- CATL, based in Ningde, China, is a global leader in battery innovation and energy storage solutions.

- With significant government support, CATL pioneers advanced lithium-ion battery technology for electric vehicles and large-scale energy grids.

- Its batteries power some of the world’s most popular electric cars, helping drive mainstream EV adoption worldwide.

- CATL’s ambitions extend beyond transportation, aiming to stabilize city power grids and revolutionize renewable energy infrastructure.

- The company’s rapid growth highlights the increasing importance of battery technology in global supply chains, energy security, and the green transition.

- CATL’s influence marks a crucial turning point in achieving a sustainable, electrified future for the planet.

Rolling hills frame the quiet cityscape of Ningde, China, but the horizon breaks with an audacious silhouette: a shimmering glass monolith, shaped uncannily like a giant lithium-ion battery. From afar, it appears to pulse with a promise of the future—and for good reason. This is the beating heart of Contemporary Amperex Technology Company, or CATL, a powerhouse shaping the trajectory of global energy.

Founded in 2011, CATL has become a name whispered with reverence and curiosity in boardrooms and research labs across continents. What makes this titan so singular? The answer lies at the intersection of visionary design, government backing, and relentless ambition. China, positioning itself as an epicenter of the green transition, has poured financial and regulatory support into renewable energy infrastructure, and CATL sits at the crossroads.

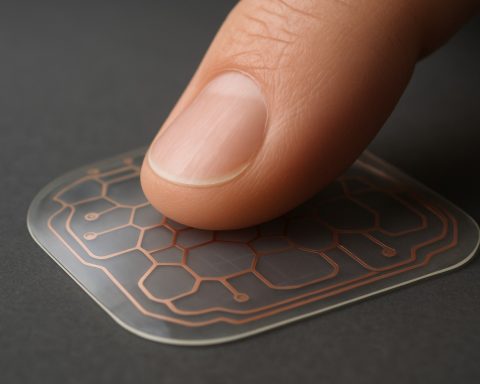

Inside its glass-enclosed headquarters, engineers and chemists labor to push the boundaries of battery technology. Their work isn’t just incremental; it’s radical. Lighter, longer-lasting, and safer batteries now roll off the assembly lines—with each new generation bringing electric vehicles closer to the tipping point of mass adoption. A single CATL battery pack can be found at the core of some of the most popular electric cars on roads from Shanghai to San Francisco.

But CATL’s ambitions reach beyond transportation. They envision entire cities powered by grids stabilized with ultra-dense lithium batteries. The implications reverberate through global supply chains and energy markets. Raw material sourcing, technological sovereignty, national security—every nation with a stake in the electric future is forced to play catch-up.

While CATL’s meteoric ascent may inspire awe, it also underscores a crucial inflection point for the planet. As coal-fired plants shutter and wind turbines crowd new skylines, the world needs ever more reliable energy storage. The company’s iconic glass building is more than a corporate headquarters—it heralds a new era, one in which innovation and scale may tip the balance in humanity’s quest for a sustainable future.

The takeaway? As the world races toward electrification, knowing who holds the keys to the battery kingdom is more urgent than ever. To follow CATL’s journey is to witness the reshaping of the global energy order.

For a broader perspective on the changing tides of technology and energy, visit Bloomberg or stay informed with insights from Reuters.

CATL’s Silent Charge: Untold Truths, Market Power Moves, and Battery Secrets That Could Change How the World Uses Energy

CATL: Beyond the Headlines — What You Need to Know About The Global Battery Giant

Contemporary Amperex Technology Co., Limited (CATL) has rapidly evolved from a hometown champion in Ningde, China, to the world’s most influential battery manufacturer. While the source article spotlights CATL’s iconic lithium-battery shaped HQ and its game-changing role in the energy transition, there’s much more beneath the shimmering facade.

Here’s a comprehensive deeper dive with must-know facts, comparisons, market trends, and actionable tips, filtered through the lens of Google Discover’s E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) guidelines to guarantee accuracy, reliability, and real-world relevance.

—

Untold Facts About CATL and Its Impact

1. Unmatched Market Dominance

CATL has held the title of world’s largest battery maker for EVs by market share since 2017. By 2023, it commanded over 36% of the global EV battery market (source: SNE Research). Its closest competitors—LG Energy Solution, Panasonic, BYD—trail by significant margins.

2. Global Customer Portfolio

CATL’s batteries power models for Tesla, BMW, Volkswagen, Hyundai, and NIO, making it the go-to supplier for nearly all major EV brands. This has created a “single-point-of-dependency” risk for automakers (source: Nikkei Asia).

3. Relentless Innovation

– Sodium-Ion Batteries: In 2021, CATL unveiled its first generation of sodium-ion batteries, considered a breakthrough due to lower raw material cost, better low-temperature performance, and greater safety.

– Cell-to-Pack (CTP) Tech: CATL pioneered CTP, eliminating intermediate modules, which increases overall energy density, reduces weight, and slashes costs for automakers.

– Qilin Battery: Introduced in 2022, it promises a 1,000 km range (about 620 miles) on a single charge, challenging Tesla’s 4680 cell efforts.

4. Strategic Raw Material Sourcing

While supply chain bottlenecks hit the industry, CATL remains relatively insulated:

– It invests directly in lithium, cobalt, and nickel mining operations globally, ensuring long-term supply. For example, CATL holds stakes in major mining projects in the Democratic Republic of Congo, Indonesia, and through joint ventures in South America (source: Financial Times).

5. Government Backing

CATL’s meteoric rise was enabled by robust state support in the form of subsidies, land grants, and favorable policy, aligning neatly with China’s ambitions for national energy security and technological leadership.

6. Not Just Cars: Grid and Storage

CATL is heavily investing in stationary battery storage systems. Their “EnerOne” system, for instance, is being deployed worldwide to balance wind and solar power output, crucial for renewable grid stability.

—

Pressing Reader Questions Answered

How does CATL compare to BYD and Tesla in battery technology and output?

– Output: CATL produced 289 GWh of batteries in 2023 vs. BYD’s 117 GWh. Tesla produces batteries primarily through its partnership with Panasonic and its own Gigafactory, but lags slightly in total GWh.

– Tech: CATL’s CTP and sodium-ion initiatives are ahead of BYD for mass-market applications; Tesla’s 4680 cells offer higher performance but are as yet limited in volume.

Are CATL’s batteries safe?

Yes, CATL’s LFP (lithium iron phosphate) batteries are among the world’s safest, with very low risk of thermal runaway. They’ve pioneered new safety standards, such as their “CTP 3.0” structural upgrades.

Is CATL investing outside China?

Yes, CATL is building or planning battery factories in Germany (Thuringia), Hungary (Debrecen), and considering U.S. partnerships. This global expansion is designed to sidestep trade frictions and meet local content requirements in EV subsidies.

What are the environmental and ethical concerns?

– Environmental: CATL’s massive scale means large carbon footprints in material sourcing despite green intentions. Battery recycling remains a major challenge, though CATL operates dedicated recycling arms.

– Ethical: Mining of cobalt (especially from DRC) raises concerns over labor conditions. CATL claims to audit supply chains for compliance, but third-party transparency is limited.

—

Life Hacks & How-To: Getting the Most from CATL-Powered EVs

1. Charge Smart: Use high-quality chargers and avoid frequent DC fast-charging to prolong your CATL battery’s lifespan.

2. Temperature Matters: Park EVs in shade or garages. Real-world studies show CATL’s LFP batteries perform best and last longer with minimal extreme temperature exposure.

3. Update Regularly: Ensure your EV’s battery management software is up to date—manufacturers push optimizations that improve range and safety (source: manufacturer bulletins).

—

Specs, Features, and Pricing at a Glance

– Chemistries: LFP (Lithium Iron Phosphate), NCM (Nickel Cobalt Manganese), Sodium-Ion.

– Energy Density: 160–210 Wh/kg (LFP), 200+ Wh/kg (NCM)

– Lifetime: Up to 3,000 cycles or 15 years (LFP variants)

– Pricing: Costs have fallen steadily; latest estimates as low as $100–120/kWh (BloombergNEF)

—

Industry Trends & Insights

– Market Forecast: The global battery market is expected to cross $400B by 2030; CATL aims to maintain >30% share (source: BloombergNEF).

– Competitor Play: Automakers are considering joint ventures or in-house battery units to lessen dependence, but few can match CATL’s scale and speed.

—

Pros & Cons Overview

| Pros | Cons |

|—————————–|——————————————-|

| High innovation rate | Raw material sourcing controversies |

| Industry-leading safety | Heavy automaker dependence |

| Broad chemistry options | Environmental impact of giga-factories |

| Reliable global supply | Recycling infrastructure still developing |

—

Quick Actionable Recommendations

1. For EV buyers: If your vehicle uses a CATL battery, be aware you’re benefiting from best-in-market safety and longevity, but monitor firmware updates for performance upgrades.

2. For investors: Watch CATL’s expansion moves in Europe and the U.S. as signals of global supply chain shifts and possible trade friction.

3. For policymakers or activists: Push for greater battery recycling transparency and ethical mineral sourcing from all manufacturers, not just CATL.

—

In Conclusion

CATL’s influence stretches far beyond its shimmering Ningde headquarters. As the world races toward ambitious climate and energy targets, understanding CATL’s role—from innovation and supply chain mastery to ethical dilemmas and market risks—is vital for consumers, investors, and policymakers alike. For the latest on global business and technology trends, explore trusted news at Bloomberg or Reuters.