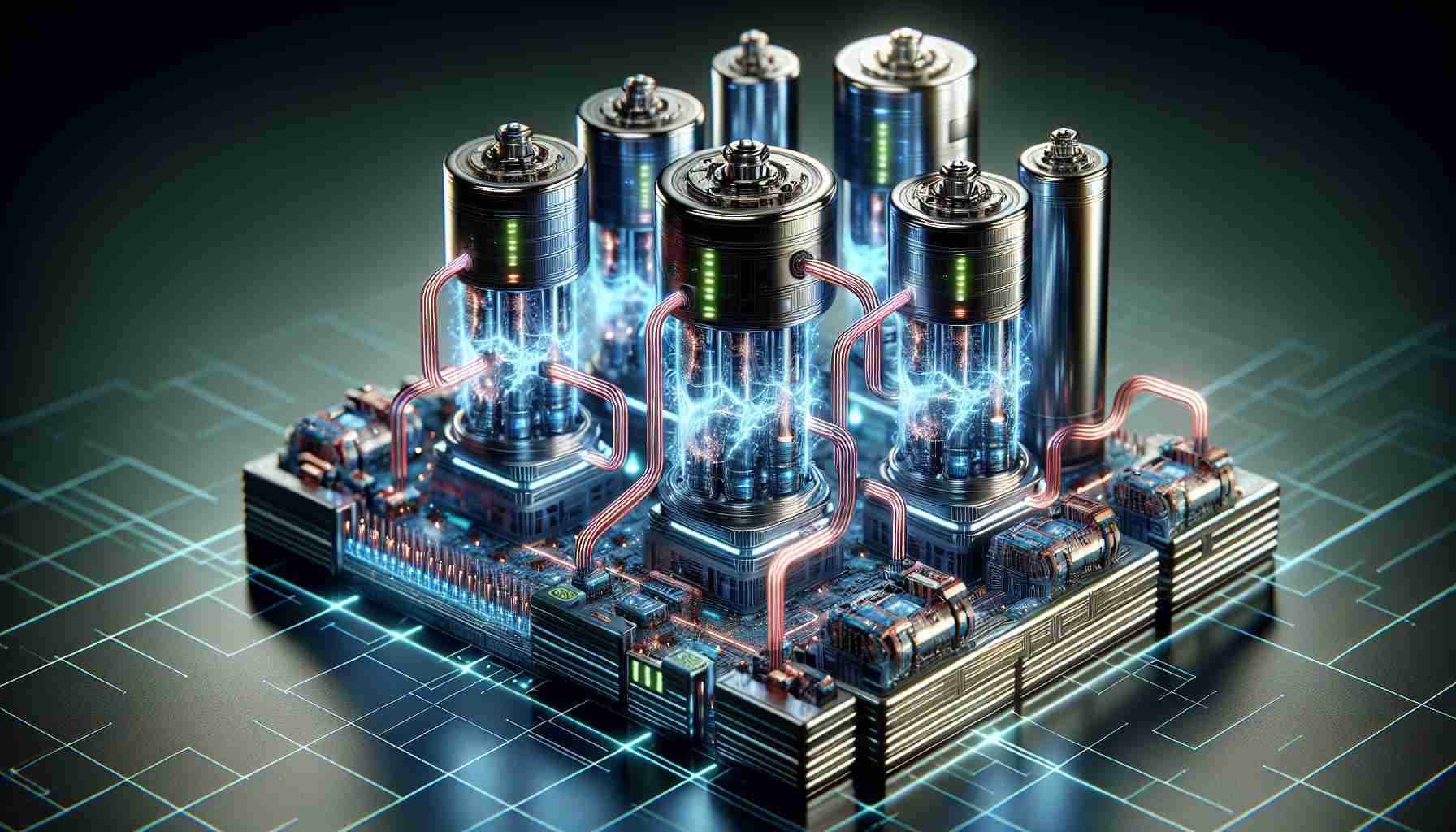

یک رویکرد نوآورانه در فناوری شارژ باتری به وجود آمده است، زیرا محققین پتانسیل جایگزینهای پیشرفته کپاسیتور را بررسی میکنند. در یک حرکت جسورانه، پروژههای پیشرو از کپاسیتورهای الکترولیتی سنتی به سمت کپاسیتورهای فیلم پلی استر با عملکرد بالا منتقل شدهاند.

با بهرهگیری از قدرت یک کپاسیتور فیلم پلی استر با مقدار ۱۰۰۰pF، مهندسان وضعیت موجود را چالش آفرینی میکنند و حدود طراحی شارژر را گسترش میدهند. انتخاب نوآورانه این انتخاب، کارآمدی و دوام بیشتر را ارائه میدهد و از قابلیتهای شارژ باتری مدرن و بهبود یافته اطمینان میبخشد.

محققین نیز به حوزه مکانیسمهای سوئیچینگ وارد شدهاند، تلفیق دکمههای سوئیچ خودقفلکن پوش دوتایی (DPDT) را در سیستمهای شارژر در نظر میگیرند. این گذار جسورانه از دکمه فشار دهید (S1 Start) سوئیچ معمولی، کنجکاوی در صنعت را برانگیخته است.

مزایا و معایب پذیرش فناوری کپاسیتور نوآورانه

مزایای یکپارچه سازی فناوری کپاسیتور پیشرفته در سیستمهای شارژ باتری چندجانبهاند. این مزایا ممکن است شامل زمانهای شارژ سریعتر، بهره وری بیشتر، عمر طولانی تر قسمتهای شارژ و کاهش تأثیر زیستمحیطی از طریق مواد ازدواجانهتر باشد. با این حال، معایب ممکن است از هزینههای اولیه برای پذیرش فناوریهای جدید، مشکلات سازگاری با زیرساخت موجود و نیاز به تخصص ویژه در طراحی و اجرای این راهحلها ناشی شود.

با پیشروی صنعت در مقابله با چالشها و بررسی امکانات ارائه شده توسط فناوریهای کپاسیتور نوین، حائز اهمیت است که با جریانات و پیشرفتهای جدید در این زمینه آشنا باشید.

برای کسب اطلاعات بیشتر درباره آخرین روندها در فناوری شارژ باتری و نوآوریهای کپاسیتور، به Battery Power Online مراجعه کنید. این دامنه نگاهی عمیق به منظر تکاملی منابع قدرت و راهکارهای ذخیرهسازی انرژی ارائه میدهد و منابع ارزشمندی برای حرفهایان و علاقمندان فراهم میکند.