturing and rapid product development cycles. These companies are expected to play a growing role in the XFP market, particularly as demand rises in emerging markets and as global supply chains continue to evolve.

Looking ahead, the XFP optical transceiver module sector is likely to see continued consolidation among leading players, with innovation focused on higher speeds, lower power consumption, and enhanced integration. Strategic partnerships and investments in next-generation manufacturing technologies will be critical for maintaining competitiveness in this dynamic market.

Supply Chain Dynamics and Regional Production Hubs

The supply chain for XFP optical transceiver module manufacturing in 2025 is characterized by a complex interplay of global and regional actors, with Asia—particularly China, Taiwan, and increasingly Southeast Asia—serving as the primary production hubs. The XFP (10 Gigabit Small Form Factor Pluggable) module, a critical component in high-speed optical networks, relies on a tightly integrated supply chain encompassing semiconductor fabrication, optical component assembly, and final module integration.

China remains the dominant force in XFP module manufacturing, with companies such as FS and Huawei Technologies Co., Ltd. leveraging extensive domestic supply networks and advanced manufacturing capabilities. These firms benefit from proximity to suppliers of key components such as laser diodes, photodetectors, and high-speed integrated circuits. The presence of major contract manufacturers and component suppliers in the Pearl River Delta and Yangtze River Delta regions further consolidates China’s leadership in this sector.

Taiwan continues to play a pivotal role, particularly in the fabrication of optoelectronic chips and precision packaging. Companies like Acer Inc. and Hon Hai Precision Industry Co., Ltd. (Foxconn) contribute to the ecosystem through advanced electronics manufacturing services and supply chain management expertise. Taiwan’s robust semiconductor industry, anchored by foundries and packaging houses, ensures a steady supply of high-quality components for XFP module assembly.

In response to ongoing geopolitical tensions and supply chain disruptions, there is a discernible trend toward diversification. Southeast Asian countries, notably Vietnam and Malaysia, are attracting investment from both regional and international players seeking to establish alternative manufacturing bases. This shift is supported by government incentives, improving infrastructure, and a growing pool of skilled labor. Companies such as Lumentum Holdings Inc. and NeoPhotonics Corporation (now part of Lumentum) have expanded their presence in these regions to mitigate risk and enhance supply chain resilience.

North America and Europe, while not primary manufacturing centers, remain important for high-value R&D, specialized component production, and final system integration. Firms like Cisco Systems, Inc. and Infinera Corporation maintain strategic partnerships with Asian manufacturers while focusing on innovation and quality assurance.

Looking ahead, the XFP module supply chain is expected to become more regionally diversified, with increased automation and digitalization driving efficiency. However, the core of high-volume manufacturing is likely to remain in Asia, supported by established infrastructure and economies of scale. The ongoing evolution of global trade policies and technology standards will continue to shape the competitive landscape for XFP optical transceiver module production through the next several years.

Application Segments: Data Centers, Telecom, and Beyond

The application landscape for XFP optical transceiver modules in 2025 is shaped by the evolving demands of data centers, telecommunications networks, and emerging sectors such as industrial automation and high-performance computing. XFP modules, which support 10 Gigabit Ethernet and other high-speed protocols, continue to play a critical role in network infrastructure, even as newer form factors like SFP+ and QSFP gain traction.

In data centers, XFP modules are primarily deployed for 10G backbone connections, aggregation layers, and legacy system upgrades. The ongoing expansion of cloud services and hyperscale data centers in North America, Europe, and Asia-Pacific sustains demand for reliable 10G optical links. Major manufacturers such as FS and NeoPhotonics (now part of Lumentum) continue to supply XFP modules tailored for high-density, low-latency environments. While the industry is gradually transitioning to higher-speed modules (25G, 40G, 100G), the installed base of 10G infrastructure ensures a steady requirement for XFP transceivers for maintenance, expansion, and cost-sensitive deployments.

Telecommunications remains a significant segment for XFP module manufacturing. Carriers and network operators rely on XFP modules for metro, access, and long-haul optical transport networks, particularly where 10G DWDM (Dense Wavelength Division Multiplexing) is prevalent. Companies like Coherent Corp. (formerly II-VI Incorporated) and Lumentum are recognized for their advanced XFP solutions supporting extended reach and tunable wavelengths, which are essential for flexible, scalable telecom networks. The ongoing rollout of 5G and fiber-to-the-home (FTTH) projects in regions such as East Asia and Europe is expected to sustain demand for XFP modules in aggregation and backhaul applications through at least 2027.

Beyond traditional data center and telecom uses, XFP modules are increasingly adopted in specialized applications. Industrial automation, medical imaging, and scientific research facilities require robust, standardized optical links for data transmission in harsh or mission-critical environments. Manufacturers such as SENKO Advanced Components and Advanced Optics offer XFP modules with enhanced temperature tolerance and custom features for these sectors.

Looking ahead, while the overall share of XFP modules in new deployments may decline as higher-speed and more compact form factors proliferate, the need for backward compatibility, cost-effective upgrades, and support for legacy systems will keep XFP manufacturing relevant. Leading suppliers are expected to focus on specialized variants, extended lifecycles, and value-added services to address the diverse requirements of data centers, telecom, and emerging verticals through the next several years.

Regulatory Standards and Industry Compliance (Referencing ieee.org)

The manufacturing of XFP (10 Gigabit Small Form Factor Pluggable) optical transceiver modules in 2025 is governed by a robust framework of regulatory standards and industry compliance requirements, ensuring interoperability, safety, and performance across global networks. The foundational technical specifications for XFP modules are defined by the IEEE, particularly through the IEEE 802.3ae standard, which outlines the requirements for 10 Gigabit Ethernet (10GbE) optical interfaces. This standard prescribes parameters such as electrical interface characteristics, optical power budgets, and signal integrity, which manufacturers must adhere to in order to guarantee compatibility and reliable operation in data center and telecom environments.

In addition to IEEE standards, the Storage Networking Industry Association (SNIA) and the Multi-Source Agreement (MSA) Form Factors consortium play significant roles in defining the mechanical dimensions, electrical pinouts, and management interfaces for XFP modules. The XFP MSA, in particular, ensures that modules from different manufacturers are physically and electrically interchangeable, which is critical for network operators seeking vendor flexibility and supply chain resilience.

Compliance with international safety and electromagnetic compatibility (EMC) regulations is also mandatory. Manufacturers must certify their XFP modules according to standards such as IEC 60825 for laser safety and IEC 60950/62368 for product safety, as enforced by regulatory bodies in major markets. This is especially relevant for companies like Cisco Systems, Inc., FS.COM Inc., and Lumentum Holdings Inc., all of which maintain extensive compliance documentation and testing protocols to meet global requirements.

In 2025, the industry is also responding to evolving requirements around environmental compliance, such as the European Union’s RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) directives. Leading manufacturers are increasingly transparent about their supply chains and material declarations, aligning with sustainability goals and customer expectations.

Looking ahead, the regulatory landscape for XFP optical transceiver modules is expected to evolve in tandem with advances in optical networking speeds and integration. The IEEE is actively developing new standards for higher-speed interfaces and improved energy efficiency, which will likely influence future XFP module designs and compliance requirements. As data center and telecom operators demand greater performance and reliability, adherence to these rigorous standards will remain a cornerstone of XFP module manufacturing and market acceptance.

Sustainability and Environmental Considerations in Manufacturing

Sustainability and environmental considerations are increasingly shaping the manufacturing landscape for XFP optical transceiver modules in 2025 and are expected to remain a central focus in the coming years. As global data traffic surges and network infrastructure expands, manufacturers are under mounting pressure to minimize the environmental footprint of their operations and products.

Key industry players such as Cisco Systems, Inc., Lumentum Holdings Inc., and Coherent Corp. (formerly II-VI Incorporated) have publicly committed to sustainability initiatives, including reducing greenhouse gas emissions, increasing energy efficiency, and adopting responsible sourcing of raw materials. For example, Cisco Systems, Inc. has set ambitious goals to reach net zero greenhouse gas emissions across its value chain by 2040, which directly impacts its optical transceiver manufacturing processes. Similarly, Lumentum Holdings Inc. emphasizes eco-design and lifecycle assessments to reduce the environmental impact of its photonic components, including XFP modules.

Manufacturers are increasingly adopting closed-loop manufacturing systems, recycling precious metals and rare earth elements used in XFP modules, and implementing water and energy conservation measures in their facilities. The use of lead-free soldering and compliance with the European Union’s Restriction of Hazardous Substances (RoHS) directive are now standard across major production lines. Coherent Corp. highlights its adherence to RoHS and Waste Electrical and Electronic Equipment (WEEE) directives, ensuring that hazardous substances are minimized and end-of-life recycling is facilitated.

Supply chain transparency is another area of focus, with companies working to ensure that suppliers adhere to environmental and ethical standards. This includes audits, supplier training, and the integration of sustainability metrics into procurement decisions. The trend is reinforced by growing customer demand for environmentally responsible products and by regulatory pressures in key markets such as the European Union, North America, and parts of Asia.

Looking ahead, the XFP optical transceiver module sector is expected to see further innovation in eco-friendly materials, energy-efficient manufacturing processes, and product designs that facilitate disassembly and recycling. Industry leaders are also exploring the use of renewable energy sources for manufacturing operations and investing in carbon offset programs. As sustainability becomes a competitive differentiator, companies that proactively address environmental considerations are likely to strengthen their market position and meet the evolving expectations of both regulators and customers.

Challenges, Risks, and Barriers to Entry

The manufacturing of XFP optical transceiver modules in 2025 faces a complex landscape of challenges, risks, and barriers to entry, shaped by technological, economic, and regulatory factors. One of the primary challenges is the rapid pace of technological advancement in optical networking. As data center and telecom operators demand higher speeds and lower power consumption, manufacturers must continually invest in R&D to keep pace with evolving standards and customer requirements. This creates a significant barrier for new entrants, as established players like Cisco Systems, Inc., Lumentum Holdings Inc., and Coherent Corp. (formerly II-VI Incorporated) have already developed extensive expertise, intellectual property portfolios, and economies of scale.

Supply chain complexity is another major risk. XFP modules require high-precision components such as lasers, photodiodes, and integrated circuits, many of which are sourced from specialized suppliers. Disruptions in the global supply chain—whether due to geopolitical tensions, trade restrictions, or shortages of critical materials—can delay production and increase costs. The semiconductor shortage that began in 2020 continues to have ripple effects, with lead times for certain components remaining elevated into 2025, as reported by leading manufacturers and suppliers in the sector.

Quality and reliability standards present further barriers. XFP modules must comply with stringent industry standards (such as those set by the Multi-Source Agreement, MSA) and undergo rigorous testing to ensure interoperability and long-term performance in mission-critical networks. Achieving and maintaining these standards requires significant investment in advanced manufacturing and testing equipment, as well as robust quality assurance processes. Companies like FS.COM Inc. and NeoPhotonics Corporation (now part of Lumentum) emphasize their compliance with international standards and reliability testing as key differentiators.

Intellectual property (IP) protection is a persistent risk, particularly for new entrants. The XFP module market is characterized by a dense web of patents covering optical design, packaging, and signal processing. Navigating this landscape without infringing on existing IP is challenging and can expose manufacturers to costly litigation or licensing fees.

Finally, the capital intensity of XFP module manufacturing remains a significant barrier. Establishing a production line with the necessary cleanroom facilities, precision assembly, and automated testing systems requires substantial upfront investment. This favors established companies with deep financial resources and global customer bases, such as Broadcom Inc. and Hon Hai Precision Industry Co., Ltd. (Foxconn), making it difficult for smaller firms or startups to compete at scale in the near future.

Future Outlook: Disruptive Trends and Strategic Opportunities Through 2030

The XFP (10 Gigabit Small Form Factor Pluggable) optical transceiver module market is poised for significant transformation through 2030, driven by evolving data center architectures, the proliferation of 5G networks, and the ongoing shift toward cloud computing. As of 2025, the demand for high-speed, energy-efficient, and compact optical transceivers remains robust, with XFP modules continuing to serve as a critical component in legacy 10G networks and certain specialized applications.

One of the most disruptive trends is the gradual migration from 10G to higher-speed modules such as SFP+ (10G), QSFP+ (40G), and QSFP28 (100G), which offer greater bandwidth and port density. However, XFP modules retain relevance in telecom backbone upgrades, metro networks, and industrial environments where backward compatibility and long-reach transmission are essential. Leading manufacturers such as FS, NeoPhotonics, and Lumentum continue to support XFP production, often focusing on specialized variants like DWDM and tunable XFPs for niche markets.

Strategic opportunities are emerging in the integration of advanced photonic components and the adoption of automated manufacturing processes. Companies are investing in silicon photonics and co-packaged optics to enhance module performance and reduce power consumption, aligning with sustainability goals and the growing emphasis on green data centers. For instance, Lumentum and NeoPhotonics are actively developing next-generation optical components that could be adapted for future XFP designs, particularly for applications requiring extended reach or specialized wavelength support.

Geographically, Asia-Pacific remains a manufacturing hub, with China-based suppliers such as FS and Huawei leveraging scale and supply chain efficiencies. These companies are well-positioned to respond to both domestic and international demand, especially as network operators in emerging markets continue to deploy 10G infrastructure.

Looking ahead, the XFP module segment is expected to experience a gradual decline in volume as higher-speed transceivers become mainstream. Nevertheless, opportunities persist in legacy network maintenance, industrial automation, and specialized telecom applications. Manufacturers that can offer cost-effective, high-reliability XFP solutions—while also investing in disruptive technologies and flexible production capabilities—will be best positioned to capture value through 2030.

Sources & References

- NeoPhotonics

- Lumentum

- Advanced Optoelectronic Technology Inc.

- Huawei

- ZTE

- Oclaro, Inc.

- Broadcom Inc.

- Cisco Systems, Inc.

- Accelink Technologies Co., Ltd.

- Hon Hai Precision Industry Co., Ltd. (Foxconn)

- Infinera Corporation

- SENKO Advanced Components

- IEEE

- Storage Networking Industry Association (SNIA)

- Coherent Corp.