Lithium-Tantalate Crystal Fabrication in 2025: Unraveling the Next Wave of Precision Materials for Advanced Electronics and Photonics. Explore How Innovation and Demand Are Shaping the Industry’s Future.

- Executive Summary: Key Trends and 2025 Outlook

- Market Size, Growth Forecasts, and Regional Hotspots (2025–2030)

- Core Applications: 5G, IoT, Medical Devices, and Beyond

- Technology Innovations in Crystal Growth and Processing

- Supply Chain Dynamics: Raw Materials, Sourcing, and Sustainability

- Competitive Landscape: Leading Manufacturers and Strategic Moves

- Emerging Players and Startups to Watch

- Regulatory Environment and Industry Standards (e.g., IEEE, IEC)

- Challenges: Yield, Cost, and Quality Control

- Future Outlook: Disruptive Technologies and Long-Term Opportunities

- Sources & References

Executive Summary: Key Trends and 2025 Outlook

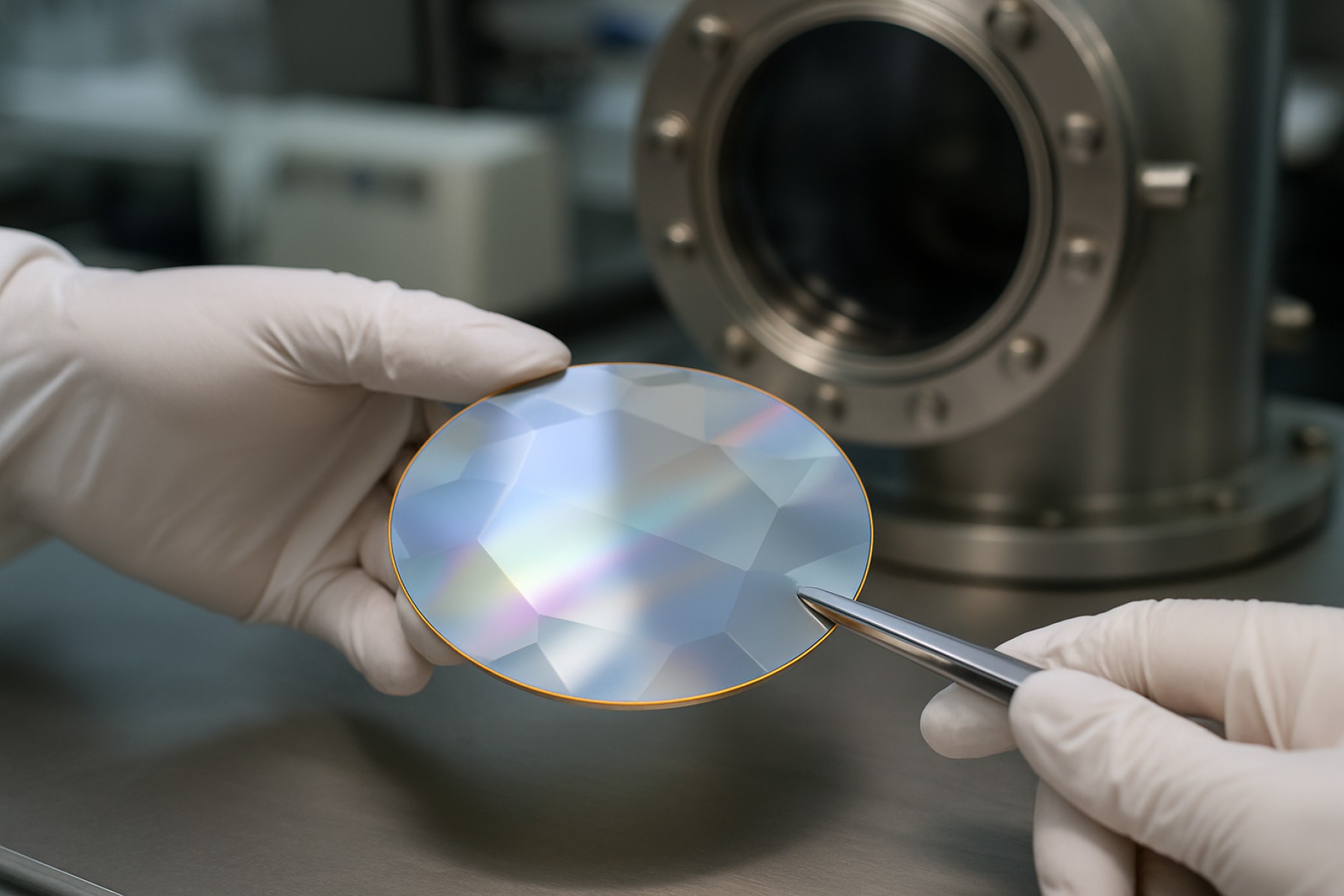

The fabrication of lithium-tantalate (LiTaO3) crystals is entering a pivotal phase in 2025, driven by surging demand from telecommunications, advanced sensing, and quantum technology sectors. Lithium-tantalate’s unique piezoelectric, pyroelectric, and nonlinear optical properties make it indispensable for surface acoustic wave (SAW) devices, optical modulators, and infrared detectors. The global market is witnessing a shift toward higher purity, larger diameter wafers, and improved yield, as end-users seek enhanced device performance and miniaturization.

Key industry players such as Shin-Etsu Chemical Co., Ltd., Saint-Gobain, and CRYSTEC GmbH are scaling up production capacities and refining crystal growth techniques. The Czochralski method remains the dominant fabrication process, but recent years have seen incremental improvements in temperature control, crucible materials, and seed orientation, resulting in higher quality boules and reduced defect densities. Shin-Etsu Chemical Co., Ltd., a global leader in specialty materials, continues to invest in R&D for large-diameter (up to 6-inch) lithium-tantalate wafers, targeting the expanding 5G and IoT device markets.

Supply chain resilience is a growing concern, as the availability of high-purity tantalum and lithium feedstocks remains subject to geopolitical and environmental pressures. Companies are increasingly seeking long-term sourcing agreements and exploring recycling initiatives to secure raw materials. Saint-Gobain, with its vertically integrated operations, is well-positioned to manage these risks and maintain consistent supply to its global customer base.

On the technology front, 2025 is expected to see further adoption of advanced wafering and polishing techniques, such as chemical-mechanical planarization (CMP), to achieve ultra-flat surfaces and tight thickness tolerances. This is critical for next-generation photonic and acoustic devices, where even minor imperfections can degrade performance. CRYSTEC GmbH is at the forefront of supplying precision-cut and polished lithium-tantalate substrates tailored for custom applications in optics and electronics.

Looking ahead, the outlook for lithium-tantalate crystal fabrication remains robust. The convergence of 5G, automotive radar, and quantum computing is expected to sustain double-digit growth in demand for high-quality LiTaO3 substrates through the next several years. Industry leaders are responding with investments in automation, process digitization, and sustainability initiatives, ensuring that lithium-tantalate remains a cornerstone material for advanced electronic and photonic systems.

Market Size, Growth Forecasts, and Regional Hotspots (2025–2030)

The global market for lithium-tantalate (LiTaO3) crystal fabrication is poised for robust growth between 2025 and 2030, driven by expanding applications in telecommunications, sensing, and advanced photonics. Lithium-tantalate crystals are essential for surface acoustic wave (SAW) and bulk acoustic wave (BAW) devices, which are integral to 5G infrastructure, RF filters, and high-frequency signal processing. As 5G and future 6G deployments accelerate, demand for high-quality LiTaO3 substrates is expected to rise significantly.

Asia-Pacific remains the dominant regional hotspot, with China, Japan, and South Korea leading both in manufacturing capacity and technological innovation. Major producers such as Shin-Etsu Chemical (Japan), Saint-Gobain (France, with global operations), and Crystal Materials (USA) are investing in capacity expansion and process optimization to meet surging demand. In China, companies like Fujian Jinlong Crystal Materials and CASTECH are scaling up production, leveraging government support for domestic semiconductor and photonics supply chains.

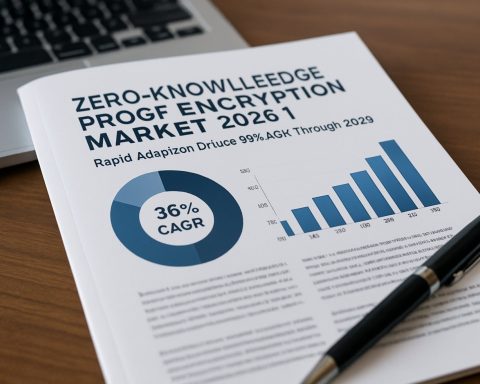

Recent data from industry sources indicate that the lithium-tantalate crystal market is projected to grow at a compound annual growth rate (CAGR) of 6–8% through 2030, with the total market value expected to surpass USD 1.2 billion by the end of the decade. This growth is underpinned by the proliferation of mobile devices, IoT sensors, and automotive radar systems, all of which require high-performance acoustic wave components. Additionally, the push for miniaturization and higher frequency operation in RF modules is driving demand for ultra-pure, defect-free LiTaO3 wafers.

Europe and North America are also witnessing increased activity, particularly in specialty applications such as quantum optics, nonlinear optics, and high-power laser systems. Companies like Oxford Instruments (UK) and Gooch & Housego (UK) are focusing on advanced crystal growth techniques and value-added processing to serve niche markets.

Looking ahead, the market outlook for lithium-tantalate crystal fabrication remains positive, with ongoing R&D into larger diameter wafers, improved yield, and enhanced material properties. Strategic partnerships between crystal growers, device manufacturers, and end-users are expected to further accelerate innovation and secure supply chains, especially as geopolitical factors and raw material sourcing continue to shape the competitive landscape.

Core Applications: 5G, IoT, Medical Devices, and Beyond

Lithium-tantalate (LiTaO3) crystal fabrication is a cornerstone technology underpinning the rapid evolution of 5G communications, Internet of Things (IoT) devices, and advanced medical instrumentation. As of 2025, the demand for high-quality, large-diameter lithium-tantalate wafers is accelerating, driven by the proliferation of surface acoustic wave (SAW) and bulk acoustic wave (BAW) filters essential for high-frequency signal processing in 5G and IoT applications. The fabrication process typically involves the Czochralski method, where high-purity lithium and tantalum oxides are melted and slowly crystallized to produce single-crystal boules, which are then sliced, polished, and processed into wafers.

Key industry players such as Shin-Etsu Chemical Co., Ltd., Sumitomo Chemical, and Saint-Gobain are at the forefront of scaling up production and refining crystal growth techniques to meet the stringent requirements of next-generation devices. Shin-Etsu Chemical Co., Ltd. is recognized for its advanced control over stoichiometry and defect reduction, enabling the production of wafers with superior uniformity and low acoustic loss—critical for high-performance RF filters. Sumitomo Chemical has invested in expanding its crystal growth facilities, focusing on larger wafer diameters (up to 6 inches and beyond) to support higher throughput and integration density for chip manufacturers.

In the medical device sector, lithium-tantalate’s unique pyroelectric and piezoelectric properties are leveraged in ultrasound transducers, infrared sensors, and implantable devices. Companies such as Saint-Gobain supply custom-engineered LiTaO3 substrates tailored for high-sensitivity medical sensors, with ongoing R&D aimed at improving biocompatibility and miniaturization. The intersection of medical and IoT applications is particularly dynamic, as wearable health monitors and remote diagnostics increasingly rely on miniaturized, high-frequency components fabricated from lithium-tantalate crystals.

Looking ahead, the outlook for lithium-tantalate crystal fabrication remains robust. The transition to 6G and the expansion of edge computing are expected to further increase demand for high-purity, large-area wafers. Industry leaders are investing in automation, in-line quality control, and recycling of process materials to enhance yield and sustainability. Collaborative efforts between manufacturers and end-users are also intensifying, with joint development agreements targeting application-specific crystal properties and integration with advanced packaging technologies. As the ecosystem matures, the role of lithium-tantalate in enabling the next wave of wireless, medical, and sensor innovations is set to expand significantly through 2025 and beyond.

Technology Innovations in Crystal Growth and Processing

Lithium-tantalate (LiTaO3) crystal fabrication remains a cornerstone of advanced photonics, acousto-optics, and piezoelectric device manufacturing. As of 2025, the sector is witnessing significant technological innovations aimed at improving crystal quality, yield, and scalability, driven by the growing demand for high-performance components in 5G, quantum technologies, and advanced sensing.

The Czochralski (CZ) method continues to dominate lithium-tantalate crystal growth, with leading manufacturers refining process control to minimize defects and enhance uniformity. Companies such as Shinkosha and Crystec have implemented advanced automation and real-time monitoring systems, enabling tighter control over stoichiometry and thermal gradients. These improvements are critical for producing large-diameter boules (up to 6 inches and beyond), which are increasingly required for wafer-scale device fabrication.

A notable trend in 2025 is the shift toward congruent and near-stoichiometric lithium-tantalate crystals. Near-stoichiometric LiTaO3 offers superior optical and piezoelectric properties, but its fabrication is more challenging due to the narrow compositional window. To address this, manufacturers like Furukawa Electric have invested in proprietary doping and post-growth annealing techniques, which stabilize the crystal lattice and reduce unwanted domain inversion. These process innovations are expected to yield crystals with lower defect densities and improved performance in high-frequency and high-power applications.

Wafer processing technologies are also advancing rapidly. Precision slicing, lapping, and polishing systems—often developed in-house or in collaboration with equipment suppliers—are now capable of producing ultra-flat, low-roughness wafers suitable for demanding photonic and acoustic devices. Saint-Gobain, a major supplier of engineered materials, has expanded its capabilities in wafering and surface finishing, supporting the integration of lithium-tantalate substrates into next-generation device architectures.

Looking ahead, the outlook for lithium-tantalate crystal fabrication is shaped by the convergence of digital process control, materials science, and end-market requirements. Industry leaders are expected to further automate growth and processing lines, leveraging AI-driven analytics for defect prediction and yield optimization. Additionally, sustainability considerations—such as recycling of off-cuts and reduction of hazardous byproducts—are gaining prominence, with companies like Shinkosha and Furukawa Electric publicly committing to greener manufacturing practices.

In summary, 2025 marks a period of accelerated innovation in lithium-tantalate crystal fabrication, with a focus on quality, scalability, and environmental responsibility. These advances are poised to support the expanding role of LiTaO3 in communications, sensing, and quantum technologies over the next several years.

Supply Chain Dynamics: Raw Materials, Sourcing, and Sustainability

The supply chain for lithium-tantalate (LiTaO3) crystal fabrication is undergoing significant transformation in 2025, driven by increasing demand from telecommunications, acousto-optic, and piezoelectric device sectors. The fabrication process relies on high-purity lithium carbonate and tantalum pentoxide as primary raw materials, both of which are subject to global sourcing challenges and sustainability concerns.

Tantalum, a critical component, is predominantly sourced from Central Africa, particularly the Democratic Republic of Congo, which accounts for a substantial share of global production. However, supply chain transparency and ethical sourcing remain pressing issues due to concerns over conflict minerals. Major crystal manufacturers such as Saint-Gobain and Shin-Etsu Chemical Co., Ltd. have implemented due diligence programs to ensure responsible sourcing, aligning with international standards like the OECD Due Diligence Guidance. These companies are also investing in traceability technologies and supplier audits to mitigate risks associated with unethical mining practices.

Lithium, another essential input, is primarily extracted from brine deposits in South America and hard rock mines in Australia. The volatility in lithium prices, driven by the electric vehicle boom, has prompted crystal manufacturers to secure long-term contracts with established suppliers such as Albemarle Corporation and Sociedad Química y Minera de Chile (SQM). These partnerships aim to stabilize supply and pricing, ensuring uninterrupted production of high-quality lithium-tantalate crystals.

On the fabrication front, leading producers like Saint-Gobain and Shin-Etsu Chemical Co., Ltd. have advanced their crystal growth technologies, focusing on the Czochralski method to achieve superior purity and uniformity. These companies are also exploring recycling initiatives to recover tantalum and lithium from end-of-life devices, contributing to a circular economy and reducing reliance on virgin materials.

Sustainability is becoming a central theme, with manufacturers increasingly adopting green energy in their operations and seeking ISO 14001 environmental management certification. The next few years are expected to see further integration of digital supply chain management tools, enhancing real-time monitoring and risk mitigation. As regulatory scrutiny intensifies and end-users demand greater transparency, the lithium-tantalate crystal supply chain is poised for continued evolution, balancing growth with ethical and environmental responsibility.

Competitive Landscape: Leading Manufacturers and Strategic Moves

The competitive landscape for lithium-tantalate (LiTaO3) crystal fabrication in 2025 is characterized by a concentrated group of specialized manufacturers, ongoing capacity expansions, and strategic investments in advanced crystal growth technologies. Lithium-tantalate crystals are critical for applications in surface acoustic wave (SAW) devices, optical modulators, and pyroelectric sensors, driving demand from telecommunications, defense, and sensing industries.

Among the global leaders, Shin-Etsu Chemical Co., Ltd. of Japan maintains a dominant position, leveraging decades of expertise in Czochralski crystal growth and vertical integration from raw materials to finished wafers. The company continues to invest in automation and quality control to meet stringent requirements for 5G and advanced sensor markets. Another major Japanese player, Sumitomo Chemical Co., Ltd., is recognized for its high-purity lithium-tantalate substrates and ongoing R&D in wafer miniaturization and defect reduction.

In China, Sinosteel Advanced Materials Co., Ltd. and Fujian Jinlong New Material Co., Ltd. have rapidly expanded their production capacities, supported by government initiatives to localize supply chains for strategic electronic materials. These companies are investing in larger-diameter boule growth and improved wafer slicing technologies to address both domestic and international demand, particularly as global supply chains seek diversification.

Europe’s presence is marked by Crytur (Czech Republic), which specializes in high-precision optical and piezoelectric crystals, and is increasingly targeting niche applications in quantum optics and high-frequency SAW devices. The company’s focus on custom crystal engineering and collaboration with research institutes positions it as a key supplier for specialized markets.

Strategic moves in 2025 include joint ventures and technology licensing agreements. Japanese and Chinese firms are exploring partnerships to secure tantalum raw materials and to co-develop next-generation crystal growth furnaces. There is also a trend toward vertical integration, with several manufacturers investing in downstream wafer processing and device packaging capabilities to capture more value along the supply chain.

Looking ahead, the competitive landscape is expected to intensify as demand for high-performance lithium-tantalate crystals grows in tandem with 5G infrastructure, advanced sensing, and emerging quantum technologies. Companies with robust R&D pipelines, secure raw material access, and advanced manufacturing automation are likely to maintain or strengthen their market positions through 2025 and beyond.

Emerging Players and Startups to Watch

The landscape of lithium-tantalate (LiTaO3) crystal fabrication is experiencing a dynamic shift as emerging players and startups enter the market, leveraging advances in materials science, automation, and precision engineering. Traditionally dominated by established manufacturers, the sector is now witnessing increased activity from agile companies aiming to address the surging demand for high-quality piezoelectric and electro-optic crystals, particularly for 5G, advanced sensing, and quantum applications.

Among the notable established players, Shinkosha (Japan) and Crystec (Germany) continue to set industry benchmarks in crystal growth and wafer processing. However, the emergence of new entrants is reshaping the competitive landscape. In China, a cluster of startups and mid-sized firms—such as Furun Technology and CASTECH—are rapidly scaling up their lithium-tantalate production capabilities, focusing on both bulk crystal growth and advanced wafer slicing technologies. These companies are investing in proprietary Czochralski growth methods and high-yield wafering processes to improve crystal uniformity and reduce defect rates, responding to the stringent requirements of next-generation RF and photonic devices.

In the United States, innovation is being driven by startups with roots in academic research and government-backed initiatives. Companies like Oxford Instruments (with a strong presence in crystal processing equipment) are collaborating with university spin-offs to develop novel doping techniques and surface treatment processes that enhance the performance of lithium-tantalate substrates. These efforts are supported by increased federal funding for domestic supply chain resilience and advanced materials manufacturing, as outlined in recent U.S. Department of Energy initiatives.

Looking ahead to 2025 and beyond, the outlook for emerging players in lithium-tantalate crystal fabrication is promising. The global push for 5G infrastructure, quantum computing, and advanced medical imaging is expected to drive double-digit growth in demand for high-purity, low-defect LiTaO3 wafers. Startups are well-positioned to capitalize on this trend by offering customized solutions, rapid prototyping, and flexible production runs—capabilities that larger incumbents may struggle to match. Furthermore, collaborations between equipment suppliers, such as Sumitomo Metal Mining, and new entrants are fostering a more robust and innovative supply ecosystem.

In summary, while established manufacturers maintain a strong foothold, the next few years will likely see emerging players and startups play an increasingly influential role in shaping the future of lithium-tantalate crystal fabrication, both through technological innovation and by addressing evolving market needs.

Regulatory Environment and Industry Standards (e.g., IEEE, IEC)

The regulatory environment and industry standards governing lithium-tantalate (LiTaO3) crystal fabrication are evolving rapidly in 2025, reflecting the material’s expanding role in advanced electronics, photonics, and telecommunications. As demand for high-quality, reproducible lithium-tantalate crystals grows, especially for use in surface acoustic wave (SAW) devices, optical modulators, and piezoelectric sensors, adherence to international standards and regulatory frameworks has become increasingly critical.

Key industry standards are set by organizations such as the IEEE and the International Electrotechnical Commission (IEC). The IEEE, through its Ultrasonics, Ferroelectrics, and Frequency Control Society, provides technical guidelines and standardization for piezoelectric materials, including lithium-tantalate, focusing on parameters such as crystal orientation, purity, and electromechanical properties. The IEC, particularly through its Technical Committee 49 (Piezoelectric and dielectric devices for frequency control and selection), issues standards that address the performance, safety, and testing protocols for piezoelectric crystals and devices, including those fabricated from lithium-tantalate.

In 2025, manufacturers such as Shinkosha (Japan), a leading supplier of high-purity lithium-tantalate crystals, and Crystec (Germany), which specializes in custom crystal growth and wafer processing, are aligning their production processes with updated IEC and IEEE standards. These standards increasingly emphasize traceability of raw materials, environmental controls during crystal growth (such as the Czochralski method), and rigorous quality assurance for defect-free wafers. Companies are also required to document compliance with RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) directives, especially for products destined for the European market.

The regulatory landscape is also shaped by regional and national bodies. For example, the Japanese Industrial Standards Committee (JISC) and the American National Standards Institute (ANSI) are actively updating their guidelines to reflect advances in crystal fabrication technology and the increasing importance of sustainability and supply chain transparency. These updates are expected to be harmonized with global standards to facilitate international trade and interoperability.

Looking ahead, the next few years will likely see further tightening of standards, particularly regarding environmental impact, recycling of tantalum, and energy efficiency in crystal growth processes. Industry leaders are collaborating with standards organizations to develop new protocols for next-generation applications, such as quantum photonics and 5G/6G communications, ensuring that lithium-tantalate crystal fabrication remains at the forefront of technological innovation while meeting stringent regulatory requirements.

Challenges: Yield, Cost, and Quality Control

Lithium-tantalate (LiTaO3) crystal fabrication remains a technically demanding process, with persistent challenges in yield, cost, and quality control that are shaping the industry’s outlook for 2025 and beyond. The fabrication process, typically involving the Czochralski method, requires precise control of stoichiometry, temperature gradients, and growth rates to ensure high-quality single crystals. Even minor deviations can result in defects such as inclusions, striations, or domain irregularities, which directly impact device performance in applications like surface acoustic wave (SAW) filters and optical modulators.

Yield rates for high-purity, large-diameter lithium-tantalate crystals are still constrained by the sensitivity of the melt composition and the volatility of lithium at high temperatures. Leading manufacturers such as Shin-Etsu Chemical Co., Ltd. and Saint-Gobain have invested in advanced process controls and proprietary furnace designs to mitigate these issues, but industry-wide yields for 6-inch and larger boules remain below those of more mature materials like quartz or silicon. The need for tight compositional control also drives up raw material costs, as high-purity tantalum and lithium sources are required, and waste from off-specification crystals remains a significant cost factor.

Quality control is another critical challenge. The industry is moving toward more stringent inspection protocols, including X-ray topography and laser interferometry, to detect sub-micron defects and domain boundaries. Companies such as TDK Corporation and Murata Manufacturing Co., Ltd. are developing in-line monitoring systems to provide real-time feedback during crystal growth and wafering, aiming to reduce defect rates and improve batch-to-batch consistency. However, the implementation of these advanced inspection systems adds to capital and operational expenditures, further impacting overall production costs.

Looking ahead to the next few years, the demand for high-performance LiTaO3 crystals in 5G communications, quantum photonics, and advanced sensing is expected to intensify pressure on manufacturers to improve yields and lower costs without compromising quality. Industry leaders are exploring automation, machine learning-driven process optimization, and recycling of off-spec material as potential solutions. However, given the fundamental material and process complexities, significant breakthroughs are likely to be incremental rather than revolutionary through 2025. Collaboration between crystal growers, equipment suppliers, and end-users will be essential to address these persistent challenges and meet the evolving requirements of next-generation electronic and photonic devices.

Future Outlook: Disruptive Technologies and Long-Term Opportunities

The future of lithium-tantalate (LiTaO3) crystal fabrication is poised for significant transformation as the industry responds to escalating demand from 5G communications, quantum technologies, and advanced sensing applications. As of 2025, the sector is witnessing a convergence of disruptive manufacturing techniques, material innovations, and strategic investments aimed at enhancing crystal quality, scalability, and cost-effectiveness.

One of the most notable trends is the refinement of the Czochralski (CZ) method, which remains the dominant process for growing high-purity, large-diameter lithium-tantalate boules. Leading manufacturers such as Shin-Etsu Chemical and Saint-Gobain are investing in automation and real-time process monitoring to improve yield and reduce defect densities. These advancements are critical as device miniaturization and higher frequency requirements demand ever-tighter tolerances in crystal uniformity and composition.

Simultaneously, there is growing interest in alternative growth techniques, such as the top-seeded solution growth (TSSG) and hydrothermal methods, which promise lower thermal stress and potentially superior crystal quality. While these methods are still in the early stages of commercialization, companies like Furukawa Electric are actively exploring their scalability for next-generation applications, particularly in quantum photonics and high-power acousto-optic devices.

Material engineering is another area of rapid progress. The development of congruent and near-stoichiometric lithium-tantalate crystals is enabling improved electro-optic and piezoelectric performance, which is essential for emerging applications in RF filters and quantum information systems. Crytur and Korth Kristalle are among the suppliers expanding their portfolios to include custom-doped and engineered substrates tailored for specific device architectures.

Looking ahead, the integration of artificial intelligence and machine learning into process control is expected to further optimize crystal growth parameters, reduce waste, and accelerate development cycles. Industry collaborations and government-backed initiatives in Asia, Europe, and North America are fostering knowledge exchange and standardization, which will be crucial for meeting the anticipated surge in demand from 6G wireless, quantum computing, and advanced medical imaging sectors.

In summary, the lithium-tantalate crystal fabrication industry in 2025 and beyond is characterized by a dynamic interplay of process innovation, material science, and strategic investment. As leading players continue to push the boundaries of crystal quality and production efficiency, the sector is well-positioned to capitalize on long-term opportunities across a spectrum of high-growth technology domains.

Sources & References

- Oxford Instruments

- Shin-Etsu Chemical Co., Ltd.

- Sumitomo Chemical

- Furukawa Electric

- Albemarle Corporation

- Sociedad Química y Minera de Chile (SQM)

- Sinosteel Advanced Materials Co., Ltd.

- Crytur

- Crystec

- Sumitomo Metal Mining

- IEEE

- Shinkosha

- Japanese Industrial Standards Committee (JISC)

- American National Standards Institute (ANSI)

- Murata Manufacturing Co., Ltd.

- Crytur

- Korth Kristalle