En banbrytande förändring i batteriadhäsiv

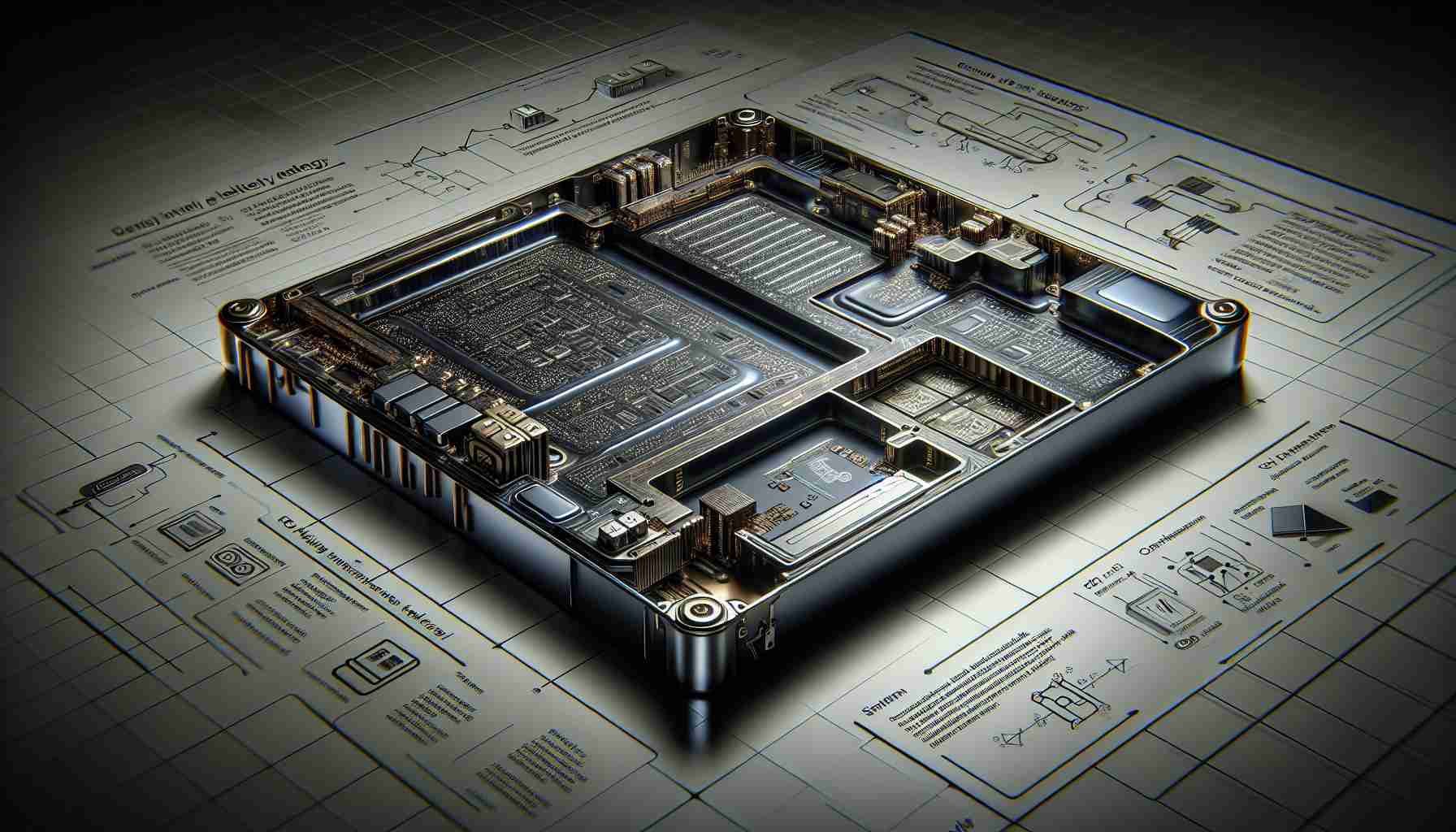

Apple är inställt på att revolutionera iPhone-användarupplevelsen med en banbrytande förändring i batteriadhäsivtekniken för den kommande iPhone 17-serien. Användare kommer inte längre behöva förlita sig på värmeblåsar och kraft för att ta bort ett batteri som behöver bytas ut. Den nya elektriskt inducerade klisteravrivningstekniken kommer att göra batteriborttagning till en barnlek genom att helt enkelt låta en elektrisk ström gå genom adhesivet. Detta innovativa tillvägagångssätt förenklar inte bara processen för batteribyte utan ökar även användarbekvämligheten som helhet.

Introducerar iPhone 17 Air

Bland de mycket efterlängtade modellerna i iPhone 17-serien finns den ultratunna iPhone 17 Air, som är inriktad på att erbjuda en stilren design och förbättrad användarupplevelse. Genom att använda den nya adhesivtekniken kommer iPhone 17 Air att behålla sin tunna formfaktor utan behov av traditionella batterikomponenter som konsoler och skruvar. Även om de inledande specifikationerna kanske inte är banbrytande, ligger tjusningen med iPhone 17 Air i dess ultratunna design och premiumprissättningsstrategi.

Spännande funktioner och prissättning

Även om det ryktas om att iPhone 17 Air kommer att ha 8 GB RAM och stöd för Apple Intelligence, kan den endast ha en enda kamera på baksidan. Trots detta förväntas enheten komma med ett högre pris jämfört med flaggskeppsmodellen iPhone 17 Pro Max, vilket återspeglar dess premiumpositionering på marknaden. Med införandet av denna innovativa batteriadhäsivteknik sätter Apple återigen nya standarder i smarttelefonbranschen.

Förbättrad batterieffektivitet i iPhone 17-serien

Inför den kommande lanseringen av iPhone 17-serien fokuserar Apple inte bara på design och användarupplevelse utan revolutionerar även batteritekniken för att förbättra effektiviteten och användarbekvämligheten. En nyckelfråga som uppkommer är hur den nya batteriadhäsivtekniken kommer att påverka batteritiden i iPhone 17-modellerna?

Den elektriskt inducerade klisteravrivningstekniken i iPhone 17-serien är utformad för att effektivisera processen för batteribyte, vilket gör det enklare och snabbare för användare. Denna innovation förväntas inte ha en betydande påverkan på batteritiden i sig, eftersom den främst förbättrar underhållens lätthet istället för att ändra batteriets prestanda.

Viktiga utmaningar och kontroverser

Precis som med alla teknologiska framsteg finns det utmaningar och kontroverser som kan uppstå med implementeringen av ny batteriteknik i iPhone 17-serien. En stor oro är kompatibiliteten hos denna adhesivteknik med framtida batteriuppgraderingar eller reparationer. Kommer användare att stå inför begränsningar eller högre kostnader när det gäller service av sin iPhone 17 på grund av detta nya adhesivmetod?

Medan den elektriskt inducerade klisteravrivningstekniken erbjuder bekvämlighet vid batteriborttagning, kan det finnas begränsningar när det gäller tredjepartsreparationer eller DIY-fixar. Användare kan behöva förlita sig mer på auktoriserade serviceleverantörer för batteribyten, vilket potentiellt kan öka reparationskostnaderna och begränsa anpassningsalternativen.

Fördelar och nackdelar

Införandet av den elektriskt inducerade klisteravrivningstekniken i iPhone 17-serien kommer med flera fördelar. Den förenklar processen för borttagning av batteriet, minskar behovet av specialverktyg och expertis, vilket gör den mer användarvänlig. Dessutom bidrar den strömlinjeformade designen utan traditionella batterikomponenter till en mer stilren och kompakt enhet som iPhone 17 Air.

Emellertid kan beroendet av denna nya adhesivteknik ha nackdelar när det gäller reparationsbarhet och kompatibilitet med eftermarknadskomponenter. Användare som föredrar DIY-reparationer eller anpassning kan möta utmaningar på grund av den specialiserade naturen hos den elektriskt inducerade klisteravrivningsmetoden, vilket potentiellt kan begränsa deras alternativ och öka kostnaderna.

För mer information om Apples senaste innovationer och produkter, besök Apples officiella webbplats.