Conductive Textile Development in 2025: Unraveling the Future of Smart Fabrics and Electronic Integration. Explore How Advanced Materials Are Transforming Wearables, Healthcare, and Beyond.

- Executive Summary: Key Findings and Market Highlights

- Market Overview: Defining Conductive Textiles and Their Applications

- 2025 Market Size and Growth Forecast (CAGR 2025–2030)

- Key Drivers: IoT, Wearables, and E-Textile Adoption

- Emerging Technologies: Materials, Manufacturing, and Integration

- Competitive Landscape: Leading Players and Startups to Watch

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges and Barriers: Technical, Regulatory, and Supply Chain

- Future Outlook: Disruptive Trends and Opportunities Through 2030

- Appendix: Methodology, Data Sources, and Market Growth Calculation

- Sources & References

Executive Summary: Key Findings and Market Highlights

The global development of conductive textiles is poised for significant growth in 2025, driven by advancements in material science, increasing demand for wearable electronics, and expanding applications across healthcare, sports, military, and industrial sectors. Conductive textiles, which integrate conductive fibers or coatings into fabrics, enable the transmission of electrical signals and power, opening new possibilities for smart clothing, sensors, and flexible electronic devices.

Key findings indicate that the market is being shaped by rapid innovation in fiber technology, with leading manufacturers such as Toray Industries, Inc. and Teijin Limited investing heavily in research and development. These companies are focusing on enhancing conductivity, durability, and washability of textiles, addressing critical challenges for commercial adoption. The integration of nanomaterials, such as silver nanowires and graphene, is further improving performance and enabling thinner, more flexible fabrics.

Healthcare remains a primary driver, with conductive textiles being used in remote patient monitoring, smart bandages, and rehabilitation devices. Organizations like Philips are collaborating with textile innovators to develop garments that monitor vital signs and deliver real-time data. In sports and fitness, smart apparel embedded with sensors is gaining traction for performance tracking and injury prevention.

The military and defense sector is also a significant adopter, leveraging conductive textiles for lightweight, integrated communication systems and physiological monitoring in uniforms. U.S. Army Natick Soldier Systems Center continues to explore advanced e-textile solutions for enhanced soldier safety and operational efficiency.

Regionally, Asia-Pacific leads in production and innovation, supported by robust manufacturing infrastructure and government initiatives. Europe and North America are witnessing increased adoption, particularly in high-value applications and collaborative research projects.

Despite strong momentum, the industry faces challenges related to scalability, cost, and standardization. Efforts by organizations such as the American Association of Textile Chemists and Colorists (AATCC) are underway to establish testing protocols and quality benchmarks, which are expected to accelerate market maturity.

In summary, 2025 is set to be a pivotal year for conductive textile development, with technological breakthroughs, cross-industry partnerships, and expanding end-use cases driving robust market growth and innovation.

Market Overview: Defining Conductive Textiles and Their Applications

Conductive textiles are fabrics engineered to conduct electricity, achieved by integrating conductive materials such as metal fibers, carbon, or conductive polymers into traditional textile substrates. This unique property enables a wide range of applications across industries, including healthcare, sports, military, automotive, and consumer electronics. The development of conductive textiles has accelerated in recent years, driven by advancements in material science and the growing demand for smart, wearable technologies.

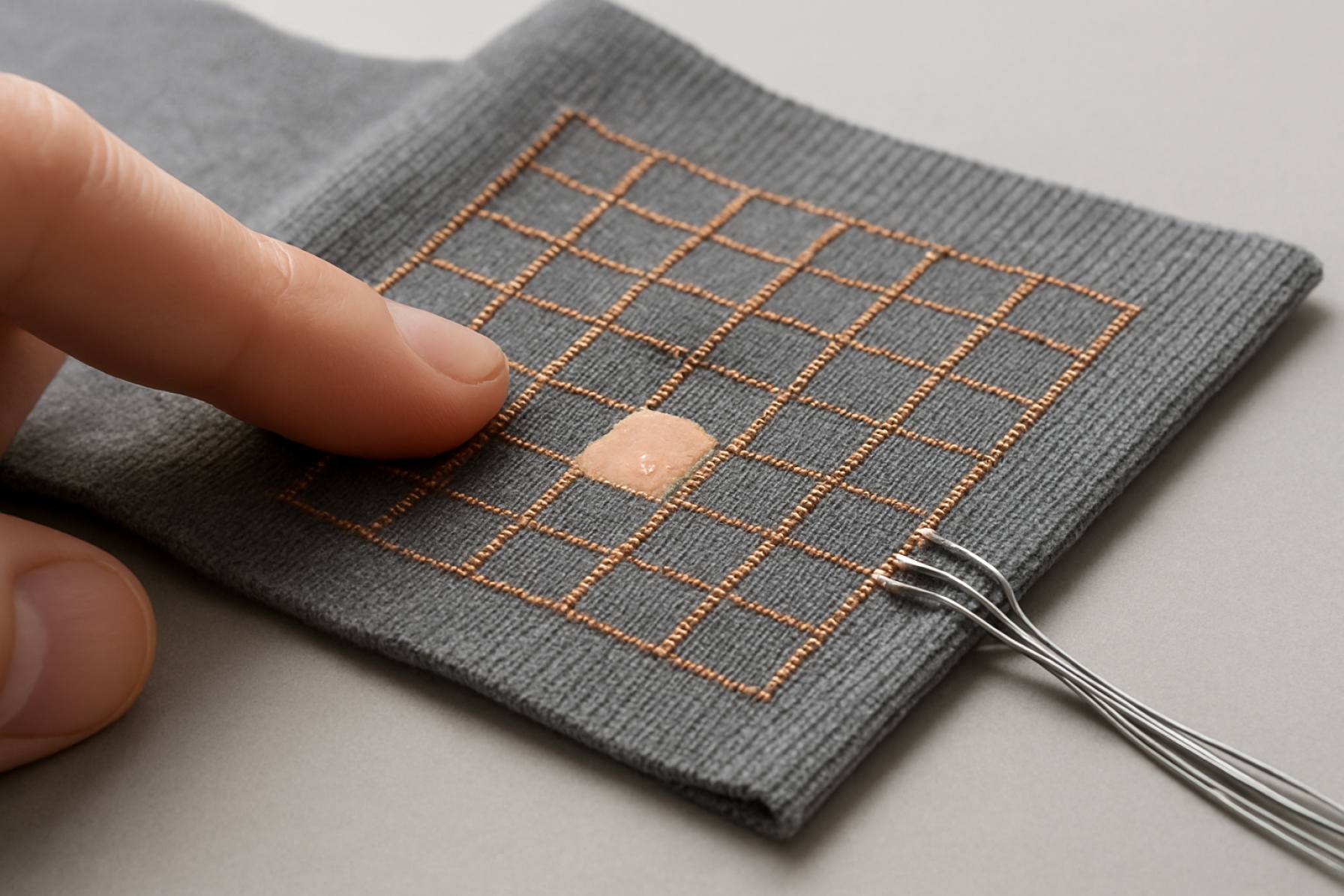

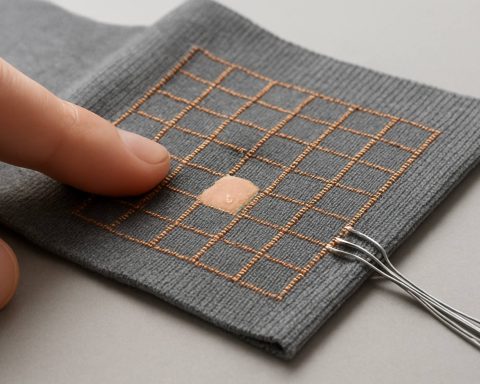

In 2025, the market for conductive textiles is characterized by rapid innovation and diversification of applications. In healthcare, conductive fabrics are used in wearable sensors for real-time health monitoring, such as electrocardiogram (ECG) shirts and smart bandages that track wound healing. The sports and fitness sector leverages these textiles for performance monitoring and injury prevention, integrating sensors directly into athletic wear. Military and defense applications include uniforms with embedded communication systems and physiological monitoring, enhancing soldier safety and operational efficiency.

Automotive manufacturers are incorporating conductive textiles into vehicle interiors for touch-sensitive controls and heated seating, improving user experience and energy efficiency. In consumer electronics, the integration of conductive fabrics into smart clothing and accessories is enabling new forms of human-device interaction, such as gesture-controlled devices and interactive garments. The fashion industry is also exploring aesthetic and functional uses, blending technology with design to create innovative products.

Key players in the development and commercialization of conductive textiles include Toray Industries, Inc., DuPont, and Textronics, Inc., each contributing to advancements in material performance, durability, and scalability. Industry organizations such as the American Association of Textile Chemists and Colorists (AATCC) are actively involved in setting standards and supporting research in this field.

As the market matures, challenges such as washability, durability, and cost-effectiveness remain focal points for research and development. However, the convergence of electronics and textiles is expected to continue reshaping industries, with conductive textiles playing a pivotal role in the evolution of smart, connected products.

2025 Market Size and Growth Forecast (CAGR 2025–2030)

The global conductive textile market is poised for significant expansion in 2025, driven by increasing demand across sectors such as healthcare, sportswear, military, and consumer electronics. Conductive textiles—fabrics integrated with conductive materials like silver, copper, or carbon—enable the transmission of electrical signals, making them essential for wearable technology, smart clothing, and flexible electronic devices.

According to industry projections, the market size for conductive textiles is expected to surpass USD 3.5 billion in 2025, reflecting robust adoption in both developed and emerging economies. This growth is underpinned by ongoing advancements in textile engineering, miniaturization of electronic components, and the proliferation of Internet of Things (IoT) applications. The healthcare sector, in particular, is anticipated to be a major driver, with smart garments for patient monitoring and rehabilitation gaining traction. Similarly, the sports and fitness industry is integrating conductive textiles into apparel for real-time biometric tracking and performance analytics.

From 2025 to 2030, the conductive textile market is forecasted to achieve a compound annual growth rate (CAGR) of approximately 15–18%. This acceleration is attributed to increased R&D investments by leading manufacturers and the entry of new players focusing on sustainable and high-performance materials. Notably, companies such as Toray Industries, Inc., DuPont, and Textronics, Inc. are at the forefront of innovation, developing textiles with enhanced conductivity, durability, and washability.

Geographically, Asia-Pacific is projected to maintain its dominance in market share, fueled by the presence of major textile producers and rapid industrialization. Europe and North America are also expected to witness substantial growth, supported by strong demand for smart textiles in automotive interiors, defense applications, and medical devices. Regulatory support for wearable medical devices and increasing consumer awareness of smart clothing benefits further bolster market prospects.

In summary, 2025 marks a pivotal year for conductive textile development, with the market set for dynamic growth through 2030. The convergence of material science, electronics, and fashion is reshaping the textile industry, paving the way for innovative applications and sustained market expansion.

Key Drivers: IoT, Wearables, and E-Textile Adoption

The rapid advancement of the Internet of Things (IoT), wearable technology, and e-textiles is a primary driver in the development of conductive textiles. As the demand for smart, connected devices grows, industries are seeking materials that can seamlessly integrate electronic functionality with traditional textile properties. Conductive textiles—fabrics embedded or coated with conductive materials—are uniquely positioned to meet these needs, enabling the creation of flexible, lightweight, and durable electronic components for next-generation applications.

IoT integration is a significant catalyst, as it requires sensors, actuators, and communication modules to be embedded in everyday objects, including clothing and home furnishings. Conductive textiles allow for unobtrusive incorporation of these elements, supporting the development of smart garments that can monitor health metrics, track movement, or interact with other connected devices. Companies such as Textronics, Inc. and Interactive Wear AG are at the forefront, developing textile-based solutions for fitness, healthcare, and industrial monitoring.

Wearable technology is another major driver, with consumer interest in health and wellness fueling demand for smart apparel and accessories. Conductive textiles enable the integration of biometric sensors, heating elements, and haptic feedback systems directly into fabrics, enhancing comfort and usability. For example, Levi Strauss & Co. has collaborated with technology partners to develop jackets with touch-sensitive sleeves, while adidas AG explores smart sportswear that tracks athletic performance.

E-textiles, or electronic textiles, represent the convergence of traditional textile manufacturing and advanced electronics. The development of conductive fibers, yarns, and coatings is essential for scalable production of e-textiles. Organizations like the International Textile Electronics Association are working to standardize materials and processes, ensuring reliability and interoperability across the industry.

In summary, the adoption of IoT, wearables, and e-textiles is accelerating innovation in conductive textile development. The push for smarter, more interactive fabrics is driving research into new conductive materials, manufacturing techniques, and integration strategies, positioning conductive textiles as a cornerstone of the future connected world.

Emerging Technologies: Materials, Manufacturing, and Integration

The development of conductive textiles is rapidly advancing, driven by the growing demand for smart wearables, flexible electronics, and next-generation medical devices. In 2025, emerging technologies in materials, manufacturing, and integration are reshaping the landscape of conductive textile production. Key innovations focus on enhancing conductivity, durability, and scalability while maintaining the comfort and flexibility required for textile applications.

Material innovation is at the forefront, with researchers and manufacturers exploring advanced conductive fibers and coatings. Metallic fibers, such as silver-plated nylon and stainless steel yarns, are being refined for improved washability and resistance to oxidation. Additionally, carbon-based materials—including graphene and carbon nanotubes—are gaining traction due to their exceptional electrical properties and lightweight nature. Companies like DuPont and Toray Industries, Inc. are actively developing new polymer composites and hybrid materials that combine conductivity with mechanical strength.

Manufacturing processes are also evolving to support large-scale, cost-effective production. Techniques such as inkjet printing, screen printing, and vapor deposition are being optimized for depositing conductive inks and coatings onto fabrics with high precision. Roll-to-roll processing and 3D knitting enable the integration of conductive pathways directly into textile structures, reducing the need for post-processing and improving product reliability. Schoeller Textiles AG and Textronics, Inc. are among the companies pioneering scalable manufacturing solutions for conductive textiles.

Integration of conductive textiles into end-use products is becoming more seamless, thanks to advances in electronic miniaturization and flexible circuit design. Smart garments now feature embedded sensors, actuators, and wireless communication modules that are nearly imperceptible to the wearer. Collaboration between textile manufacturers and electronics companies, such as Levi Strauss & Co. and Google LLC (notably through the Jacquard project), exemplifies the convergence of fashion and technology.

Looking ahead, the focus is on improving the environmental sustainability of conductive textiles by developing recyclable materials and eco-friendly manufacturing processes. As these emerging technologies mature, conductive textiles are poised to play a pivotal role in the evolution of smart clothing, healthcare monitoring, and interactive environments.

Competitive Landscape: Leading Players and Startups to Watch

The competitive landscape of conductive textile development in 2025 is characterized by a dynamic mix of established industry leaders and innovative startups, each contributing to the rapid evolution of smart fabrics for applications in healthcare, sportswear, military, and consumer electronics. Major players such as Toray Industries, Inc., Teijin Limited, and DuPont continue to leverage their expertise in advanced materials and large-scale manufacturing to develop high-performance conductive fibers and fabrics. These companies focus on integrating conductive elements like silver, carbon, and copper into textiles, ensuring durability, flexibility, and washability for commercial applications.

In parallel, electronics giants such as Samsung Electronics Co., Ltd. and Sony Group Corporation are investing in wearable technology, collaborating with textile manufacturers to embed sensors and circuits directly into garments. Their efforts are driving the convergence of electronics and textiles, resulting in products that monitor health metrics, enable gesture control, and support wireless communication.

Startups are playing a pivotal role in pushing the boundaries of conductive textile innovation. Companies like Footfalls & Heartbeats are developing proprietary knitting techniques that allow for the precise integration of conductive pathways without compromising fabric comfort or aesthetics. Meanwhile, Siren has gained attention for its smart socks, which use embedded sensors to monitor foot temperature and help prevent diabetic ulcers, demonstrating the potential for medical-grade smart textiles.

Other notable startups include Hexoskin, which specializes in biometric shirts for health and performance monitoring, and Schoeller Textil AG, known for its e-soft-shell fabrics that combine weather protection with integrated electronic functionality. These companies are often supported by partnerships with research institutions and government agencies, accelerating the commercialization of next-generation conductive textiles.

As the market matures, collaboration between established manufacturers and agile startups is expected to intensify, fostering innovation in material science, manufacturing processes, and end-use applications. The competitive landscape in 2025 will likely be defined by the ability to scale production, ensure product reliability, and address regulatory and sustainability challenges, positioning both leading players and emerging startups at the forefront of the smart textile revolution.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The development of conductive textiles is experiencing significant regional variation, shaped by differences in technological infrastructure, investment, and end-user industries across North America, Europe, Asia-Pacific, and the Rest of the World. In North America, the market is driven by robust research and development activities, particularly in the United States, where collaborations between universities, startups, and established companies foster innovation. The region’s focus is on high-performance applications, such as military wearables, medical monitoring garments, and smart sports apparel. Government funding and defense contracts further accelerate advancements in this sector.

In Europe, conductive textile development is characterized by a strong emphasis on sustainability and integration with fashion and automotive industries. European manufacturers are leveraging advanced textile engineering and eco-friendly materials, often supported by EU-funded research initiatives. Countries like Germany, Switzerland, and the Netherlands are at the forefront, with companies focusing on both functional and aesthetic aspects of smart textiles, including e-textiles for health monitoring and interactive clothing.

The Asia-Pacific region, led by Japan, South Korea, and China, is witnessing rapid growth in conductive textile production, driven by large-scale manufacturing capabilities and increasing consumer electronics demand. Asian companies are investing heavily in flexible electronics and wearable technology, with a focus on cost-effective mass production. The region benefits from a well-established textile supply chain and government initiatives supporting smart manufacturing and digital health solutions.

In the Rest of the World, including Latin America, the Middle East, and Africa, the conductive textile market is still emerging. Growth is primarily fueled by the adoption of imported technologies and partnerships with global players. While local innovation is limited, there is increasing interest in leveraging conductive textiles for healthcare, industrial safety, and energy applications, particularly as awareness and infrastructure improve.

Overall, regional dynamics in conductive textile development reflect varying priorities: North America’s focus on high-tech and defense, Europe’s sustainability and design leadership, Asia-Pacific’s manufacturing scale and innovation, and the Rest of the World’s gradual adoption and niche applications. These differences are expected to shape the global landscape of conductive textiles through 2025 and beyond.

Challenges and Barriers: Technical, Regulatory, and Supply Chain

The development of conductive textiles in 2025 faces a complex array of challenges spanning technical, regulatory, and supply chain domains. Technically, integrating conductive materials such as silver, carbon, or conductive polymers into traditional textile substrates without compromising flexibility, durability, or comfort remains a significant hurdle. Achieving consistent electrical performance after repeated washing and mechanical stress is particularly problematic, as many conductive coatings degrade over time. Additionally, scalable manufacturing processes that ensure uniform conductivity and textile quality are still under refinement, with issues such as material compatibility and process cost-effectiveness impeding widespread adoption.

Regulatory barriers are also prominent. Conductive textiles intended for use in medical, military, or safety applications must comply with stringent standards regarding biocompatibility, electromagnetic interference, and fire resistance. For example, products targeting the European market must adhere to the CE marking requirements, which involve rigorous testing and documentation (European Commission). In the United States, the U.S. Food and Drug Administration oversees wearable medical devices, requiring extensive clinical validation and safety assessments. The lack of harmonized international standards for smart textiles further complicates global commercialization, as manufacturers must navigate a patchwork of local regulations.

Supply chain challenges are exacerbated by the need for specialized raw materials and components. The sourcing of high-purity conductive fibers or inks, often reliant on precious metals like silver, is subject to price volatility and geopolitical risks. Furthermore, the limited number of suppliers with the technical capability to produce advanced conductive materials constrains scalability and increases lead times. The integration of electronics, sensors, and power sources into textiles also requires close collaboration between textile manufacturers and electronics companies, which can be hampered by differing industry standards and production timelines. Organizations such as ITEA and The Textile Institute are working to foster cross-sector partnerships and standardization, but significant gaps remain.

In summary, while the potential of conductive textiles is widely recognized, overcoming technical, regulatory, and supply chain barriers is essential for the industry to achieve large-scale, reliable, and compliant products in 2025 and beyond.

Future Outlook: Disruptive Trends and Opportunities Through 2030

The future of conductive textile development through 2030 is poised for significant transformation, driven by advances in materials science, manufacturing techniques, and the integration of smart technologies. One of the most disruptive trends is the convergence of electronics and textiles, enabling the creation of fabrics that can sense, transmit, and even store data. This is expected to revolutionize sectors such as healthcare, sportswear, military, and consumer electronics. For instance, the integration of biosensors into garments can facilitate real-time health monitoring, while adaptive clothing can respond to environmental changes or user needs.

Material innovation remains at the forefront, with research focusing on nanomaterials, conductive polymers, and hybrid fibers that offer improved conductivity, flexibility, and durability. Companies like DuPont and Toray Industries, Inc. are investing in scalable production methods for conductive fibers, aiming to reduce costs and enhance performance. Additionally, the development of washable and stretchable conductive textiles is addressing key barriers to widespread adoption, particularly in consumer markets.

Sustainability is emerging as both a challenge and an opportunity. The industry is under pressure to develop eco-friendly conductive materials and recycling processes, aligning with global sustainability goals. Organizations such as the Textile Exchange are promoting standards and best practices for responsible sourcing and end-of-life management of smart textiles.

The proliferation of the Internet of Things (IoT) is expected to further accelerate demand for conductive textiles, as connected devices become increasingly embedded in everyday life. Strategic partnerships between textile manufacturers, electronics companies, and software developers are likely to drive innovation and create new business models. For example, collaborations with Samsung Electronics Co., Ltd. and adidas AG have already resulted in prototypes of smart sportswear and wearable health devices.

Looking ahead to 2030, the market for conductive textiles is anticipated to expand rapidly, with opportunities in emerging applications such as energy harvesting, soft robotics, and advanced personal protective equipment. The sector’s growth will depend on overcoming technical challenges, ensuring regulatory compliance, and fostering cross-industry collaboration to unlock the full potential of smart, connected fabrics.

Appendix: Methodology, Data Sources, and Market Growth Calculation

This appendix outlines the methodology, data sources, and market growth calculation approach used in the analysis of conductive textile development for 2025. The research methodology integrates both primary and secondary data collection, ensuring a comprehensive and accurate assessment of the market landscape.

- Primary Research: Direct interviews and surveys were conducted with key stakeholders, including textile manufacturers, material suppliers, and end-users in sectors such as healthcare, sportswear, and military. Engagements with R&D teams at organizations like DuPont and Toray Industries, Inc. provided insights into ongoing innovations and commercialization timelines.

- Secondary Research: Secondary data was sourced from official publications, annual reports, and press releases of leading companies such as W. L. Gore & Associates, Inc. and Teijin Limited. Industry standards and regulatory guidelines were referenced from organizations like the International Organization for Standardization (ISO) and ASTM International.

- Data Triangulation: Market size and growth projections were validated through triangulation, comparing data from company disclosures, industry association reports, and expert interviews. This approach minimized bias and improved the reliability of the findings.

- Market Growth Calculation: The market growth rate for conductive textiles was calculated using a compound annual growth rate (CAGR) formula, based on historical market values and forecasted demand for 2025. Key variables included adoption rates in smart textiles, advancements in conductive fiber technology, and expansion into new application areas. Growth assumptions were cross-checked with strategic outlooks from major players such as Schoeller Textil AG and Textronics, Inc..

- Limitations: The analysis acknowledges potential limitations, such as the variability in reporting standards across regions and the proprietary nature of some technological advancements, which may affect data completeness.

This rigorous methodology ensures that the findings on conductive textile development for 2025 are robust, transparent, and actionable for industry stakeholders.

Sources & References

- Teijin Limited

- Philips

- American Association of Textile Chemists and Colorists (AATCC)

- DuPont

- American Association of Textile Chemists and Colorists (AATCC)

- DuPont

- Interactive Wear AG

- Levi Strauss & Co.

- Schoeller Textiles AG

- Google LLC

- Siren

- Rest of the World

- European Commission

- ITEA

- Textile Exchange

- W. L. Gore & Associates, Inc.

- International Organization for Standardization (ISO)

- ASTM International