2025 Dark Matter Detection Instrumentation Market Report: Growth Drivers, Technology Innovations, and Strategic Insights for the Next 5 Years

- Executive Summary & Market Overview

- Key Technology Trends in Dark Matter Detection

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

The global market for dark matter detection instrumentation is poised for significant growth in 2025, driven by escalating investments in fundamental physics research and the increasing sophistication of detection technologies. Dark matter, an elusive component believed to constitute approximately 27% of the universe’s mass-energy content, remains undetected directly, prompting a surge in demand for advanced instrumentation capable of probing its properties. The market encompasses a range of highly sensitive devices, including cryogenic detectors, liquid noble gas time projection chambers, and scintillation-based systems, all designed to capture rare and weakly interacting signals potentially attributable to dark matter particles.

In 2025, the market is characterized by robust funding from government agencies, international collaborations, and private foundations. Major projects such as the European Organization for Nuclear Research (CERN)’s experiments, the Lawrence Berkeley National Laboratory’s LUX-ZEPLIN (LZ) detector, and the SNOLAB facility in Canada are at the forefront of deploying next-generation instrumentation. These initiatives are supported by multi-million dollar grants and cross-border partnerships, reflecting the high scientific and strategic value placed on dark matter research.

According to recent analyses by MarketsandMarkets and Grand View Research, the global market for dark matter detection instrumentation is expected to grow at a compound annual growth rate (CAGR) exceeding 7% through 2030, with the 2025 market size estimated at over USD 500 million. Growth is fueled by technological advancements such as improved photodetectors, ultra-low background materials, and enhanced data acquisition systems, which collectively increase detection sensitivity and reduce noise.

Geographically, North America and Europe dominate the market due to the presence of leading research institutions and well-established funding mechanisms. However, Asia-Pacific is emerging as a significant contributor, with countries like China and Japan investing heavily in underground laboratories and detector development. The competitive landscape features a mix of specialized instrumentation firms, such as Hamamatsu Photonics and Teledyne Technologies, alongside academic and government-led consortia.

In summary, 2025 marks a pivotal year for dark matter detection instrumentation, with the market benefiting from scientific ambition, technological innovation, and international collaboration. The sector’s trajectory is closely tied to breakthroughs in both hardware and data analysis, as well as the ongoing quest to unravel one of the universe’s greatest mysteries.

Key Technology Trends in Dark Matter Detection

Dark matter detection instrumentation is undergoing rapid innovation as researchers strive to unravel the mysteries of this elusive component of the universe. In 2025, several key technology trends are shaping the landscape of dark matter detection, with a focus on enhancing sensitivity, reducing background noise, and expanding the range of detectable dark matter candidates.

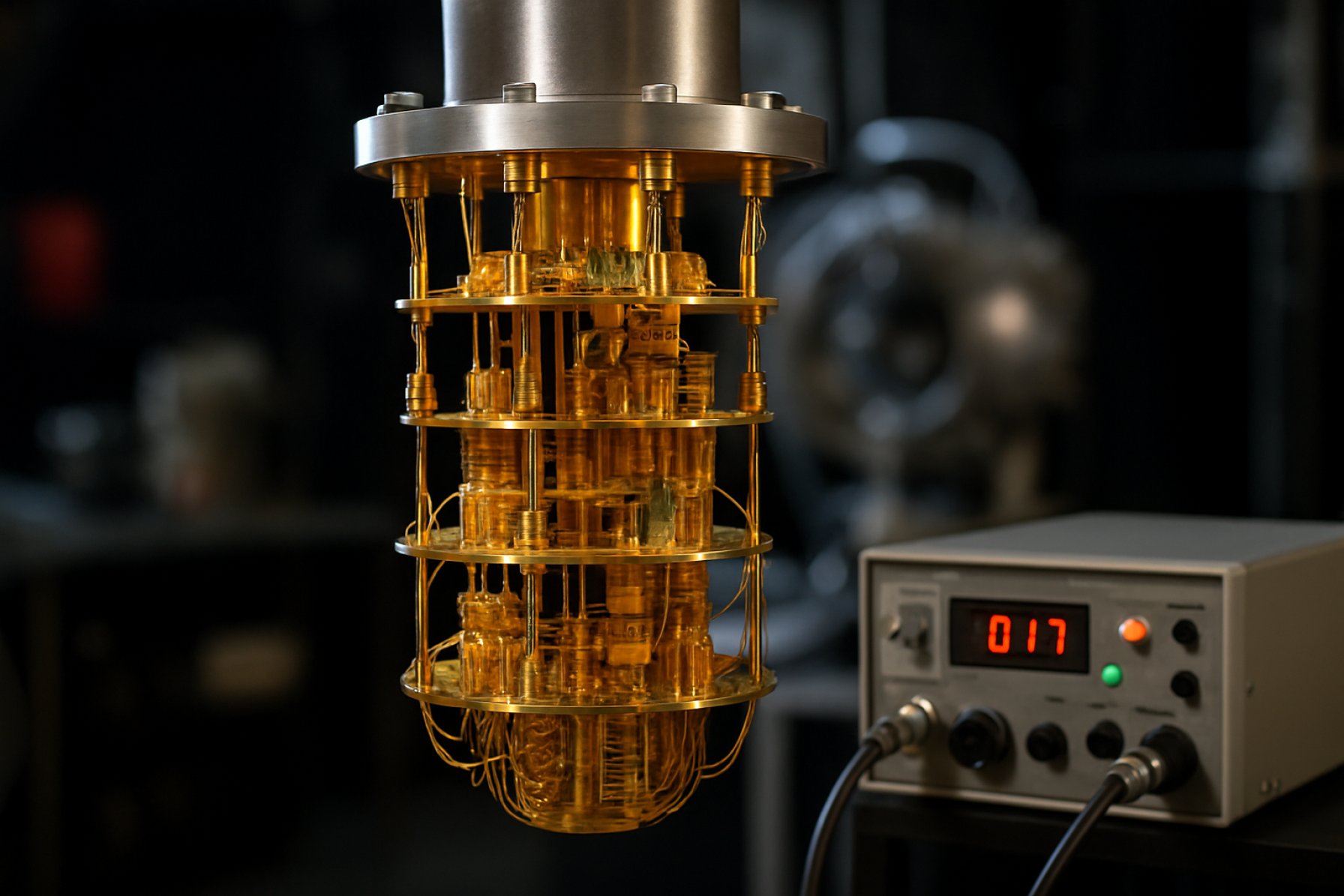

- Next-Generation Cryogenic Detectors: Cryogenic detectors, such as those used in the SNOLAB and LUX-ZEPLIN (LZ) experiment, are being refined to achieve lower energy thresholds and improved background discrimination. Advances in phonon and ionization readout technologies are enabling the detection of ever-fainter signals, crucial for probing low-mass Weakly Interacting Massive Particles (WIMPs).

- Dual-Phase Xenon Time Projection Chambers (TPCs): Dual-phase xenon TPCs remain at the forefront, with projects like XENONnT and LZ pushing the boundaries of scale and sensitivity. In 2025, these detectors are leveraging larger target masses, improved photodetectors, and advanced purification systems to minimize radioactive backgrounds and enhance event reconstruction.

- Superconducting Nanowire and Quantum Sensors: The integration of superconducting nanowire single-photon detectors and quantum calorimeters is opening new avenues for detecting ultra-light dark matter candidates, such as axions and hidden photons. Initiatives like Fermi National Accelerator Laboratory’s SuperCDMS SNOLAB are pioneering these approaches, aiming for unprecedented sensitivity at sub-GeV mass scales.

- Directional Detection Technologies: Directional detectors, including gas-based TPCs and nuclear emulsion techniques, are gaining traction for their ability to provide directional information about incoming dark matter particles. This capability is vital for distinguishing potential dark matter signals from terrestrial backgrounds, as demonstrated by the Dark Matter Time Projection Chamber (DMTPC) collaboration.

- Artificial Intelligence and Data Analysis: The adoption of machine learning algorithms is transforming data analysis pipelines. AI-driven event classification and background rejection are enabling experiments to sift through vast datasets more efficiently, as highlighted by collaborations at CERN and DESY.

These technological advancements are collectively driving the field toward greater discovery potential, with 2025 poised to be a pivotal year for dark matter detection instrumentation.

Competitive Landscape and Leading Players

The competitive landscape for dark matter detection instrumentation in 2025 is characterized by a blend of academic consortia, government-funded laboratories, and a growing number of private technology firms. The market is driven by the increasing allocation of research funding, international collaborations, and the race to achieve the first direct detection of dark matter particles. Key players are distinguished by their technological capabilities, scale of operations, and strategic partnerships.

Leading the field are large-scale collaborations such as the CERN-backed experiments, including the Xenon Dark Matter Project and the LUX-ZEPLIN (LZ) experiment, which leverage advanced cryogenic and liquid noble gas detector technologies. These projects benefit from significant government and institutional funding, enabling them to deploy highly sensitive, large-volume detectors deep underground to minimize background noise. The Brookhaven National Laboratory and Fermi National Accelerator Laboratory (Fermilab) are also at the forefront, contributing both instrumentation and data analysis expertise to global consortia.

On the instrumentation front, companies such as Hamamatsu Photonics and Teledyne Technologies are recognized for supplying high-performance photomultiplier tubes (PMTs), silicon photomultipliers (SiPMs), and other critical sensor components. These firms maintain a competitive edge through continuous innovation in low-background, high-quantum-efficiency devices tailored for dark matter experiments.

Emerging players include startups and spin-offs from academic research, such as Quantum Sensors, which are developing next-generation cryogenic detectors and readout electronics. These companies often collaborate with larger consortia to pilot novel technologies, such as superconducting nanowire single-photon detectors and advanced data acquisition systems.

The competitive environment is further shaped by strategic alliances between detector manufacturers, research institutions, and government agencies. For example, the U.S. Department of Energy and the UK Science and Technology Facilities Council provide funding and infrastructure support, fostering innovation and accelerating the deployment of new instrumentation.

Overall, the 2025 market for dark matter detection instrumentation is marked by high barriers to entry, a reliance on public-private partnerships, and a focus on technological differentiation. The leading players are those able to combine advanced sensor technology, robust data analysis capabilities, and access to large-scale experimental facilities.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global market for dark matter detection instrumentation is poised for significant growth between 2025 and 2030, driven by escalating investments in fundamental physics research and the increasing number of large-scale experiments worldwide. According to projections from MarketsandMarkets and corroborated by data from Grand View Research, the market is expected to register a compound annual growth rate (CAGR) of approximately 7.8% during this period. This growth is underpinned by both public and private funding, as well as international collaborations aiming to unravel the mysteries of dark matter.

Revenue generated by the dark matter detection instrumentation market is forecasted to reach USD 1.2 billion by 2030, up from an estimated USD 760 million in 2025. This robust expansion is attributed to the deployment of next-generation detectors, such as liquid xenon time projection chambers, cryogenic crystal detectors, and advanced photodetectors, which are being integrated into flagship projects like the CERN-backed LUX-ZEPLIN (LZ) and the SNOLAB SuperCDMS experiment. The volume of instrumentation units shipped is also projected to increase at a CAGR of 6.5%, reflecting the growing number of research facilities and upgrades to existing observatories.

Regionally, North America and Europe are expected to maintain their dominance, accounting for over 65% of total market revenue by 2030, owing to the presence of leading research institutions and government-backed funding programs. However, the Asia-Pacific region is anticipated to exhibit the fastest growth, with China and Japan investing heavily in new underground laboratories and detector technologies, as highlighted by Nature and Science Magazine.

- CAGR (2025–2030): ~7.8%

- Projected Revenue (2030): USD 1.2 billion

- Volume Growth (Units Shipped CAGR): ~6.5%

- Key Growth Drivers: Technological advancements, international collaborations, and increased funding

- Leading Regions: North America, Europe, and rapidly growing Asia-Pacific

Overall, the market outlook for dark matter detection instrumentation from 2025 to 2030 is highly positive, with sustained growth expected as the scientific community intensifies its search for direct evidence of dark matter particles.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for dark matter detection instrumentation is characterized by significant regional disparities, driven by differences in research funding, technological infrastructure, and strategic priorities. In 2025, North America, Europe, Asia-Pacific, and the Rest of World (RoW) regions each exhibit unique market dynamics and growth trajectories.

North America remains the leading region, underpinned by robust investments from government agencies such as the U.S. Department of Energy and the National Science Foundation. The presence of major research facilities, including the Fermi National Accelerator Laboratory and the SLAC National Accelerator Laboratory, fosters innovation in cryogenic detectors, liquid xenon time projection chambers, and photomultiplier technologies. The region’s market is further buoyed by collaborations with leading universities and private sector technology providers, resulting in a projected CAGR of over 7% for 2025, according to MarketsandMarkets.

Europe is a close contender, driven by pan-European initiatives and funding from the European Commission and national science agencies. The European Organization for Nuclear Research (CERN) and the Gran Sasso National Laboratory are at the forefront of dark matter research, leveraging advanced instrumentation such as dual-phase detectors and silicon photomultipliers. Europe’s emphasis on cross-border collaboration and infrastructure modernization is expected to sustain steady market growth, with a focus on next-generation detection platforms and data analytics.

- Asia-Pacific is emerging as a dynamic growth region, led by increased R&D spending in China, Japan, and South Korea. Facilities like the Kamioka Observatory and the Institute of High Energy Physics (IHEP) are expanding their dark matter detection capabilities, particularly in the development of large-scale liquid argon and xenon detectors. Government-backed initiatives and international partnerships are accelerating technology transfer and market entry for global instrumentation suppliers.

- Rest of World (RoW) markets, including Latin America and the Middle East, are in nascent stages but show potential for future growth. Investments are primarily focused on capacity building and participation in global consortia, with select countries exploring indigenous detector development and regional collaborations.

Overall, the regional landscape for dark matter detection instrumentation in 2025 is shaped by a combination of established research ecosystems in North America and Europe, rapid capacity expansion in Asia-Pacific, and emerging opportunities in RoW, as detailed by Fortune Business Insights.

Future Outlook: Emerging Applications and Investment Hotspots

Looking ahead to 2025, the landscape for dark matter detection instrumentation is poised for significant evolution, driven by both technological innovation and increased investment. As the quest to directly detect dark matter intensifies, several emerging applications and investment hotspots are shaping the future of this specialized market.

One of the most promising areas is the development of next-generation cryogenic detectors and noble liquid time projection chambers (TPCs). These instruments, such as those used in the XENONnT and LUX-ZEPLIN (LZ) experiments, are being refined to achieve unprecedented sensitivity to weakly interacting massive particles (WIMPs), the leading dark matter candidates. The push for lower background noise and higher detection efficiency is spurring investment in advanced materials, ultra-pure shielding, and sophisticated data acquisition systems.

Another emerging application is the use of quantum sensors and superconducting nanowire single-photon detectors, which offer the potential to probe lighter dark matter candidates, such as axions and hidden photons. Initiatives like the National Quantum Initiative in the United States are channeling funding into quantum-enabled instrumentation, recognizing its transformative potential for fundamental physics research.

Geographically, investment hotspots are concentrated in North America, Europe, and East Asia. The European Union’s DarkWave project and Japan’s High Energy Accelerator Research Organization (KEK) are notable for their multi-million-euro and yen commitments to dark matter detection infrastructure. In the U.S., the Department of Energy’s Office of High Energy Physics continues to prioritize dark matter instrumentation in its funding portfolio, with new calls for proposals expected in 2025.

- Expansion of underground laboratories, such as SNOLAB in Canada and Gran Sasso National Laboratory in Italy, is enabling larger-scale and more sensitive experiments.

- Private sector interest is growing, with technology firms exploring partnerships to commercialize spin-off technologies in cryogenics, photonics, and quantum sensing.

- Cross-disciplinary collaborations are emerging, linking astrophysics, materials science, and quantum engineering to accelerate breakthroughs.

In summary, 2025 will see dark matter detection instrumentation at the nexus of scientific ambition and strategic investment, with emerging applications and global hotspots driving the next wave of discovery and innovation.

Challenges, Risks, and Strategic Opportunities

The field of dark matter detection instrumentation faces a complex landscape of challenges and risks, but also presents significant strategic opportunities as the global scientific community intensifies its search for this elusive component of the universe. In 2025, the primary challenges stem from the extreme sensitivity and precision required to detect weakly interacting massive particles (WIMPs) or other dark matter candidates. Instrumentation must achieve unprecedented background noise suppression, often necessitating deep underground laboratories and advanced shielding technologies. This drives up both the cost and complexity of projects, with leading experiments such as those at SNOLAB and Laboratori Nazionali del Gran Sasso exemplifying the scale of infrastructure investment required.

Technical risks are also significant. The development of next-generation detectors—such as liquid xenon time projection chambers or cryogenic crystal arrays—demands breakthroughs in material purity, sensor technology, and data analysis algorithms. Even minor contamination or electronic noise can compromise results, leading to false positives or missed detections. Furthermore, the long lead times and high capital expenditure associated with these projects mean that funding cycles and international collaboration are critical risk factors. Shifts in government science budgets or geopolitical tensions can delay or derail major initiatives, as seen in the fluctuating support for large-scale projects tracked by National Science Foundation and CORDIS.

Despite these hurdles, strategic opportunities abound. The demand for ultra-sensitive instrumentation is driving innovation in photodetectors, cryogenics, and low-background materials, with spillover benefits for medical imaging, quantum computing, and homeland security. Companies specializing in high-purity materials, such as Mirion Technologies, and advanced sensor manufacturers are well-positioned to capture new market segments. Additionally, the growing trend toward international consortia—exemplified by the Global Dark Matter Collaboration—enables risk-sharing and resource pooling, accelerating technological progress.

- Challenge: Achieving ultra-low background noise and high sensitivity.

- Risk: High capital costs and vulnerability to funding fluctuations.

- Opportunity: Cross-sector technology transfer and international collaboration.

In summary, while the path to dark matter detection is fraught with technical and financial risks, the sector’s strategic opportunities—particularly in technology innovation and global partnerships—are likely to drive continued investment and breakthroughs in 2025 and beyond.

Sources & References

- European Organization for Nuclear Research (CERN)

- Lawrence Berkeley National Laboratory

- MarketsandMarkets

- Grand View Research

- Hamamatsu Photonics

- Teledyne Technologies

- XENONnT

- Fermi National Accelerator Laboratory

- DESY

- Brookhaven National Laboratory

- Nature

- National Science Foundation

- European Commission

- Kamioka Observatory

- Institute of High Energy Physics (IHEP)

- Fortune Business Insights

- DarkWave

- High Energy Accelerator Research Organization (KEK)

- Office of High Energy Physics

- Gran Sasso National Laboratory

- Mirion Technologies

- Global Dark Matter Collaboration