Excimer Laser Scanning Systems in 2025: Unleashing Next-Gen Precision for Semiconductor and Medical Markets. Explore How Advanced Scanning is Shaping the Future of High-Performance Manufacturing.

- Executive Summary: Key Trends and Market Drivers in 2025

- Technology Overview: Fundamentals of Excimer Laser Scanning Systems

- Competitive Landscape: Leading Manufacturers and Innovators

- Market Size and Growth Forecasts Through 2029

- Emerging Applications: Semiconductors, Medical Devices, and Beyond

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Recent Innovations: Advances in Beam Control and System Integration

- Regulatory and Industry Standards (e.g., SEMI, ISO)

- Challenges and Barriers: Technical, Supply Chain, and Cost Factors

- Future Outlook: Disruptive Trends and Strategic Opportunities

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

Excimer laser scanning systems are poised for significant advancements and market expansion in 2025, driven by their critical role in semiconductor manufacturing, flat panel display production, and advanced materials processing. The ongoing transition to smaller process nodes in semiconductor fabrication, particularly for logic and memory chips, is intensifying demand for high-precision lithography tools. Excimer lasers, especially those operating at 193 nm and 248 nm wavelengths, remain indispensable for deep ultraviolet (DUV) lithography, enabling the production of advanced integrated circuits with feature sizes below 10 nm.

Key industry players such as ASML Holding, the global leader in photolithography systems, continue to innovate in excimer laser scanner technology, integrating higher throughput, improved overlay accuracy, and advanced process control. Cymer, a subsidiary of ASML, is a primary supplier of excimer laser light sources, supporting the latest DUV scanners deployed in leading-edge fabs worldwide. Canon Inc. and Nikon Corporation also maintain strong positions in the excimer scanner market, with ongoing investments in system upgrades and service capabilities to support both mature and advanced technology nodes.

In 2025, the market is further shaped by the ramp-up of advanced memory (DRAM, NAND) and logic foundries in Asia, particularly in South Korea, Taiwan, and China. These regions are expanding their installed base of excimer laser scanners to meet surging demand for high-performance computing, AI, and 5G applications. The push for domestic semiconductor manufacturing in the United States and Europe, supported by government incentives, is also expected to drive new investments in excimer-based lithography equipment.

Technological trends include the integration of artificial intelligence and machine learning for real-time process optimization, predictive maintenance, and yield enhancement in excimer laser scanning systems. Additionally, sustainability initiatives are prompting manufacturers to develop more energy-efficient laser sources and extend the operational lifetime of critical components, reducing total cost of ownership for chipmakers.

Looking ahead, while extreme ultraviolet (EUV) lithography is gaining traction for the most advanced nodes, excimer laser scanning systems will remain essential for volume production at established nodes and for specific patterning steps even in EUV-enabled fabs. The outlook for 2025 and the following years is robust, with continued innovation and strong demand anticipated from both leading-edge and mature semiconductor manufacturing sectors.

Technology Overview: Fundamentals of Excimer Laser Scanning Systems

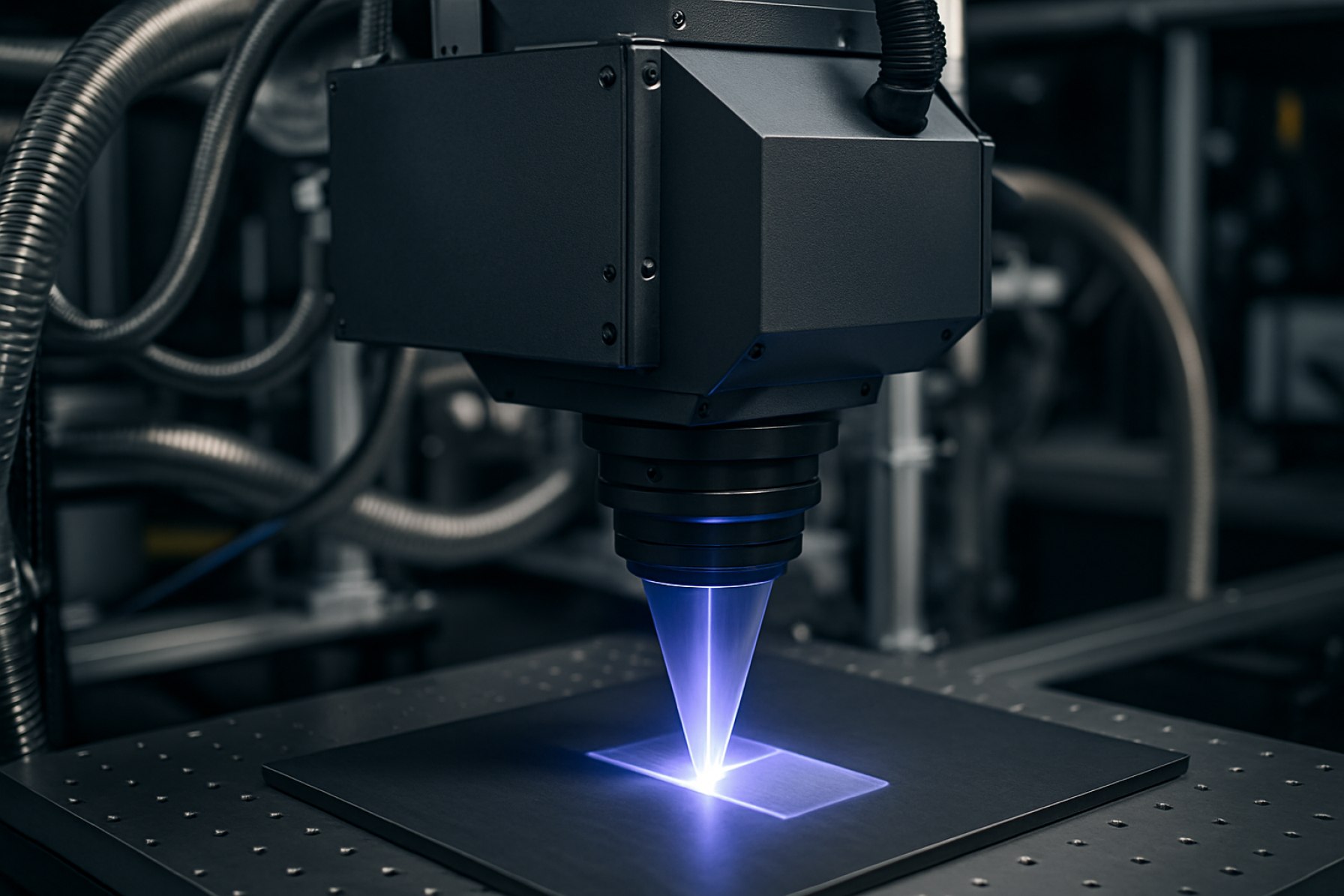

Excimer laser scanning systems are pivotal in advanced manufacturing and microfabrication, leveraging the unique properties of excimer lasers—typically using noble gas-halide mixtures such as KrF (248 nm) or ArF (193 nm)—to deliver high-energy ultraviolet (UV) pulses. These systems are distinguished by their ability to ablate materials with exceptional precision and minimal thermal damage, making them indispensable in industries such as semiconductor lithography, flat panel display (FPD) production, and medical device fabrication.

At the core of an excimer laser scanning system is the excimer laser source, which emits short-wavelength UV light. This light is directed through a series of optical components, including beam homogenizers, mirrors, and high-speed scanning units, to achieve uniform energy distribution and precise patterning. The scanning mechanism, often based on galvanometer mirrors or linear stages, enables rapid and programmable movement of the laser beam across the substrate, facilitating high-throughput and high-resolution processing.

In 2025, the technology landscape for excimer laser scanning systems is shaped by ongoing innovations in laser source reliability, beam shaping optics, and system integration. Leading manufacturers such as Cymer (a subsidiary of ASML), Coherent, and Nikon are at the forefront, supplying excimer lasers and integrated scanning solutions for semiconductor and display applications. Cymer is particularly notable for its deep ultraviolet (DUV) excimer lasers, which are critical for advanced photolithography in chip manufacturing. Coherent provides excimer laser systems tailored for both industrial and medical applications, emphasizing high pulse energy and stability.

Recent advancements focus on increasing system throughput and extending operational lifetimes. For example, improvements in gas management and optical component durability have reduced maintenance intervals and operational costs. Enhanced beam uniformity and real-time process monitoring are also being integrated, supporting tighter process control and higher yields in mass production environments. The adoption of AI-driven diagnostics and predictive maintenance is expected to further optimize uptime and performance in the coming years.

Looking ahead, the demand for excimer laser scanning systems is projected to grow, driven by the continued scaling of semiconductor nodes (e.g., sub-5 nm processes) and the proliferation of high-resolution OLED and microLED displays. The integration of excimer lasers with advanced automation and digital control platforms will likely enable even finer feature sizes and more complex patterning, reinforcing the technology’s central role in next-generation electronics and precision manufacturing.

Competitive Landscape: Leading Manufacturers and Innovators

The competitive landscape for excimer laser scanning systems in 2025 is characterized by a concentrated group of global manufacturers and technology innovators, each leveraging decades of expertise in photonics, precision optics, and semiconductor equipment. The sector is driven by the increasing demand for advanced lithography, flat panel display production, and high-precision micromachining, with a focus on higher throughput, improved beam homogeneity, and tighter process control.

At the forefront is ASML Holding, the world’s leading supplier of photolithography systems for the semiconductor industry. ASML’s excimer laser-based scanners, particularly those utilizing deep ultraviolet (DUV) wavelengths, remain critical for advanced chip manufacturing nodes. The company’s close collaboration with Cymer (a subsidiary specializing in excimer laser light sources) ensures continuous innovation in laser reliability, pulse energy stability, and integration with advanced scanner platforms. ASML’s market dominance is reinforced by its extensive service network and ongoing R&D investments targeting sub-5nm process technologies.

Another major player is Canon Inc., which maintains a significant presence in the excimer laser scanner market, particularly for both semiconductor and flat panel display applications. Canon’s FPA series scanners are recognized for their precision overlay and throughput, with recent models incorporating advanced alignment and stage control systems. Canon’s strategy emphasizes modular upgrades and compatibility with a range of excimer laser sources, supporting both legacy and next-generation manufacturing lines.

Nikon Corporation is also a key innovator, with its NSR series excimer laser scanners widely adopted in memory and logic device fabrication. Nikon’s focus on high numerical aperture optics and advanced wafer handling technologies has enabled it to address the stringent requirements of leading-edge semiconductor production. The company continues to invest in R&D for both immersion and dry excimer scanner platforms, aiming to enhance resolution and productivity.

On the excimer laser source side, Coherent Corp. and Lumentum Holdings are notable for their development of high-power, long-lifetime excimer lasers used in both lithography and materials processing. These companies are advancing gas management systems, pulse shaping, and remote diagnostics to meet the reliability and uptime demands of 24/7 manufacturing environments.

Looking ahead, the competitive landscape is expected to remain dynamic, with ongoing consolidation and strategic partnerships. The push for smaller process nodes, higher display resolutions, and new applications in advanced packaging and microLEDs will drive further innovation. Companies with strong vertical integration, robust service capabilities, and a commitment to R&D are likely to maintain or expand their market positions through 2025 and beyond.

Market Size and Growth Forecasts Through 2029

The global market for excimer laser scanning systems is poised for robust growth through 2029, driven by expanding applications in semiconductor manufacturing, flat panel display production, and advanced materials processing. As of 2025, the market is witnessing heightened demand due to the ongoing transition to advanced lithography nodes in semiconductor fabrication, particularly for logic and memory chips. Excimer lasers, especially those operating at 193 nm and 248 nm wavelengths, remain critical for deep ultraviolet (DUV) lithography, a technology essential for producing integrated circuits at sub-10 nm geometries.

Key industry players such as ASML Holding, the world’s leading supplier of photolithography systems, and Canon Inc. and Nikon Corporation, both major Japanese manufacturers, continue to invest in excimer laser-based scanning systems to support the semiconductor industry’s scaling roadmap. Cymer, a subsidiary of ASML, is a primary supplier of excimer laser light sources, providing critical components for high-volume manufacturing. These companies are expanding their production capacities and R&D investments to meet the surging requirements of foundries and integrated device manufacturers (IDMs) worldwide.

In 2025, the excimer laser scanning systems market is estimated to be valued in the multi-billion dollar range, with Asia-Pacific—particularly Taiwan, South Korea, and China—representing the largest regional share due to the concentration of leading semiconductor fabs and display panel manufacturers. The market is expected to register a compound annual growth rate (CAGR) in the high single digits through 2029, propelled by the proliferation of consumer electronics, 5G infrastructure, and automotive electronics, all of which demand advanced microfabrication technologies.

Beyond semiconductors, excimer laser scanning systems are increasingly adopted in the production of organic light-emitting diode (OLED) displays and advanced glass substrates, with companies like Coherent Corp. and Lumentum Holdings supplying high-performance excimer laser modules for these applications. The outlook for the next few years includes further integration of excimer laser systems in emerging fields such as microLED fabrication and advanced packaging, as well as continued innovation in laser source reliability and energy efficiency.

Overall, the excimer laser scanning systems market is set for sustained expansion through 2029, underpinned by technological advancements, capacity expansions by leading manufacturers, and the relentless drive for miniaturization and performance in electronics manufacturing.

Emerging Applications: Semiconductors, Medical Devices, and Beyond

Excimer laser scanning systems are poised for significant growth and diversification in 2025 and the coming years, driven by their unique capabilities in precision material processing. These systems, which utilize short-wavelength ultraviolet light generated by excimer lasers, are increasingly central to advanced manufacturing in semiconductors, medical devices, and a range of emerging applications.

In the semiconductor sector, excimer laser scanning systems are critical for photolithography, enabling the production of ever-smaller and more complex integrated circuits. The transition to sub-5nm process nodes by leading foundries is intensifying demand for high-performance excimer laser tools. ASML Holding, the world’s largest supplier of photolithography systems, continues to innovate in deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography, with excimer lasers playing a foundational role in DUV platforms. In 2025, ASML and its key laser supplier Cymer (a subsidiary of ASML) are expected to further enhance laser source stability and throughput, supporting the semiconductor industry’s roadmap for higher yields and lower defect rates.

Medical device manufacturing is another area where excimer laser scanning systems are expanding their footprint. The precision ablation and micromachining capabilities of excimer lasers are essential for fabricating intricate features in stents, catheters, and ophthalmic devices. Companies such as Coherent and Jenoptik are actively developing excimer-based solutions tailored for medical device production, focusing on improved beam quality, process automation, and compliance with stringent regulatory standards. In ophthalmology, excimer laser systems remain the gold standard for corneal refractive surgeries, with ongoing advancements aimed at faster procedures and enhanced patient outcomes.

Beyond semiconductors and medical devices, excimer laser scanning systems are finding new applications in flexible electronics, microfluidics, and advanced display manufacturing. The ability to process polymers, glass, and composite materials with minimal thermal damage is opening opportunities in next-generation display panels and lab-on-chip devices. Industry leaders such as TRUMPF and Lumentum are investing in R&D to adapt excimer laser platforms for these emerging markets, emphasizing scalability and integration with digital manufacturing workflows.

Looking ahead, the outlook for excimer laser scanning systems is robust, with continued innovation expected in laser source efficiency, system integration, and application-specific customization. As industries demand higher precision and throughput, excimer laser technology is set to remain a cornerstone of advanced manufacturing well into the next decade.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for excimer laser scanning systems is experiencing dynamic regional shifts, with North America, Europe, and Asia-Pacific emerging as key centers of innovation and adoption. As of 2025, these regions are characterized by distinct drivers, regulatory environments, and industrial focuses, shaping the competitive landscape and future outlook for excimer laser scanning technologies.

North America remains a leading hub, propelled by robust investments in semiconductor manufacturing, advanced medical device production, and research infrastructure. The United States, in particular, benefits from the presence of major excimer laser system manufacturers such as Coherent and Lumentum, both of which are actively expanding their product portfolios to address the growing demand for high-precision lithography and ophthalmic procedures. The region’s regulatory clarity and strong intellectual property protections further encourage innovation and adoption. In 2025, North American manufacturers are expected to focus on enhancing system throughput and energy efficiency, responding to the needs of both the semiconductor and medical sectors.

Europe is distinguished by its emphasis on quality standards and sustainability. Germany and the Netherlands are particularly prominent, with companies like TRUMPF and ASML leading advancements in excimer laser technology for semiconductor lithography and industrial applications. European Union initiatives supporting green manufacturing and digital transformation are anticipated to drive further adoption of excimer laser scanning systems, especially in automotive and electronics manufacturing. The region’s collaborative research networks and public-private partnerships are expected to yield new system architectures and integration with Industry 4.0 frameworks over the next few years.

Asia-Pacific is witnessing the fastest growth, fueled by aggressive investments in electronics, display manufacturing, and medical technology. Japan, South Korea, and China are at the forefront, with companies such as Hamamatsu Photonics and Canon expanding their excimer laser offerings. The region’s rapid industrialization, government incentives for semiconductor self-sufficiency, and increasing healthcare expenditures are expected to sustain double-digit growth rates through the late 2020s. Local manufacturers are also focusing on cost-effective system designs and expanding service networks to capture emerging market opportunities.

Rest of World regions, including Latin America and the Middle East, are gradually increasing adoption, primarily in medical and research applications. While market penetration remains lower compared to other regions, ongoing investments in healthcare infrastructure and technology transfer initiatives are expected to create new opportunities for excimer laser scanning system suppliers in the coming years.

Recent Innovations: Advances in Beam Control and System Integration

Recent years have witnessed significant advancements in excimer laser scanning systems, particularly in the domains of beam control and system integration. These innovations are driven by the increasing demand for higher precision, throughput, and reliability in applications such as semiconductor lithography, flat panel display manufacturing, and advanced materials processing.

A major trend in 2025 is the integration of real-time beam monitoring and adaptive optics within excimer laser scanning systems. Leading manufacturers such as Cymer (a subsidiary of ASML) and Coherent have introduced systems that utilize closed-loop feedback mechanisms to maintain beam uniformity and stability at nanometer scales. These systems employ high-speed sensors and actuators to dynamically adjust beam parameters, compensating for thermal drift and optical aberrations, which is critical for the sub-10 nm node semiconductor processes now entering high-volume manufacturing.

Another notable innovation is the development of modular system architectures that facilitate seamless integration with advanced process control and factory automation platforms. Companies like TRUMPF and Jenoptik have focused on scalable designs that allow for rapid reconfiguration and maintenance, reducing downtime and enabling flexible manufacturing. These modular systems are increasingly equipped with standardized communication protocols, such as OPC UA, to support Industry 4.0 initiatives and predictive maintenance strategies.

In terms of beam shaping and homogenization, recent excimer laser scanning systems incorporate sophisticated diffractive optical elements and programmable spatial light modulators. This enables precise tailoring of the energy distribution across the scan field, which is essential for uniform material processing and defect reduction. Coherent and Cymer have both reported significant improvements in energy efficiency and process yield through these technologies.

Looking ahead, the outlook for excimer laser scanning systems is marked by continued convergence of photonics and digital control. The next few years are expected to see further adoption of AI-driven beam optimization and deeper integration with metrology systems, enabling real-time process correction and higher levels of automation. As device geometries shrink and process windows tighten, these innovations will be pivotal in sustaining the pace of advancement in semiconductor and display manufacturing.

Regulatory and Industry Standards (e.g., SEMI, ISO)

Excimer laser scanning systems are critical components in advanced semiconductor manufacturing, flat panel display production, and precision micromachining. As these systems become more integral to high-value manufacturing processes, regulatory and industry standards play a pivotal role in ensuring safety, interoperability, and quality. In 2025 and the coming years, the regulatory landscape for excimer laser scanning systems is shaped by both international and industry-specific standards, with a focus on safety, performance, and environmental compliance.

The SEMI organization remains central to the development and maintenance of standards for semiconductor equipment, including excimer laser scanning systems. SEMI standards such as SEMI S2 (Environmental, Health, and Safety Guideline for Semiconductor Manufacturing Equipment) and SEMI S14 (Safety Guidelines for Fire Risk Assessment and Mitigation) are widely referenced by manufacturers and end-users. These standards are periodically updated to address emerging risks and technological advancements, with recent revisions emphasizing risk assessment for high-energy laser systems and integration with factory automation protocols.

On the international front, the International Organization for Standardization (ISO) provides a framework for laser safety and performance. ISO 11553 (Safety of machinery—Laser processing machines) and ISO 13849 (Safety of machinery—Safety-related parts of control systems) are particularly relevant for excimer laser scanning systems. These standards are being updated to reflect the increasing complexity of laser-based manufacturing and the need for robust safety interlocks, operator protection, and system diagnostics.

Manufacturers such as Cymer (a subsidiary of ASML and a leading supplier of excimer laser light sources for lithography) and Coherent (a major provider of industrial laser solutions) actively participate in standards development and compliance. These companies implement rigorous internal protocols to meet or exceed SEMI and ISO requirements, often collaborating with industry bodies to shape future standards. Their involvement ensures that new excimer laser scanning systems are designed with advanced safety features, energy efficiency, and compatibility with smart manufacturing environments.

Looking ahead, regulatory focus is expected to intensify on cybersecurity for networked laser systems, environmental sustainability (including end-of-life management and hazardous material handling), and harmonization of standards across regions. The ongoing evolution of SEMI and ISO standards will likely drive further innovation in excimer laser scanning system design, supporting the industry’s push toward higher throughput, precision, and automation while maintaining strict safety and environmental benchmarks.

Challenges and Barriers: Technical, Supply Chain, and Cost Factors

Excimer laser scanning systems are critical in advanced manufacturing sectors such as semiconductor lithography, display panel production, and precision micromachining. As of 2025, the industry faces a complex set of challenges and barriers that impact the deployment and scaling of these systems. These challenges are primarily technical, supply chain-related, and cost-driven.

Technical Challenges: Excimer lasers, which typically operate at ultraviolet wavelengths (e.g., 193 nm, 248 nm), require highly specialized optical components and precise control systems. Maintaining beam stability, uniformity, and pulse energy is essential for applications like photolithography, where even minor deviations can result in significant yield losses. The increasing demand for smaller feature sizes in semiconductor manufacturing, such as those required for sub-5 nm nodes, places additional pressure on system precision and reliability. Furthermore, the integration of excimer lasers with advanced scanning stages and real-time feedback mechanisms remains a significant engineering hurdle, as it requires synchronization at nanosecond timescales and sub-micron spatial accuracy.

Supply Chain Barriers: The excimer laser ecosystem is highly concentrated, with a few key players dominating the market for both laser sources and critical components. Cymer (a subsidiary of ASML) is a leading supplier of excimer laser light sources for semiconductor lithography, while Coherent and Hamamatsu Photonics are prominent in broader industrial and scientific applications. The supply of rare gases (e.g., krypton, xenon, fluorine) and high-purity optical materials is subject to geopolitical and logistical risks, which can disrupt production schedules. In recent years, global events have exposed vulnerabilities in the supply chain, leading to increased lead times and price volatility for both lasers and their consumables.

Cost Factors: The capital expenditure for excimer laser scanning systems remains high, often exceeding several million dollars per unit for state-of-the-art lithography tools. Ongoing operational costs are also significant, driven by the need for regular replacement of consumables (such as laser tubes and optics), maintenance, and the procurement of specialty gases. The high cost of ownership can be a barrier for smaller manufacturers and new entrants, consolidating market power among established players. Companies like ASML and Nikon continue to invest in R&D to improve system efficiency and reduce total cost of ownership, but progress is incremental due to the complexity of the technology.

Outlook: Over the next few years, the industry is expected to focus on incremental improvements in system reliability, component lifetimes, and supply chain resilience. Collaborative efforts between equipment manufacturers, component suppliers, and end-users will be essential to address these challenges. However, the fundamental barriers of technical complexity and high costs are likely to persist, shaping the competitive landscape and influencing the pace of innovation in excimer laser scanning systems.

Future Outlook: Disruptive Trends and Strategic Opportunities

The excimer laser scanning systems market is poised for significant transformation in 2025 and the following years, driven by rapid technological advancements, evolving application demands, and strategic industry shifts. Excimer lasers, which emit ultraviolet light, are critical in industries such as semiconductor manufacturing, ophthalmology, and advanced materials processing. The future outlook is shaped by several disruptive trends and emerging opportunities that are expected to redefine the competitive landscape.

A primary driver is the ongoing miniaturization in semiconductor fabrication, with the transition to sub-5nm nodes and the increasing adoption of extreme ultraviolet (EUV) lithography. Excimer laser systems, particularly those operating at 193 nm, remain essential for deep ultraviolet (DUV) lithography, which continues to be used in multiple patterning and complementary processes alongside EUV. Leading manufacturers such as ASML Holding and Cymer (a subsidiary of ASML) are investing heavily in enhancing excimer laser source reliability, pulse energy stability, and throughput to meet the stringent requirements of next-generation chip production. These improvements are expected to support higher wafer yields and lower cost per chip, maintaining excimer technology’s relevance even as EUV adoption grows.

In ophthalmology, excimer laser scanning systems are central to refractive surgeries such as LASIK and PRK. The next few years will likely see further integration of real-time eye-tracking, topography-guided ablation, and AI-driven treatment planning. Companies like Alcon and Carl Zeiss Meditec are at the forefront, developing systems with enhanced precision, patient customization, and reduced procedure times. The global rise in myopia and presbyopia prevalence, especially in Asia-Pacific, is expected to drive demand for advanced excimer platforms.

Materials processing is another area of opportunity, with excimer lasers enabling high-precision micromachining, surface structuring, and thin-film patterning for displays, photovoltaics, and medical devices. Coherent and Jenoptik are expanding their excimer portfolios to address new applications, including flexible electronics and bio-compatible device fabrication. The push for sustainable manufacturing and miniaturized components is likely to accelerate adoption of excimer-based solutions.

Strategically, partnerships between laser manufacturers, system integrators, and end-users are expected to intensify, fostering co-development of tailored solutions and accelerating time-to-market. Additionally, the integration of digital twins, predictive maintenance, and remote diagnostics—leveraging IoT and AI—will become standard, enhancing system uptime and reducing operational costs.

Overall, the excimer laser scanning systems sector in 2025 and beyond will be characterized by innovation, cross-industry collaboration, and a focus on precision, efficiency, and adaptability. Companies that invest in R&D, digital integration, and customer-centric solutions are well-positioned to capture emerging opportunities in this dynamic landscape.

Sources & References

- ASML Holding

- Canon Inc.

- Nikon Corporation

- Coherent

- Lumentum Holdings

- Jenoptik

- TRUMPF

- Hamamatsu Photonics

- International Organization for Standardization (ISO)

- Alcon

- Carl Zeiss Meditec