Biodegradable Electronics Manufacturing in 2025: Pioneering Sustainable Tech for a Greener Future. Explore How Eco-Friendly Innovation Is Transforming the Electronics Industry and What Lies Ahead.

- Executive Summary: Key Trends and Market Drivers in 2025

- Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

- Breakthrough Materials: Innovations in Biodegradable Substrates and Components

- Manufacturing Processes: Advances in Eco-Friendly Production Techniques

- Leading Companies and Industry Initiatives (e.g., flexenable.com, ieee.org)

- Applications: Consumer Electronics, Medical Devices, and IoT

- Regulatory Landscape and Environmental Standards

- Supply Chain and Sourcing of Biodegradable Materials

- Challenges: Technical, Economic, and Scalability Barriers

- Future Outlook: Strategic Opportunities and Next-Gen Developments

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

Biodegradable electronics manufacturing is poised for significant growth in 2025, driven by mounting environmental concerns, regulatory pressures, and rapid advances in materials science. The sector is witnessing a shift from traditional, non-degradable electronic components toward devices designed for minimal environmental impact at end-of-life. This transition is underpinned by the development of novel biodegradable substrates, conductors, and encapsulants, enabling the creation of fully or partially compostable electronic devices.

Key industry players are accelerating research and commercialization efforts. Samsung Electronics has publicly committed to sustainable product design, including the exploration of eco-friendly materials for future device generations. Similarly, Panasonic Corporation is investing in green electronics, with a focus on biodegradable polymers and printed circuit boards. These initiatives align with global sustainability goals and are expected to influence supply chain standards across the industry.

In 2025, regulatory frameworks in the European Union and parts of Asia are tightening restrictions on electronic waste, incentivizing manufacturers to adopt biodegradable alternatives. The European Commission’s Circular Economy Action Plan, for example, is pushing for eco-design requirements and extended producer responsibility, directly impacting electronics manufacturing practices. This regulatory momentum is prompting both established firms and startups to accelerate the development of biodegradable sensors, batteries, and flexible circuits.

Material innovation remains a central driver. Companies such as Stora Enso, a leader in renewable materials, are supplying cellulose-based substrates for printed electronics, while BASF is advancing biodegradable polymers suitable for electronic applications. These materials are being integrated into products ranging from medical implants to single-use environmental sensors, with pilot projects and early commercial deployments expected to scale in the next few years.

The outlook for 2025 and beyond is characterized by increased collaboration between electronics manufacturers, material suppliers, and research institutions. Industry consortia and public-private partnerships are accelerating the translation of laboratory breakthroughs into scalable manufacturing processes. As a result, the market for biodegradable electronics is expected to expand rapidly, particularly in sectors such as healthcare, environmental monitoring, and smart packaging. The convergence of regulatory drivers, consumer demand for sustainability, and technological innovation positions biodegradable electronics manufacturing as a key growth area in the global electronics industry.

Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

The biodegradable electronics manufacturing sector is poised for significant expansion between 2025 and 2030, driven by increasing environmental regulations, consumer demand for sustainable products, and technological advancements in materials science. As of 2025, the market is transitioning from early-stage pilot projects to more robust commercial applications, particularly in sectors such as medical devices, environmental sensors, and transient consumer electronics.

Key industry players—including Samsung Electronics, Fujifilm, and Zeon Corporation—are investing in research and development to scale up production of biodegradable substrates, conductive inks, and encapsulation materials. For example, Fujifilm has announced initiatives to develop organic and biodegradable materials for flexible electronics, while Zeon Corporation is advancing bio-based polymers for electronic applications. These efforts are supported by collaborations with academic institutions and government agencies to accelerate commercialization.

Although precise revenue figures for 2025 are not universally published by manufacturers, industry consensus and public statements from leading companies suggest that the global market for biodegradable electronics is expected to reach several hundred million USD by 2025, with projections indicating a compound annual growth rate (CAGR) of 20–30% through 2030. This rapid growth is underpinned by the increasing adoption of biodegradable sensors in medical diagnostics and environmental monitoring, as well as the integration of eco-friendly materials in consumer electronics.

The European Union’s Green Deal and similar regulatory frameworks in Asia and North America are catalyzing demand for sustainable electronics manufacturing. Companies such as Samsung Electronics have publicly committed to reducing electronic waste and increasing the use of recyclable and biodegradable materials in their product lines. These commitments are expected to translate into higher market penetration for biodegradable electronics, especially as supply chains adapt to new material requirements.

Looking ahead, the market outlook for 2025–2030 is optimistic, with expectations of mainstream adoption in select applications by the late 2020s. The sector’s growth will likely be further accelerated by advances in printable electronics, miniaturization, and the development of high-performance biodegradable semiconductors. As manufacturing processes mature and economies of scale are realized, the cost competitiveness of biodegradable electronics is anticipated to improve, paving the way for broader industry adoption and sustained revenue growth.

Breakthrough Materials: Innovations in Biodegradable Substrates and Components

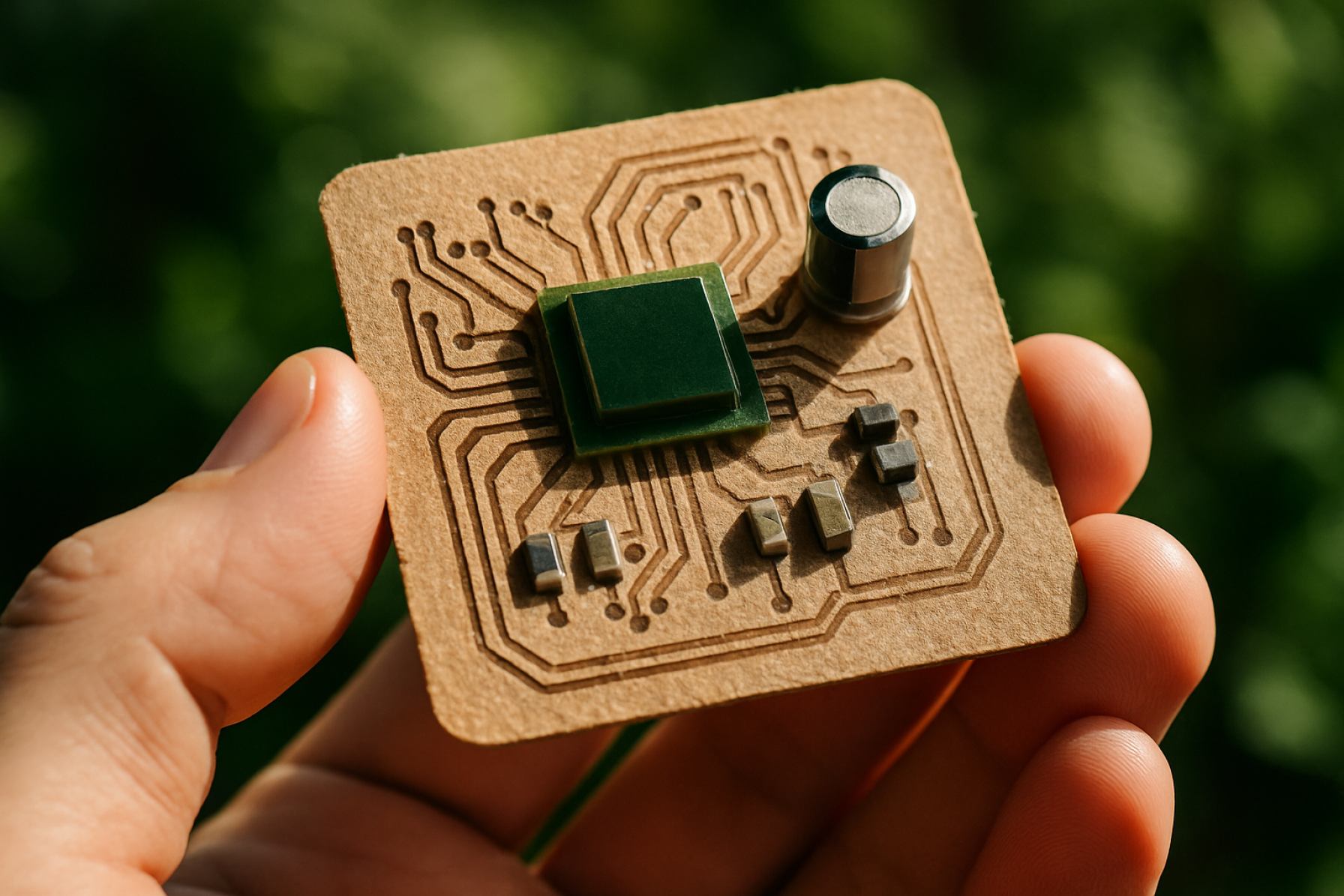

The landscape of biodegradable electronics manufacturing is rapidly evolving in 2025, driven by the urgent need to reduce electronic waste and the environmental impact of conventional devices. Central to this progress are breakthrough materials—particularly biodegradable substrates and components—that enable the creation of fully or partially compostable electronic devices. These innovations are not only reshaping the design and end-of-life management of electronics but also opening new markets in medical, environmental, and consumer applications.

A key area of advancement is the development of cellulose-based substrates. Cellulose, derived from plant sources, offers flexibility, transparency, and biodegradability, making it an attractive alternative to traditional plastics. Companies such as Stora Enso are at the forefront, leveraging their expertise in renewable materials to produce cellulose films suitable for printed electronics. These substrates are being integrated into sensors, RFID tags, and disposable medical devices, with pilot-scale manufacturing lines already operational.

Another significant innovation is the use of silk fibroin, a protein extracted from silkworm cocoons, as a substrate and encapsulation material. Silk-based electronics, pioneered by research collaborations with industry partners like FUJIFILM Corporation, demonstrate high biocompatibility and controlled degradation rates, making them ideal for transient medical implants and environmental sensors. In 2025, several start-ups and established firms are scaling up production of silk-based substrates, with clinical trials underway for bioresorbable electronic devices.

Conductive materials are also undergoing a transformation. Traditional metals are being replaced or supplemented with biodegradable alternatives such as magnesium, zinc, and iron, which naturally corrode in physiological environments. ZEON Corporation is actively developing conductive inks and pastes based on these metals, targeting applications in flexible and disposable electronics. Additionally, organic semiconductors derived from natural sources are being refined for use in transistors and diodes, with companies like Nitto Denko Corporation exploring scalable manufacturing processes.

Looking ahead, the outlook for biodegradable electronics manufacturing is promising. Industry consortia and standardization bodies are working to establish guidelines for compostability and safety, while manufacturers are investing in pilot plants and supply chain integration. As material performance improves and costs decrease, it is expected that biodegradable electronics will move from niche applications to mainstream adoption in the next few years, particularly in single-use medical devices, smart packaging, and environmental monitoring systems.

Manufacturing Processes: Advances in Eco-Friendly Production Techniques

Biodegradable electronics manufacturing is undergoing rapid transformation in 2025, driven by the urgent need to reduce electronic waste and environmental impact. The sector is witnessing significant advances in eco-friendly production techniques, with a focus on using renewable materials, green solvents, and low-energy processes. Key players in the field are scaling up pilot lines and commercial production, aiming to meet both regulatory pressures and growing consumer demand for sustainable electronics.

One of the most notable trends is the adoption of organic and cellulose-based substrates as alternatives to traditional plastics and silicon. Companies such as Sekisui Chemical are developing cellulose nanofiber films that serve as flexible, biodegradable bases for electronic circuits. These materials not only decompose naturally but also offer mechanical strength and transparency, making them suitable for displays, sensors, and packaging.

In parallel, the use of green solvents and water-based inks for printing conductive patterns is gaining traction. Novamont, a leader in bioplastics, is collaborating with electronics manufacturers to integrate compostable polymers and eco-friendly additives into printed circuit boards (PCBs). This approach reduces reliance on toxic chemicals and enables end-of-life composting or safe incineration.

Another breakthrough is the development of transient electronics—devices designed to dissolve or degrade after a predetermined period. Samsung Electronics has announced research initiatives into transient memory and sensor devices, leveraging water-soluble metals and biodegradable encapsulants. These innovations are expected to enter niche markets such as medical implants and environmental sensors by 2026.

Manufacturing processes are also shifting toward additive techniques, such as inkjet and screen printing, which minimize material waste and energy consumption. FlexEnable is pioneering roll-to-roll production of organic transistors on biodegradable substrates, enabling high-throughput fabrication of flexible displays and smart labels. This method aligns with circular economy principles by facilitating recycling and reducing the carbon footprint.

Looking ahead, the outlook for biodegradable electronics manufacturing is promising. Industry consortia and standards bodies, including the IEEE, are working to establish guidelines for eco-friendly materials and processes. As regulatory frameworks tighten and supply chains adapt, the next few years are likely to see broader commercialization of biodegradable electronics in consumer goods, healthcare, and environmental monitoring, marking a pivotal shift toward sustainable technology.

Leading Companies and Industry Initiatives (e.g., flexenable.com, ieee.org)

The landscape of biodegradable electronics manufacturing is rapidly evolving, with several pioneering companies and industry organizations spearheading research, development, and commercialization efforts as of 2025. These entities are addressing the growing demand for sustainable electronic solutions by leveraging novel materials, innovative fabrication techniques, and collaborative industry initiatives.

A notable leader in this space is FlexEnable, a UK-based company specializing in flexible organic electronics. While their primary focus has been on organic thin-film transistors (OTFTs) for flexible displays and sensors, FlexEnable has also explored the integration of biodegradable substrates and materials to reduce electronic waste. Their partnerships with material suppliers and device manufacturers are accelerating the adoption of eco-friendly electronics in consumer and industrial applications.

In Asia, several electronics giants are investing in biodegradable technologies. Samsung Electronics has announced research initiatives aimed at developing biodegradable polymers for use in flexible circuit boards and packaging, with pilot projects expected to reach prototype stage by 2026. Similarly, Panasonic Corporation is collaborating with academic institutions to create cellulose-based substrates for printed electronics, targeting applications in smart packaging and disposable medical devices.

On the materials front, BASF is advancing the development of compostable polymers suitable for electronic applications. Their work focuses on ensuring that these materials meet the electrical and mechanical requirements of next-generation devices while maintaining environmental compatibility. BASF’s collaborations with electronics manufacturers are expected to yield commercial products within the next few years.

Industry organizations are also playing a crucial role in standardizing and promoting biodegradable electronics. The IEEE has established working groups dedicated to the development of standards for sustainable electronics, including guidelines for biodegradability testing and lifecycle assessment. These efforts are fostering greater transparency and interoperability across the supply chain.

Looking ahead, the outlook for biodegradable electronics manufacturing is promising. With regulatory pressures mounting and consumer awareness of e-waste issues increasing, industry leaders are expected to accelerate investments in sustainable technologies. Collaborative initiatives between manufacturers, material suppliers, and standards bodies are likely to drive the commercialization of biodegradable electronic products, particularly in sectors such as healthcare, packaging, and single-use sensors, over the next several years.

Applications: Consumer Electronics, Medical Devices, and IoT

Biodegradable electronics manufacturing is rapidly gaining traction as a sustainable alternative to conventional electronic production, with significant implications for consumer electronics, medical devices, and the Internet of Things (IoT). As of 2025, the sector is witnessing a surge in research and pilot-scale commercialization, driven by mounting e-waste concerns and regulatory pressures for greener solutions.

In consumer electronics, biodegradable components are being integrated into single-use or short-lifecycle products such as smart packaging, environmental sensors, and wearable devices. Companies like Samsung Electronics have publicly committed to exploring eco-friendly materials and processes, with ongoing R&D into biodegradable substrates and casings for select product lines. Similarly, Panasonic Corporation has announced initiatives to reduce plastic use and investigate cellulose-based materials for electronic applications, aiming to introduce more sustainable options in the near future.

The medical device sector is a particularly promising field for biodegradable electronics, where transient implants and diagnostic sensors can safely dissolve in the body after use, eliminating the need for surgical removal. Medtronic, a global leader in medical technology, has invested in partnerships with academic institutions to develop bioresorbable electronic sensors for post-operative monitoring. These devices are designed to function for a predetermined period before harmlessly degrading, reducing patient risk and healthcare costs. Additionally, Boston Scientific is exploring biodegradable materials for temporary cardiac and neural implants, with several prototypes undergoing preclinical evaluation as of 2025.

In the IoT domain, the proliferation of disposable sensors for environmental monitoring, agriculture, and logistics is fueling demand for biodegradable alternatives. STMicroelectronics, a major semiconductor manufacturer, has initiated pilot projects to develop printed circuit boards (PCBs) and sensor substrates using cellulose nanofibers and other compostable materials. These efforts are aimed at reducing the environmental footprint of billions of IoT nodes expected to be deployed in the coming years. Furthermore, Texas Instruments is collaborating with supply chain partners to test biodegradable packaging and encapsulation for low-power IoT chips, targeting large-scale field trials by 2026.

Looking ahead, the outlook for biodegradable electronics manufacturing is optimistic, with industry leaders and startups alike accelerating innovation. Regulatory incentives in the EU and Asia, combined with growing consumer awareness, are expected to drive broader adoption across these application areas. However, challenges remain in scaling up production, ensuring device reliability, and achieving cost parity with traditional electronics. Continued collaboration between manufacturers, material suppliers, and end-users will be crucial to realizing the full potential of biodegradable electronics in the next few years.

Regulatory Landscape and Environmental Standards

The regulatory landscape for biodegradable electronics manufacturing is rapidly evolving as governments and industry bodies respond to mounting concerns over electronic waste (e-waste) and environmental sustainability. In 2025, the European Union continues to lead with its comprehensive regulatory framework, notably the Waste Electrical and Electronic Equipment (WEEE) Directive and the Restriction of Hazardous Substances (RoHS) Directive, both of which are being updated to encourage the use of biodegradable and non-toxic materials in electronic products. The EU’s Circular Economy Action Plan, part of the European Green Deal, specifically highlights the need for sustainable product design, including electronics, and is expected to introduce stricter eco-design requirements in the coming years.

In the United States, the Environmental Protection Agency (EPA) is increasing its focus on sustainable electronics through voluntary programs and partnerships, such as the Sustainable Materials Management (SMM) Electronics Challenge. While federal regulations remain less prescriptive than in the EU, several states—most notably California—are considering or have enacted legislation to incentivize the development and adoption of biodegradable electronic components. These efforts are complemented by industry standards from organizations like the IEEE, which is developing guidelines for the assessment and certification of biodegradable electronic materials and devices.

Asia-Pacific countries, particularly Japan and South Korea, are also advancing regulatory measures. Japan’s Ministry of the Environment is piloting initiatives to promote green electronics, while South Korea’s Ministry of Environment is updating its Extended Producer Responsibility (EPR) scheme to include incentives for biodegradable and recyclable electronics. China, as the world’s largest electronics manufacturer, is gradually integrating environmental standards into its industrial policies, with the Ministry of Industry and Information Technology (MIIT) supporting research and pilot projects in biodegradable electronics.

On the industry side, leading manufacturers such as Samsung Electronics and Panasonic Corporation are actively participating in international standardization efforts and collaborating with regulatory bodies to shape future requirements. These companies are investing in R&D to develop biodegradable substrates, inks, and encapsulation materials that meet both performance and environmental criteria. Industry associations like the FlexTech Alliance are also working to establish best practices and certification schemes for biodegradable electronics manufacturing.

Looking ahead, the regulatory environment is expected to become more stringent, with harmonized global standards likely to emerge by the late 2020s. Manufacturers will need to adapt to evolving requirements, including transparent supply chains, lifecycle assessments, and end-of-life management protocols. The convergence of regulatory pressure and industry innovation is poised to accelerate the adoption of biodegradable electronics, supporting broader sustainability goals and reducing the environmental impact of the electronics sector.

Supply Chain and Sourcing of Biodegradable Materials

The supply chain and sourcing of biodegradable materials for electronics manufacturing are rapidly evolving as the industry seeks sustainable alternatives to conventional plastics and metals. In 2025, the focus is on scaling up the availability of biopolymers, natural fibers, and organic semiconductors that can meet the performance and reliability standards required for electronic devices, while also ensuring environmental compatibility.

Key materials in this sector include polylactic acid (PLA), cellulose derivatives, silk proteins, and other biopolymers, which are being integrated into substrates, encapsulants, and even conductive components. BASF, a global leader in chemicals, has expanded its portfolio of biodegradable polymers, such as ecovio®, which are being evaluated for use in flexible circuit boards and packaging for electronics. Similarly, Novamont is advancing the production of Mater-Bi®, a family of biodegradable and compostable bioplastics, with potential applications in electronic device casings and insulation.

On the semiconductor side, companies like Merck KGaA are developing organic electronic materials, including biodegradable semiconductors and dielectrics, which are crucial for transient electronics and medical implants. These materials are sourced from renewable feedstocks and are designed to decompose safely after their functional life. The supply chain for such advanced materials is still maturing, with partnerships forming between chemical producers, electronics manufacturers, and research institutions to ensure consistent quality and scalability.

Natural fibers such as cellulose and silk are also gaining traction. Stora Enso, a major provider of renewable materials, is supplying cellulose-based substrates for printed electronics, while companies like Amyris are leveraging synthetic biology to produce bio-based building blocks for electronic components. These efforts are supported by investments in biorefinery infrastructure and the development of traceable, sustainable sourcing practices.

Looking ahead, the outlook for the supply chain of biodegradable electronics materials is positive, with increased investment in biopolymer production capacity and the establishment of regional supply hubs to reduce transportation emissions. Industry collaborations, such as those facilitated by Electronic Components Industry Association, are expected to standardize material specifications and promote responsible sourcing. However, challenges remain in ensuring the cost competitiveness and performance parity of biodegradable materials compared to traditional options, which will be a key focus for manufacturers and suppliers through 2025 and beyond.

Challenges: Technical, Economic, and Scalability Barriers

Biodegradable electronics manufacturing, while promising for reducing electronic waste and environmental impact, faces a range of technical, economic, and scalability challenges as of 2025. These barriers must be addressed for the sector to transition from laboratory-scale innovation to widespread commercial adoption.

Technical Barriers remain significant. The development of biodegradable substrates, conductors, and semiconductors that match the performance and reliability of conventional materials is ongoing. For instance, while cellulose-based substrates and silk fibroin have shown promise, their mechanical and electrical properties often lag behind traditional plastics and silicon. Achieving stable device operation over a required lifespan, followed by predictable degradation, is a complex materials science challenge. Companies such as Samsung Electronics and TDK Corporation have demonstrated interest in sustainable materials research, but fully biodegradable, high-performance components remain largely at the prototype stage.

Another technical hurdle is the integration of biodegradable components with existing manufacturing processes. Most current electronics fabrication lines are optimized for non-degradable materials, and adapting these for new materials can require significant retooling. Furthermore, ensuring compatibility between biodegradable and non-biodegradable components—often necessary in hybrid devices—adds complexity to design and assembly.

Economic Barriers are closely tied to the technical challenges. The cost of sourcing, processing, and scaling up biodegradable materials is currently higher than for established alternatives. For example, companies like STMicroelectronics have explored eco-friendly packaging and substrates, but the price premium for biodegradable options remains a deterrent for mass-market applications. Additionally, the lack of established supply chains for biodegradable materials increases procurement risk and cost volatility.

Scalability Barriers are evident as most biodegradable electronics are produced at laboratory or pilot scale. Scaling up to industrial volumes requires not only reliable material supply but also robust quality control and process standardization. Industry consortia such as the SEMI are beginning to address these issues by fostering collaboration between material suppliers, device manufacturers, and end-users. However, the absence of universally accepted standards for biodegradability and device performance complicates efforts to harmonize production and certification.

Looking ahead, overcoming these barriers will require coordinated investment in R&D, supply chain development, and standardization. As regulatory and consumer pressure for sustainable electronics grows, industry leaders and organizations are expected to accelerate efforts to resolve these challenges, but significant progress is likely to unfold over the next several years rather than immediately.

Future Outlook: Strategic Opportunities and Next-Gen Developments

The future of biodegradable electronics manufacturing is poised for significant transformation as the industry responds to mounting environmental concerns and regulatory pressures. In 2025 and the coming years, strategic opportunities are emerging at the intersection of material innovation, scalable production, and integration into mainstream electronic applications.

Key players in the sector are accelerating the development of next-generation biodegradable substrates, conductors, and encapsulants. Samsung Electronics has publicly committed to advancing eco-friendly materials in its product lines, with ongoing research into biodegradable polymers for flexible displays and wearable devices. Similarly, Panasonic Corporation is investing in cellulose-based substrates and organic semiconductors, aiming to reduce the environmental footprint of consumer electronics.

In the medical device sector, Medtronic and Boston Scientific are exploring transient electronics—devices designed to dissolve harmlessly in the body after use. These efforts are expected to yield commercial products within the next few years, particularly in temporary implants and diagnostic sensors, aligning with the growing demand for sustainable healthcare solutions.

Manufacturing scalability remains a central challenge and opportunity. Companies such as TDK Corporation are piloting roll-to-roll printing techniques for biodegradable circuits, which could enable mass production at lower costs. Meanwhile, STMicroelectronics is collaborating with academic partners to optimize the performance and reliability of biodegradable microchips, targeting applications in smart packaging and environmental monitoring.

Strategically, the sector is witnessing increased cross-industry partnerships. For example, electronics manufacturers are working with material suppliers and recycling organizations to establish closed-loop systems for biodegradable components. This collaborative approach is expected to accelerate the adoption of standards and certifications, facilitating market entry and consumer trust.

Looking ahead, regulatory frameworks in the European Union and Asia are likely to drive further innovation, as extended producer responsibility and eco-design directives become more stringent. The convergence of policy, technology, and market demand positions biodegradable electronics as a critical growth area. By 2027, industry analysts anticipate that biodegradable components will begin to penetrate mainstream consumer and industrial markets, with early adoption in wearables, medical devices, and smart packaging.

In summary, the next few years will be pivotal for biodegradable electronics manufacturing, with strategic opportunities centered on material breakthroughs, scalable production, and cross-sector collaboration. Companies that invest in these areas are well-positioned to lead the transition toward a more sustainable electronics industry.

Sources & References

- BASF

- Fujifilm

- Zeon Corporation

- Sekisui Chemical

- Novamont

- FlexEnable

- IEEE

- Medtronic

- Boston Scientific

- STMicroelectronics

- Texas Instruments

- Amyris