Flywheel Energy Storage Systems in 2025: Unleashing High-Speed Innovation and Market Expansion. Explore How Advanced Flywheel Technologies Are Powering the Future of Grid Stability and Clean Energy.

- Executive Summary: Key Insights for 2025 and Beyond

- Market Overview: Flywheel Energy Storage Systems Landscape

- Technology Deep Dive: Innovations and Breakthroughs in Flywheel Design

- Market Size & Forecast (2025–2030): Growth Trajectory and Revenue Projections (CAGR: 12–15%)

- Competitive Analysis: Leading Players and Emerging Startups

- Applications & Use Cases: Grid, Microgrid, and Industrial Solutions

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Drivers & Challenges: Factors Shaping Market Adoption

- Investment & Funding Trends: Capital Flows and Strategic Partnerships

- Future Outlook: Next-Gen Flywheel Technologies and Market Opportunities

- Conclusion & Strategic Recommendations

- Sources & References

Executive Summary: Key Insights for 2025 and Beyond

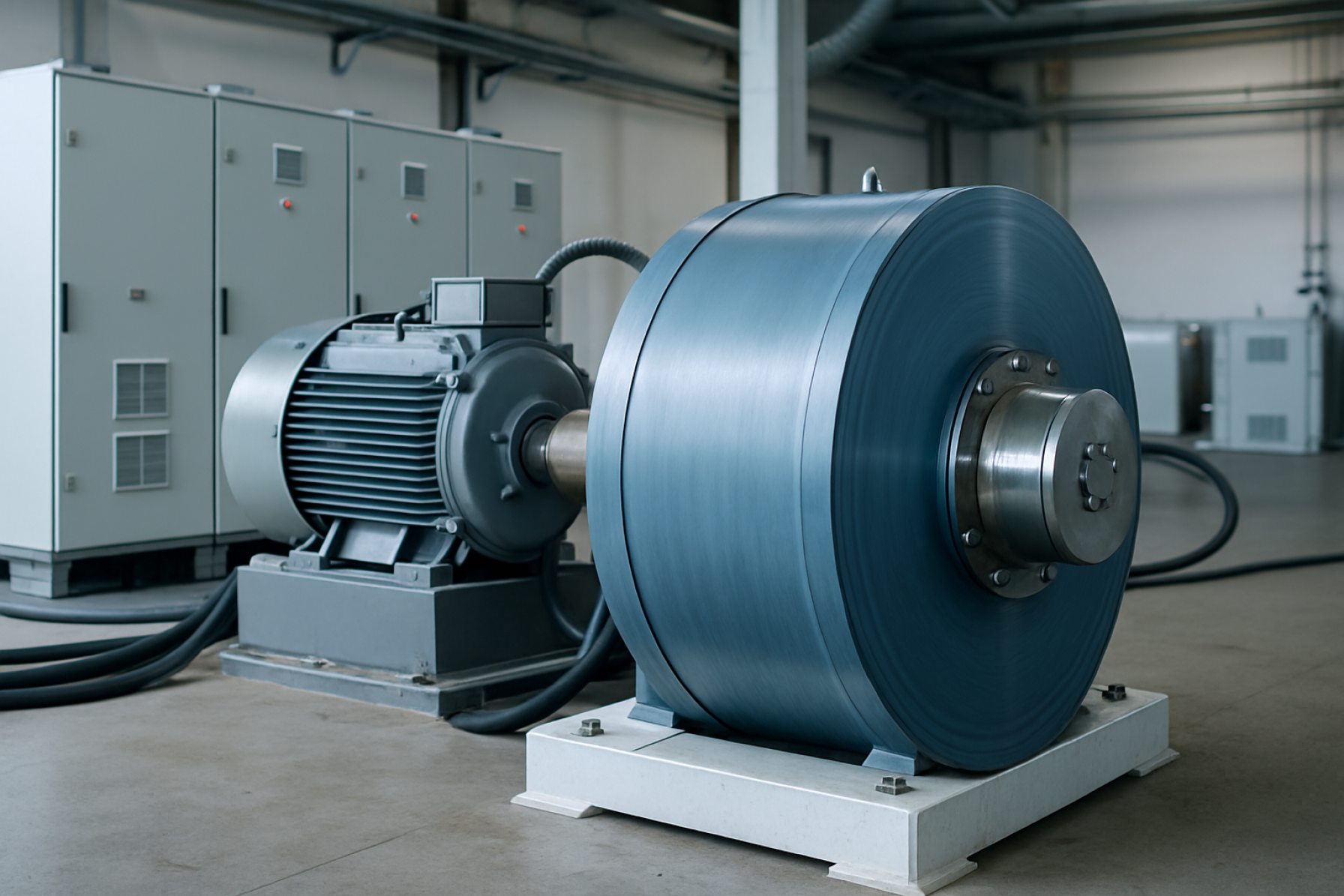

Flywheel Energy Storage Systems (FESS) are poised to play a pivotal role in the evolving global energy landscape through 2025 and beyond. These systems store kinetic energy in a rotating mass, offering rapid response times, high cycle durability, and minimal environmental impact compared to chemical batteries. As the integration of renewable energy sources accelerates, FESS are increasingly recognized for their ability to provide grid stability, frequency regulation, and short-term energy balancing.

Key insights for 2025 indicate a surge in demand for FESS, driven by the need for resilient and flexible energy storage solutions. Utilities and grid operators are adopting flywheel technology to address the intermittency of solar and wind power, ensuring reliable electricity supply during fluctuations. Notably, advancements in composite materials and magnetic bearings have enhanced the efficiency and lifespan of modern flywheel systems, reducing operational costs and maintenance requirements.

Major industry players such as Beacon Power and Temporal Power are expanding their project portfolios, with installations supporting both grid-scale and distributed energy applications. Additionally, organizations like the Sandia National Laboratories are actively researching next-generation flywheel technologies, focusing on higher energy densities and integration with smart grid infrastructure.

Policy support and regulatory frameworks in regions such as North America, Europe, and parts of Asia are fostering market growth by incentivizing energy storage deployment and grid modernization. The European Union’s commitment to decarbonization and grid resilience, for example, is catalyzing investments in advanced storage technologies, including FESS.

Looking ahead, the sector faces challenges such as high upfront capital costs and competition from lithium-ion batteries. However, the unique advantages of flywheels—such as unlimited cycling capability, rapid charge/discharge, and environmental safety—position them as a complementary solution in hybrid storage systems and specialized applications like uninterruptible power supply (UPS) and microgrids.

In summary, 2025 marks a critical juncture for Flywheel Energy Storage Systems, with technological innovation, supportive policy environments, and growing renewable integration driving adoption. Stakeholders across the energy value chain are expected to increasingly leverage FESS to enhance grid reliability, sustainability, and operational flexibility.

Market Overview: Flywheel Energy Storage Systems Landscape

The global market for Flywheel Energy Storage Systems (FESS) is experiencing significant growth as the demand for efficient, high-cycle energy storage solutions intensifies across various sectors. Flywheel systems store energy mechanically by accelerating a rotor to high speeds and maintaining the energy as rotational kinetic energy, which can be rapidly converted back to electricity when needed. This technology is gaining traction due to its long operational life, high power density, rapid response times, and minimal environmental impact compared to chemical batteries.

In 2025, the FESS market is characterized by increasing adoption in grid stabilization, renewable energy integration, uninterruptible power supply (UPS), and transportation applications. Utilities and grid operators are leveraging flywheels to provide frequency regulation and voltage support, addressing the intermittency challenges posed by solar and wind power. For instance, Beacon Power, LLC operates commercial flywheel plants in the United States, providing grid frequency regulation services. Similarly, Temporal Power Ltd. (now part of NRStor Inc.) has deployed flywheel systems for grid balancing in Canada.

The market landscape is also shaped by advancements in materials and manufacturing, such as the use of high-strength carbon fiber rotors and magnetic bearings, which enhance system efficiency and reduce maintenance. Companies like Active Power, Inc. and Punch Flybrid Ltd. are innovating in modular and scalable flywheel solutions for both industrial and transportation sectors. In the rail and automotive industries, flywheels are being explored for regenerative braking and hybrid propulsion, with Siemens AG and Alstom SA among the notable players investigating these applications.

Regionally, North America and Europe lead in FESS deployment, driven by supportive regulatory frameworks and investments in grid modernization. Asia-Pacific is emerging as a promising market, particularly in countries like Japan and China, where grid reliability and renewable integration are priorities. The competitive landscape is marked by both established energy technology firms and specialized startups, fostering innovation and driving down costs.

Overall, the 2025 market for Flywheel Energy Storage Systems is poised for robust expansion, underpinned by the global transition to cleaner energy systems and the need for resilient, high-performance storage technologies.

Technology Deep Dive: Innovations and Breakthroughs in Flywheel Design

Recent years have witnessed significant technological advancements in flywheel energy storage systems (FESS), positioning them as a competitive solution for grid stability, renewable integration, and high-power applications. Modern flywheel designs leverage breakthroughs in materials science, magnetic levitation, and power electronics to enhance efficiency, durability, and scalability.

One of the most transformative innovations is the adoption of advanced composite materials, such as carbon fiber-reinforced polymers, for the flywheel rotor. These materials offer exceptional tensile strength and low density, enabling higher rotational speeds and greater energy storage capacity without compromising safety. Companies like Beacon Power have pioneered the use of such composites, resulting in flywheels that can operate at tens of thousands of revolutions per minute (RPM) with minimal energy loss.

Magnetic levitation (maglev) technology has also revolutionized flywheel design. By suspending the rotor using magnetic bearings, friction is drastically reduced, leading to lower maintenance requirements and longer operational lifespans. Temporal Power and Active Power have integrated maglev systems into their commercial products, achieving round-trip efficiencies exceeding 90% and enabling continuous operation with minimal degradation.

Another key breakthrough is the integration of advanced power electronics and control systems. Modern FESS employ sophisticated inverters and digital controllers to manage rapid charge and discharge cycles, grid synchronization, and real-time performance optimization. This allows flywheels to respond within milliseconds to frequency fluctuations or power quality events, making them ideal for ancillary services and microgrid applications. Siemens Energy and GE Vernova have developed modular flywheel solutions that can be seamlessly integrated with renewable energy sources and smart grid infrastructure.

Looking ahead to 2025, research is focused on further increasing energy density, reducing system costs, and enhancing integration with other storage and generation technologies. Innovations such as vacuum enclosures to minimize air resistance, AI-driven predictive maintenance, and hybrid systems combining flywheels with batteries are under active development. These advances are expected to expand the role of FESS in supporting a resilient, low-carbon energy future.

Market Size & Forecast (2025–2030): Growth Trajectory and Revenue Projections (CAGR: 12–15%)

The global market for Flywheel Energy Storage Systems (FESS) is poised for robust expansion between 2025 and 2030, driven by increasing demand for grid stability, renewable energy integration, and advancements in high-speed composite materials. Industry analysts project a compound annual growth rate (CAGR) of 12–15% during this period, with market revenues expected to reach several billion USD by 2030. This growth trajectory is underpinned by the technology’s unique advantages—such as rapid response times, high cycle life, and minimal environmental impact—making FESS an attractive solution for both utility-scale and distributed energy storage applications.

Key market drivers include the global shift toward decarbonization, the proliferation of intermittent renewable energy sources, and the need for frequency regulation and ancillary grid services. Regions such as North America and Europe are anticipated to lead adoption, supported by favorable regulatory frameworks and significant investments in grid modernization. For instance, initiatives by organizations like the U.S. Department of Energy and the European Commission are fostering research, pilot projects, and commercial deployments of advanced energy storage technologies, including flywheels.

The commercial and industrial sectors are also emerging as significant contributors to market growth, leveraging FESS for uninterruptible power supply (UPS), voltage stabilization, and peak shaving. Leading manufacturers such as Beacon Power, LLC and Temporal Power Ltd. are expanding their product portfolios and global reach, further accelerating market penetration. Additionally, ongoing R&D efforts are expected to enhance system efficiency, reduce costs, and extend operational lifespans, thereby improving the overall value proposition of flywheel solutions.

By 2030, the FESS market is projected to benefit from increased standardization, economies of scale, and integration with digital grid management platforms. As a result, flywheel systems are likely to capture a growing share of the broader energy storage market, particularly in applications requiring high power density and rapid charge-discharge cycles. The anticipated CAGR of 12–15% reflects both the technology’s maturation and its expanding role in the global energy transition.

Competitive Analysis: Leading Players and Emerging Startups

The flywheel energy storage systems (FESS) market in 2025 is characterized by a dynamic interplay between established industry leaders and a wave of innovative startups. Major players such as Beacon Power and Temporal Power continue to dominate the sector, leveraging decades of experience in grid-scale applications and robust technology portfolios. Beacon Power, for instance, has deployed multiple commercial flywheel plants in North America, focusing on frequency regulation and grid stability. Their systems are recognized for high cycle life and rapid response times, making them attractive for ancillary services markets.

Meanwhile, Temporal Power has carved a niche with its low-maintenance, magnetically levitated flywheel designs, targeting both utility and industrial customers. These established companies benefit from proven track records, established supply chains, and strong relationships with grid operators and utilities.

However, the competitive landscape is rapidly evolving as emerging startups introduce novel materials, advanced control systems, and new business models. Companies like Storen Energy and Flywheel Energy (not to be confused with the oil and gas operator) are experimenting with composite rotors, vacuum enclosures, and modular architectures to improve energy density and reduce costs. These startups often target niche applications such as microgrids, remote communities, and commercial facilities seeking high power quality and resilience.

Collaboration between established players and startups is also increasing, with joint ventures and pilot projects aimed at integrating flywheels with other storage technologies or renewable energy sources. For example, Siemens Energy has shown interest in hybrid systems that combine flywheels with batteries to optimize performance across different timescales.

Overall, the FESS market in 2025 is marked by technological innovation, strategic partnerships, and a growing recognition of flywheels’ unique advantages—such as long cycle life, rapid charge/discharge, and minimal environmental impact. As both leading players and agile startups push the boundaries of performance and cost-effectiveness, flywheel energy storage is poised to play a significant role in the global transition to more resilient and sustainable energy systems.

Applications & Use Cases: Grid, Microgrid, and Industrial Solutions

Flywheel energy storage systems (FESS) are increasingly being adopted across a range of applications, particularly in grid stabilization, microgrid operations, and industrial settings. Their ability to deliver rapid response times, high cycle life, and minimal maintenance requirements makes them well-suited for scenarios where reliability and power quality are paramount.

In grid-scale applications, FESS are used to provide frequency regulation, voltage support, and spinning reserve. By absorbing or injecting power within milliseconds, flywheels help maintain grid stability during fluctuations in supply and demand. For example, Beacon Power has deployed flywheel plants in the United States that offer fast frequency regulation services, supporting grid operators in balancing real-time electricity supply.

Microgrids, which often integrate renewable energy sources like solar and wind, benefit from flywheel systems’ ability to smooth out intermittent generation and manage short-term power imbalances. Flywheels can bridge the gap between variable renewable output and steady load requirements, reducing reliance on fossil-fuel-based backup generators. Companies such as Temporal Power have demonstrated the use of flywheels in microgrid projects, enhancing both reliability and sustainability.

In industrial environments, FESS are deployed to ensure power quality and protect sensitive equipment from voltage sags, surges, and brief outages. Industries with critical processes—such as semiconductor manufacturing, data centers, and hospitals—use flywheels for uninterruptible power supply (UPS) applications. Piller Power Systems offers flywheel-based UPS solutions that deliver instantaneous backup power, reducing the risk of costly downtime and equipment damage.

Additionally, flywheels are being explored for use in transportation infrastructure, such as providing energy buffering for electric rail systems and supporting regenerative braking in urban transit. The versatility and durability of modern flywheel systems position them as a valuable component in the evolving landscape of energy storage and power quality management.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for flywheel energy storage systems (FESS) in 2025 reflects varying levels of adoption, technological advancement, and market drivers across North America, Europe, Asia-Pacific, and the Rest of the World. Each region’s approach is shaped by its energy infrastructure, policy frameworks, and investment in grid modernization.

- North America: The United States and Canada are at the forefront of FESS deployment, driven by grid reliability concerns, renewable integration, and frequency regulation needs. The presence of established players such as Beacon Power and supportive regulatory environments, particularly in states like California and New York, have accelerated pilot projects and commercial installations. The region benefits from robust R&D funding and a focus on decarbonization, positioning it as a leader in utility-scale flywheel applications.

- Europe: Europe’s FESS market is propelled by ambitious renewable energy targets and grid stability requirements. Countries like Germany and the United Kingdom are investing in advanced storage solutions to support intermittent wind and solar generation. The European Union’s policy initiatives, such as the European Green Deal, encourage the adoption of innovative storage technologies. Companies like Temporal Power (now part of NRStor Inc.) have contributed to demonstration projects, while cross-border collaborations foster knowledge exchange and standardization.

- Asia-Pacific: Rapid urbanization and industrialization in China, Japan, and South Korea are driving demand for resilient energy storage. Japan, in particular, has invested in FESS for grid stabilization following the Fukushima disaster, with companies such as Toshiba Energy Systems & Solutions Corporation developing commercial flywheel systems. China’s focus on smart grid development and renewable integration is expected to further stimulate market growth, supported by government incentives and local manufacturing capabilities.

- Rest of World: In regions such as Latin America, the Middle East, and Africa, FESS adoption remains nascent but is gaining attention for off-grid and microgrid applications. The technology’s ability to provide rapid response and low maintenance makes it attractive for remote or underserved areas. International organizations and development agencies are beginning to explore pilot projects to address energy access and reliability challenges.

Overall, while North America and Europe currently lead in FESS deployment, Asia-Pacific is poised for significant growth, and emerging markets are exploring niche applications. Regional policy support, grid modernization efforts, and renewable energy integration will continue to shape the global trajectory of flywheel energy storage systems in 2025.

Drivers & Challenges: Factors Shaping Market Adoption

The adoption of flywheel energy storage systems (FESS) in 2025 is shaped by a dynamic interplay of drivers and challenges. One of the primary drivers is the increasing demand for grid stability and frequency regulation, especially as renewable energy sources like wind and solar become more prevalent. Flywheels offer rapid response times and high cycle durability, making them attractive for applications requiring frequent charge and discharge cycles. Utilities and grid operators, such as National Grid, are exploring FESS to address short-term fluctuations and maintain power quality.

Another significant driver is the push for decarbonization and the need for sustainable, low-maintenance energy storage solutions. Flywheels, which use kinetic energy rather than chemical reactions, have a long operational life and minimal environmental impact compared to battery-based systems. Companies like Beacon Power are demonstrating the commercial viability of flywheel technology in grid-scale applications, further encouraging market adoption.

However, several challenges temper the widespread deployment of FESS. High upfront capital costs remain a barrier, particularly when compared to the rapidly declining costs of lithium-ion batteries. The mechanical complexity of flywheels, including the need for precision engineering and robust safety measures to contain high-speed rotors, adds to installation and maintenance expenses. Additionally, the energy density of flywheels is generally lower than that of chemical batteries, limiting their use to short-duration storage and specific grid services rather than long-term energy shifting.

Regulatory uncertainty and the lack of standardized market mechanisms for ancillary services also pose challenges. While organizations such as the Federal Energy Regulatory Commission (FERC) in the United States are working to create more favorable conditions for energy storage participation, policy frameworks are still evolving. This can make it difficult for project developers to secure revenue streams and financing.

In summary, the market adoption of flywheel energy storage systems in 2025 is propelled by the need for fast, durable, and environmentally friendly storage solutions, but is constrained by cost, technical limitations, and regulatory hurdles. Continued innovation and supportive policy development will be crucial in determining the future trajectory of FESS deployment.

Investment & Funding Trends: Capital Flows and Strategic Partnerships

In 2025, investment and funding trends in flywheel energy storage systems (FESS) reflect a growing recognition of their potential to address grid stability, renewable integration, and high-cycle energy storage needs. Capital flows into the sector have accelerated, driven by both public and private stakeholders seeking alternatives to chemical batteries for applications requiring rapid charge-discharge cycles and long operational lifespans. Notably, government-backed initiatives in the United States and Europe have provided grants and incentives to support pilot projects and commercialization efforts, with agencies such as the U.S. Department of Energy and the European Commission prioritizing grid modernization and resilience.

Venture capital and private equity firms have also increased their exposure to FESS startups, particularly those developing advanced composite rotors, magnetic bearings, and integrated power electronics. Strategic partnerships between flywheel technology developers and established energy infrastructure companies have become more common, as seen in collaborations between firms like Beacon Power and utility operators to deploy grid-scale flywheel installations. These alliances often focus on demonstration projects that validate performance in frequency regulation, voltage support, and microgrid applications.

Corporate investment from automotive and industrial conglomerates is another notable trend, with companies such as Siemens Energy exploring flywheel solutions for uninterruptible power supply (UPS) and regenerative braking systems. This cross-sector interest is fostering technology transfer and scaling opportunities, as well as opening new markets beyond traditional grid storage.

Despite these positive trends, funding challenges remain for early-stage companies, particularly in scaling manufacturing and achieving cost competitiveness with lithium-ion batteries. However, the emergence of green finance instruments and sustainability-linked loans is beginning to bridge this gap, as investors increasingly prioritize low-carbon and circular economy solutions. Looking ahead, the trajectory of capital flows and strategic partnerships in 2025 suggests that flywheel energy storage is poised for broader adoption, contingent on continued performance improvements and supportive policy frameworks.

Future Outlook: Next-Gen Flywheel Technologies and Market Opportunities

The future of flywheel energy storage systems (FESS) is poised for significant advancement, driven by innovations in materials science, system integration, and the growing demand for grid stability and renewable energy support. Next-generation flywheel technologies are expected to leverage high-strength carbon fiber composites, magnetic bearings, and vacuum enclosures to achieve higher rotational speeds, greater energy densities, and reduced maintenance requirements. These improvements will enable FESS to compete more effectively with other energy storage solutions, particularly in applications requiring rapid response and high cycle life.

Emerging research focuses on hybrid systems that combine flywheels with batteries or supercapacitors, optimizing both short-term power delivery and longer-duration energy storage. Such hybridization can address the intermittency of renewable sources like wind and solar, providing grid operators with flexible tools for frequency regulation, voltage support, and peak shaving. Additionally, advancements in digital control systems and predictive maintenance, supported by real-time data analytics, are expected to enhance the reliability and operational efficiency of FESS installations.

Market opportunities for next-gen flywheel technologies are expanding beyond traditional grid applications. The electrification of transportation, particularly in rail and urban transit, presents a growing demand for high-power, fast-cycling storage solutions. Flywheels are also being explored for uninterruptible power supply (UPS) systems in data centers and critical infrastructure, where their long service life and rapid discharge capabilities offer distinct advantages over chemical batteries.

Key industry players such as Beacon Power, LLC and Temporal Power Ltd. are actively developing and deploying advanced flywheel systems, while organizations like the Sandia National Laboratories continue to conduct research on performance optimization and integration strategies. As regulatory frameworks increasingly recognize the value of fast-responding, sustainable storage, the global FESS market is projected to grow, with Asia-Pacific and North America leading in deployment.

Looking ahead to 2025 and beyond, the convergence of material innovation, digitalization, and supportive policy environments is expected to unlock new applications and drive down costs. This positions flywheel energy storage as a critical enabler of resilient, low-carbon energy systems, supporting the transition to a more sustainable and reliable power grid.

Conclusion & Strategic Recommendations

Flywheel Energy Storage Systems (FESS) are emerging as a robust solution for grid stability, renewable energy integration, and high-power applications requiring rapid charge and discharge cycles. In 2025, the sector is characterized by technological advancements in composite materials, magnetic bearings, and vacuum enclosures, which have collectively improved efficiency, lifespan, and safety. As the global energy landscape shifts toward decarbonization and distributed generation, FESS offers unique advantages such as high cycle durability, minimal environmental impact, and low maintenance requirements.

Strategically, stakeholders should prioritize the following recommendations to maximize the value and adoption of FESS:

- Target Niche Applications: Focus on markets where FESS’s rapid response and high power density are critical, such as frequency regulation, uninterruptible power supply (UPS) for data centers, and microgrid stabilization. Collaborations with grid operators and industrial users can accelerate deployment.

- Invest in R&D: Continued investment in advanced materials and control systems will further enhance energy density and reduce costs. Partnerships with research institutions and industry leaders like Beacon Power and Temporal Power can drive innovation.

- Policy Engagement: Engage with regulatory bodies such as the U.S. Department of Energy and International Energy Agency to shape supportive policies, standards, and incentives for energy storage technologies, ensuring FESS is recognized alongside batteries and other storage solutions.

- Lifecycle and Sustainability Marketing: Highlight the recyclability and long operational life of FESS compared to chemical batteries, appealing to customers with sustainability goals and reducing total cost of ownership.

- Integration with Renewables: Develop turnkey solutions that pair FESS with solar and wind installations, leveraging their ability to smooth output fluctuations and provide ancillary services.

In conclusion, Flywheel Energy Storage Systems are poised to play a significant role in the evolving energy ecosystem. By focusing on innovation, strategic partnerships, and policy advocacy, industry participants can unlock new markets and contribute to a more resilient, sustainable power grid in 2025 and beyond.

Sources & References

- Beacon Power

- Sandia National Laboratories

- Active Power, Inc.

- Punch Flybrid Ltd.

- Siemens AG

- Alstom SA

- Siemens Energy

- GE Vernova

- European Commission

- Flywheel Energy

- Piller Power Systems

- National Grid

- International Energy Agency