2025 Graphene-Driven Photodetector Manufacturing Industry Report: Market Dynamics, Technology Breakthroughs, and Strategic Forecasts Through 2030

- Executive Summary and Market Overview

- Key Technology Trends in Graphene-Driven Photodetectors

- Competitive Landscape and Leading Players

- Market Size, Growth Forecasts, and CAGR Analysis (2025–2030)

- Regional Market Analysis and Emerging Hotspots

- Challenges, Risks, and Barriers to Adoption

- Opportunities and Strategic Recommendations

- Future Outlook: Innovations and Market Trajectories

- Sources & References

Executive Summary and Market Overview

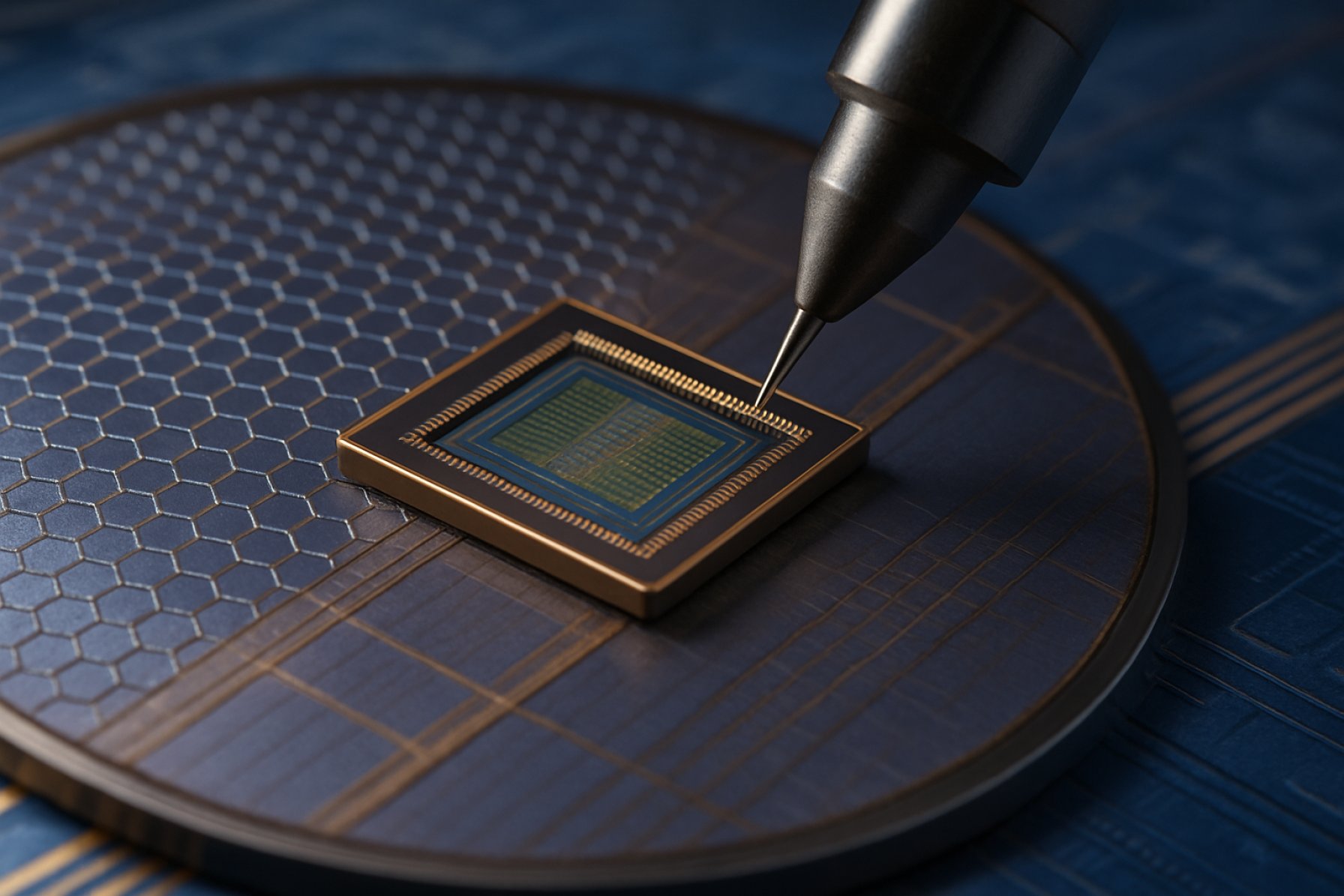

Graphene-driven photodetector manufacturing represents a rapidly evolving segment within the optoelectronics industry, leveraging the unique electrical and optical properties of graphene to enable next-generation photodetection technologies. Graphene, a single layer of carbon atoms arranged in a hexagonal lattice, offers exceptional carrier mobility, broadband absorption, and ultrafast response times, making it a highly attractive material for photodetector applications across telecommunications, imaging, sensing, and consumer electronics.

As of 2025, the global market for graphene-based photodetectors is experiencing robust growth, driven by increasing demand for high-speed, energy-efficient, and miniaturized optoelectronic devices. According to IDTechEx, the broader graphene market is projected to surpass $1 billion by 2025, with photodetector applications constituting a significant and expanding share due to their integration in advanced imaging systems, LiDAR, and next-generation communication networks.

Key industry players, including Graphenea, First Graphene, and Directa Plus, are actively investing in scalable manufacturing processes and strategic partnerships to accelerate the commercialization of graphene photodetectors. These efforts are complemented by research initiatives at leading institutions such as University of Cambridge and MIT, which are pioneering novel device architectures and integration techniques to enhance device performance and manufacturability.

The market landscape is characterized by a transition from laboratory-scale prototypes to industrial-scale production, with advancements in chemical vapor deposition (CVD) and roll-to-roll manufacturing enabling higher yields and cost efficiencies. The Asia-Pacific region, particularly China and South Korea, is emerging as a manufacturing hub, supported by government initiatives and investments in nanotechnology infrastructure (MarketsandMarkets).

Despite the promising outlook, challenges remain in standardizing material quality, ensuring device reliability, and achieving seamless integration with existing semiconductor processes. Nevertheless, the convergence of technological innovation, strategic collaborations, and growing end-user demand positions graphene-driven photodetector manufacturing as a key growth engine within the global optoelectronics market in 2025 and beyond.

Key Technology Trends in Graphene-Driven Photodetectors

Graphene-driven photodetector manufacturing in 2025 is characterized by rapid advancements in material synthesis, device architecture, and integration techniques, all aimed at leveraging graphene’s exceptional optoelectronic properties. The industry is witnessing a shift from laboratory-scale fabrication to scalable, commercially viable production processes, with a focus on achieving high sensitivity, broad spectral response, and ultrafast operation.

One of the most significant trends is the adoption of chemical vapor deposition (CVD) for large-area, high-quality graphene film production. CVD enables the growth of monolayer and few-layer graphene on copper or other substrates, which can then be transferred onto silicon or flexible substrates for device fabrication. Companies such as Graphenea and 2D Semiconductors are at the forefront of supplying CVD-grown graphene tailored for optoelectronic applications.

Another key trend is the integration of graphene with other two-dimensional (2D) materials, such as transition metal dichalcogenides (TMDs), to form van der Waals heterostructures. These hybrid structures enable enhanced light absorption and tunable bandgaps, resulting in photodetectors with improved responsivity and spectral selectivity. Research institutions and industry players are increasingly focusing on scalable stacking and transfer techniques to facilitate mass production of these heterostructures Nature Reviews Materials.

Device architecture innovation is also prominent, with the development of vertical and lateral photodetector designs that exploit graphene’s high carrier mobility and transparency. Vertical photodetectors, in particular, allow for efficient charge separation and collection, leading to higher quantum efficiency. Additionally, the use of plasmonic nanostructures and optical cavities is being explored to further enhance light-matter interaction in graphene-based devices Materials Today.

Manufacturers are increasingly adopting roll-to-roll processing and inkjet printing for flexible and wearable photodetector applications. These methods promise lower production costs and compatibility with large-area electronics, opening new markets in consumer electronics, healthcare, and the Internet of Things (IoT) IDTechEx.

In summary, 2025 sees graphene-driven photodetector manufacturing advancing toward scalable, cost-effective, and high-performance solutions, underpinned by innovations in material synthesis, device integration, and flexible electronics processing.

Competitive Landscape and Leading Players

The competitive landscape of graphene-driven photodetector manufacturing in 2025 is characterized by a dynamic mix of established semiconductor giants, specialized nanomaterials firms, and innovative startups. The market is witnessing increased collaboration between academic research institutions and commercial entities, aiming to accelerate the commercialization of graphene-based photodetectors, which offer superior sensitivity, ultrafast response times, and broad spectral detection compared to traditional silicon-based devices.

Key players in this sector include Samsung Electronics, which has invested heavily in graphene research and integrated photonic devices, leveraging its advanced fabrication capabilities. IBM Research continues to push the boundaries of graphene photonics, focusing on scalable manufacturing processes and integration with existing CMOS technology. Advanced Micro Devices (AMD) and Intel Corporation are also exploring graphene-based photodetectors for next-generation data communication and high-speed computing applications.

Among specialized firms, Graphenea and 2D Semiconductors are notable for their expertise in high-quality graphene synthesis and wafer-scale production, supplying materials to both research and industrial partners. Cambridge Graphene Centre (affiliated with the University of Cambridge) has spun out several startups, such as Emberion, which focuses on commercializing graphene-based photodetector modules for imaging and sensing markets.

The competitive environment is further shaped by strategic partnerships and licensing agreements. For instance, Graphene Flagship, a major European initiative, fosters collaboration between over 150 academic and industrial partners, accelerating the transfer of graphene photodetector technologies from lab to market. In Asia, TSMC and Sony Semiconductor Solutions are exploring integration of graphene photodetectors into consumer electronics and imaging sensors.

Overall, the competitive landscape in 2025 is marked by rapid innovation, with leading players focusing on overcoming challenges related to large-scale manufacturing, device integration, and cost reduction. The sector is expected to see increased M&A activity and cross-sector partnerships as companies race to capture emerging opportunities in telecommunications, medical imaging, and environmental sensing.

Market Size, Growth Forecasts, and CAGR Analysis (2025–2030)

The global market for graphene-driven photodetector manufacturing is poised for significant expansion between 2025 and 2030, driven by the material’s unique optoelectronic properties and the surging demand for high-performance photodetection in sectors such as telecommunications, consumer electronics, automotive, and healthcare. According to projections by MarketsandMarkets, the broader graphene market is expected to reach USD 2.8 billion by 2025, with photodetectors representing a rapidly growing application segment due to graphene’s high carrier mobility, broadband absorption, and ultrafast response times.

Specific to photodetectors, a report by IDTechEx forecasts that the graphene-based photodetector market will achieve a compound annual growth rate (CAGR) of approximately 35% from 2025 to 2030. This robust growth is attributed to increasing integration of graphene photodetectors in next-generation imaging systems, LiDAR, and optical communication devices, where traditional silicon-based detectors face performance limitations.

Regionally, Asia-Pacific is anticipated to dominate the market, led by substantial investments in semiconductor manufacturing and R&D initiatives in countries such as China, South Korea, and Japan. According to Grand View Research, these countries are accelerating the commercialization of graphene-based optoelectronic components, with several pilot production lines already operational by 2025. North America and Europe are also expected to witness strong growth, supported by government funding and strategic partnerships between research institutions and industry players.

- 2025 Market Size: Estimated at USD 120–150 million for graphene-driven photodetector manufacturing globally.

- Growth Drivers: Demand for high-speed, low-noise photodetectors in 5G/6G networks, autonomous vehicles, and medical imaging.

- CAGR (2025–2030): Projected at 35%, outpacing the overall graphene market growth rate.

- Key Players: Companies such as Graphenea, First Graphene, and AMS Technologies are actively scaling up production and forming collaborations to accelerate market adoption.

In summary, the period from 2025 to 2030 is expected to mark a transformative phase for graphene-driven photodetector manufacturing, with rapid market expansion, technological advancements, and increasing commercial deployments across multiple high-growth industries.

Regional Market Analysis and Emerging Hotspots

The regional landscape for graphene-driven photodetector manufacturing in 2025 is characterized by a dynamic interplay of established semiconductor hubs and emerging innovation hotspots. Asia-Pacific continues to dominate the market, propelled by robust investments in advanced materials and optoelectronics, particularly in China, South Korea, and Japan. China’s aggressive push for semiconductor self-sufficiency and its government-backed initiatives have led to the establishment of several graphene research centers and pilot production lines, with companies such as China Techfaith Wireless Communication Technology Limited and research institutions like Chinese Academy of Sciences spearheading photodetector innovation.

South Korea’s focus on next-generation display and sensor technologies has positioned it as a leader in integrating graphene into photodetector manufacturing. Major electronics conglomerates, including Samsung Electronics, are investing in R&D partnerships with universities to commercialize graphene-based optoelectronic devices. Japan, leveraging its expertise in precision manufacturing and materials science, is fostering collaborations between industry and academia, with entities such as National Institute for Materials Science (NIMS) playing a pivotal role.

In North America, the United States remains at the forefront of graphene photodetector research, driven by federal funding and a vibrant startup ecosystem. Institutions like Massachusetts Institute of Technology (MIT) and companies such as Graphenea are advancing scalable manufacturing techniques and exploring applications in telecommunications, imaging, and quantum technologies. The presence of leading semiconductor foundries and a strong intellectual property framework further bolster the region’s competitiveness.

Europe is emerging as a significant player, supported by the Graphene Flagship initiative, which coordinates cross-border research and commercialization efforts. Countries like Germany, the UK, and Spain are witnessing increased activity, with startups and established firms collaborating on pilot lines and supply chain development. The European Union’s emphasis on sustainable manufacturing and high-value applications is fostering a favorable environment for graphene photodetector innovation.

Emerging hotspots include India and Israel, where government-backed programs and a growing pool of skilled engineers are accelerating the adoption of graphene technologies. These regions are attracting foreign direct investment and forming international partnerships to bridge gaps in manufacturing infrastructure and expertise.

Overall, the global market for graphene-driven photodetector manufacturing in 2025 is marked by regional specialization, strategic investments, and a race to achieve commercial scalability, with Asia-Pacific leading but other regions rapidly closing the gap through targeted innovation and collaboration.

Challenges, Risks, and Barriers to Adoption

The adoption of graphene-driven photodetector manufacturing faces several significant challenges, risks, and barriers that could impede its widespread commercialization in 2025. Despite graphene’s exceptional electrical, optical, and mechanical properties, translating laboratory-scale breakthroughs into scalable, cost-effective industrial processes remains a complex endeavor.

- Material Quality and Consistency: Achieving uniform, defect-free graphene layers at wafer scale is a persistent challenge. Variations in synthesis methods, such as chemical vapor deposition (CVD), can lead to inconsistencies in thickness, grain boundaries, and contamination, directly impacting device performance and yield. The lack of standardized, high-throughput production methods hinders reliable integration into photodetector fabrication lines (Nature Reviews Materials).

- Integration with Existing Semiconductor Processes: Incorporating graphene into established CMOS-compatible manufacturing flows is non-trivial. Issues such as thermal budget constraints, interface engineering, and compatibility with photolithography processes present technical barriers. These integration challenges can increase production complexity and costs, slowing adoption by mainstream semiconductor manufacturers (Semiconductor Industry Association).

- Cost and Scalability: The high cost of high-quality graphene production, combined with the need for specialized equipment and process controls, makes large-scale manufacturing economically challenging. Until significant cost reductions are achieved, graphene-based photodetectors may struggle to compete with established silicon and III-V compound alternatives in price-sensitive markets (IDTechEx).

- Reliability and Long-Term Stability: Ensuring the long-term operational stability of graphene photodetectors under varying environmental conditions (humidity, temperature, radiation) is critical for commercial applications. Degradation mechanisms, such as oxidation or contamination at the graphene interface, can compromise device reliability and lifespan (IEEE).

- Regulatory and Standardization Issues: The absence of universally accepted standards for graphene material quality, device testing, and safety protocols creates uncertainty for manufacturers and end-users. Regulatory clarity and industry-wide standardization are needed to facilitate market entry and build customer confidence (International Organization for Standardization (ISO)).

Addressing these challenges will require coordinated efforts across the supply chain, including advances in materials science, process engineering, and regulatory frameworks, to unlock the full commercial potential of graphene-driven photodetector manufacturing.

Opportunities and Strategic Recommendations

The graphene-driven photodetector manufacturing sector is poised for significant growth in 2025, driven by the material’s unique optoelectronic properties and expanding application landscape. As the demand for high-speed, broadband, and ultra-sensitive photodetectors intensifies across industries such as telecommunications, medical imaging, automotive LiDAR, and consumer electronics, graphene’s atomic thickness, high carrier mobility, and broadband absorption position it as a disruptive enabler.

Opportunities

- Integration with Silicon Photonics: The compatibility of graphene with CMOS processes enables seamless integration into existing silicon photonics platforms, reducing manufacturing costs and accelerating commercialization. Strategic partnerships with foundries and photonics companies can unlock new revenue streams (imec).

- Emerging Applications: The proliferation of 5G/6G networks, autonomous vehicles, and advanced medical diagnostics is fueling demand for next-generation photodetectors. Graphene’s ultrafast response and tunable spectral sensitivity make it ideal for these high-growth segments (IDTechEx).

- Flexible and Wearable Devices: The flexibility and transparency of graphene open opportunities in wearable health monitoring, smart textiles, and flexible consumer electronics, where traditional photodetector materials fall short (Samsung Semiconductor).

- Government and R&D Funding: Ongoing investments from government initiatives and research consortia, particularly in Europe and Asia, are accelerating technology maturation and pilot-scale manufacturing (Graphene Flagship).

Strategic Recommendations

- Scale Up Production: Invest in scalable, high-yield graphene synthesis methods (e.g., CVD) to ensure consistent quality and cost competitiveness for mass-market adoption.

- Collaborative Innovation: Form alliances with photonics, semiconductor, and end-user companies to co-develop application-specific solutions and accelerate time-to-market.

- Intellectual Property (IP) Strategy: Secure patents around device architectures, integration techniques, and novel applications to strengthen competitive positioning.

- Market Education: Engage in targeted outreach to educate OEMs and system integrators on the performance and integration benefits of graphene photodetectors.

In summary, 2025 presents robust opportunities for graphene-driven photodetector manufacturers who prioritize scalable production, strategic partnerships, and application-driven innovation.

Future Outlook: Innovations and Market Trajectories

The future outlook for graphene-driven photodetector manufacturing in 2025 is marked by rapid innovation and evolving market trajectories, driven by the unique properties of graphene and its integration into next-generation optoelectronic devices. Graphene’s exceptional carrier mobility, broadband absorption, and mechanical flexibility are catalyzing the development of photodetectors with higher sensitivity, faster response times, and broader spectral ranges compared to traditional semiconductor-based devices.

Key innovations anticipated in 2025 include the commercialization of hybrid photodetector architectures, where graphene is combined with other two-dimensional (2D) materials such as transition metal dichalcogenides (TMDs) and perovskites. These heterostructures are expected to deliver enhanced photoresponsivity and tunable detection wavelengths, opening new applications in telecommunications, medical imaging, and environmental monitoring. Leading research institutions and industry players are investing in scalable chemical vapor deposition (CVD) techniques and roll-to-roll manufacturing processes to enable cost-effective, large-area production of graphene films suitable for integration into photodetector arrays IDTechEx.

Market trajectories indicate a shift from laboratory-scale prototypes to commercial deployment, particularly in sectors demanding ultrafast and flexible photodetection solutions. The consumer electronics industry is poised to adopt graphene-based photodetectors for advanced camera sensors and biometric devices, while the automotive sector explores their use in LiDAR and driver-assistance systems. The telecommunications industry is also expected to benefit from graphene’s high-speed photodetection capabilities, supporting the rollout of 5G and future 6G networks MarketsandMarkets.

- Emerging partnerships between material suppliers, device manufacturers, and end-users are accelerating the commercialization timeline.

- Standardization efforts and regulatory frameworks are being developed to ensure quality and reliability in mass-produced graphene photodetectors.

- Venture capital and government funding are fueling startups and scale-ups focused on graphene optoelectronics, with Asia-Pacific and Europe leading in pilot production facilities Graphene Flagship.

By 2025, the convergence of material innovation, scalable manufacturing, and expanding application domains is expected to position graphene-driven photodetectors as a disruptive force in the global optoelectronics market, with significant growth potential and a trajectory toward mainstream adoption.

Sources & References

- IDTechEx

- First Graphene

- Directa Plus

- University of Cambridge

- MIT

- MarketsandMarkets

- 2D Semiconductors

- Nature Reviews Materials

- IBM Research

- Grand View Research

- AMS Technologies

- Chinese Academy of Sciences

- National Institute for Materials Science (NIMS)

- Graphene Flagship

- Semiconductor Industry Association

- IEEE

- International Organization for Standardization (ISO)

- imec