Invasive Species Genomic Surveillance Technologies Market Report 2025: Unveiling Key Growth Drivers, Emerging Technologies, and Global Forecasts. Explore How Advanced Genomics is Transforming Biosecurity and Ecosystem Management.

- Executive Summary & Market Overview

- Key Market Drivers and Restraints

- Technology Trends: AI, Real-Time Sequencing, and Data Integration

- Competitive Landscape and Leading Players

- Market Size & Growth Forecasts (2025–2030): CAGR and Revenue Projections

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges and Opportunities in Genomic Surveillance

- Future Outlook: Innovations and Strategic Recommendations

- Sources & References

Executive Summary & Market Overview

Invasive species genomic surveillance technologies represent a rapidly evolving segment within the broader biosecurity and environmental monitoring markets. These technologies leverage advanced genomic tools—such as next-generation sequencing (NGS), environmental DNA (eDNA) analysis, and bioinformatics platforms—to detect, monitor, and track the spread of non-native organisms across ecosystems. The global market for invasive species genomic surveillance is projected to experience robust growth through 2025, driven by increasing governmental and institutional focus on biodiversity protection, agricultural biosecurity, and the mitigation of ecological and economic damages caused by invasive species.

According to recent analyses, the economic impact of invasive species is estimated to exceed $120 billion annually in the United States alone, with similar challenges reported globally (U.S. Department of Agriculture). This has prompted significant investments in early detection and rapid response (EDRR) systems, where genomic surveillance plays a pivotal role. The integration of high-throughput sequencing and portable DNA analysis devices has enabled real-time, field-based identification of invasive organisms, reducing response times and improving management outcomes (Nature Biotechnology).

Key market drivers in 2025 include the increasing adoption of eDNA-based monitoring in aquatic and terrestrial environments, regulatory mandates for invasive species management, and the expansion of public-private partnerships. Notably, agencies such as the U.S. Environmental Protection Agency and the Centre for Agriculture and Bioscience International (CABI) have launched initiatives to standardize genomic surveillance protocols and facilitate data sharing across borders. The Asia-Pacific region is emerging as a significant growth area, fueled by heightened awareness of invasive species threats to agriculture and native biodiversity (Food and Agriculture Organization of the United Nations).

- Market leaders include technology providers specializing in NGS platforms, such as Illumina, Inc. and Thermo Fisher Scientific, as well as bioinformatics firms offering cloud-based surveillance solutions.

- Collaborative research networks and government agencies are key end-users, with increasing uptake among conservation NGOs and agricultural producers.

- Challenges remain in standardizing methodologies, ensuring data interoperability, and addressing privacy and ethical concerns related to genomic data collection.

Overall, the invasive species genomic surveillance technologies market in 2025 is characterized by technological innovation, cross-sector collaboration, and a growing recognition of the critical role genomics plays in safeguarding ecosystems and economies from biological invasions.

Key Market Drivers and Restraints

In 2025, the market for invasive species genomic surveillance technologies is shaped by a dynamic interplay of drivers and restraints, reflecting both technological advancements and persistent challenges in biosecurity and environmental management.

Key Market Drivers

- Rising Incidence of Invasive Species: The increasing frequency and impact of biological invasions, exacerbated by global trade and climate change, are compelling governments and industries to invest in advanced surveillance solutions. The economic cost of invasive species is estimated at over $423 billion annually worldwide, underscoring the urgency for effective monitoring tools (United Nations Environment Programme).

- Technological Advancements in Genomics: Rapid progress in next-generation sequencing (NGS), portable DNA analysis, and bioinformatics has significantly improved the sensitivity, speed, and cost-effectiveness of genomic surveillance. These innovations enable early detection and real-time monitoring of invasive species, even at low population densities (Illumina, Inc.).

- Regulatory and Policy Support: Strengthening of biosecurity regulations and international agreements, such as the Convention on Biological Diversity, is driving adoption of genomic surveillance technologies by mandating early detection and rapid response systems (Convention on Biological Diversity).

- Integration with Digital Platforms: The convergence of genomic data with digital mapping, AI, and cloud-based platforms is enhancing data sharing and decision-making capabilities for stakeholders in agriculture, forestry, and environmental management (Thermo Fisher Scientific).

Key Market Restraints

- High Initial Investment and Operational Costs: Despite falling sequencing costs, the deployment of comprehensive genomic surveillance systems requires significant capital for equipment, skilled personnel, and data infrastructure, which can be prohibitive for resource-limited regions (Food and Agriculture Organization of the United Nations).

- Data Management and Standardization Challenges: The vast volume and complexity of genomic data necessitate robust data management, interoperability, and standardization protocols, which remain underdeveloped in many jurisdictions (Nature Biotechnology).

- Regulatory and Ethical Concerns: Issues related to data privacy, cross-border data sharing, and the ethical use of genetic information can slow adoption and complicate international collaboration (Organisation for Economic Co-operation and Development).

Technology Trends: AI, Real-Time Sequencing, and Data Integration

In 2025, invasive species genomic surveillance technologies are rapidly evolving, driven by advances in artificial intelligence (AI), real-time sequencing, and integrated data platforms. These innovations are transforming how researchers, governments, and industry stakeholders detect, monitor, and respond to biological invasions across ecosystems.

AI-powered analytics are at the forefront of this transformation. Machine learning algorithms now process vast genomic datasets to identify invasive species signatures with unprecedented speed and accuracy. For example, AI models can distinguish between native and non-native genetic material in environmental DNA (eDNA) samples, enabling early detection of invasive organisms before they establish damaging populations. This approach is being adopted in national biosecurity programs and by research consortia, such as those coordinated by the U.S. Geological Survey and the Centre for Agriculture and Bioscience International.

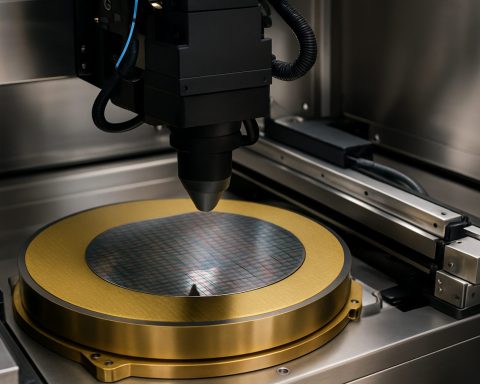

Real-time sequencing technologies, particularly portable nanopore sequencers, are revolutionizing field-based surveillance. Devices like Oxford Nanopore’s MinION allow for on-site genomic analysis, reducing the time from sample collection to actionable results from weeks to mere hours. This capability is critical for rapid response to new incursions, as demonstrated in pilot projects by the Commonwealth Scientific and Industrial Research Organisation (CSIRO) and the European Union’s LIFE projects. The integration of real-time sequencing with cloud-based AI platforms further accelerates data interpretation and decision-making.

- Data Integration: The proliferation of genomic data from multiple sources—eDNA, metagenomics, and traditional surveys—necessitates robust data integration frameworks. In 2025, cloud-based platforms are enabling seamless aggregation, harmonization, and sharing of surveillance data across borders and institutions. Initiatives like the Global Biodiversity Information Facility (GBIF) and the National Invasive Species Information Center are centralizing access to genomic surveillance outputs, supporting coordinated management strategies.

- Interoperability and Standards: The adoption of open data standards and interoperable formats is facilitating cross-platform analytics and collaborative research. This trend is supported by organizations such as the European Bioinformatics Institute (EMBL-EBI), which provides guidelines for genomic data sharing and annotation.

Collectively, these technology trends are enhancing the precision, speed, and scalability of invasive species genomic surveillance, positioning the sector for more proactive and data-driven management in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for invasive species genomic surveillance technologies in 2025 is characterized by rapid innovation, strategic partnerships, and a growing number of specialized players. The market is driven by the urgent need for early detection and management of invasive species, which threaten biodiversity, agriculture, and public health worldwide. Key players are leveraging advances in next-generation sequencing (NGS), portable DNA analysis, and bioinformatics to offer comprehensive surveillance solutions.

Leading companies in this space include Illumina, Inc., which dominates the NGS market with platforms widely adopted for environmental DNA (eDNA) monitoring. Oxford Nanopore Technologies has gained significant traction with its portable MinION sequencer, enabling real-time, in-field genomic analysis of invasive species. These technologies are increasingly integrated into national and regional biosecurity programs, as seen in collaborations with government agencies and research institutions.

Emerging players such as QIAGEN and Thermo Fisher Scientific are expanding their portfolios to include specialized kits and reagents for eDNA extraction and amplification, tailored for invasive species detection. Startups like Trace Genomics are innovating with AI-driven analytics platforms that interpret complex genomic data, providing actionable insights for ecosystem managers.

Strategic collaborations are a hallmark of the sector. For example, Illumina has partnered with conservation organizations and governmental bodies to develop standardized protocols for invasive species surveillance. Similarly, Oxford Nanopore Technologies collaborates with academic consortia to validate field applications of their portable sequencers in diverse environments, from freshwater systems to agricultural landscapes.

- Market Differentiators: Companies differentiate through platform portability, data analysis speed, and the ability to detect multiple species simultaneously. Integration with cloud-based bioinformatics and user-friendly reporting tools is increasingly important.

- Regional Dynamics: North America and Europe lead in technology adoption, supported by robust regulatory frameworks and funding for invasive species management. Asia-Pacific is emerging as a high-growth region, driven by expanding agricultural and aquaculture sectors.

Overall, the competitive landscape in 2025 is marked by technological convergence, with established genomics firms and agile startups racing to provide scalable, accurate, and cost-effective surveillance solutions for invasive species management worldwide.

Market Size & Growth Forecasts (2025–2030): CAGR and Revenue Projections

The global market for invasive species genomic surveillance technologies is poised for robust expansion between 2025 and 2030, driven by increasing governmental and private sector investments in biosecurity, agriculture, and environmental monitoring. In 2025, the market is projected to reach approximately USD 1.2 billion, with a compound annual growth rate (CAGR) estimated at 13.8% through 2030. This growth trajectory is underpinned by the rising adoption of next-generation sequencing (NGS), portable genomic analysis devices, and advanced bioinformatics platforms for early detection and management of invasive species.

Key drivers include heightened awareness of the economic and ecological impacts of invasive species, which cost the global economy an estimated USD 423 billion annually, according to the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES). Governments in North America, Europe, and Asia-Pacific are increasingly mandating genomic surveillance in agricultural and natural resource management, further fueling market demand. For instance, the U.S. Department of Agriculture (USDA) and the European Environment Agency (EEA) have launched initiatives to integrate genomic tools into invasive species monitoring programs.

Revenue projections indicate that by 2030, the market could surpass USD 2.3 billion, with North America and Europe accounting for over 60% of global revenues due to their advanced research infrastructure and regulatory frameworks. The Asia-Pacific region is expected to register the fastest CAGR, exceeding 15%, as countries like China, Japan, and Australia ramp up investments in genomic surveillance to protect biodiversity and agricultural exports.

Segment-wise, portable sequencing devices and cloud-based bioinformatics solutions are anticipated to exhibit the highest growth rates, reflecting a shift toward real-time, field-deployable surveillance. Companies such as Oxford Nanopore Technologies and Illumina, Inc. are leading innovation in this space, with new product launches and strategic partnerships aimed at expanding their market footprint.

Overall, the 2025–2030 period will likely see accelerated adoption of genomic surveillance technologies, supported by favorable policy environments, technological advancements, and the urgent need to mitigate the spread and impact of invasive species worldwide.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for invasive species genomic surveillance technologies in 2025 is shaped by varying levels of technological adoption, regulatory frameworks, and ecological priorities across North America, Europe, Asia-Pacific, and the Rest of World (RoW).

- North America: The United States and Canada lead in the deployment of advanced genomic surveillance platforms, driven by robust funding from government agencies such as the U.S. Department of Agriculture and Environment and Climate Change Canada. The region benefits from established research infrastructure and public-private partnerships, with a focus on early detection of agricultural pests and aquatic invaders. The integration of next-generation sequencing (NGS) and environmental DNA (eDNA) monitoring is widespread, supported by initiatives like the U.S. Geological Survey’s invasive species programs. North America’s market is projected to maintain steady growth, with increasing investment in real-time, field-deployable genomic tools.

- Europe: The European Union’s stringent biosecurity regulations and cross-border collaboration foster a strong market for genomic surveillance. Agencies such as the European Commission and European Food Safety Authority drive harmonized surveillance protocols, particularly for invasive plant pathogens and vectors. The region emphasizes data sharing and interoperability, with projects like the LifeWatch ERIC supporting pan-European biodiversity monitoring. Adoption of portable sequencing devices and AI-driven analytics is accelerating, especially in response to climate-driven species shifts.

- Asia-Pacific: Rapid economic development and high biodiversity make Asia-Pacific both a hotspot for invasions and a growing market for genomic surveillance. Countries such as Australia and Japan are at the forefront, leveraging investments from organizations like the Commonwealth Scientific and Industrial Research Organisation (CSIRO) and National Institute for Environmental Studies (NIES). The focus is on protecting agriculture, aquaculture, and native ecosystems, with increasing adoption of eDNA and metagenomics. However, disparities in infrastructure and expertise persist across the region, limiting uniform uptake.

- Rest of World (RoW): In Latin America, Africa, and the Middle East, adoption of genomic surveillance technologies is nascent but growing, often supported by international collaborations and funding from entities like the Food and Agriculture Organization (FAO). Efforts are concentrated on high-impact invaders affecting food security and public health. Capacity-building initiatives and technology transfer are critical to market development in these regions.

Overall, while North America and Europe dominate in terms of market maturity and technological sophistication, Asia-Pacific and RoW present significant growth opportunities as awareness and investment in invasive species genomic surveillance expand globally.

Challenges and Opportunities in Genomic Surveillance

Genomic surveillance technologies for invasive species have rapidly evolved, offering both significant opportunities and notable challenges as of 2025. These technologies, which include next-generation sequencing (NGS), environmental DNA (eDNA) analysis, and portable sequencing devices, are transforming how researchers and policymakers detect, monitor, and manage invasive species across ecosystems.

One of the primary opportunities lies in the increased sensitivity and specificity of detection. NGS and eDNA methods enable early identification of invasive organisms at low population densities, often before traditional survey methods would detect their presence. This early warning capability is crucial for rapid response and containment, potentially saving billions in ecological and economic damages. For example, the use of eDNA in aquatic environments has allowed for the detection of invasive carp and zebra mussels at trace levels, facilitating targeted management actions (U.S. Geological Survey).

Another opportunity is the scalability and cost-effectiveness of genomic surveillance. As sequencing costs continue to decline, large-scale monitoring programs become more feasible, allowing for broader geographic coverage and more frequent sampling. Cloud-based bioinformatics platforms further streamline data analysis and sharing, fostering collaboration among agencies and countries (Illumina, Inc.).

However, several challenges persist. One major hurdle is the need for comprehensive and curated reference databases. Accurate identification of invasive species from genomic data depends on the availability of high-quality reference genomes, which are lacking for many taxa, especially in understudied regions (National Center for Biotechnology Information). Additionally, distinguishing between closely related native and invasive species can be difficult, leading to potential misidentification and management errors.

Data interpretation and standardization also present obstacles. Variability in sampling protocols, sequencing platforms, and bioinformatics pipelines can result in inconsistent data, complicating cross-study comparisons and policy decisions. There is a growing need for international standards and best practices to ensure data reliability and interoperability (Organisation for Economic Co-operation and Development).

Finally, ethical and legal considerations, such as data ownership, privacy, and the potential for unintended ecological impacts, must be addressed as genomic surveillance becomes more widespread. Engaging stakeholders and developing transparent governance frameworks will be essential to maximize the benefits and minimize the risks of these powerful technologies.

Future Outlook: Innovations and Strategic Recommendations

The future of invasive species genomic surveillance technologies in 2025 is poised for significant transformation, driven by rapid advancements in sequencing platforms, bioinformatics, and data-sharing frameworks. As global trade and climate change accelerate the spread of invasive species, the demand for real-time, high-resolution monitoring tools is intensifying. Next-generation sequencing (NGS) platforms are expected to become more portable and cost-effective, enabling field-based genomic surveillance that can deliver actionable insights within hours rather than days. Companies such as Oxford Nanopore Technologies are leading the way with handheld sequencers that facilitate on-site detection and identification of invasive organisms.

Artificial intelligence (AI) and machine learning (ML) are set to play a pivotal role in automating the analysis of complex genomic datasets. These technologies will enhance the accuracy of species identification, track genetic adaptations, and predict potential spread patterns. Strategic integration of AI-driven analytics with cloud-based data repositories, such as those managed by National Center for Biotechnology Information (NCBI), will foster global collaboration and rapid response to emerging threats.

Looking ahead, the convergence of environmental DNA (eDNA) sampling with advanced genomics will enable non-invasive, large-scale monitoring of ecosystems. This approach is already being piloted in several regions, with organizations like U.S. Geological Survey (USGS) and CSIRO investing in eDNA-based surveillance networks. By 2025, these systems are expected to be integrated with remote sensing and Internet of Things (IoT) devices, providing continuous, automated updates on invasive species presence and movement.

Strategic recommendations for stakeholders include:

- Investing in the development and deployment of portable, real-time sequencing devices to enhance field surveillance capabilities.

- Establishing cross-sector partnerships to standardize data formats and promote interoperability between surveillance platforms.

- Leveraging AI and ML for predictive modeling and early warning systems, enabling proactive management interventions.

- Expanding public-private collaborations to secure funding and accelerate the translation of research innovations into operational tools.

- Prioritizing capacity-building initiatives to train personnel in genomic data interpretation and bioinformatics.

In summary, the future landscape of invasive species genomic surveillance will be shaped by technological innovation, data integration, and collaborative frameworks, offering unprecedented opportunities for early detection and rapid response in 2025 and beyond.

Sources & References

- Nature Biotechnology

- Centre for Agriculture and Bioscience International (CABI)

- Food and Agriculture Organization of the United Nations

- Illumina, Inc.

- Thermo Fisher Scientific

- United Nations Environment Programme

- Commonwealth Scientific and Industrial Research Organisation (CSIRO)

- Global Biodiversity Information Facility (GBIF)

- National Invasive Species Information Center

- European Bioinformatics Institute (EMBL-EBI)

- QIAGEN

- Trace Genomics

- European Environment Agency (EEA)

- Oxford Nanopore Technologies

- Environment and Climate Change Canada

- European Commission

- European Food Safety Authority

- LifeWatch ERIC

- National Institute for Environmental Studies (NIES)

- National Center for Biotechnology Information