Quantum Key Distribution (QKD) Security Hardware Manufacturing in 2025: Unveiling the Next Era of Ultra-Secure Communications. Explore Market Growth, Technology Shifts, and Strategic Opportunities Shaping the Future.

- Executive Summary: QKD Security Hardware Market in 2025

- Industry Overview: Defining Quantum Key Distribution Hardware

- Key Players and Competitive Landscape (e.g., idquantique.com, toshiba.com, qutools.com)

- Market Size, Segmentation, and 2025–2030 Growth Forecasts (Estimated CAGR: 28–32%)

- Core Technologies: Photonic Components, Quantum Random Number Generators, and Protocols

- Manufacturing Innovations and Supply Chain Developments

- Regulatory Environment and Industry Standards (e.g., ieee.org, etsi.org)

- Adoption Drivers: Telecom, Finance, and Government Use Cases

- Challenges: Scalability, Cost, and Integration with Classical Networks

- Future Outlook: Emerging Trends, R&D, and Strategic Roadmaps to 2030

- Sources & References

Executive Summary: QKD Security Hardware Market in 2025

The Quantum Key Distribution (QKD) security hardware market is poised for significant growth in 2025, driven by escalating concerns over quantum computing threats to classical encryption and increasing governmental and enterprise investments in quantum-safe communications. QKD leverages quantum mechanics to enable ultra-secure key exchange, and its hardware segment encompasses photon sources, detectors, quantum random number generators, and integrated QKD modules. In 2025, the market is characterized by a transition from pilot deployments to early-stage commercial rollouts, particularly in sectors such as finance, defense, and critical infrastructure.

Key industry players are accelerating manufacturing capabilities and forming strategic partnerships to address the rising demand. Toshiba Corporation remains a global leader, with its QKD hardware deployed in several metropolitan networks and ongoing collaborations with telecom operators to integrate QKD into existing fiber infrastructure. ID Quantique, based in Switzerland, continues to expand its product portfolio, offering commercial QKD systems and quantum random number generators, and is actively involved in European and Asian quantum network projects. QuantumCTek, a major Chinese manufacturer, is scaling up production to support national quantum communication initiatives, including the world’s largest quantum network backbone in China.

In 2025, manufacturing trends emphasize miniaturization, improved integration with classical network equipment, and enhanced reliability for real-world deployment. Companies such as Toshiba Corporation and ID Quantique are investing in chip-based QKD modules, aiming to reduce costs and facilitate mass adoption. Meanwhile, QuantumCTek is focusing on ruggedized hardware suitable for deployment in diverse environmental conditions, reflecting the growing need for QKD in critical infrastructure and field applications.

Governmental support remains a key market driver. The European Union’s EuroQCI initiative and China’s national quantum communication projects are spurring demand for domestically manufactured QKD hardware. In the United States, increased funding for quantum technologies is expected to stimulate local manufacturing and foster new entrants into the market.

Looking ahead, the QKD security hardware market in 2025 is set for robust expansion, with a projected shift from bespoke, high-cost systems to more standardized, scalable solutions. As interoperability standards mature and supply chains strengthen, the sector is likely to see broader adoption across global markets, positioning QKD hardware manufacturing as a cornerstone of next-generation secure communications.

Industry Overview: Defining Quantum Key Distribution Hardware

Quantum Key Distribution (QKD) security hardware manufacturing is a rapidly evolving sector at the intersection of quantum physics and cybersecurity. QKD hardware enables the secure exchange of cryptographic keys using quantum properties of photons, making eavesdropping detectable and, in theory, providing information-theoretic security. As of 2025, the industry is characterized by a mix of established technology firms, specialized quantum startups, and state-backed initiatives, all racing to commercialize and scale QKD solutions for critical infrastructure, government, and enterprise applications.

QKD hardware systems typically comprise photon sources, single-photon detectors, quantum random number generators, and specialized optical components. These are integrated into modules or devices that can be deployed over fiber-optic networks or, increasingly, via free-space and satellite links. The manufacturing process demands ultra-high precision, cleanroom environments, and advanced photonic integration, often leveraging expertise from the semiconductor and telecommunications industries.

Key players in the QKD hardware manufacturing landscape include Toshiba Corporation, which has developed commercial QKD systems and is actively deploying them in pilot networks across Europe and Asia. ID Quantique, based in Switzerland, is another pioneer, offering a range of QKD hardware products and collaborating with telecom operators for real-world deployments. In China, China Electronics Technology Group Corporation (CETC) and QuantumCTek are leading manufacturers, supplying QKD equipment for the world’s largest quantum communication networks, including the Beijing-Shanghai backbone.

The industry is also seeing significant activity from European consortia and national initiatives, with companies like ADVA Optical Networking SE (now part of Adtran) integrating QKD modules into optical transport systems. Meanwhile, BT Group in the UK is collaborating with hardware manufacturers to test and validate QKD in metropolitan networks. In the US, Quantum Xchange and MagiQ Technologies are notable for their focus on QKD hardware for government and financial sector clients.

Looking ahead to the next few years, the QKD hardware manufacturing sector is expected to benefit from increased standardization efforts, government funding, and the integration of QKD with classical network infrastructure. The push for quantum-safe security, driven by the looming threat of quantum computers to conventional encryption, is accelerating demand for robust, scalable QKD hardware. However, challenges remain in reducing costs, improving interoperability, and extending the range and reliability of QKD systems. As manufacturing processes mature and supply chains stabilize, the industry is poised for broader adoption, particularly in sectors where data security is paramount.

Key Players and Competitive Landscape (e.g., idquantique.com, toshiba.com, qutools.com)

The competitive landscape of Quantum Key Distribution (QKD) security hardware manufacturing in 2025 is characterized by a mix of established technology conglomerates and specialized quantum technology firms, each vying for leadership in a rapidly evolving market. The sector is driven by increasing demand for quantum-safe communications, particularly from government, defense, and financial sectors, as well as growing interest from telecom operators and critical infrastructure providers.

- ID Quantique (ID Quantique) remains a global pioneer and market leader in QKD hardware. Headquartered in Switzerland, the company offers a comprehensive portfolio including QKD systems, quantum random number generators, and network integration solutions. In recent years, ID Quantique has expanded its partnerships with telecom operators and infrastructure providers, notably collaborating with European and Asian carriers to deploy QKD-secured networks. Their Cerberis XG platform is widely recognized for its interoperability and compliance with emerging international standards.

- Toshiba (Toshiba) is a major player leveraging its extensive R&D capabilities to commercialize QKD solutions. The company’s Cambridge Research Laboratory has been at the forefront of developing long-distance QKD hardware, achieving record-breaking transmission distances over optical fiber. Toshiba’s QKD systems are being piloted in several national and cross-border quantum network projects, particularly in the UK and Japan, and the company is actively working on integrating QKD with existing telecom infrastructure.

- Qutools (Qutools), based in Germany, specializes in quantum optics and QKD devices for both research and commercial applications. The company is known for its modular QKD platforms and has supplied hardware for several European quantum communication testbeds. Qutools is also involved in educational and industrial collaborations to advance the adoption of quantum-secure technologies.

- QuantumCTek (QuantumCTek) is a leading Chinese manufacturer of QKD hardware, playing a central role in China’s ambitious quantum communication infrastructure projects. The company supplies QKD systems for metropolitan and intercity networks, and its products are integral to the world’s largest quantum communication backbone, the Beijing-Shanghai trunk line.

- SK Telecom (SK Telecom) is notable for integrating QKD hardware into commercial telecom networks in South Korea. The company has developed proprietary QKD modules and is actively expanding its quantum-secured services for enterprise and government clients.

Looking ahead, the QKD hardware market is expected to see intensified competition as more telecom operators and technology firms enter the field, and as international standards for quantum-safe communications mature. Strategic partnerships, interoperability, and large-scale pilot deployments will be key differentiators among leading manufacturers. The next few years will likely witness further consolidation and the emergence of new players, particularly as governments and multinational organizations invest in quantum-secure infrastructure.

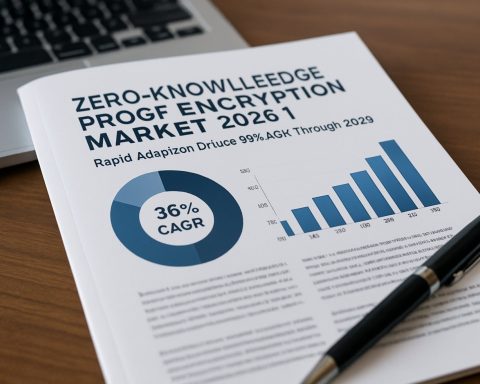

Market Size, Segmentation, and 2025–2030 Growth Forecasts (Estimated CAGR: 28–32%)

The global market for Quantum Key Distribution (QKD) security hardware is entering a period of accelerated growth, driven by increasing awareness of quantum threats to classical encryption and the need for future-proof secure communications. As of 2025, the QKD hardware segment—encompassing quantum random number generators, photon sources, detectors, and full QKD systems—is estimated to be valued in the low hundreds of millions USD, with projections indicating a compound annual growth rate (CAGR) of approximately 28–32% through 2030. This expansion is fueled by both government-backed infrastructure projects and early commercial deployments in sectors such as finance, defense, and critical infrastructure.

Market segmentation reveals several key categories: point-to-point QKD systems (for direct fiber links), trusted node networks (for metropolitan and national scale), and satellite-based QKD hardware (for global reach). The largest share currently resides in terrestrial fiber-based QKD, but satellite QKD is expected to grow rapidly as international projects mature. Notably, Toshiba Corporation has established itself as a leader in commercial QKD hardware, with its multiplexed QKD systems deployed in pilot networks across Europe and Asia. ID Quantique, based in Switzerland, is another major player, supplying QKD hardware for both government and enterprise customers, and collaborating on several cross-border quantum network initiatives.

In China, China Electronics Technology Group Corporation (CETC) and QuantumCTek are at the forefront, having delivered QKD hardware for the world’s largest quantum communication backbone, the Beijing-Shanghai trunk line, and for satellite QKD experiments. These companies are expected to maintain strong growth as China continues to invest heavily in quantum-safe infrastructure.

The European market is also dynamic, with Adva Network Security (formerly ADVA Optical Networking) and Sicpa Secure Networks (formerly Arqit) developing QKD hardware and integration solutions for telecom operators and government networks. Meanwhile, the US market is seeing increased activity from Quantum Xchange and MagiQ Technologies, both of which are focused on QKD hardware for critical infrastructure and financial services.

Looking ahead to 2030, the QKD security hardware market is expected to diversify further, with new entrants and established photonics manufacturers expanding their quantum portfolios. The anticipated CAGR of 28–32% reflects both the urgency of quantum-safe security adoption and the maturation of QKD hardware supply chains. As interoperability standards and government procurement frameworks solidify, the market is likely to see broader adoption beyond pilot projects, particularly in regions with strong policy support for quantum technologies.

Core Technologies: Photonic Components, Quantum Random Number Generators, and Protocols

Quantum Key Distribution (QKD) security hardware manufacturing in 2025 is characterized by rapid advancements in core photonic technologies, quantum random number generators (QRNGs), and the implementation of robust quantum protocols. These components are fundamental to the secure generation, transmission, and management of cryptographic keys in quantum communication networks.

Photonic components form the backbone of QKD systems, enabling the generation, manipulation, and detection of single photons or entangled photon pairs. Leading manufacturers such as ID Quantique and Toshiba Corporation have developed integrated photonic modules that combine sources, modulators, and detectors into compact, scalable units. In 2025, the trend is toward silicon photonics and indium phosphide platforms, which offer improved integration, lower losses, and compatibility with existing telecom infrastructure. Toshiba Corporation has demonstrated QKD over metropolitan fiber networks, leveraging their proprietary photonic integrated circuits for stable, high-rate key distribution.

Quantum random number generators (QRNGs) are essential for producing the true randomness required for cryptographic keys. Companies like ID Quantique and QuantumCTek have commercialized QRNG modules based on quantum optical processes, such as photon arrival time or phase noise. In 2025, QRNGs are increasingly being embedded directly into QKD transmitters and receivers, enhancing security and reducing system complexity. ID Quantique’s QRNG chips are now found in a range of security appliances and are certified for use in critical infrastructure.

The implementation of QKD protocols—such as BB84, decoy-state, and measurement-device-independent (MDI) QKD—requires precise hardware synchronization and error correction. Manufacturers are integrating advanced field-programmable gate arrays (FPGAs) and application-specific integrated circuits (ASICs) to handle real-time protocol processing. QuantumCTek and Toshiba Corporation have both demonstrated commercial MDI-QKD systems, which offer enhanced security against detector side-channel attacks.

Looking ahead, the QKD hardware sector is expected to see further miniaturization, cost reduction, and standardization. Industry consortia and standards bodies, such as the European Telecommunications Standards Institute (ETSI), are working with manufacturers to define interoperability and security benchmarks. As quantum-safe networks expand, the demand for robust, scalable QKD hardware will drive continued innovation in photonic integration, QRNG performance, and protocol implementation.

Manufacturing Innovations and Supply Chain Developments

The manufacturing landscape for Quantum Key Distribution (QKD) security hardware is undergoing significant transformation in 2025, driven by both technological innovation and evolving supply chain strategies. As global demand for quantum-safe communication infrastructure accelerates, manufacturers are investing in advanced photonic integration, miniaturization, and scalable production processes to meet the stringent requirements of QKD systems.

A notable trend is the shift from laboratory-scale prototypes to industrial-grade, mass-producible QKD devices. Companies such as Toshiba Corporation and ID Quantique are at the forefront, leveraging their expertise in quantum optics and semiconductor fabrication. Toshiba Corporation has announced the deployment of its QKD hardware in commercial networks, emphasizing the use of silicon photonics to enhance reliability and reduce costs. Similarly, ID Quantique continues to refine its manufacturing processes, focusing on the integration of single-photon detectors and compact modules suitable for telecom infrastructure.

Supply chain resilience has become a critical focus, especially in light of recent global semiconductor shortages and geopolitical uncertainties. Leading QKD hardware manufacturers are diversifying their supplier base and investing in localized production facilities. For instance, QuantumCTek, a major Chinese QKD provider, has expanded its domestic manufacturing capabilities to ensure continuity and security of supply. This move is mirrored by European initiatives, where companies like ADVA Optical Networking SE are collaborating with regional partners to establish secure and transparent supply chains for quantum components.

Manufacturing innovations are also being driven by the need for interoperability and standardization. Industry bodies such as the European Telecommunications Standards Institute (ETSI) are working closely with hardware manufacturers to define technical standards for QKD modules, connectors, and interfaces. This collaboration is expected to streamline component sourcing and facilitate the integration of QKD hardware into existing network infrastructure.

Looking ahead, the outlook for QKD security hardware manufacturing in the next few years is marked by continued investment in automation, quality control, and eco-friendly production methods. As quantum-safe networks move from pilot projects to large-scale deployments, manufacturers are poised to scale up production while maintaining the high precision and security required for quantum communications. The convergence of photonic chip technology, robust supply chains, and international standards is set to underpin the next phase of growth in the QKD hardware sector.

Regulatory Environment and Industry Standards (e.g., ieee.org, etsi.org)

The regulatory environment and industry standards for Quantum Key Distribution (QKD) security hardware manufacturing are rapidly evolving as the technology matures and deployment accelerates globally. In 2025, the sector is witnessing increased activity from international standards bodies and industry consortia, aiming to ensure interoperability, security assurance, and market trust for QKD systems.

A central player in this landscape is the European Telecommunications Standards Institute (ETSI), which has established the Industry Specification Group for Quantum Key Distribution (ISG-QKD). ETSI’s ISG-QKD has published a suite of standards covering QKD component interfaces, security requirements, and network integration, with ongoing work in 2025 focusing on certification frameworks and conformance testing. These standards are critical for manufacturers, as they provide the technical and procedural benchmarks necessary for commercial deployment and cross-vendor compatibility.

In parallel, the Institute of Electrical and Electronics Engineers (IEEE) is advancing its own standardization efforts. The IEEE Quantum Communications and Quantum Key Distribution Working Group is developing standards for QKD protocol definitions, hardware interfaces, and performance metrics. These initiatives are expected to culminate in new IEEE standards releases in the next few years, further shaping the requirements for QKD hardware manufacturers and influencing procurement specifications for telecom operators and government agencies.

On the international stage, the International Telecommunication Union (ITU) has also entered the QKD standardization arena, with its Telecommunication Standardization Sector (ITU-T) Study Group 13 working on recommendations for quantum-safe network architectures and QKD integration into existing telecom infrastructure. This global harmonization is particularly important for manufacturers targeting cross-border deployments and multinational clients.

Manufacturers such as Toshiba Corporation and ID Quantique are actively participating in these standardization efforts, contributing technical expertise and aligning their product development roadmaps with emerging requirements. Their involvement ensures that new QKD hardware platforms are designed to meet both current and anticipated regulatory expectations, facilitating smoother certification and market entry.

Looking ahead, the regulatory environment is expected to become more stringent, with formal certification schemes and government procurement mandates likely to emerge by 2026–2027. This will drive further investment in compliance testing and quality assurance among QKD hardware manufacturers, while also fostering greater interoperability and security assurance across the industry.

Adoption Drivers: Telecom, Finance, and Government Use Cases

Quantum Key Distribution (QKD) security hardware manufacturing is experiencing accelerated momentum in 2025, driven by the urgent need for quantum-safe communications across critical sectors such as telecommunications, finance, and government. The adoption of QKD is propelled by the looming threat of quantum computers rendering classical encryption vulnerable, prompting organizations to invest in future-proof security infrastructure.

In the telecommunications sector, major operators are actively deploying QKD hardware to secure backbone and metropolitan networks. For instance, Telefónica has partnered with leading QKD hardware manufacturers to pilot quantum-secure links in Spain, while BT Group in the UK has integrated QKD systems into its core network, collaborating with hardware providers such as Toshiba Corporation and ID Quantique. These deployments typically involve the installation of QKD transmitters and receivers, as well as trusted node infrastructure, to enable secure key exchange over fiber optic cables.

The financial sector is another early adopter, with banks and stock exchanges seeking to protect high-value transactions and sensitive customer data. In Switzerland, SIX Group has worked with ID Quantique to implement QKD-secured communication channels between data centers. Similarly, Asian financial institutions are collaborating with hardware manufacturers to pilot QKD for interbank communications, leveraging the expertise of companies like QuantumCTek in China, which has supplied QKD hardware for several large-scale deployments.

Government agencies are also at the forefront of QKD adoption, motivated by the need to secure classified communications and critical infrastructure. The European Union’s EuroQCI initiative, involving multiple member states, is fostering the development and deployment of QKD hardware across national and cross-border networks, with contributions from manufacturers such as Toshiba Corporation, ID Quantique, and QuantumCTek. In Asia, government-backed projects in China and South Korea are scaling up QKD hardware manufacturing to support national quantum communication networks.

Looking ahead, the outlook for QKD security hardware manufacturing is robust. As standardization efforts mature and interoperability improves, hardware vendors are expected to ramp up production and reduce costs, making QKD more accessible to a broader range of customers. The convergence of regulatory pressure, technological readiness, and sector-specific security needs will continue to drive adoption, positioning QKD hardware as a cornerstone of next-generation secure communications.

Challenges: Scalability, Cost, and Integration with Classical Networks

Quantum Key Distribution (QKD) security hardware manufacturing faces several significant challenges as the technology moves from research labs to broader commercial deployment in 2025 and the coming years. Chief among these are issues of scalability, cost, and seamless integration with existing classical communication networks.

Scalability remains a primary hurdle. QKD systems, particularly those based on discrete-variable protocols, often require highly specialized components such as single-photon sources, superconducting nanowire single-photon detectors, and ultra-stable lasers. Manufacturing these components at scale, with consistent quality and reliability, is complex and capital-intensive. Companies like ID Quantique and Toshiba have made progress in miniaturizing and standardizing QKD modules, but widespread deployment—especially over metropolitan or national networks—demands further advances in mass production and supply chain robustness.

Cost is closely tied to scalability. The precision and purity required for quantum components drive up manufacturing expenses, making QKD hardware significantly more expensive than conventional cryptographic solutions. For example, the cost of single-photon detectors and quantum random number generators remains high, limiting adoption to government, defense, and select financial sectors. QuantumCTek, a leading Chinese QKD hardware manufacturer, has focused on reducing costs through vertical integration and domestic supply chains, but price points are still a barrier for broader commercial uptake.

Integration with classical networks is another critical challenge. QKD hardware must interface with existing fiber-optic infrastructure and network management systems, which were not designed for quantum signals. This requires the development of hybrid devices and protocols that can multiplex quantum and classical data streams without cross-talk or signal degradation. Toshiba has demonstrated prototype QKD systems capable of coexisting with classical data on the same fiber, but large-scale, plug-and-play integration remains a work in progress. Interoperability standards are still evolving, with industry bodies such as the European Telecommunications Standards Institute (ETSI) working to define specifications for QKD network interfaces and security modules.

Looking ahead, the outlook for QKD security hardware manufacturing in 2025 and beyond will depend on continued innovation in photonic integration, automated assembly, and standardization. As more companies enter the field and governments invest in quantum-safe infrastructure, economies of scale and improved manufacturing processes are expected to gradually reduce costs and improve compatibility with classical networks. However, overcoming these challenges will require sustained collaboration between hardware manufacturers, telecom operators, and standards organizations.

Future Outlook: Emerging Trends, R&D, and Strategic Roadmaps to 2030

Quantum Key Distribution (QKD) security hardware manufacturing is entering a pivotal phase in 2025, driven by rapid advances in quantum technologies, increased cybersecurity demands, and strategic investments from both public and private sectors. The next few years are expected to witness significant developments in the scalability, integration, and commercialization of QKD hardware, with a focus on overcoming current limitations in cost, distance, and interoperability.

Leading manufacturers such as ID Quantique (IDQ) and Toshiba Corporation are at the forefront of QKD hardware innovation. IDQ, headquartered in Switzerland, continues to expand its portfolio of QKD systems, including compact, rack-mountable modules designed for integration into existing telecom infrastructure. Toshiba, leveraging its expertise in quantum optics and photonics, is advancing twin-field QKD and chip-based solutions, aiming to extend secure key distribution over metropolitan and intercity distances. Both companies are actively collaborating with telecom operators and infrastructure providers to pilot and deploy QKD networks in Europe and Asia.

In China, QuantumCTek is scaling up production of QKD hardware for government, finance, and energy sectors, and is a key supplier for the country’s ambitious quantum communication backbone projects. The company is also investing in miniaturized QKD modules and satellite-based QKD terminals, reflecting a broader industry trend toward compact, cost-effective, and versatile hardware.

Emerging players such as Quantinuum and Qasky are focusing on integrated photonic chips and next-generation single-photon detectors, which are expected to reduce the size, power consumption, and cost of QKD devices. These innovations are crucial for enabling mass deployment and for embedding QKD capabilities into standard network equipment.

Industry-wide, there is a strong emphasis on standardization and interoperability, with organizations like the European Telecommunications Standards Institute (ETSI) and the International Telecommunication Union (ITU) working closely with hardware manufacturers to define protocols and certification schemes. This is expected to accelerate the adoption of QKD hardware in critical infrastructure and cross-border networks.

Looking ahead to 2030, the QKD hardware manufacturing sector is poised for robust growth, underpinned by ongoing R&D in quantum repeaters, integrated photonics, and satellite QKD. Strategic roadmaps from leading companies indicate a shift toward hybrid quantum-classical security solutions and the convergence of QKD with post-quantum cryptography, ensuring resilience against both classical and quantum cyber threats.

Sources & References

- Toshiba Corporation

- ID Quantique

- Toshiba Corporation

- China Electronics Technology Group Corporation (CETC)

- QuantumCTek

- BT Group

- Quantum Xchange

- MagiQ Technologies

- ID Quantique

- Qutools

- SK Telecom

- QuantumCTek

- Institute of Electrical and Electronics Engineers (IEEE)

- International Telecommunication Union (ITU)

- Telefónica

- SIX Group

- Quantinuum