Unveiling the Future of Maskless Lithography Systems in 2025: How Direct-Write Technologies Are Transforming Semiconductor Fabrication and Driving Double-Digit Growth. Explore the Innovations, Market Dynamics, and Strategic Shifts Shaping the Next Era.

- Executive Summary: Key Findings and 2025 Outlook

- Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

- Technology Landscape: Direct-Write Lithography Innovations

- Competitive Analysis: Leading Players and Strategic Initiatives

- Application Segments: Semiconductors, MEMS, Photonics, and Beyond

- Regional Trends: North America, Europe, Asia-Pacific, and Emerging Markets

- Drivers and Challenges: Speed, Resolution, and Cost Factors

- Recent Developments: Partnerships, M&A, and Product Launches

- Regulatory and Industry Standards: Compliance and Roadmaps

- Future Outlook: Disruptive Trends and Strategic Recommendations

- Sources & References

Executive Summary: Key Findings and 2025 Outlook

Maskless lithography systems are rapidly transforming the landscape of semiconductor and microfabrication industries by offering direct-write patterning capabilities that eliminate the need for traditional photomasks. As of 2025, the sector is witnessing accelerated adoption driven by the demand for greater design flexibility, faster prototyping, and the ability to fabricate advanced devices at smaller nodes. Key players such as Heidelberg Instruments, Vistec Electron Beam, and Mycronic are at the forefront, each leveraging unique technologies—ranging from electron beam (e-beam) to laser direct imaging (LDI)—to address diverse application requirements.

In 2025, maskless lithography is increasingly recognized as a critical enabler for rapid innovation in fields such as photonics, MEMS, advanced packaging, and compound semiconductors. The technology’s ability to support low- to mid-volume production and rapid design iterations is particularly valuable for R&D centers, universities, and specialty foundries. Heidelberg Instruments continues to expand its portfolio with high-resolution laser and multi-beam systems, targeting both academic and industrial users. Meanwhile, Vistec Electron Beam is advancing its e-beam lithography platforms, which are essential for applications requiring sub-10 nm patterning precision.

The market is also witnessing increased interest in maskless solutions for advanced packaging and heterogeneous integration, where design complexity and shorter product cycles challenge the economics of mask-based lithography. Mycronic is a notable supplier of LDI systems for PCB and advanced substrate manufacturing, reporting growing demand from the electronics and display sectors. The flexibility of maskless systems is further enhanced by ongoing improvements in throughput, automation, and software-driven pattern generation, making them more competitive for select production environments.

Looking ahead, the outlook for maskless lithography systems through the next few years is robust. Industry roadmaps indicate continued investment in higher throughput multi-beam and parallel direct-write technologies, aiming to bridge the gap with traditional photolithography for certain high-mix, low-volume applications. Collaborations between equipment manufacturers and research institutes are expected to accelerate, fostering innovation in both hardware and process integration. As device architectures become more complex and the need for rapid customization grows, maskless lithography is poised to play an increasingly strategic role in the semiconductor ecosystem.

Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

The global market for maskless lithography systems is poised for significant expansion between 2025 and 2030, driven by the increasing demand for advanced semiconductor devices, microelectromechanical systems (MEMS), and photonic components. Maskless lithography, which eliminates the need for physical photomasks by directly writing patterns onto substrates, is gaining traction due to its flexibility, cost-effectiveness for low- to mid-volume production, and rapid prototyping capabilities.

Key industry players such as Vistec Electron Beam, a leading supplier of electron beam lithography systems, and Heidelberg Instruments, known for their direct-write laser lithography tools, are at the forefront of technological advancements and market expansion. NuFlare Technology, a subsidiary of Toshiba, is another major contributor, particularly in the electron beam maskless lithography segment. These companies are investing in higher throughput systems and improved resolution to address the evolving needs of the semiconductor and nanofabrication industries.

As of 2025, the maskless lithography systems market is estimated to be valued at approximately USD 600–700 million, with expectations of robust growth over the next five years. The compound annual growth rate (CAGR) is projected to range between 8% and 12% through 2030, reflecting the increasing adoption of maskless techniques in both research and commercial manufacturing environments. This growth is underpinned by the rising complexity of integrated circuits, the proliferation of IoT devices, and the need for rapid design iterations in photonics and MEMS.

Geographically, Asia-Pacific remains the dominant region, fueled by substantial investments in semiconductor fabrication facilities in countries such as China, South Korea, and Taiwan. North America and Europe also represent significant markets, particularly in research institutions and specialty device manufacturing. The expansion of foundry services and the push for advanced packaging solutions are further accelerating demand for maskless lithography systems.

Looking ahead, the market outlook remains positive, with ongoing R&D efforts aimed at increasing throughput, reducing cost per wafer, and enabling sub-10 nm patterning. Collaborations between equipment manufacturers and semiconductor foundries are expected to yield next-generation systems capable of addressing the challenges of advanced node production. As the industry continues to prioritize flexibility and rapid innovation, maskless lithography is set to play an increasingly vital role in the global microfabrication landscape.

Technology Landscape: Direct-Write Lithography Innovations

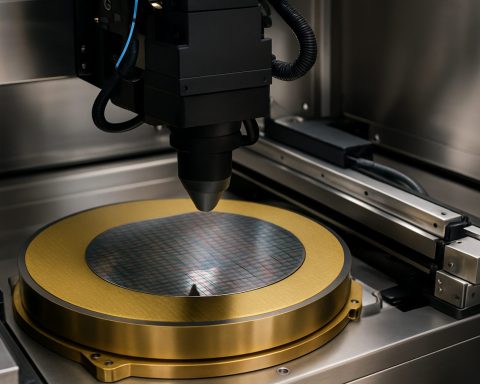

Maskless lithography systems, a subset of direct-write lithography, are rapidly transforming semiconductor and microfabrication industries by eliminating the need for costly photomasks. As of 2025, these systems are gaining traction due to their flexibility, rapid prototyping capabilities, and suitability for low- to mid-volume production. The technology leverages focused electron beams, laser beams, or digital micromirror devices (DMDs) to directly pattern substrates, enabling faster design iterations and reduced time-to-market.

Key players in the maskless lithography market include Vistec Electron Beam, a leader in electron beam lithography (EBL) systems, and Heidelberg Instruments, which specializes in both laser and maskless aligner systems. Nanoscribe is notable for its two-photon polymerization direct-write systems, targeting micro-optics and advanced 3D microfabrication. Mycronic is another significant manufacturer, offering maskless lithography solutions for advanced packaging and display applications.

Recent advancements focus on increasing throughput and resolution. For example, multi-beam electron beam systems are being developed to address the traditional speed limitations of single-beam EBL, with Vistec Electron Beam and others investing in parallelization technologies. DMD-based systems, such as those from Heidelberg Instruments, are achieving sub-micron resolutions while maintaining high patterning speeds, making them attractive for MEMS, photonics, and rapid prototyping.

In 2025, maskless lithography is increasingly adopted in research institutes, foundries, and specialty fabs, particularly for applications where design flexibility and short production cycles are critical. The technology is also being explored for advanced packaging, photonic integrated circuits, and microfluidic devices, where traditional mask-based lithography is less economical or too rigid.

Looking ahead, the outlook for maskless lithography systems is positive. As device geometries continue to shrink and customization becomes more important, demand for flexible, high-resolution direct-write solutions is expected to grow. Industry roadmaps suggest ongoing improvements in throughput, overlay accuracy, and automation, with leading manufacturers such as Heidelberg Instruments and Vistec Electron Beam poised to introduce next-generation systems. The convergence of maskless lithography with AI-driven design and process control is also anticipated to further enhance productivity and enable new applications in the coming years.

Competitive Analysis: Leading Players and Strategic Initiatives

The competitive landscape for maskless lithography systems in 2025 is characterized by a dynamic interplay between established semiconductor equipment giants and innovative niche players. The market is driven by the demand for greater design flexibility, rapid prototyping, and the ability to fabricate advanced semiconductor devices without the high costs and lead times associated with traditional photomask-based lithography.

Among the leading players, ASML Holding stands out as a dominant force in the broader lithography sector, though its primary focus remains on extreme ultraviolet (EUV) and deep ultraviolet (DUV) systems. However, ASML has shown interest in maskless approaches, particularly for advanced packaging and research applications, leveraging its expertise in high-precision optics and system integration.

A key innovator in direct-write maskless lithography is Vistec Electron Beam, which specializes in electron beam lithography (EBL) systems. Vistec’s systems are widely adopted in both R&D and low-volume production environments, offering sub-10 nm resolution and flexibility for applications in photonics, MEMS, and advanced materials. The company continues to invest in throughput improvements and automation to address the scalability challenges of EBL.

Another significant player is Heidelberg Instruments, which provides a range of maskless lithography solutions, including laser direct writing (LDW) and grayscale lithography. Heidelberg Instruments’ systems are recognized for their versatility and are used in both academic and industrial settings for rapid prototyping and small-batch production. The company’s recent strategic initiatives include expanding its product portfolio to address the growing demand for advanced packaging and heterogeneous integration.

Emerging companies such as Micronit and Nanoscribe are also making strides in the maskless lithography space, particularly in microfluidics and 3D microfabrication, respectively. Nanoscribe, for example, leverages two-photon polymerization to enable high-resolution 3D printing at the microscale, opening new avenues for device miniaturization and complex geometries.

Strategically, leading players are focusing on partnerships with semiconductor foundries, research institutes, and materials suppliers to accelerate technology adoption. There is a clear trend toward integrating maskless lithography with complementary processes such as nanoimprint and additive manufacturing, aiming to create flexible, hybrid fabrication platforms. Over the next few years, advancements in beam control, automation, and software-driven pattern generation are expected to further enhance the competitiveness of maskless lithography systems, positioning them as essential tools for next-generation semiconductor and photonic device manufacturing.

Application Segments: Semiconductors, MEMS, Photonics, and Beyond

Maskless lithography systems are increasingly pivotal across a spectrum of high-technology application segments, notably semiconductors, MEMS (Micro-Electro-Mechanical Systems), and photonics. As of 2025, the demand for flexible, high-resolution, and cost-effective patterning solutions is driving rapid adoption and innovation in maskless lithography, particularly as traditional photomask-based methods face challenges in cost, turnaround time, and design flexibility.

In the semiconductor sector, maskless lithography is gaining traction for rapid prototyping, low-volume production, and advanced packaging. The technology is especially relevant for applications where design cycles are short and customization is frequent, such as in ASICs (Application-Specific Integrated Circuits) and heterogeneous integration. Leading suppliers like DR. JOHANNES HEIDENHAIN GmbH and Vistec Electron Beam GmbH are advancing electron beam direct write (EBDW) and laser-based direct imaging systems, which enable sub-100 nm patterning without the need for costly photomasks. These systems are being adopted by foundries and research institutions for both R&D and niche production, with ongoing improvements in throughput and overlay accuracy.

MEMS fabrication is another area where maskless lithography is making significant inroads. The ability to rapidly iterate designs and produce small batches aligns well with the MEMS market, which often requires bespoke solutions for sensors, actuators, and microfluidic devices. Companies such as Microtech and MLT Maskless Lithography are providing direct-write systems tailored for MEMS foundries and research labs, supporting both prototyping and pilot production. The flexibility of maskless systems is particularly valuable for emerging MEMS applications in automotive, biomedical, and IoT devices.

In photonics, maskless lithography is enabling the rapid development of integrated photonic circuits, waveguides, and diffractive optical elements. The technology supports the fabrication of complex, non-repetitive structures that are difficult or uneconomical to produce with traditional mask-based lithography. Heptagon and Nanoscribe GmbH & Co. KG are notable for their advanced direct-write systems, which are used in both academic and industrial settings for photonic device prototyping and small-scale manufacturing.

Looking ahead, the outlook for maskless lithography systems across these segments is robust. Continued advances in laser and electron beam technologies, coupled with improvements in automation and software, are expected to further enhance throughput and resolution. As device architectures become more complex and the need for rapid customization grows, maskless lithography is poised to play an increasingly central role in next-generation electronics, sensors, and photonic systems.

Regional Trends: North America, Europe, Asia-Pacific, and Emerging Markets

Maskless lithography systems, which enable direct patterning of substrates without the need for photomasks, are experiencing differentiated growth and adoption across global regions. As of 2025, the landscape is shaped by the semiconductor industry’s push for flexibility, rapid prototyping, and advanced packaging, with regional dynamics influenced by local manufacturing priorities, R&D investments, and supply chain strategies.

North America remains a leader in maskless lithography innovation, driven by its robust semiconductor ecosystem and concentration of research institutions. Companies such as KLA Corporation and Ultratech (a division of Veeco Instruments) are prominent in developing and supplying advanced direct-write lithography tools. The region’s focus is on high-value applications, including advanced packaging, MEMS, and photonics, with ongoing collaborations between industry and academia to push the limits of resolution and throughput. The U.S. government’s continued investment in domestic semiconductor manufacturing, as part of broader supply chain resilience initiatives, is expected to further stimulate demand for flexible, maskless solutions.

Europe is characterized by a strong emphasis on research-driven innovation and specialty applications. The Netherlands-based ASML Holding, while globally renowned for its photolithography systems, has also explored maskless and direct-write technologies through partnerships and R&D initiatives. Germany’s Heidelberg Instruments is a key supplier of maskless lithography systems, particularly for rapid prototyping, micro-optics, and academic research. European Union funding for microelectronics and photonics research continues to support the adoption of maskless lithography in both established and emerging sectors, such as quantum technologies and biosensors.

Asia-Pacific is the fastest-growing region for maskless lithography, propelled by the rapid expansion of semiconductor manufacturing in China, Taiwan, South Korea, and Japan. Local players, including Japan Advanced Institute of Science and Technology (in collaboration with industry), are advancing direct-write techniques for both R&D and volume production. The region’s focus on advanced packaging, display technologies, and compound semiconductors is driving demand for flexible lithography solutions. Government-backed initiatives to localize semiconductor supply chains and reduce reliance on imported photomasks are further accelerating adoption.

Emerging markets in Southeast Asia, India, and parts of the Middle East are beginning to invest in maskless lithography, primarily for education, prototyping, and niche manufacturing. While adoption is at an earlier stage, increasing access to affordable direct-write systems from global suppliers is expected to foster local innovation and support the development of regional semiconductor ecosystems over the next several years.

Drivers and Challenges: Speed, Resolution, and Cost Factors

Maskless lithography systems are gaining momentum in semiconductor and microfabrication industries, driven by the need for greater flexibility, rapid prototyping, and the ability to pattern complex or custom designs without the expense and lead time of photomask production. As of 2025, the primary drivers for adoption are improvements in throughput (speed), resolution, and cost-effectiveness, but these same factors also present significant challenges.

Speed remains a critical factor. Traditional mask-based photolithography, especially with deep ultraviolet (DUV) and extreme ultraviolet (EUV) systems, achieves high wafer throughput by exposing entire patterns in a single step. In contrast, maskless systems—such as those based on direct-write electron beam (e-beam), laser, or digital micromirror device (DMD) technologies—typically write patterns serially or in parallelized segments, which can limit throughput. Recent advances, such as multi-beam e-beam systems, are addressing this bottleneck. For example, IMS Nanofabrication (a subsidiary of Intel Corporation) has developed multi-beam maskless e-beam writers capable of significantly higher speeds, targeting both mask writing and direct wafer patterning applications. Similarly, Vistec Electron Beam and Heidelberg Instruments are advancing direct-write systems for both research and low-volume production.

Resolution is another key driver and challenge. Maskless systems can achieve extremely fine features—down to the single-digit nanometer scale with e-beam lithography—surpassing many mask-based optical systems. This capability is crucial for advanced research, photonics, and next-generation semiconductor devices. However, maintaining high resolution while increasing writing speed is technically demanding, as higher beam currents or parallelization can introduce pattern fidelity issues. Companies like IMS Nanofabrication and Vistec Electron Beam are investing in beam control and data handling technologies to address these trade-offs.

Cost factors are central to the outlook for maskless lithography. While maskless systems eliminate the need for expensive photomasks—making them attractive for prototyping, small-batch, and custom device fabrication—the capital cost of high-end direct-write tools remains substantial. Furthermore, the lower throughput compared to mask-based systems can increase per-unit costs for high-volume manufacturing. Nevertheless, for applications such as compound semiconductors, MEMS, photonics, and rapid design iteration, the overall cost-benefit is increasingly favorable. Companies like Heidelberg Instruments and Nanoscribe (specializing in two-photon lithography) are expanding their offerings to address these niche but growing markets.

Looking ahead to the next few years, ongoing R&D is expected to further improve the speed and resolution of maskless lithography systems, while efforts to reduce system costs and expand parallelization will broaden their industrial adoption. The sector is likely to see increased collaboration between equipment manufacturers, semiconductor foundries, and research institutions to overcome current limitations and unlock new applications.

Recent Developments: Partnerships, M&A, and Product Launches

The maskless lithography systems sector has experienced notable momentum in 2025, driven by strategic partnerships, mergers and acquisitions (M&A), and a wave of new product launches. These developments reflect the industry’s response to growing demand for flexible, high-resolution patterning solutions in semiconductor, display, and advanced packaging markets.

A significant trend in 2025 is the intensification of collaborations between maskless lithography equipment manufacturers and semiconductor foundries. Mycronic AB, a leading supplier of maskless lithography systems, has expanded its partnership network with major advanced packaging and photonics manufacturers, aiming to accelerate the adoption of its latest direct-write platforms. The company’s MYPro series, launched in late 2024, has seen rapid uptake in both Europe and Asia, with new installations at several leading OSATs (Outsourced Semiconductor Assembly and Test providers).

On the M&A front, consolidation continues as companies seek to broaden their technology portfolios. In early 2025, Heidelberg Instruments announced the acquisition of a smaller direct-write technology firm, strengthening its position in the high-resolution maskless lithography segment. This move is expected to enhance Heidelberg’s capabilities in both R&D and volume manufacturing, particularly for applications in micro-optics and MEMS.

Product innovation remains robust. Mycronic AB introduced the MYPro X, a next-generation maskless aligner featuring sub-micron resolution and increased throughput, targeting advanced IC packaging and photonics. Meanwhile, Heidelberg Instruments launched the MLA 300, a high-speed direct-write system designed for rapid prototyping and low-volume production, which has already been adopted by several research institutes and specialty foundries.

Emerging players are also making their mark. Visitech, known for its digital light processing (DLP) based maskless lithography, has expanded its product line in 2025, focusing on large-area and high-throughput applications for printed electronics and advanced displays. The company has entered into new supply agreements with display manufacturers in Asia, signaling growing acceptance of DLP-based direct-write solutions.

Looking ahead, the maskless lithography market is expected to see further integration of AI-driven process control and increased automation, as manufacturers respond to the need for higher yield and flexibility. The ongoing shift toward heterogeneous integration and advanced packaging is likely to sustain demand for maskless systems, with industry leaders and new entrants alike investing in R&D and strategic alliances to capture emerging opportunities.

Regulatory and Industry Standards: Compliance and Roadmaps

Maskless lithography systems, which eliminate the need for photomasks in semiconductor patterning, are increasingly significant as the industry seeks greater flexibility, faster prototyping, and cost-effective solutions for advanced nodes and heterogeneous integration. As of 2025, regulatory and industry standards for these systems are evolving in tandem with rapid technological advancements and the growing adoption of maskless approaches in both research and commercial semiconductor manufacturing.

The primary regulatory framework for maskless lithography systems is shaped by international standards organizations such as the SEMI (Semiconductor Equipment and Materials International), which develops and maintains global standards for semiconductor equipment, including safety, interoperability, and process control. SEMI’s standards, such as SEMI S2 (Environmental, Health, and Safety Guideline for Semiconductor Manufacturing Equipment), are applicable to maskless lithography tools, ensuring compliance with environmental and worker safety requirements. In 2025, SEMI continues to update its standards to address the unique aspects of direct-write and electron-beam lithography, including electromagnetic compatibility and contamination control.

Industry roadmaps, notably the International Roadmap for Devices and Systems (IRDS), have recognized maskless lithography as a key enabler for advanced packaging, photonics, and rapid prototyping. The IRDS 2024-2025 updates emphasize the need for standardization in data formats, tool interfaces, and process metrology to facilitate integration of maskless systems into existing semiconductor fabs. This includes alignment with Industry 4.0 initiatives, such as equipment connectivity and data traceability, which are increasingly mandated by leading foundries and integrated device manufacturers.

Major equipment suppliers, including Vistec Electron Beam and Heidelberg Instruments, are actively participating in standards development and compliance programs. These companies are aligning their maskless lithography platforms with SEMI and IRDS guidelines, focusing on process repeatability, tool qualification, and cybersecurity. For example, Heidelberg Instruments has announced ongoing collaborations with industry consortia to ensure its direct-write systems meet both current and anticipated regulatory requirements.

Looking ahead, the next few years are expected to bring further harmonization of standards for maskless lithography, particularly as adoption expands into high-volume manufacturing and new application domains such as MEMS, photonics, and quantum devices. Regulatory bodies are anticipated to introduce more granular requirements for tool validation, data integrity, and environmental impact, reflecting the increasing complexity and criticality of maskless lithography in the semiconductor ecosystem. Industry stakeholders are thus prioritizing proactive compliance and active engagement in standards-setting processes to ensure smooth integration and global market access.

Future Outlook: Disruptive Trends and Strategic Recommendations

Maskless lithography systems are poised to play a transformative role in semiconductor manufacturing and advanced microfabrication over the next several years. As the industry faces increasing challenges with traditional photomask-based lithography—particularly in terms of cost, cycle time, and design flexibility—maskless approaches are gaining traction for both prototyping and, increasingly, for low- to mid-volume production.

In 2025, the most significant disruptive trend is the maturation of multi-beam and direct-write electron beam lithography (EBL) systems. Companies such as Vistec Electron Beam and Advantest are advancing high-throughput EBL platforms, targeting applications in photonics, MEMS, and advanced packaging. These systems eliminate the need for costly photomasks, enabling rapid design iterations and supporting the growing demand for heterogeneous integration and custom chiplets.

Another key development is the commercialization of maskless optical lithography, with firms like Heidelberg Instruments and Microlight3D offering systems that leverage digital micromirror devices (DMDs) or spatial light modulators (SLMs) for high-resolution, flexible patterning. These technologies are particularly attractive for research institutes, universities, and specialty foundries, where short-run and rapid prototyping capabilities are essential.

Strategically, the adoption of maskless lithography is expected to accelerate in markets where design cycles are short and customization is critical, such as silicon photonics, quantum devices, and biomedical microdevices. The flexibility of maskless systems aligns with the trend toward application-specific integrated circuits (ASICs) and the proliferation of Internet of Things (IoT) devices, where production volumes may not justify the expense of traditional mask sets.

Looking ahead, industry bodies such as SEMI are highlighting the need for continued innovation in maskless lithography to address the scaling and cost challenges of next-generation nodes. While throughput remains a limiting factor for high-volume manufacturing, ongoing R&D in multi-beam and parallelization techniques is expected to narrow this gap by the late 2020s. Strategic recommendations for stakeholders include investing in collaborative R&D, fostering partnerships between equipment suppliers and end-users, and developing standardized workflows to integrate maskless lithography into existing semiconductor fabs.

In summary, maskless lithography systems are set to disrupt traditional manufacturing paradigms, offering new opportunities for agile, cost-effective, and innovative device fabrication. The next few years will be critical as the technology matures and adoption expands beyond niche applications into broader segments of the semiconductor and microfabrication industries.

Sources & References

- Heidelberg Instruments

- Mycronic

- Vistec Electron Beam

- Heidelberg Instruments

- NuFlare Technology

- Nanoscribe

- Mycronic

- ASML Holding

- Micronit

- DR. JOHANNES HEIDENHAIN GmbH

- Microtech

- Heptagon

- KLA Corporation

- Japan Advanced Institute of Science and Technology

- IMS Nanofabrication

- Visitech

- Advantest

- Microlight3D