Biodegradable Electronics Manufacturing Industry Report 2025: Market Dynamics, Technology Advances, and Growth Projections. Explore Key Trends, Regional Insights, and Strategic Opportunities Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Biodegradable Electronics

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Barriers to Adoption

- Opportunities and Strategic Recommendations

- Future Outlook: Innovation Pathways and Market Evolution

- Sources & References

Executive Summary & Market Overview

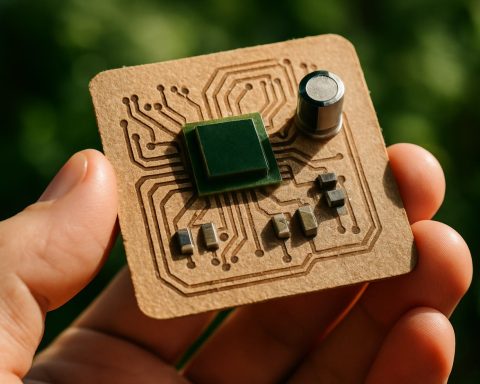

Biodegradable electronics manufacturing represents a transformative shift in the electronics industry, aiming to address the mounting environmental concerns associated with electronic waste (e-waste). Biodegradable electronics, also known as transient electronics, are designed to perform their function for a predetermined period before safely decomposing into environmentally benign byproducts. This market segment leverages materials such as cellulose, silk proteins, polylactic acid (PLA), and magnesium, which can break down naturally, reducing the long-term ecological footprint of discarded devices.

In 2025, the global biodegradable electronics manufacturing market is poised for significant growth, driven by increasing regulatory pressures, consumer demand for sustainable products, and rapid advancements in material science. According to IDTechEx, the market for biodegradable electronics is expected to expand at a compound annual growth rate (CAGR) exceeding 20% through the next decade, with applications spanning medical implants, environmental sensors, and disposable consumer electronics.

Key drivers include stringent e-waste management regulations in regions such as the European Union and North America, where directives like the Waste Electrical and Electronic Equipment (WEEE) Directive are pushing manufacturers to adopt greener alternatives. Additionally, the proliferation of single-use medical devices and the growing adoption of Internet of Things (IoT) sensors in agriculture and environmental monitoring are catalyzing demand for biodegradable solutions. Leading research institutions and companies, including imec and Samsung Electronics, are investing in R&D to enhance the performance and scalability of biodegradable components.

Despite its promise, the market faces challenges such as high production costs, limited material durability, and the need for standardized testing protocols. However, ongoing innovations in organic semiconductors and printable electronics are expected to mitigate these barriers. Strategic collaborations between material suppliers, device manufacturers, and end-users are also accelerating commercialization efforts.

In summary, the biodegradable electronics manufacturing market in 2025 is characterized by robust innovation, regulatory momentum, and a growing ecosystem of stakeholders committed to sustainable electronics. As the industry matures, it is likely to play a pivotal role in reducing global e-waste and shaping the future of green technology.

Key Technology Trends in Biodegradable Electronics

Biodegradable electronics manufacturing in 2025 is characterized by rapid advancements in materials science, process engineering, and scalable fabrication techniques. The sector is witnessing a shift from laboratory-scale prototypes to pilot and commercial-scale production, driven by increasing demand for sustainable electronic solutions in medical devices, environmental sensors, and transient consumer electronics.

One of the most significant trends is the adoption of green materials, such as cellulose nanofibers, silk fibroin, polylactic acid (PLA), and magnesium, which serve as substrates, conductors, and encapsulants. These materials are not only biodegradable but also compatible with existing microfabrication processes, enabling integration with conventional electronics manufacturing lines. For instance, research collaborations and industry partnerships are accelerating the development of printable inks based on organic semiconductors and biodegradable metals, facilitating the production of flexible and transient circuits using inkjet and screen printing methods (IDTechEx).

Process innovation is another key trend, with roll-to-roll (R2R) manufacturing and additive manufacturing (3D printing) gaining traction for their scalability and cost-effectiveness. R2R techniques allow continuous production of thin-film biodegradable devices, reducing material waste and energy consumption. Meanwhile, 3D printing enables the fabrication of complex, multi-material structures tailored for specific degradation profiles and functional requirements (Frost & Sullivan).

Quality control and standardization are emerging as critical focus areas. Manufacturers are investing in advanced metrology tools and in-line monitoring systems to ensure device reliability, performance consistency, and predictable degradation rates. This is particularly important for medical implants and environmental sensors, where device failure or incomplete degradation could have significant consequences (IEEE).

- Integration of biodegradable components with conventional silicon-based chips for hybrid devices.

- Development of water-soluble and compostable packaging for electronic modules.

- Collaborative efforts between academia, industry, and regulatory bodies to establish manufacturing standards and certification protocols.

Overall, the manufacturing landscape for biodegradable electronics in 2025 is defined by a convergence of sustainable materials, scalable processes, and rigorous quality assurance, positioning the industry for broader commercialization and regulatory acceptance.

Competitive Landscape and Leading Players

The competitive landscape of the biodegradable electronics manufacturing sector in 2025 is characterized by a dynamic mix of established electronics firms, innovative startups, and research-driven collaborations. The market is still in its nascent stage but is rapidly evolving due to increasing regulatory pressure for sustainable solutions and growing consumer demand for eco-friendly products. Key players are focusing on the development of biodegradable substrates, conductive inks, and fully compostable components to differentiate their offerings.

Leading the market are companies such as Samsung Electronics and Panasonic Corporation, both of which have invested in R&D for green electronics and have announced pilot projects for biodegradable sensors and flexible circuits. These conglomerates leverage their scale and supply chain expertise to accelerate commercialization. Meanwhile, startups like Beonchip and Bioinicia are gaining traction by focusing on niche applications such as biodegradable medical implants and transient electronics for environmental monitoring.

Academic and industry partnerships are also pivotal. For instance, imec collaborates with both startups and established manufacturers to develop cellulose-based substrates and water-soluble electronic components. Such collaborations are crucial for bridging the gap between laboratory innovation and scalable manufacturing.

Geographically, Europe and Asia-Pacific are at the forefront, driven by stringent environmental regulations and robust funding for sustainable technology. The European Union’s Green Deal and similar initiatives in South Korea and Japan are fostering a competitive environment where both local and multinational players are incentivized to innovate.

- Samsung Electronics: Focused on biodegradable sensors and flexible displays.

- Panasonic Corporation: Investing in compostable circuit boards and packaging.

- Beonchip: Specializes in biodegradable lab-on-a-chip devices.

- Bioinicia: Develops biodegradable substrates for medical and environmental applications.

- imec: Research leader in sustainable electronics materials and processes.

The competitive landscape is expected to intensify as more players enter the market and as regulatory frameworks mature, pushing for higher standards of biodegradability and performance. Strategic alliances, intellectual property development, and vertical integration are likely to be key strategies for market leadership in 2025 and beyond.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The biodegradable electronics manufacturing market is poised for significant expansion between 2025 and 2030, driven by increasing environmental regulations, consumer demand for sustainable products, and rapid advancements in materials science. According to projections by MarketsandMarkets, the global biodegradable electronics market is expected to register a compound annual growth rate (CAGR) of approximately 22% during this period. This robust growth is underpinned by the rising adoption of eco-friendly alternatives in consumer electronics, medical devices, and packaging solutions.

Revenue forecasts indicate that the market, valued at around USD 100 million in 2024, could surpass USD 270 million by 2030, reflecting both increased production volumes and higher average selling prices as technology matures and scales. The Asia-Pacific region is anticipated to lead in both revenue and volume, owing to strong government initiatives, a large manufacturing base, and growing investments in green technologies. North America and Europe are also expected to see substantial growth, particularly in sectors such as healthcare and wearable electronics, where regulatory pressures and consumer awareness are high.

Volume analysis suggests that unit shipments of biodegradable electronic components—such as sensors, transistors, and circuit boards—will grow at a CAGR exceeding 20% through 2030. This surge is attributed to the integration of biodegradable materials in single-use medical devices, smart packaging, and short-lifecycle consumer gadgets. The medical sector, in particular, is projected to account for a significant share of volume growth, as demand rises for implantable and disposable devices that minimize environmental impact post-use.

- Key Drivers: Stringent environmental policies, technological breakthroughs in organic and cellulose-based substrates, and increased R&D funding.

- Challenges: High production costs, scalability issues, and the need for improved performance parity with conventional electronics.

- Opportunities: Expansion into emerging markets, partnerships with major electronics manufacturers, and the development of new application areas such as smart agriculture and environmental monitoring.

Overall, the 2025–2030 period is expected to be transformative for biodegradable electronics manufacturing, with strong double-digit growth rates and expanding market opportunities across multiple sectors, as confirmed by industry analyses from IDTechEx and Grand View Research.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global biodegradable electronics manufacturing market is experiencing differentiated growth across regions, driven by regulatory frameworks, R&D investments, and consumer awareness. In 2025, North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present unique dynamics shaping the adoption and production of biodegradable electronics.

North America remains a leader in R&D and early-stage commercialization, propelled by robust funding and a strong ecosystem of startups and academic institutions. The United States, in particular, benefits from government initiatives supporting sustainable electronics and partnerships between universities and industry. Companies such as Xerox and research centers like National Science Foundation are at the forefront of developing biodegradable sensors and circuit boards. However, large-scale manufacturing is still nascent, with most activity focused on prototyping and pilot projects.

Europe is characterized by stringent environmental regulations and ambitious circular economy targets, which are accelerating the adoption of biodegradable electronics. The European Union’s Green Deal and directives on electronic waste are compelling manufacturers to invest in eco-friendly alternatives. Germany, France, and the Netherlands are notable hubs, with companies such as Infineon Technologies and research consortia like CORDIS driving innovation. The region is witnessing increased commercialization, particularly in medical devices and smart packaging.

Asia-Pacific is emerging as a manufacturing powerhouse, leveraging its established electronics supply chain and cost advantages. Countries like China, Japan, and South Korea are investing in scaling up production, with a focus on biodegradable substrates and flexible electronics. Major players such as Samsung Electronics and Panasonic are exploring biodegradable components for consumer electronics and IoT devices. The region’s growth is further supported by government incentives and rising environmental consciousness among consumers.

- Rest of the World (RoW) markets, including Latin America and the Middle East, are in the early stages of adoption. Activity is primarily limited to pilot projects and academic research, with limited commercial manufacturing. However, increasing awareness of e-waste issues and international collaborations are expected to spur gradual growth.

Overall, while Europe and North America lead in innovation and regulatory frameworks, Asia-Pacific is poised to dominate large-scale manufacturing by 2025, setting the stage for global expansion of biodegradable electronics manufacturing.

Challenges, Risks, and Barriers to Adoption

The manufacturing of biodegradable electronics in 2025 faces a complex array of challenges, risks, and barriers that hinder widespread adoption and scalability. While the promise of reducing electronic waste and environmental impact is significant, several technical, economic, and regulatory factors must be addressed.

- Material Performance and Stability: Biodegradable electronic components often rely on novel organic or bio-based materials, which can suffer from limited electrical performance, shorter operational lifespans, and sensitivity to environmental factors such as humidity and temperature. Achieving parity with conventional silicon-based electronics in terms of reliability and durability remains a significant hurdle, as highlighted by IDTechEx.

- Manufacturing Process Integration: Existing semiconductor fabrication infrastructure is optimized for traditional materials and processes. Integrating biodegradable materials often requires new equipment, modified process flows, and stringent contamination controls, leading to increased capital expenditure and operational complexity. According to IEEE, the lack of standardized manufacturing protocols for biodegradable electronics further complicates large-scale production.

- Cost Competitiveness: The high cost of sourcing, synthesizing, and processing biodegradable materials, combined with lower yields and shorter product lifespans, makes these devices less economically attractive compared to conventional alternatives. MarketsandMarkets notes that cost remains a primary barrier, especially for consumer electronics applications where price sensitivity is high.

- Regulatory and Certification Uncertainty: The absence of clear regulatory frameworks and industry standards for biodegradable electronics creates uncertainty for manufacturers and end-users. Certification processes for biodegradability, safety, and environmental impact are still evolving, as reported by UL Solutions, making it difficult for companies to guarantee compliance and market acceptance.

- Supply Chain and Scalability: The supply chain for biodegradable materials is less mature than that for traditional electronics, with limited suppliers and inconsistent quality. Scaling up production to meet commercial demand poses logistical and quality assurance challenges, as observed by FlexTech Alliance.

Addressing these challenges will require coordinated efforts in research, standardization, and investment to unlock the full potential of biodegradable electronics manufacturing in the coming years.

Opportunities and Strategic Recommendations

The biodegradable electronics manufacturing sector is poised for significant growth in 2025, driven by increasing regulatory pressure to reduce electronic waste, rising consumer demand for sustainable products, and rapid advancements in materials science. Key opportunities and strategic recommendations for stakeholders in this market are outlined below.

- Expansion into Medical and Healthcare Devices: Biodegradable electronics are particularly well-suited for temporary medical implants, drug delivery systems, and diagnostic sensors. The global medical device market’s shift toward minimally invasive and patient-friendly solutions creates a lucrative opportunity for manufacturers to collaborate with healthcare providers and research institutions. Companies like Medtronic and Boston Scientific are actively exploring bioresorbable electronics, indicating strong industry interest.

- Strategic Partnerships for R&D: The complexity of developing high-performance biodegradable materials necessitates collaboration between electronics manufacturers, material scientists, and academic institutions. Strategic alliances with universities and research centers, such as those supported by the National Science Foundation, can accelerate innovation and reduce time-to-market for new products.

- Targeting Consumer Electronics and Packaging: As sustainability becomes a key purchasing criterion, there is growing potential for biodegradable components in single-use consumer electronics (e.g., festival wristbands, smart packaging, and disposable sensors). Companies like Samsung and Apple have made public commitments to environmental responsibility, suggesting a favorable environment for partnerships or supply agreements.

- Leveraging Government Incentives and Compliance: Regulatory frameworks in the EU, US, and Asia are increasingly favoring eco-friendly manufacturing. Tapping into government grants, tax incentives, and green procurement programs can offset R&D costs and improve margins. The European Commission and US Environmental Protection Agency are key sources of such support.

- Scaling Production and Supply Chain Optimization: To meet anticipated demand, manufacturers should invest in scalable production technologies and secure reliable sources of biodegradable raw materials. Building relationships with suppliers of biopolymers and organic semiconductors, such as Novamont and BASF, will be critical.

In summary, 2025 presents a pivotal year for biodegradable electronics manufacturing. Companies that prioritize innovation, strategic partnerships, and regulatory alignment are best positioned to capture emerging market opportunities and drive sustainable growth.

Future Outlook: Innovation Pathways and Market Evolution

The future outlook for biodegradable electronics manufacturing in 2025 is shaped by accelerating innovation, regulatory momentum, and evolving market demands for sustainable solutions. As environmental concerns intensify and electronic waste (e-waste) volumes continue to rise, the industry is witnessing a paradigm shift toward the development and commercialization of eco-friendly electronic components and devices. Key innovation pathways include the advancement of organic and bio-based materials, such as cellulose nanofibers, silk proteins, and polylactic acid, which are being engineered to replace conventional plastics and metals in substrates, conductors, and encapsulants. These materials not only offer biodegradability but also enable new device architectures, such as transient electronics that dissolve after use, minimizing environmental impact.

In 2025, research and development efforts are increasingly focused on improving the performance, scalability, and cost-effectiveness of biodegradable electronics. Notable breakthroughs are emerging from collaborations between academic institutions and industry leaders, with significant investments in pilot-scale manufacturing and process optimization. For instance, companies are leveraging additive manufacturing and printing technologies to fabricate flexible, low-power devices for applications in medical implants, environmental sensors, and smart packaging. The integration of biodegradable electronics into the Internet of Things (IoT) ecosystem is also anticipated to drive market growth, as demand rises for disposable, single-use, or short-lifecycle devices that do not contribute to long-term waste streams.

- Regulatory and Policy Drivers: Governments in Europe, North America, and Asia-Pacific are introducing stricter e-waste management regulations and incentivizing the adoption of sustainable materials, which is expected to accelerate the commercialization of biodegradable electronics. The European Union’s Circular Economy Action Plan and the U.S. Environmental Protection Agency’s initiatives are particularly influential in shaping industry standards and market entry requirements (European Commission, U.S. Environmental Protection Agency).

- Market Evolution: According to recent market analyses, the global biodegradable electronics market is projected to grow at a double-digit CAGR through 2030, with Asia-Pacific and Europe leading in both innovation and adoption (MarketsandMarkets). Key sectors include healthcare, environmental monitoring, and consumer electronics, where sustainability is becoming a core purchasing criterion.

Looking ahead, the convergence of material science innovation, supportive policy frameworks, and rising consumer awareness is set to redefine the competitive landscape of electronics manufacturing. Companies that invest in scalable, high-performance biodegradable solutions are likely to capture early market share and set industry benchmarks for sustainability in 2025 and beyond.

Sources & References

- IDTechEx

- imec

- Frost & Sullivan

- IEEE

- Beonchip

- Bioinicia

- MarketsandMarkets

- Grand View Research

- Xerox

- National Science Foundation

- Infineon Technologies

- CORDIS

- UL Solutions

- Medtronic

- Apple

- European Commission

- Novamont

- BASF