Table of Contents

- Executive Summary: The State of Additive Diamond Deposition in 2025

- Market Sizing and 5-Year Forecasts for Additive Diamond Deposition Devices

- Technology Deep Dive: Recent Advances in Deposition Methods

- Key Players and Industry Alliances (2025 Edition)

- Applications: From Semiconductor to Aerospace—Emerging Use Cases

- Competitive Landscape: Differentiators and IP Trends

- Supply Chain Dynamics and Raw Material Sourcing

- Regulatory Environment and Standards (e.g., IEEE, ASME Updates)

- Challenges, Barriers, and Scalability Concerns

- Future Outlook: Disruptive Potential and Investment Hotspots Through 2030

- Sources & References

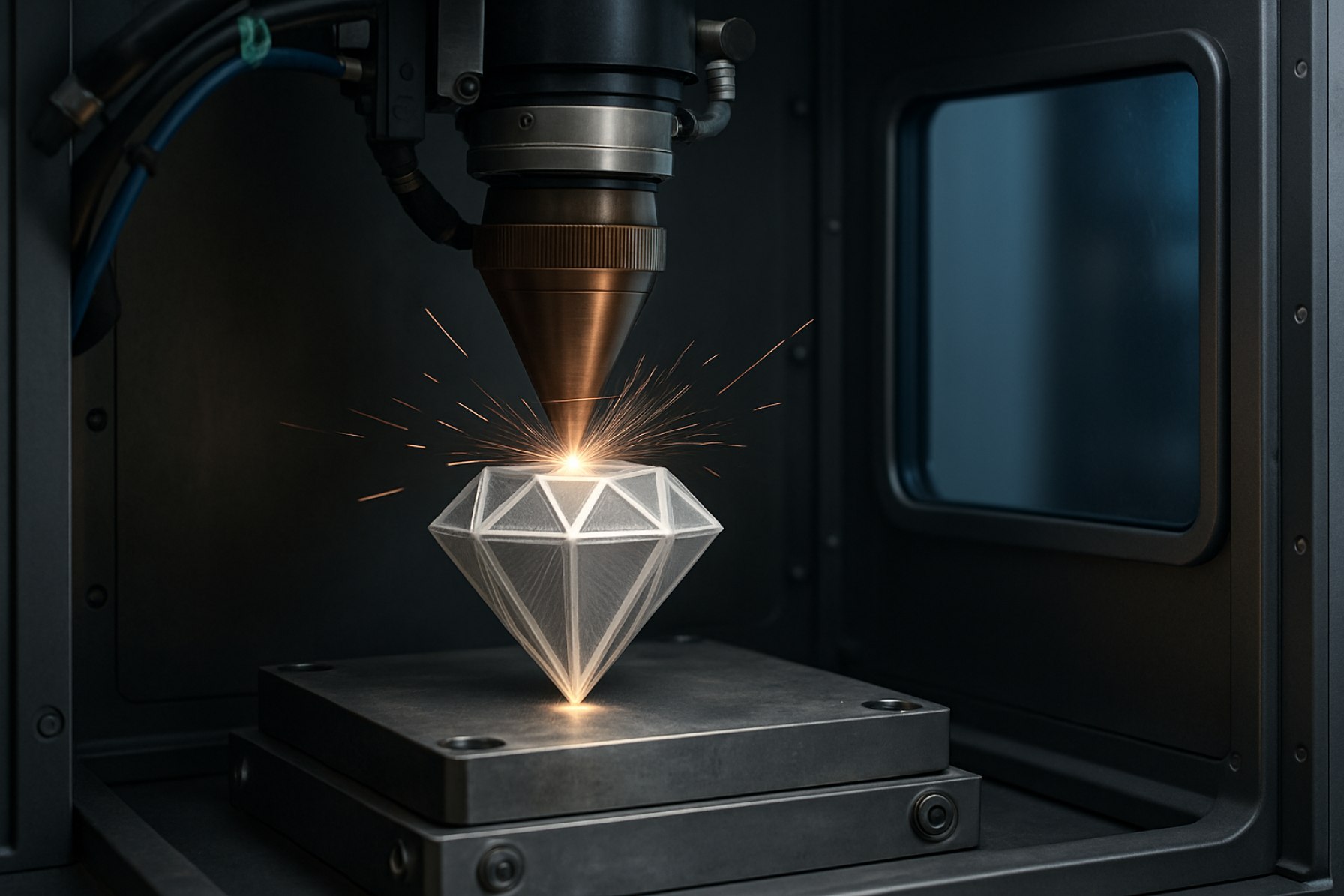

Executive Summary: The State of Additive Diamond Deposition in 2025

The field of additive diamond deposition devices is undergoing significant advancements as of 2025, marked by rapid commercialization, technological refinement, and expanding industrial uptake. Additive manufacturing (AM) of diamond materials—primarily using chemical vapor deposition (CVD) and related techniques—enables the fabrication of diamond structures and coatings with intricate geometries, tailored properties, and scalable production potential. These developments are being driven by industries seeking diamond’s exceptional hardness, thermal conductivity, and chemical inertness for applications in electronics, quantum technologies, tooling, and optics.

Leading the sector, Element Six (part of the De Beers Group) has expanded its suite of CVD diamond solutions, launching new systems capable of producing larger-area, high-purity diamond plates and complex architectures via additive processes. The company’s investment in modular reactor technologies and process automation is facilitating greater throughput and customization for sectors such as semiconductors and photonics.

Startups and established players alike are innovating device architectures. Advanced Diamond Technologies (ADT), now part of ULVAC Technologies, continues to push the boundaries with proprietary microwave plasma CVD reactors tailored for additive patterning and coating of diamond onto various substrates. These devices are increasingly adopted by manufacturers of cutting tools and thermal management components.

European companies are also making significant contributions. SCD (Specialized CVD Diamond Company), based in Poland, has introduced next-generation diamond AM reactors with improved energy efficiency and digital process controls. Their systems are seeing uptake in research institutes and industrial R&D centers exploring advanced quantum sensing devices and optical components.

In Asia, Element Six’s Singapore facility and Japanese firms like Sumitomo Electric Industries are refining both hot-filament and microwave plasma CVD equipment, focusing on the integration of additive processes for ultra-hard coatings and electronic-grade diamond films. These efforts are supported by government initiatives promoting domestic semiconductor and advanced materials industries.

Looking ahead, the outlook for additive diamond deposition devices is robust. The transition from prototype to production-scale machines, coupled with advances in process monitoring and AI-driven optimization, is expected to lower costs and expand market access. The next few years will likely see further integration of diamond AM devices into semiconductor fabs, quantum device manufacturing, and high-performance tooling lines, cementing additive diamond deposition as a cornerstone of advanced manufacturing.

Market Sizing and 5-Year Forecasts for Additive Diamond Deposition Devices

The market for additive diamond deposition devices—encompassing chemical vapor deposition (CVD) and related additive manufacturing approaches for synthetic diamond—is positioned for notable growth through 2025 and beyond. As of early 2025, the sector is characterized by increasing adoption across electronics, quantum computing, optics, and advanced tooling, driven by the demand for high-performance synthetic diamond components. Leading device manufacturers such as Element Six (a De Beers Group company), Microwave Enterprises, and SCD (Scientific and Commercial Diamond) are expanding production capacity and diversifying device portfolios to address both volume and specialty applications.

Recent data indicates that the global installed base of CVD diamond reactors is rising, particularly in regions with strong semiconductor and photonics industries. Element Six has reported significant investment in new facilities and reactor upgrades, citing the rapid expansion of markets for synthetic diamond in quantum sensing and high-power electronics. Similarly, SCD has announced the commissioning of updated microwave plasma CVD systems capable of producing both single-crystal and polycrystalline diamond for industrial and scientific customers.

The outlook for the next five years projects a compounded annual growth rate (CAGR) in the low double digits for additive diamond deposition devices. This is underpinned by several factors:

- Increasing integration of synthetic diamond substrates and coatings in semiconductor fabrication, where device manufacturers are scaling up to meet demand for thermal management and quantum components (Element Six).

- Emergence of new end-use markets, such as biosensing, photonics, and wear-resistant coatings, which are prompting device innovation and more adaptable reactor designs (Microwave Enterprises).

- Active R&D and pilot-scale investments from leading suppliers to enable larger substrate sizes, higher throughput, and improved cost efficiency (SCD).

By 2030, it is anticipated that the additive diamond deposition device sector will have moved from predominantly pilot-scale and specialized production to more mainstream, high-volume manufacturing, especially for electronic and photonics applications. Companies are expected to focus on automation, process standardization, and integration with Industry 4.0 systems to further boost productivity and quality consistency (Element Six). Overall, the next five years will likely see a transition from early adoption to broader industrialization, with market leaders and new entrants alike scaling up to fulfill expanding global demand.

Technology Deep Dive: Recent Advances in Deposition Methods

Additive diamond deposition devices have seen significant technological advances in recent years, primarily driven by the growing demand for synthetic diamond materials in quantum computing, semiconductor, optics, and thermal management applications. The latest deposition methods, particularly chemical vapor deposition (CVD), have become more refined, enabling precise layer-by-layer growth of high-purity diamond films and intricate three-dimensional (3D) structures.

In 2025, the industry’s focus has shifted toward improving the scalability and throughput of these devices. Element Six, a subsidiary of the De Beers Group, has reported continuous improvements in microwave plasma-assisted CVD (MPCVD) systems, allowing for greater uniformity across large substrates and improved control over defect densities. Their new reactors are equipped with real-time process monitoring and feedback loops, enabling automated adjustments and more consistent crystal quality, critical for quantum and electronic applications.

Another notable advance comes from Synthetized Crystals Diamond (SCD), which has introduced modular CVD platforms capable of depositing both single-crystal and polycrystalline diamond films with customizable doping profiles. This flexibility supports rapid prototyping and shortens development cycles for photonics and MEMS devices.

High-pressure high-temperature (HPHT) methods have also evolved, but additive approaches—especially those using plasma-enhanced CVD (PECVD)—are leading the way for integrated device manufacturing. Adamas Nanotechnologies has developed systems optimized for nanodiamond additive deposition, catering specifically to bioimaging and quantum sensing markets, where uniformity at the nanometer scale is paramount.

Automation and digital integration are major trends in 2025. 2D Semiconductors is pioneering the use of machine learning algorithms in CVD process control, predicting growth outcomes and reducing material waste. These innovations are expected to lower production costs and increase accessibility for smaller labs and startups.

Looking ahead, industry experts anticipate further miniaturization and integration of additive diamond deposition hardware. This will likely result in benchtop systems capable of producing device-grade diamond films in university and small-scale industrial settings. There is also growing interest in hybrid deposition platforms that combine diamond with other wide-bandgap materials, potentially enabling new classes of electronic and photonic devices. As these technologies mature, additive diamond deposition devices are poised to become foundational tools in next-generation manufacturing ecosystems.

Key Players and Industry Alliances (2025 Edition)

The additive diamond deposition device sector is witnessing significant activity in 2025, as established manufacturers and emerging innovators accelerate efforts to commercialize advanced diamond fabrication technologies. These devices, which enable the layer-by-layer synthesis of diamond structures via chemical vapor deposition (CVD) and related additive processes, are increasingly critical to industries demanding superior thermal, electronic, and mechanical properties.

Key players in this field include Element Six, a De Beers Group company, which remains a global leader in synthetic diamond production and has continued to invest in advanced CVD equipment for both research and industrial-scale applications. The company’s focus in 2025 is on scalable additive platforms for electronics, quantum devices, and optics, expanding its collaboration with semiconductor manufacturers and quantum computing firms.

Japan’s ULVAC, Inc. has maintained its position as a major supplier of CVD systems, introducing modular additive deposition units that cater to both R&D and high-throughput manufacturing environments. Their ongoing work with academic institutions and industrial partners is aimed at refining process control, uniformity, and integration with advanced robotics.

Another crucial player is Shenyang Machine Tool Co., Ltd. (SMTCL), which, in the past year, has expanded its portfolio to include hybrid additive/subtractive diamond deposition machines, targeting the tooling and aerospace sectors for wear-resistant components. SMTCL’s strategic partnerships with leading cutting tool suppliers have accelerated adoption in Asia and Europe.

On the U.S. front, Adamas Nanotechnologies has focused on developing compact, modular diamond deposition devices for quantum sensing and bioimaging. Their 2025 roadmap emphasizes open-architecture systems to facilitate third-party integration and rapid prototyping, which has fostered alliances with university labs and government research agencies.

Industry alliances and consortia are also shaping the landscape. The SEMI International Standards initiative, for example, has established a working group in 2025 to develop interoperability standards for diamond additive manufacturing equipment, aiming to accelerate cross-industry adoption and ensure quality benchmarks. Collaborative projects between Element Six, ULVAC, Inc., and research bodies are expected to deliver new reference architectures and process validation protocols by late 2026.

Looking ahead, the field is poised for further consolidation and specialization, as players invest in proprietary process know-how and form alliances to address application-specific needs—from quantum technologies to ultra-hard coatings. The next few years are likely to see new entrants leveraging open standards and modular platforms, while established leaders continue to scale production and refine device performance.

Applications: From Semiconductor to Aerospace—Emerging Use Cases

Additive diamond deposition devices are driving transformative applications across multiple industries, capitalizing on diamond’s exceptional thermal conductivity, dielectric properties, hardness, and chemical stability. In 2025 and the coming years, the convergence of advanced additive manufacturing techniques—especially chemical vapor deposition (CVD)—with precision engineering is enabling novel use cases from semiconductors to aerospace.

In the semiconductor sector, additive diamond deposition is increasingly integral to thermal management solutions for high-power devices. Diamond heat spreaders and substrates, produced via scalable CVD processes, are being adopted to dissipate heat efficiently in next-generation gallium nitride (GaN) and silicon carbide (SiC) power electronics. Companies such as Element Six are advancing the deployment of single-crystal and polycrystalline diamond components, supporting the rapid growth of electric vehicles (EVs) and 5G infrastructure where thermal constraints are a bottleneck.

Additive manufacturing of diamond films is also gaining traction in high-frequency electronic devices, including radio-frequency (RF) filters, microelectromechanical systems (MEMS), and quantum computing hardware. For instance, Adamas Nanotechnologies specializes in engineered nanodiamond materials for quantum sensors and photonic devices, leveraging additive processes for customized geometries and integration with existing chip architectures.

In aerospace, additive diamond deposition devices are enabling the production of advanced coatings and wear-resistant components for propulsion systems, turbine blades, and optical windows. The use of diamond-coated parts reduces maintenance intervals and enhances operational lifetimes under extreme conditions. De Beers Group, through its industrial division, is collaborating with aerospace manufacturers to deploy diamond-coated tooling and components that can withstand aggressive environments, contributing to lightweighting and improved fuel efficiency.

Additional emerging applications include medical devices—where biocompatible, wear-resistant diamond coatings are used for implants and surgical tools—and high-performance optics for laser and synchrotron systems. Companies like Coherent Corp. are commercializing CVD diamond windows and lenses for demanding photonics and spectroscopy environments.

Looking ahead, the additive diamond deposition market is poised for robust growth, driven by ongoing innovation in device architectures, process scalability, and integration with hybrid materials. Investments in automation and in-situ quality control are expected to further lower production costs and open new application domains by 2027, solidifying additive diamond deposition as a key enabling technology across advanced manufacturing sectors.

Competitive Landscape: Differentiators and IP Trends

The competitive landscape for additive diamond deposition devices is rapidly evolving in 2025, driven by advances in chemical vapor deposition (CVD) technology, materials science, and automation. Key differentiators among players in this space include substrate flexibility, deposition speed, diamond quality (purity, grain size, defect density), and device scalability. Intellectual property (IP) activity is intense, with patent filings focusing on novel reactor designs, gas chemistry optimization, in-situ monitoring, and hybrid additive manufacturing approaches that integrate diamond with other materials.

Major industry players such as Element Six (a De Beers Group company) and Mitsubishi Chemical continue to invest heavily in refining microwave plasma-assisted CVD systems that enable precise layer-by-layer diamond growth. Element Six in particular has developed proprietary platforms for both single-crystal and polycrystalline diamond deposition, suitable for applications ranging from quantum technology to advanced thermal management. Meanwhile, startups and university spin-offs are targeting niche opportunities in additive microfabrication, such as 3D printing of diamond-coated components for electronics and medical devices.

In 2025, the race for IP dominance is apparent in the surge of patent applications and granted patents related to additive diamond deposition. Advanced Diamond Technologies, a subsidiary of UNIPOL, holds a suite of patents on ultrananocrystalline diamond (UNCD) film deposition, emphasizing integration with MEMS and sensor platforms. Sumitomo Electric Industries and ILJIN Diamond are also active in protecting their innovations around high-throughput CVD reactors and post-deposition treatment processes.

Key differentiators in 2025 include the ability to deposit diamond on non-traditional substrates, such as metals and ceramics, and the integration of in-situ diagnostics to ensure consistent film quality. Automated process control, enabled by real-time spectroscopic feedback, is becoming a standard feature in leading devices, reducing defect rates and production costs. Companies are also investing in modular reactor designs to address the need for scalability and customization across industries.

Looking ahead, the next few years are expected to see increasing collaboration between device manufacturers and end users in sectors such as quantum computing, power electronics, and biomedical devices. As more companies such as De Beers Group and Sumitomo Electric Industries expand their patent portfolios and proprietary process know-how, barriers to entry are likely to rise, cementing the competitive positions of established firms while incentivizing new entrants to pursue disruptive innovations or specialized applications.

Supply Chain Dynamics and Raw Material Sourcing

The supply chain dynamics and raw material sourcing landscape for additive diamond deposition devices is evolving rapidly as the industry matures and demand for synthetic diamond components grows. In 2025, supply chains are characterized by a mix of vertical integration and strategic partnerships focused on ensuring reliable access to high-purity feedstocks, robust equipment, and advanced precursor gases critical for chemical vapor deposition (CVD) and related additive processes.

A key trend is the increasing investment in domestic and regional diamond synthesis capabilities to mitigate geopolitical risks in raw material supply. Manufacturers such as Element Six and De Beers Group continue to expand their synthetic diamond production facilities, incorporating advanced CVD reactors to secure consistent supply for downstream device fabrication. These companies emphasize traceability of carbon sources and tightly controlled processing conditions to meet the stringent requirements of electronics, quantum, and tooling markets.

On the precursor side, the supply of ultra-high-purity gases—particularly methane and hydrogen—remains a focal point. Suppliers like Linde and Air Liquide are scaling production and refining capabilities to support the growing demand from diamond deposition device makers. Supply agreements and long-term contracts are increasingly common to buffer against volatility in global gas markets and ensure uninterrupted device manufacturing.

Supply chain resilience efforts are also evident in the adoption of digital tracking and quality assurance systems. Companies engaged in additive diamond deposition, such as Adamas Nanotechnologies and Smiths Detection (for diamond-based sensors), are leveraging blockchain and advanced analytics to monitor the provenance and quality of both diamond substrates and precursor inputs throughout the supply chain.

Looking ahead to the next few years, the industry is expected to further diversify raw material sourcing, with a focus on closed-loop recycling of diamond offcuts and end-of-life components. This is both a response to sustainability pressures and a means of reducing dependency on virgin feedstocks. Pilot programs for diamond recycling are underway at several firms, and standards for recycled diamond quality are being developed in coordination with industry bodies like the International Diamond Exchange.

In summary, the 2025 outlook for additive diamond deposition device supply chains is defined by proactive risk management, investment in upstream capacity, and innovation in raw material tracking and recycling. These efforts are laying the groundwork for stable, scalable growth as device applications expand across high-tech sectors.

Regulatory Environment and Standards (e.g., IEEE, ASME Updates)

The regulatory environment for additive diamond deposition devices is evolving rapidly as both technology maturity and market adoption accelerate through 2025. These devices, which use advanced additive manufacturing techniques such as chemical vapor deposition (CVD) to fabricate diamond components, intersect with several established and emerging standards frameworks, particularly in applications spanning electronics, optics, and tooling.

A central body influencing technical standards is the IEEE, which continues to expand its portfolio of additive manufacturing standards. IEEE’s Standards Association has recently prioritized working groups focused on AM process control, material traceability, and device interoperability, all of which are pertinent for manufacturers of CVD diamond components. While there is currently no diamond-specific IEEE standard, ongoing discussions in 2024–2025 suggest that standards for high-value, functionally graded materials like diamond are under consideration, especially regarding electronic and photonic device reliability.

The ASME (American Society of Mechanical Engineers) has similarly updated its standards for additive manufacturing processes. The ASME Y14.46-2022 standard for the definition and documentation of AM parts now explicitly references non-metallic advanced materials, including synthetic diamond, to ensure accurate digital modeling and post-processing traceability. ASME’s ongoing AM codes and standards committee meetings in 2025 are expected to produce further guidance on inspection methodologies and safety for diamond-based additively manufactured components, reflecting the increased adoption of these devices in demanding industrial settings.

On the regulatory front, manufacturers of additive diamond deposition devices are engaging with agencies such as the National Institute of Standards and Technology (NIST), which has established the Additive Manufacturing Metrology Testbed. This facility is working with industry partners to develop reference materials and calibrations for non-metallic AM, including synthetic diamond, to help ensure process repeatability and device certification. In parallel, the International Organization for Standardization (ISO) continues to update ISO/ASTM 52900 and related standards to address new classes of AM materials and their unique performance characteristics.

Looking ahead, the outlook through 2025 and beyond is for tighter regulatory controls and more detailed standards as additive diamond deposition devices become integral to critical applications, such as quantum electronics and precision machining. The convergence of industry-driven standardization (led by companies like Element Six) and regulatory oversight will likely yield new certification pathways, ensuring both market access and end-use safety for these advanced devices.

Challenges, Barriers, and Scalability Concerns

Additive diamond deposition devices are poised to redefine advanced manufacturing, especially in electronics, optics, and cutting tools. However, as of 2025, several technical and commercial challenges impede their wider adoption and scalability.

- Material Quality and Uniformity: Maintaining the high purity, crystallinity, and uniform thickness needed for demanding applications remains difficult. Variability in gas feedstock, reactor conditions, and substrate compatibility can result in defects or non-uniform films, directly affecting device performance. Leading providers such as Element Six and Adamas Materials have invested in process controls, yet achieving consistent results at scale, especially for large-area or complex 3D geometries, remains a significant challenge.

- Process Throughput and Speed: Current chemical vapor deposition (CVD) and plasma-assisted methods are relatively slow, often requiring multiple hours to deposit micrometer-thick films. This limits throughput and makes large-scale manufacturing costly. Efforts by SYNTHETIC DIAMOND TECHNOLOGIES and Meyer Burger Technology AG focus on reactor design and plasma source improvements, but substantial throughput gains are necessary for competitive, high-volume production.

- Equipment Cost and Maintenance: The capital investment for advanced diamond deposition systems is high, driven by the need for precision controls, vacuum systems, and high-purity feedstocks. Maintenance and consumables costs are also significant, particularly for hot filament and microwave plasma CVD equipment. This represents a barrier for new entrants and limits deployment in smaller manufacturing environments, as acknowledged by sp3 Diamond Technologies.

- Post-Processing and Integration: Even after deposition, diamond films often require additional processing—such as surface smoothing, patterning, or doping—to meet application-specific requirements. These steps add complexity and can introduce defects, reducing yield and reliability. Companies like Element Six and ILJIN Diamond Co., Ltd. are working to optimize integration with downstream processes, but seamless workflows are not yet routine.

- Supply Chain and Skilled Workforce: The industry’s reliance on specialized materials and skilled technicians further constrains scalability. Training and retaining personnel with expertise in diamond growth, reactor maintenance, and quality assurance is a recognized bottleneck, as noted by multiple equipment manufacturers.

Looking forward, the next few years are likely to see incremental improvements in reactor technology, process automation, and in situ quality control. However, for additive diamond deposition devices to reach mass-market potential, breakthroughs in deposition rate, cost reduction, and seamless integration will be essential. Industry collaborations and public-private partnerships may accelerate progress, but overcoming these barriers remains a multi-year endeavor.

Future Outlook: Disruptive Potential and Investment Hotspots Through 2030

Additive diamond deposition devices, leveraging technologies such as chemical vapor deposition (CVD) and emerging additive manufacturing platforms, are positioned for significant industry disruption between 2025 and 2030. The convergence of advanced materials science and precision engineering is enabling fabrication of synthetic diamond components with tailored properties, unlocking new applications across electronics, optics, quantum technology, and thermal management.

As of 2025, industry leaders like Element Six (a De Beers Group company) and Adamas Materials are scaling up proprietary CVD systems capable of producing high-purity, single-crystal diamonds at wafer-scale dimensions. These advances are crucial for the production of diamond-based semiconductors, which offer ultra-high thermal conductivity and breakdown voltages far surpassing silicon or even wide-bandgap materials like SiC and GaN. In parallel, Mitsubishi Chemical continues to refine its microwave plasma CVD processes, focusing on reproducibility and integration with existing microfabrication workflows, a key step toward mass adoption in electronics and photonics.

A major disruptive vector is quantum technology, where additive diamond deposition devices enable the fabrication of nitrogen-vacancy (NV) and silicon-vacancy (SiV) centers for quantum sensing, secure communications, and emerging quantum computing hardware. Companies such as Qnami and Element Six are at the forefront, with announcements of new device-ready diamond substrates and partnerships with quantum hardware startups as of 2025.

Investment hotspots through 2030 are anticipated in three primary sectors:

- Advanced electronics and power devices: Demand for diamond-based power transistors and heat spreaders is rising, with pilot manufacturing lines under development at Element Six and Mitsubishi Chemical.

- Quantum technology: Strategic investments are accelerating in fabrication of engineered diamond substrates for quantum hardware (Qnami, Element Six).

- Optics and photonics: Diamond’s superior optical transparency and hardness are spurring device development in high-power laser optics and radiation detectors, with Adamas Materials and Element Six expanding their commercial offerings.

Looking ahead, the combination of additive manufacturing flexibility and diamond’s unmatched physical properties suggests a strong trajectory toward bespoke, high-performance components across multiple industries. Strategic investments and cross-sector collaborations are expected to intensify, with diamond additive deposition devices becoming a focal point for innovation-driven growth by 2030.

Sources & References

- SCD

- Sumitomo Electric Industries

- 2D Semiconductors

- ULVAC, Inc.

- Shenyang Machine Tool Co., Ltd.

- De Beers Group

- Sumitomo Electric Industries

- ILJIN Diamond

- Linde

- Air Liquide

- Smiths Detection

- International Diamond Exchange

- IEEE

- ASME

- National Institute of Standards and Technology (NIST)

- International Organization for Standardization (ISO)

- sp3 Diamond Technologies

- Qnami