Energy-Aware Edge AI Systems Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities. Explore Key Trends, Forecasts, and Strategic Insights Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Energy-Aware Edge AI Systems

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Emerging Opportunities

- Future Outlook: Strategic Recommendations and Investment Insights

- Sources & References

Executive Summary & Market Overview

Energy-aware edge AI systems represent a rapidly evolving segment at the intersection of artificial intelligence, edge computing, and energy efficiency. These systems are designed to process data locally on edge devices—such as sensors, smartphones, and IoT gateways—while optimizing for minimal energy consumption. This approach addresses the growing demand for real-time analytics in applications ranging from smart manufacturing and autonomous vehicles to healthcare and smart cities, all while mitigating the environmental and operational costs associated with high energy usage.

The global market for energy-aware edge AI systems is projected to experience robust growth through 2025, driven by several converging trends. The proliferation of connected devices, estimated to surpass 30 billion by 2025, is fueling the need for decentralized intelligence that can operate efficiently at the network edge Gartner. Simultaneously, rising energy costs and sustainability mandates are compelling enterprises to adopt solutions that minimize power consumption without sacrificing performance.

According to IDC, spending on edge computing infrastructure and AI-enabled edge devices is expected to reach $74 billion in 2025, with a significant portion allocated to energy-efficient hardware and software. Key industry players—including NVIDIA, Qualcomm, and Intel—are investing heavily in low-power AI accelerators and adaptive algorithms that dynamically manage workloads based on energy availability and application requirements.

The market is also shaped by regulatory and environmental pressures. The European Union’s Green Deal and similar initiatives in Asia and North America are incentivizing the adoption of energy-aware technologies across sectors European Commission. As a result, energy-aware edge AI systems are becoming a strategic priority for organizations seeking to balance digital transformation with sustainability goals.

In summary, the energy-aware edge AI systems market in 2025 is characterized by strong growth prospects, technological innovation, and increasing alignment with global energy efficiency standards. The sector’s trajectory will be shaped by advances in hardware, software, and regulatory frameworks, positioning it as a critical enabler of next-generation intelligent infrastructure.

Key Technology Trends in Energy-Aware Edge AI Systems

Energy-aware edge AI systems represent a convergence of artificial intelligence, edge computing, and energy efficiency, enabling intelligent data processing closer to data sources while minimizing power consumption. As the proliferation of IoT devices and real-time applications accelerates, 2025 is witnessing several key technology trends shaping the evolution of energy-aware edge AI systems.

- Ultra-Low Power AI Chips: Semiconductor manufacturers are introducing specialized AI accelerators designed for edge deployment, focusing on reducing energy consumption without sacrificing performance. Companies like Arm and Qualcomm are leading with chipsets that leverage advanced process nodes (e.g., 5nm, 3nm) and innovative architectures such as neuromorphic computing, which mimics brain-like efficiency for AI workloads.

- On-Device Model Optimization: Techniques such as model quantization, pruning, and knowledge distillation are being widely adopted to shrink AI models, enabling them to run efficiently on resource-constrained edge devices. Frameworks from TensorFlow Lite and PyTorch Mobile support these optimizations, allowing for real-time inference with minimal energy draw.

- Adaptive Workload Management: Dynamic workload allocation and intelligent scheduling are being integrated into edge AI systems to optimize energy use. Solutions from NVIDIA and Intel employ real-time monitoring to adjust processing loads, selectively activating or deactivating hardware components based on current demand.

- Federated and Distributed Learning: Federated learning allows edge devices to collaboratively train AI models without sharing raw data, reducing the need for energy-intensive data transmission to the cloud. This approach, championed by organizations like Google, not only enhances privacy but also conserves bandwidth and device power.

- Energy Harvesting and Management: Integration of energy harvesting technologies—such as solar, thermal, or kinetic energy—into edge devices is gaining traction. Companies like STMicroelectronics are developing microcontrollers and sensors capable of operating on harvested energy, further extending the operational life of edge AI deployments.

These trends are collectively driving the market toward more sustainable, scalable, and intelligent edge AI solutions, as highlighted in recent analyses by IDC and Gartner. The focus on energy efficiency is expected to be a defining factor in the widespread adoption and long-term viability of edge AI systems in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for energy-aware edge AI systems in 2025 is characterized by rapid innovation, strategic partnerships, and a growing emphasis on sustainability. As edge computing becomes integral to sectors such as manufacturing, automotive, healthcare, and smart cities, leading technology companies and specialized startups are vying for market share by developing solutions that optimize AI performance while minimizing energy consumption.

Major semiconductor companies are at the forefront of this market. NVIDIA continues to expand its edge AI portfolio with energy-efficient GPUs and system-on-chip (SoC) solutions, targeting applications from autonomous vehicles to industrial automation. Intel leverages its OpenVINO toolkit and Movidius VPU technology to deliver low-power AI inference at the edge, while Qualcomm’s Snapdragon platforms are widely adopted in mobile and IoT edge devices for their balance of performance and power efficiency.

In addition to established players, startups such as Hailo and Edge Impulse are gaining traction. Hailo’s AI processors are designed specifically for edge devices, offering high throughput with low energy requirements, and are being integrated into smart cameras and industrial sensors. Edge Impulse provides a development platform for building and deploying energy-efficient machine learning models on resource-constrained edge hardware, enabling rapid prototyping and deployment across diverse industries.

Cloud service providers are also entering the edge AI space. Amazon Web Services (AWS) and Microsoft Azure have introduced edge AI services that incorporate energy management features, allowing enterprises to optimize workloads between cloud and edge environments for both performance and sustainability.

- Arm’s Cortex-M and Cortex-A series processors remain foundational for ultra-low-power edge AI applications, especially in IoT and embedded systems.

- Texas Instruments and STMicroelectronics are prominent in providing microcontrollers and AI accelerators with advanced power management capabilities.

- Collaborations between hardware and software vendors are intensifying, with joint efforts to create end-to-end solutions that address both AI performance and energy efficiency.

As regulatory and corporate sustainability goals intensify, the competitive edge in 2025 will increasingly depend on the ability to deliver high-performance AI at the edge with minimal energy footprint, driving further innovation and consolidation in this dynamic market segment.

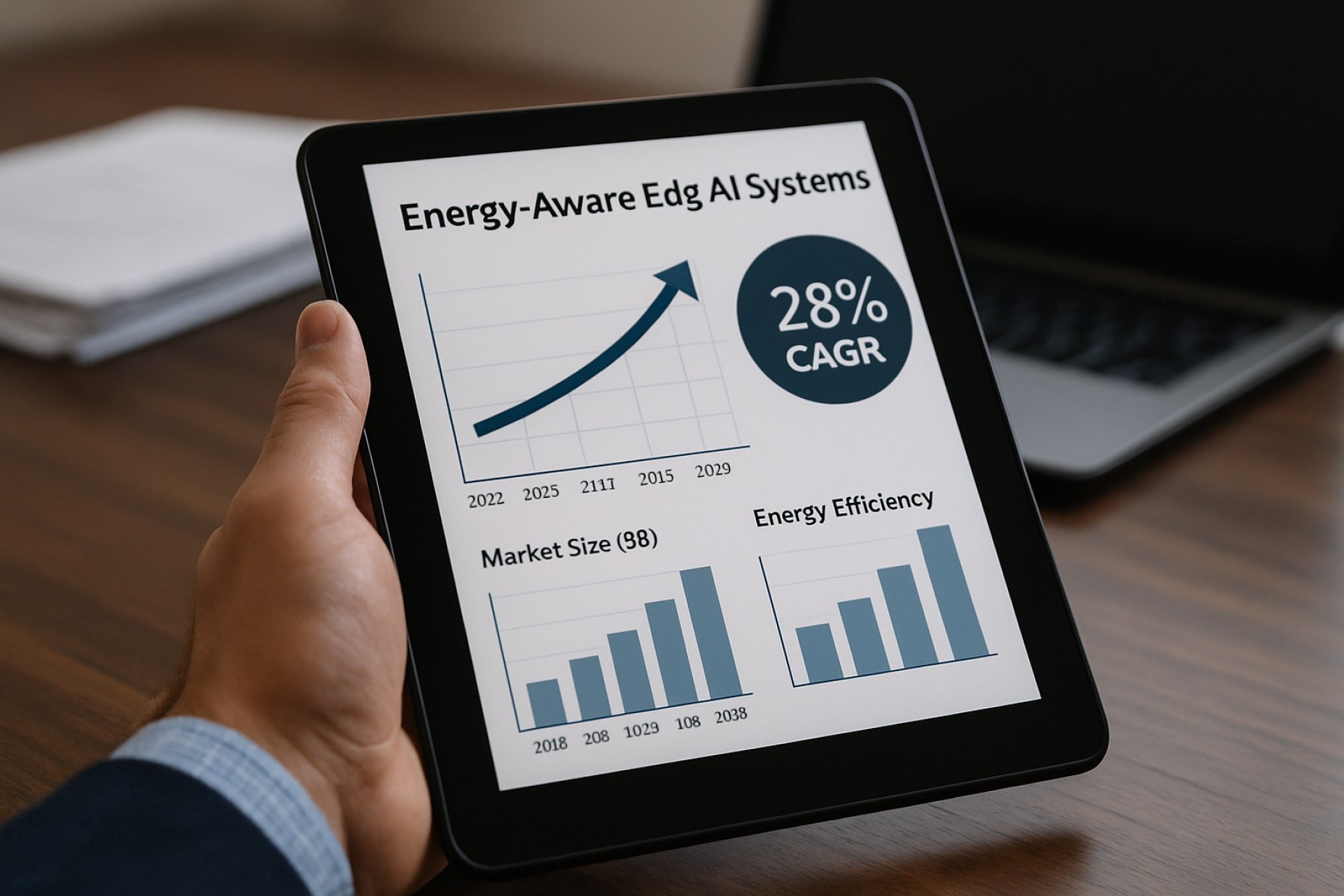

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The market for energy-aware edge AI systems is poised for robust expansion between 2025 and 2030, driven by the convergence of edge computing, artificial intelligence, and the imperative for energy efficiency in distributed devices. According to projections from Gartner, the global edge computing market is expected to surpass $317 billion by 2026, with a significant portion attributed to AI-enabled and energy-optimized solutions. Within this context, energy-aware edge AI systems are forecasted to achieve a compound annual growth rate (CAGR) of approximately 22% from 2025 to 2030, outpacing the broader edge AI segment due to increasing regulatory and operational demands for sustainability.

Revenue generation in this segment is anticipated to accelerate, with market size estimates reaching $18.7 billion by 2030, up from $6.8 billion in 2025, as reported by International Data Corporation (IDC). This growth is underpinned by the proliferation of IoT devices, smart manufacturing, and intelligent infrastructure, all of which require real-time data processing with minimal energy consumption. Volume-wise, shipments of energy-aware edge AI modules are projected to grow from 42 million units in 2025 to over 120 million units by 2030, reflecting widespread adoption across sectors such as automotive, healthcare, and industrial automation (Statista).

- Automotive: The integration of energy-efficient AI in advanced driver-assistance systems (ADAS) and autonomous vehicles is expected to account for nearly 28% of total market volume by 2030.

- Healthcare: Wearable and remote monitoring devices leveraging energy-aware AI are forecasted to see a CAGR of 25%, driven by demand for continuous, low-power analytics.

- Industrial Automation: Smart factories and predictive maintenance applications will contribute significantly to both revenue and volume, as manufacturers prioritize energy savings alongside operational intelligence.

Regionally, Asia-Pacific is set to lead market growth, with North America and Europe following closely, propelled by government initiatives and investments in sustainable digital infrastructure (McKinsey & Company). Overall, the 2025–2030 period will mark a pivotal phase for energy-aware edge AI systems, characterized by rapid scaling, technological innovation, and a strong emphasis on energy optimization.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional market dynamics for energy-aware edge AI systems in 2025 reflect varying levels of technological maturity, regulatory frameworks, and industry adoption across North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

- North America: North America, led by the United States, is expected to maintain its dominance in the energy-aware edge AI systems market in 2025. The region benefits from a robust ecosystem of AI startups, established semiconductor companies, and hyperscale cloud providers. Key sectors such as smart manufacturing, autonomous vehicles, and healthcare are driving demand for low-latency, energy-efficient AI at the edge. Government initiatives supporting AI research and energy efficiency, such as those from the U.S. Department of Energy, further accelerate adoption. According to International Data Corporation (IDC), North America will account for over 35% of global edge AI spending in 2025.

- Europe: Europe’s market is characterized by strong regulatory emphasis on sustainability and data privacy, with the European Commission promoting energy-efficient digital infrastructure through initiatives like the European Green Deal. The region’s industrial automation, smart grid, and mobility sectors are key adopters of energy-aware edge AI. European companies are investing in R&D to comply with stringent energy consumption standards, and collaborations between academia and industry are fostering innovation. Gartner projects that Europe will see a compound annual growth rate (CAGR) of over 18% in edge AI deployments through 2025, with energy efficiency as a core driver.

- Asia-Pacific: Asia-Pacific is the fastest-growing region, propelled by rapid digital transformation in China, Japan, South Korea, and India. The proliferation of IoT devices, smart cities, and 5G networks is fueling demand for energy-aware edge AI solutions. Governments are investing heavily in AI infrastructure, with China’s Ministry of Industry and Information Technology and Japan’s Ministry of Economy, Trade and Industry supporting large-scale pilot projects. MarketsandMarkets estimates that Asia-Pacific will achieve the highest CAGR globally, exceeding 22% in 2025.

- Rest of World (RoW): The RoW segment, including Latin America, the Middle East, and Africa, is at an earlier stage of adoption. However, increasing investments in smart infrastructure and energy management, particularly in urban centers, are creating new opportunities. According to Frost & Sullivan, pilot projects in smart agriculture and utilities are emerging, with energy efficiency as a key value proposition.

Overall, while North America and Europe lead in established deployments, Asia-Pacific’s rapid growth and the RoW’s emerging opportunities signal a broadening global market for energy-aware edge AI systems in 2025.

Challenges, Risks, and Emerging Opportunities

Energy-aware edge AI systems are rapidly gaining traction as organizations seek to deploy intelligent applications closer to data sources while minimizing energy consumption. However, the sector faces a complex landscape of challenges and risks, even as new opportunities emerge for innovators and investors in 2025.

One of the primary challenges is the inherent trade-off between computational performance and energy efficiency. Edge devices, such as IoT sensors, smartphones, and industrial controllers, often operate under strict power constraints. Designing AI models that deliver high accuracy without exceeding energy budgets remains a significant technical hurdle. Hardware limitations, including limited memory and processing power, further complicate the deployment of sophisticated AI algorithms at the edge Arm Holdings.

Security and privacy risks are also heightened in energy-aware edge AI systems. Processing sensitive data locally can reduce exposure to centralized breaches, but it also introduces new attack surfaces at the device level. Ensuring robust security protocols without incurring excessive energy overhead is a delicate balance, especially as edge deployments scale across critical infrastructure and consumer applications National Institute of Standards and Technology (NIST).

Another challenge is the lack of standardized frameworks for measuring and optimizing energy consumption in edge AI workloads. The absence of universally accepted benchmarks makes it difficult for organizations to compare solutions or demonstrate compliance with emerging sustainability regulations. This gap is particularly relevant as governments and industry bodies introduce stricter energy efficiency mandates for digital infrastructure International Energy Agency (IEA).

Despite these challenges, several emerging opportunities are shaping the market in 2025. Advances in ultra-low-power AI chips and neuromorphic computing architectures are enabling more efficient on-device inference, opening new use cases in remote monitoring, smart cities, and autonomous vehicles Qualcomm. Additionally, the integration of renewable energy sources with edge deployments is creating synergies for sustainable AI operations, particularly in off-grid and rural environments International Energy Agency (IEA).

Strategic partnerships between semiconductor companies, cloud providers, and AI software vendors are accelerating the development of holistic solutions that address both energy and performance requirements. As the ecosystem matures, organizations that can navigate the technical and regulatory complexities of energy-aware edge AI stand to capture significant value in the evolving digital landscape.

Future Outlook: Strategic Recommendations and Investment Insights

The future outlook for energy-aware edge AI systems in 2025 is shaped by accelerating demand for real-time, low-latency intelligence across industries, coupled with mounting pressure to reduce energy consumption and carbon footprints. As edge AI deployments proliferate in sectors such as manufacturing, automotive, smart cities, and healthcare, strategic recommendations for stakeholders center on technology innovation, ecosystem partnerships, and targeted investments.

Strategic Recommendations:

- Prioritize Custom AI Hardware: Companies should invest in the development and adoption of application-specific integrated circuits (ASICs) and neuromorphic chips designed for ultra-low power consumption. Leading semiconductor firms such as NVIDIA and Qualcomm are advancing edge AI chipsets with integrated energy management, while startups like Syntiant are pioneering neural decision processors for always-on applications.

- Leverage AI Model Optimization: Organizations should focus on model compression, quantization, and pruning techniques to reduce computational load and energy use. Open-source frameworks and toolkits from Google AI and PyTorch are enabling developers to deploy efficient models on resource-constrained edge devices.

- Adopt Holistic System Design: Integrating hardware, software, and network optimization is critical. Collaborations with system integrators and cloud-edge orchestration providers such as Microsoft and Amazon Web Services can accelerate deployment of energy-aware solutions.

- Engage in Standards and Ecosystem Development: Participation in industry consortia like the LF Edge and OpenFog Consortium will help shape interoperability and energy efficiency standards, ensuring long-term competitiveness.

Investment Insights:

- Growth Sectors: According to IDC, edge AI spending is projected to surpass $40 billion by 2025, with energy-aware solutions gaining traction in industrial IoT, autonomous vehicles, and smart infrastructure.

- Venture Capital Focus: Investors are increasingly targeting startups specializing in edge AI hardware, federated learning, and energy optimization, as evidenced by recent funding rounds for companies like Edge Impulse and Kneron.

- Long-Term Value: Energy-aware edge AI is expected to deliver significant operational cost savings and sustainability benefits, aligning with global ESG mandates and digital transformation strategies.

Sources & References

- IDC

- NVIDIA

- Qualcomm

- European Commission

- Arm

- TensorFlow Lite

- PyTorch Mobile

- STMicroelectronics

- Hailo

- Edge Impulse

- Amazon Web Services (AWS)

- Texas Instruments

- Statista

- McKinsey & Company

- MarketsandMarkets

- Frost & Sullivan

- National Institute of Standards and Technology (NIST)

- International Energy Agency (IEA)

- Google AI

- Microsoft

- LF Edge

- OpenFog Consortium

- Kneron