Biodegradable Electronics Manufacturing in 2025: Pioneering Sustainable Tech for a Greener Tomorrow. Explore Market Growth, Breakthrough Materials, and the Next Wave of Eco-Friendly Devices.

- Executive Summary: The Rise of Biodegradable Electronics

- Market Size and 2025–2029 Growth Forecast (CAGR: 18–22%)

- Key Drivers: Sustainability Mandates and Consumer Demand

- Breakthrough Materials: Polymers, Substrates, and Conductors

- Manufacturing Innovations and Process Optimization

- Leading Companies and Industry Initiatives (e.g., samsung.com, ieee.org)

- Application Landscape: Medical Devices, Wearables, and IoT

- Regulatory Environment and Global Standards

- Challenges: Scalability, Cost, and Performance Trade-offs

- Future Outlook: Roadmap to Mainstream Adoption by 2029

- Sources & References

Executive Summary: The Rise of Biodegradable Electronics

The manufacturing of biodegradable electronics is rapidly emerging as a transformative trend in the global electronics industry, driven by mounting concerns over electronic waste (e-waste), regulatory pressures, and the demand for sustainable alternatives. As of 2025, the sector is witnessing significant advancements in materials science, process engineering, and commercial partnerships, positioning biodegradable electronics as a viable solution to the environmental challenges posed by conventional devices.

Key industry players are accelerating research and development to bring biodegradable components—such as substrates, conductors, and encapsulants—into mainstream production. Companies like Samsung Electronics have publicly committed to exploring eco-friendly materials and have initiated pilot projects focused on sustainable device design. Similarly, Panasonic Corporation is investing in the development of organic and cellulose-based substrates for printed circuit boards, aiming to reduce the environmental footprint of their consumer electronics.

Material innovation is at the core of this movement. For instance, STMicroelectronics is collaborating with academic and industrial partners to develop biodegradable polymers and natural fiber composites for use in sensors and flexible electronics. These efforts are complemented by initiatives from TDK Corporation, which is advancing the use of bio-based dielectrics and conductive inks in passive components. Such collaborations are expected to accelerate the commercialization of biodegradable electronics, with pilot-scale manufacturing lines already operational in select facilities.

The outlook for the next few years is marked by a transition from laboratory-scale prototypes to scalable manufacturing processes. Industry consortia and standards bodies, such as the IEEE, are beginning to address the need for standardized testing and certification protocols for biodegradable electronic components. This is anticipated to facilitate broader adoption by major device manufacturers and component suppliers.

While challenges remain—particularly in achieving performance parity with traditional electronics and ensuring cost competitiveness—the sector is poised for robust growth. Regulatory frameworks in the European Union and Asia are expected to further incentivize the adoption of biodegradable materials in electronics manufacturing. As a result, the period from 2025 onward is likely to see the first wave of commercially available biodegradable electronic products, ranging from single-use medical sensors to environmentally friendly consumer gadgets, signaling a pivotal shift toward circular economy principles in the electronics industry.

Market Size and 2025–2029 Growth Forecast (CAGR: 18–22%)

The global market for biodegradable electronics manufacturing is poised for robust expansion between 2025 and 2029, with a projected compound annual growth rate (CAGR) in the range of 18–22%. This growth is driven by increasing regulatory pressure to reduce electronic waste, rising consumer awareness of sustainability, and rapid advancements in materials science enabling the commercial viability of biodegradable components. The market, which was valued at an estimated $150–200 million in 2024, is expected to surpass $400 million by 2029, as more manufacturers and end-users adopt eco-friendly alternatives to conventional electronics.

Key industry players are accelerating the transition from laboratory-scale prototypes to scalable manufacturing processes. Samsung Electronics has announced ongoing research into biodegradable substrates for flexible displays and wearable devices, aiming to integrate these materials into select product lines by 2026. Similarly, Fujifilm Holdings Corporation is investing in organic semiconductors and cellulose-based substrates, targeting medical sensors and single-use diagnostic devices. STMicroelectronics is collaborating with academic partners to develop compostable microcontrollers and printed circuit boards, with pilot production expected to begin in late 2025.

The medical and healthcare sector is anticipated to be the largest adopter of biodegradable electronics, particularly for implantable sensors and temporary monitoring devices. This is exemplified by Medtronic, which is exploring transient electronics for post-surgical monitoring, and Boston Scientific, which has initiated trials of bioresorbable electronic implants. The packaging industry is also emerging as a significant market, with companies like Amcor investigating smart, biodegradable packaging solutions that integrate environmental sensors.

Geographically, Asia-Pacific is expected to lead market growth, driven by strong manufacturing ecosystems in South Korea, Japan, and China, as well as supportive government policies promoting green electronics. Europe is following closely, with the European Union’s Circular Economy Action Plan incentivizing the adoption of biodegradable materials in electronics manufacturing.

Looking ahead, the market outlook remains highly positive. As supply chains mature and production costs decrease, biodegradable electronics are projected to move beyond niche applications into mainstream consumer electronics, wearables, and IoT devices. The next five years will be critical for scaling up production, standardizing materials, and establishing industry-wide certifications, setting the stage for widespread adoption by the end of the decade.

Key Drivers: Sustainability Mandates and Consumer Demand

The momentum behind biodegradable electronics manufacturing in 2025 is being decisively shaped by two converging forces: increasingly stringent sustainability mandates and a marked rise in consumer demand for eco-friendly products. Regulatory frameworks across major economies are tightening, with governments and supranational bodies setting ambitious targets for electronic waste (e-waste) reduction and circular economy integration. For instance, the European Union’s Circular Electronics Initiative, part of the European Green Deal, is pushing manufacturers to design products with end-of-life recyclability and biodegradability in mind. This regulatory pressure is compelling electronics manufacturers to invest in alternative materials and processes that minimize environmental impact.

On the industry front, leading electronics and materials companies are responding proactively. Samsung Electronics has publicly committed to increasing the use of recycled and bio-based materials in its products, with pilot projects exploring biodegradable substrates for flexible displays and wearable devices. Similarly, Panasonic Corporation is advancing research into cellulose-based circuit boards and biodegradable packaging for its consumer electronics lines. These initiatives are not only compliance-driven but also reflect a strategic pivot to capture emerging market segments that prioritize sustainability.

Consumer awareness and demand are equally pivotal. Surveys conducted by industry groups such as the Consumer Technology Association indicate that a growing proportion of buyers—especially in North America, Europe, and parts of Asia—are willing to pay a premium for electronics with reduced environmental footprints. This trend is particularly pronounced among younger demographics, who are both tech-savvy and environmentally conscious. As a result, brands are leveraging biodegradable components as a differentiator in marketing and product development.

Material innovation is accelerating to meet these dual pressures. Companies like Stora Enso, a global leader in renewable materials, are scaling up production of wood-based biocomposites and nanocellulose films suitable for electronic applications. Meanwhile, DuPont is collaborating with electronics manufacturers to develop biodegradable polymers for circuit substrates and encapsulants. These partnerships are expected to yield commercially viable biodegradable electronic components within the next few years, with pilot-scale manufacturing already underway.

Looking ahead, the interplay of regulatory mandates and consumer expectations is set to accelerate the adoption of biodegradable electronics manufacturing. As supply chains adapt and material costs decrease, industry analysts anticipate a significant uptick in the availability of biodegradable electronic products by 2027, positioning sustainability as a core value proposition in the electronics sector.

Breakthrough Materials: Polymers, Substrates, and Conductors

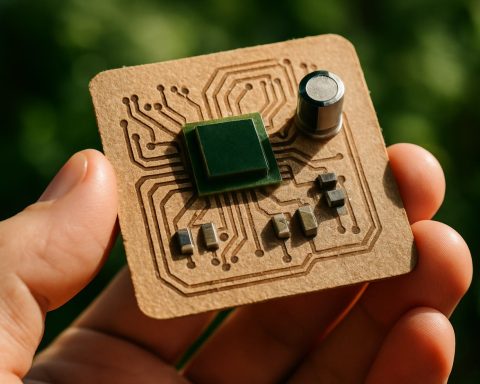

The development of breakthrough materials is at the heart of progress in biodegradable electronics manufacturing, with 2025 marking a pivotal year for the commercialization and scaling of novel polymers, substrates, and conductors. The industry’s focus is on replacing conventional, persistent plastics and metals with materials that can safely decompose after use, minimizing electronic waste and environmental impact.

Polymers are a primary area of innovation. Biodegradable polymers such as polylactic acid (PLA), polycaprolactone (PCL), and cellulose derivatives are increasingly being adopted as the base for flexible electronic circuits. These materials offer mechanical flexibility and processability, while their decomposition profiles can be tuned for specific applications. Companies like Covestro are advancing bio-based and biodegradable polymer solutions, leveraging their expertise in high-performance plastics to develop substrates suitable for printed electronics and transient devices.

Substrate innovation is also accelerating. Paper-based substrates, derived from renewable cellulose, are gaining traction due to their low cost, abundance, and ease of disposal. Stora Enso, a global leader in renewable materials, has been actively developing paper and board substrates tailored for electronic applications, including RFID tags and sensors. Their work demonstrates the feasibility of integrating electronic functionality into fully biodegradable packaging and labeling solutions.

On the conductor front, the challenge has been to identify materials that combine electrical performance with environmental compatibility. Recent advances include the use of transient metals such as magnesium, zinc, and iron, which corrode harmlessly in natural environments. Additionally, carbon-based materials—such as graphene and carbon nanotubes—are being explored for their conductivity and potential biodegradability. Novamont, known for its bioplastics, is collaborating with research institutes to develop conductive inks and pastes based on renewable resources, aiming to replace silver and copper in printed electronics.

Looking ahead, the next few years are expected to see further integration of these materials into commercial products, particularly in single-use medical devices, environmental sensors, and smart packaging. Industry partnerships and pilot projects are expanding, with companies like Covestro and Stora Enso at the forefront. As regulatory pressures on electronic waste intensify, the adoption of biodegradable materials in electronics manufacturing is poised for significant growth, setting new standards for sustainability in the sector.

Manufacturing Innovations and Process Optimization

The manufacturing landscape for biodegradable electronics is undergoing rapid transformation in 2025, driven by the convergence of sustainability imperatives and advances in materials science. Key innovations are emerging in substrate selection, device fabrication, and process integration, with a focus on reducing environmental impact while maintaining device performance and scalability.

One of the most significant trends is the adoption of naturally derived substrates such as cellulose nanofibers, silk fibroin, and polylactic acid (PLA), which offer mechanical flexibility and biodegradability. Companies like FUJIFILM Corporation are leveraging their expertise in organic materials and thin-film processing to develop flexible, eco-friendly substrates suitable for printed electronics. Similarly, Samsung Electronics has announced research initiatives into biodegradable polymers for transient electronic devices, aiming to integrate these materials into their manufacturing lines within the next few years.

Printing technologies, particularly inkjet and screen printing, are being optimized for use with biodegradable inks and substrates. Xerox Holdings Corporation has expanded its portfolio to include conductive inks based on organic and bio-derived materials, enabling low-temperature processing compatible with sensitive biodegradable substrates. These advances are reducing the energy footprint of device fabrication and enabling roll-to-roll manufacturing, which is essential for scaling production.

Process optimization is also being driven by the integration of additive manufacturing and laser patterning techniques. 3D Systems Corporation is collaborating with academic and industrial partners to refine 3D printing processes for biodegradable electronic components, focusing on precise deposition and minimal material waste. This approach supports the customization of device architectures and the rapid prototyping of new designs.

In terms of device assembly, companies are exploring water-soluble adhesives and encapsulants to ensure that the entire electronic system can degrade safely after use. Dow Inc. is developing bio-based encapsulation materials that protect sensitive components during operation but break down under environmental conditions post-disposal.

Looking ahead, the outlook for biodegradable electronics manufacturing is promising. Industry leaders are targeting commercial-scale production of transient sensors, medical implants, and environmental monitoring devices by 2027. The sector is expected to benefit from ongoing collaborations between material suppliers, device manufacturers, and end-users, with a shared goal of establishing closed-loop manufacturing systems and robust end-of-life management protocols. As regulatory pressures and consumer demand for sustainable electronics intensify, manufacturing innovations and process optimization will remain central to the sector’s growth trajectory.

Leading Companies and Industry Initiatives (e.g., samsung.com, ieee.org)

The field of biodegradable electronics manufacturing is rapidly evolving, with several leading companies and industry organizations spearheading research, development, and commercialization efforts as of 2025. These initiatives are driven by the urgent need to address electronic waste (e-waste) and to develop sustainable alternatives for consumer electronics, medical devices, and environmental sensors.

Among the global technology leaders, Samsung Electronics has been at the forefront of integrating eco-friendly materials and processes into its product lines. In recent years, Samsung has announced investments in research partnerships focused on developing biodegradable substrates and packaging for electronic components, aiming to reduce the environmental impact of its vast product portfolio. The company’s R&D centers in South Korea and Europe are actively exploring organic semiconductors and cellulose-based materials for flexible and transient electronics.

Another major player, Panasonic Corporation, has expanded its sustainability initiatives to include the development of biodegradable printed circuit boards (PCBs) and organic light-emitting diode (OLED) displays. Panasonic’s collaboration with academic institutions and material suppliers is expected to yield pilot-scale production of biodegradable sensors and medical patches by 2026, targeting both consumer health and industrial monitoring applications.

In the United States, HP Inc. has launched pilot programs to incorporate biodegradable polymers into its 3D printing and electronics manufacturing processes. HP’s focus is on leveraging additive manufacturing to produce custom, short-lifecycle electronic devices—such as smart packaging and single-use medical diagnostics—that can safely decompose after use. The company’s sustainability roadmap, updated for 2025, highlights a commitment to circular economy principles and the reduction of persistent plastics in electronics.

Industry-wide collaboration is also being facilitated by organizations such as the Institute of Electrical and Electronics Engineers (IEEE), which has established working groups to develop standards and best practices for biodegradable electronics. These efforts are crucial for harmonizing material specifications, safety protocols, and end-of-life management across the sector. The IEEE’s conferences and publications in 2024–2025 have seen a marked increase in contributions from both academia and industry, reflecting the growing momentum in this field.

Looking ahead, the next few years are expected to witness the scaling up of pilot projects to commercial production, particularly in applications where device longevity is less critical than environmental impact. The convergence of material science innovation, manufacturing advances, and regulatory support positions biodegradable electronics as a key growth area in the global electronics industry through 2027 and beyond.

Application Landscape: Medical Devices, Wearables, and IoT

The application landscape for biodegradable electronics manufacturing is rapidly expanding, with medical devices, wearables, and Internet of Things (IoT) systems at the forefront of adoption in 2025 and the coming years. The convergence of sustainability imperatives and technological innovation is driving both established manufacturers and startups to develop solutions that address electronic waste while enabling new functionalities.

In the medical sector, biodegradable electronics are being integrated into temporary implants, sensors, and drug delivery systems. These devices are designed to perform diagnostic or therapeutic functions and then safely dissolve in the body, eliminating the need for surgical removal. Companies such as Medtronic and Boston Scientific are actively exploring bioresorbable materials for next-generation implantables, leveraging advances in transient electronics and biocompatible substrates. The U.S. Food and Drug Administration (FDA) has signaled openness to such innovations, with several pilot studies underway as of 2025.

Wearable technology is another major beneficiary of biodegradable electronics. The demand for sustainable, skin-conformal sensors and patches is growing, particularly for health monitoring and fitness applications. Companies like Philips and Smith+Nephew are developing flexible, biodegradable sensors that can monitor vital signs or wound healing, then degrade harmlessly after use. These solutions are expected to reduce the environmental impact of single-use medical wearables, a segment projected to see double-digit growth through 2027.

In the IoT domain, biodegradable sensors and tags are being deployed in agriculture, logistics, and environmental monitoring. For example, STMicroelectronics is collaborating with partners to develop eco-friendly RFID tags and environmental sensors that decompose after their operational life, addressing the challenge of device proliferation in smart environments. Similarly, Infineon Technologies is investing in research on biodegradable substrates for low-power IoT nodes, aiming to support circular economy models in electronics.

Looking ahead, the outlook for biodegradable electronics in these application areas is robust. Industry bodies such as the Semiconductor Industry Association are advocating for standards and best practices to accelerate commercialization. As manufacturing processes mature and regulatory frameworks adapt, the integration of biodegradable electronics into medical, wearable, and IoT devices is expected to become mainstream, supporting both innovation and sustainability goals through 2030.

Regulatory Environment and Global Standards

The regulatory environment for biodegradable electronics manufacturing is rapidly evolving as governments and international bodies recognize the need to address electronic waste (e-waste) and promote sustainable innovation. In 2025, the sector is witnessing increased scrutiny and the emergence of new standards aimed at ensuring that biodegradable electronic products meet both environmental and performance criteria.

The European Union remains at the forefront of regulatory action, building on its existing directives such as the Waste Electrical and Electronic Equipment (WEEE) Directive and the Restriction of Hazardous Substances (RoHS) Directive. In 2024, the EU initiated consultations on updating these frameworks to explicitly address biodegradable and bio-based electronic components, with draft amendments expected to be finalized in 2025. These updates are anticipated to introduce clear definitions, labeling requirements, and end-of-life management protocols for biodegradable electronics, setting a precedent for global markets. The European Commission is also working with industry stakeholders to develop harmonized testing methods for biodegradability and compostability in electronic devices.

In the United States, the Environmental Protection Agency (EPA) has begun collaborating with industry leaders and research institutions to establish voluntary guidelines for biodegradable electronics. These guidelines focus on material safety, environmental impact assessments, and pathways for responsible disposal. The EPA’s Sustainable Materials Management program is expected to release a draft framework for public comment in late 2025, which could influence future federal and state-level regulations.

Internationally, the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO) are actively developing technical standards for biodegradable electronic materials and devices. Working groups within these organizations are addressing issues such as standardized biodegradation testing, certification schemes, and interoperability with existing e-waste management systems. The first set of ISO/IEC standards specific to biodegradable electronics is projected for publication by 2026, providing a global reference point for manufacturers and regulators.

Industry leaders such as Samsung Electronics and Panasonic Corporation are participating in pilot programs and public-private partnerships to align their product development with emerging regulatory requirements. These companies are also contributing to the development of industry best practices through consortia and standardization bodies.

Looking ahead, the regulatory landscape for biodegradable electronics manufacturing is expected to become more stringent and harmonized across major markets. Manufacturers will need to invest in compliance infrastructure and transparent supply chains to meet evolving standards, while ongoing collaboration between industry, regulators, and standardization bodies will be critical to ensuring both environmental protection and technological advancement.

Challenges: Scalability, Cost, and Performance Trade-offs

Biodegradable electronics manufacturing is poised for significant growth in 2025 and the coming years, but the sector faces persistent challenges related to scalability, cost, and performance trade-offs. As the demand for sustainable alternatives to conventional electronics intensifies, manufacturers and material suppliers are under pressure to deliver solutions that can be produced at scale, remain cost-competitive, and meet the functional requirements of modern devices.

One of the primary challenges is scalability. While laboratory-scale demonstrations of biodegradable sensors, circuits, and substrates have proliferated, transitioning these innovations to mass production remains complex. The manufacturing processes for biodegradable materials—such as cellulose nanofibers, silk fibroin, and polylactic acid—often require specialized equipment and tightly controlled environments, which can limit throughput and increase capital expenditure. Companies like Stora Enso, a leader in renewable materials, have made strides in scaling up cellulose-based substrates, but achieving the consistency and reliability required for electronic applications is still a work in progress.

Cost is another significant barrier. Biodegradable materials are typically more expensive than their conventional counterparts due to limited supply chains, lower economies of scale, and the need for high-purity feedstocks. For example, DuPont and BASF have both invested in biopolymer development, but their biodegradable offerings often command a price premium over traditional plastics and resins. This cost differential can be prohibitive for consumer electronics, where margins are tight and price sensitivity is high.

Performance trade-offs further complicate adoption. Biodegradable electronics must balance environmental benefits with electrical, mechanical, and thermal performance. Many biodegradable substrates and conductors exhibit lower conductivity, reduced mechanical strength, or limited thermal stability compared to conventional materials. This can restrict their use to low-power, short-lifetime applications such as medical implants, environmental sensors, or smart packaging. Companies like FUJIFILM are actively researching new formulations and hybrid materials to bridge this gap, but widespread deployment in high-performance devices remains a future goal.

Looking ahead, industry collaboration and investment in process innovation will be crucial to overcoming these challenges. Initiatives by organizations such as SEMI are fostering knowledge exchange and standardization, which may accelerate the development of scalable, cost-effective, and high-performance biodegradable electronics. However, in 2025 and the near term, the sector is likely to remain focused on niche applications where the unique advantages of biodegradability outweigh current limitations.

Future Outlook: Roadmap to Mainstream Adoption by 2029

The outlook for biodegradable electronics manufacturing between 2025 and 2029 is shaped by accelerating innovation, regulatory momentum, and growing commercial interest. As environmental concerns and e-waste regulations intensify globally, the sector is poised for significant transformation, with several key players and initiatives paving the way toward mainstream adoption.

By 2025, the industry is expected to move beyond laboratory-scale prototypes toward scalable pilot production. Companies such as Samsung Electronics and Panasonic Corporation have publicly committed to sustainability initiatives, including research into eco-friendly materials and processes for electronic components. Samsung Electronics has announced investments in green technologies, with biodegradable substrates and packaging under development for select product lines. Meanwhile, Panasonic Corporation is exploring cellulose-based films and organic semiconductors for flexible, disposable sensors and RFID tags.

Material innovation is a central driver. BASF, a global leader in chemicals, is collaborating with electronics manufacturers to develop biodegradable polymers suitable for printed circuit boards and encapsulation. These materials are designed to decompose under industrial composting conditions, addressing the challenge of persistent e-waste. Stora Enso, a major supplier of renewable materials, is advancing paper-based substrates for printed electronics, targeting applications in smart packaging and single-use medical diagnostics.

On the regulatory front, the European Union’s Circular Electronics Initiative and similar policies in Asia are expected to set stricter requirements for recyclability and biodegradability in consumer electronics by 2027. This is likely to accelerate R&D and adoption, as manufacturers seek compliance and competitive advantage. Industry consortia such as the IEEE are also developing standards for biodegradable electronic components, which will facilitate interoperability and quality assurance.

Looking ahead to 2029, analysts anticipate that biodegradable electronics will capture a growing share of the market for disposable and short-lifecycle devices, such as environmental sensors, smart labels, and medical patches. The convergence of material science breakthroughs, regulatory incentives, and supply chain partnerships is expected to lower costs and improve performance, making biodegradable options viable for mainstream applications. Leading manufacturers, including Samsung Electronics, Panasonic Corporation, and material suppliers like BASF and Stora Enso, are likely to play pivotal roles in this transition, shaping the roadmap toward a more sustainable electronics industry by the end of the decade.

Sources & References

- STMicroelectronics

- IEEE

- Fujifilm Holdings Corporation

- Medtronic

- Boston Scientific

- Amcor

- DuPont

- Covestro

- Novamont

- Xerox Holdings Corporation

- 3D Systems Corporation

- Philips

- Smith+Nephew

- Infineon Technologies

- Semiconductor Industry Association

- European Commission

- International Organization for Standardization (ISO)

- Panasonic Corporation

- BASF