The Future of Robotic Endobronchial Surgery Systems in 2025: Transforming Pulmonary Procedures with Precision Robotics. Explore Market Growth, Breakthrough Technologies, and Strategic Insights for the Next Five Years.

- Executive Summary: Key Trends and Market Drivers in 2025

- Market Size and Forecast (2025–2030): Growth Trajectory and 18% CAGR Analysis

- Technological Innovations: Next-Gen Robotics and AI Integration

- Leading Manufacturers and Industry Players (e.g., intuitive.com, johnsonandjohnson.com, olympus-global.com)

- Clinical Applications: Expanding Indications and Patient Outcomes

- Regulatory Landscape and Compliance Standards

- Competitive Landscape: Strategic Partnerships and M&A Activity

- Regional Analysis: North America, Europe, Asia-Pacific, and Emerging Markets

- Challenges and Barriers: Adoption, Training, and Cost Considerations

- Future Outlook: Disruptive Trends and Long-Term Opportunities

- Sources & References

Executive Summary: Key Trends and Market Drivers in 2025

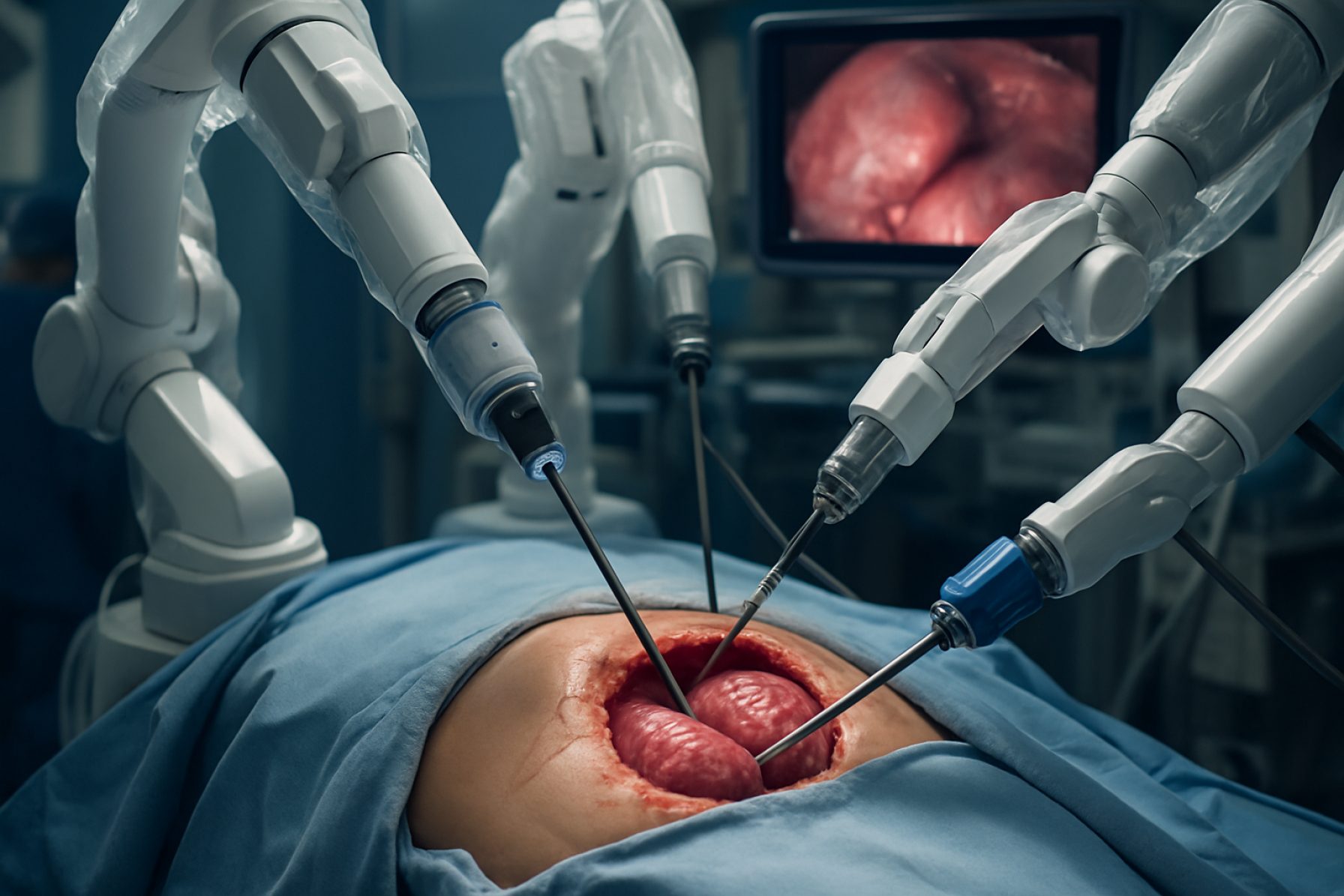

Robotic endobronchial surgery systems are poised for significant growth and technological advancement in 2025, driven by the convergence of minimally invasive surgical trends, rising lung cancer incidence, and rapid innovation in medical robotics. The global burden of lung cancer, which remains the leading cause of cancer-related deaths, is intensifying demand for early diagnosis and precise intervention. Robotic platforms are increasingly recognized for their ability to enhance navigation, visualization, and accuracy during bronchoscopic procedures, particularly for the biopsy and ablation of small, peripheral pulmonary nodules.

A key trend in 2025 is the accelerated adoption of next-generation robotic bronchoscopy systems. Intuitive Surgical, a pioneer in robotic surgery, continues to expand its Ion Endoluminal System, which leverages shape-sensing technology for precise navigation deep into the lung periphery. The Ion system is being adopted by leading academic and community hospitals, with clinical studies demonstrating improved diagnostic yield and safety profiles compared to conventional techniques. Similarly, Johnson & Johnson (through its subsidiary Auris Health) markets the Monarch Platform, which combines robotic control with advanced imaging to facilitate minimally invasive lung procedures. The Monarch system is being integrated into major U.S. and international centers, with ongoing trials evaluating its impact on early-stage lung cancer outcomes.

Another notable development is the entry of new players and the expansion of product portfolios. Olympus Corporation is advancing its robotic bronchoscopy solutions, building on its global leadership in endoscopy. The company is investing in research collaborations and clinical validation to support regulatory approvals and market expansion. Meanwhile, Medtronic is leveraging its expertise in surgical navigation and imaging to develop integrated robotic platforms for pulmonary applications, with pilot programs and partnerships underway in North America and Europe.

Market drivers in 2025 include increasing physician familiarity with robotic systems, favorable reimbursement trends for minimally invasive lung procedures, and growing evidence supporting the clinical and economic benefits of robotic bronchoscopy. Hospitals are prioritizing investments in robotic platforms to differentiate service offerings and improve patient outcomes, particularly as guidelines emphasize early detection and intervention for lung cancer.

Looking ahead, the next few years are expected to see further technological convergence, with artificial intelligence, real-time imaging, and advanced instrumentation enhancing the capabilities of robotic endobronchial systems. Strategic collaborations between device manufacturers, healthcare providers, and research institutions will accelerate clinical adoption and expand indications, positioning robotic bronchoscopy as a standard of care in pulmonary medicine.

Market Size and Forecast (2025–2030): Growth Trajectory and 18% CAGR Analysis

The global market for robotic endobronchial surgery systems is poised for robust expansion between 2025 and 2030, with industry consensus pointing to a compound annual growth rate (CAGR) of approximately 18%. This growth trajectory is underpinned by accelerating adoption of minimally invasive technologies in pulmonology, rising incidence of lung cancer, and ongoing technological advancements in robotic-assisted bronchoscopy platforms.

As of 2025, the market is led by a handful of pioneering companies. Intuitive Surgical—renowned for its da Vinci platform—has made significant inroads into the pulmonary space with its Ion Endoluminal System, which received FDA clearance in 2019 and has since seen increasing clinical uptake. Johnson & Johnson, through its subsidiary Auris Health, offers the Monarch Platform, another FDA-cleared robotic bronchoscopy system that is being rapidly adopted in major healthcare centers. Both companies are investing heavily in R&D to enhance navigation, imaging, and biopsy capabilities, aiming to improve diagnostic yield and procedural safety.

The market’s expansion is further supported by the entry of new players and the global rollout of these systems. Olympus Corporation has announced development efforts in robotic bronchoscopy, leveraging its established presence in endoscopy. Meanwhile, Medtronic is actively developing robotic-assisted solutions for pulmonary procedures, signaling intensifying competition and innovation in the sector.

From a quantitative perspective, the installed base of robotic endobronchial systems is expected to more than double by 2030, with North America and Western Europe accounting for the majority of early adoption. However, Asia-Pacific markets are projected to experience the fastest growth rates, driven by increasing healthcare investments and rising awareness of early lung cancer detection.

Key growth drivers include the rising prevalence of lung cancer—currently the leading cause of cancer death worldwide—and the clinical need for precise, minimally invasive diagnostic and therapeutic interventions. Robotic systems offer enhanced reach, stability, and visualization within the bronchial tree, enabling access to peripheral lung nodules that are challenging for conventional bronchoscopes.

Looking ahead, the market outlook remains highly favorable. Ongoing clinical studies, expanded indications (such as robotic-guided ablation and therapeutics), and integration with advanced imaging modalities are expected to further accelerate adoption. As reimbursement pathways solidify and procedural volumes increase, the robotic endobronchial surgery systems market is set to maintain its strong double-digit growth through 2030.

Technological Innovations: Next-Gen Robotics and AI Integration

Robotic endobronchial surgery systems are at the forefront of technological innovation in interventional pulmonology, with 2025 marking a pivotal year for next-generation robotics and artificial intelligence (AI) integration. These systems are designed to enhance the precision, safety, and efficacy of diagnostic and therapeutic procedures within the bronchial tree, particularly for lung cancer diagnosis and treatment.

The current market is led by a handful of pioneering companies. Intuitive Surgical, renowned for its da Vinci platform, has expanded its portfolio with the Ion Endoluminal System, which leverages shape-sensing robotic technology to navigate deep into the lung periphery. The Ion system’s real-time 3D navigation and ultra-thin, flexible catheter allow for minimally invasive access to small and previously unreachable pulmonary nodules. In 2024, Intuitive Surgical reported significant growth in Ion procedures, with adoption accelerating in major academic and community hospitals.

Another major player, Johnson & Johnson (through its subsidiary Ethicon and the Auris Health acquisition), offers the Monarch Platform. This system combines robotic-assisted bronchoscopy with advanced data integration, providing physicians with continuous vision and precise control during navigation and biopsy. The Monarch Platform’s integration of AI-driven image analysis is expected to further improve diagnostic yield and procedural safety in 2025 and beyond.

Emerging competitors are also shaping the landscape. Olympus Corporation is developing robotic bronchoscopy solutions that integrate their expertise in endoscopic imaging and therapeutic devices. Their systems are anticipated to feature enhanced maneuverability and AI-powered lesion detection, with clinical trials and regulatory submissions expected in the near term.

Technological advancements in 2025 are focused on deeper AI integration, including real-time image interpretation, automated lesion targeting, and predictive analytics for procedural planning. These innovations aim to reduce operator variability, shorten learning curves, and improve patient outcomes. The convergence of robotics and AI is also enabling the development of fully automated navigation pathways and the potential for remote or teleoperated procedures, expanding access to expert care.

Looking ahead, the next few years will likely see increased interoperability between robotic platforms and hospital information systems, facilitating seamless data exchange and longitudinal patient tracking. As regulatory approvals expand and clinical evidence accumulates, robotic endobronchial surgery systems are poised to become standard of care for complex pulmonary interventions, with ongoing innovation driven by industry leaders such as Intuitive Surgical, Johnson & Johnson, and Olympus Corporation.

Leading Manufacturers and Industry Players (e.g., intuitive.com, johnsonandjohnson.com, olympus-global.com)

The landscape of robotic endobronchial surgery systems in 2025 is shaped by a select group of leading manufacturers, each leveraging advanced robotics, imaging, and navigation technologies to address the growing demand for minimally invasive pulmonary procedures. These systems are primarily used for the diagnosis and treatment of lung lesions, including early-stage lung cancer, and are increasingly integrated into interventional pulmonology suites worldwide.

Intuitive Surgical, Inc. remains a dominant force in the field, building on its legacy with the da Vinci platform and expanding into bronchoscopy with the Ion Endoluminal System. The Ion system utilizes a flexible robotic catheter and advanced fiber-optic shape-sensing technology, enabling precise navigation to peripheral lung nodules. Since its FDA clearance in 2019, Ion has seen rapid adoption in major U.S. and international centers, with 2025 expected to bring further software enhancements and expanded clinical indications. Intuitive Surgical continues to invest in R&D, aiming to improve diagnostic yield and procedural efficiency.

Johnson & Johnson, through its subsidiary Ethicon and the acquisition of Auris Health, has established a significant presence with the Monarch Platform. The Monarch system combines robotic-assisted bronchoscopy with real-time 3D vision and electromagnetic navigation, allowing for accurate targeting of small and hard-to-reach lung lesions. The company is actively expanding the Monarch’s clinical applications and global reach, with ongoing studies and regulatory submissions anticipated to broaden its use in both diagnostic and therapeutic interventions. Johnson & Johnson is also exploring integration with artificial intelligence to further enhance procedural planning and outcomes.

Olympus Corporation, a global leader in endoscopy, has entered the robotic bronchoscopy market with its own platform, leveraging decades of expertise in imaging and minimally invasive devices. Olympus is focusing on seamless integration with its existing endoscopic technologies and is expected to accelerate commercialization efforts in North America, Europe, and Asia-Pacific through 2025. The company’s strategy includes partnerships with hospitals and research centers to validate clinical performance and workflow advantages. Olympus Corporation is also investing in next-generation navigation and therapeutic tools to complement its robotic system.

Other notable entrants include Medtronic, which is developing robotic-assisted bronchoscopy solutions as part of its broader minimally invasive surgery portfolio, and Siemens Healthineers, which is exploring advanced imaging integration for robotic pulmonary interventions. These companies are expected to intensify competition and innovation in the sector over the next few years.

Overall, the outlook for robotic endobronchial surgery systems in 2025 and beyond is marked by rapid technological evolution, increased clinical adoption, and expanding indications, driven by the efforts of these leading industry players.

Clinical Applications: Expanding Indications and Patient Outcomes

Robotic endobronchial surgery systems are rapidly transforming the landscape of pulmonary interventions, with 2025 marking a pivotal year for their clinical applications. These systems, designed to navigate the intricate bronchial tree with high precision, are expanding indications beyond traditional diagnostic bronchoscopy to include a range of therapeutic procedures. The most prominent platforms in this space are the Intuitive Surgical Ion Endoluminal System and the Johnson & Johnson Monarch Platform, both of which have received regulatory clearances for use in the United States and are being adopted in leading medical centers worldwide.

Initially, robotic endobronchial systems were primarily utilized for the biopsy of small, peripheral pulmonary nodules, a task that is challenging with conventional bronchoscopes due to limited reach and stability. Recent clinical studies and real-world data in 2024 and 2025 demonstrate that these systems significantly improve diagnostic yield, with published results showing diagnostic accuracy rates exceeding 80% for peripheral lesions, compared to 60–70% with traditional methods. This improvement is attributed to enhanced maneuverability, real-time navigation, and the ability to maintain tool stability during tissue acquisition.

In 2025, the scope of robotic endobronchial interventions is broadening to include therapeutic applications such as fiducial marker placement for stereotactic radiotherapy, dye marking for surgical localization, and even early-stage tumor ablation. The integration of advanced imaging modalities, including cone-beam CT and augmented fluoroscopy, is further enhancing the precision and safety of these procedures. Both Intuitive Surgical and Johnson & Johnson are actively developing software and hardware upgrades to support these expanded indications, with ongoing clinical trials evaluating the efficacy of robotic-guided ablation and localized drug delivery.

Patient outcomes are a central focus of ongoing research. Early data from multicenter registries indicate that robotic endobronchial procedures are associated with lower complication rates, reduced need for repeat biopsies, and shorter hospital stays compared to conventional approaches. These benefits are particularly significant for patients with comorbidities or those at higher risk for surgical complications. Furthermore, the minimally invasive nature of robotic systems is expected to facilitate earlier diagnosis and intervention, potentially improving long-term survival rates for lung cancer patients.

Looking ahead, the next few years are likely to see further expansion of indications, including the treatment of benign airway diseases and the delivery of novel therapeutics. As more data become available and technology continues to evolve, robotic endobronchial surgery systems are poised to become a standard of care in interventional pulmonology, with ongoing investments from industry leaders such as Intuitive Surgical and Johnson & Johnson driving innovation and clinical adoption.

Regulatory Landscape and Compliance Standards

The regulatory landscape for robotic endobronchial surgery systems is evolving rapidly as these technologies gain traction in interventional pulmonology and thoracic surgery. In 2025, the primary focus remains on ensuring patient safety, device efficacy, and interoperability with existing hospital infrastructure. Regulatory agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other national bodies are actively updating frameworks to address the unique challenges posed by robotic-assisted platforms.

In the United States, the FDA classifies robotic endobronchial systems as Class II or Class III medical devices, depending on their intended use and risk profile. Manufacturers must typically submit a 510(k) premarket notification or, for novel systems, a more rigorous Premarket Approval (PMA) application. The FDA has issued specific guidance for computer-assisted surgical systems, emphasizing requirements for human factors engineering, cybersecurity, and post-market surveillance. In 2024 and 2025, the FDA has increased scrutiny on software updates and remote connectivity features, reflecting the growing integration of artificial intelligence and teleoperation in these systems.

In Europe, the Medical Device Regulation (MDR) (EU 2017/745) governs the approval and monitoring of robotic endobronchial platforms. The MDR, fully enforced since 2021, imposes stricter clinical evidence requirements and post-market surveillance obligations compared to its predecessor. Notified Bodies are now demanding more robust clinical data, including real-world evidence from multicenter studies, before granting CE marking. This has led to longer approval timelines but is expected to enhance patient safety and device reliability.

Key industry players such as Intuitive Surgical, the developer of the Ion Endoluminal System, and Johnson & Johnson (through its subsidiary Auris Health, creator of the Monarch Platform), are actively engaging with regulators to shape standards and best practices. Both companies have announced ongoing collaborations with regulatory agencies to ensure compliance with evolving requirements, particularly regarding data security and interoperability with hospital electronic health records.

In Asia-Pacific, regulatory harmonization efforts are underway, with countries like Japan and South Korea aligning their approval processes with international standards. China’s National Medical Products Administration (NMPA) has also introduced new pathways for innovative medical devices, expediting market access for robotic systems that demonstrate significant clinical benefit.

Looking ahead, the next few years will likely see the introduction of international standards specific to robotic bronchoscopy, including guidelines for system validation, operator training, and long-term safety monitoring. Industry consortia and professional societies are expected to play a larger role in defining these standards, supporting a global framework that balances innovation with patient protection.

Competitive Landscape: Strategic Partnerships and M&A Activity

The competitive landscape for robotic endobronchial surgery systems in 2025 is characterized by a dynamic interplay of strategic partnerships, mergers, and acquisitions (M&A) among leading medtech companies. This activity is driven by the rapid adoption of minimally invasive technologies for lung cancer diagnosis and treatment, as well as the race to integrate advanced robotics, artificial intelligence, and navigation systems into bronchoscopic platforms.

A central player in this space is Intuitive Surgical, renowned for its da Vinci robotic system and the Ion endoluminal platform. Intuitive has continued to expand its reach through collaborations with hospitals and research centers to validate and broaden the clinical applications of its Ion system, which is designed for minimally invasive lung biopsy and nodule localization. The company’s ongoing investments in R&D and partnerships with academic institutions are aimed at maintaining its technological edge and regulatory momentum.

Another major force is Johnson & Johnson, through its subsidiary Auris Health. The Monarch Platform, developed by Auris Health, has been a focal point for J&J’s digital surgery strategy. Since its acquisition of Auris Health in 2019, J&J has accelerated integration of robotics and digital solutions, and in 2024–2025, the company has announced further collaborations with imaging and AI firms to enhance navigation and diagnostic accuracy in bronchoscopic procedures.

Strategic partnerships have also been pivotal for Olympus Corporation, a global leader in endoscopy. Olympus has entered into joint ventures and technology-sharing agreements with robotics startups and navigation technology providers to strengthen its position in the robotic bronchoscopy market. The company’s focus on interoperability and open-platform solutions is expected to foster further alliances in the coming years.

M&A activity remains robust as established medtech giants seek to acquire innovative startups specializing in robotics, AI-driven navigation, and advanced imaging. For example, Medtronic has signaled its intent to expand its minimally invasive lung care portfolio through targeted acquisitions and partnerships, aiming to complement its existing surgical and navigation technologies.

Looking ahead, the next few years are likely to see continued consolidation as companies vie for leadership in the robotic endobronchial surgery segment. The convergence of robotics, AI, and real-time imaging is expected to drive further strategic deals, with a focus on expanding clinical indications, improving patient outcomes, and achieving regulatory approvals in new markets. As competition intensifies, collaboration between device manufacturers, software developers, and healthcare providers will be crucial for sustained innovation and market growth.

Regional Analysis: North America, Europe, Asia-Pacific, and Emerging Markets

The global market for robotic endobronchial surgery systems is experiencing dynamic growth, with significant regional variations in adoption, regulatory progress, and clinical integration. As of 2025, North America, Europe, and Asia-Pacific represent the primary centers of activity, while emerging markets are beginning to show early-stage interest and investment.

North America remains the leading region for robotic endobronchial surgery systems, driven by robust healthcare infrastructure, high rates of lung cancer screening, and early regulatory approvals. The United States, in particular, has seen widespread clinical adoption of systems such as the Intuitive Surgical Ion Endoluminal System and the Johnson & Johnson (through its subsidiary Auris Health) Monarch Platform. These platforms have received FDA clearance for diagnostic and therapeutic bronchoscopic procedures, and are being rapidly integrated into major academic and cancer centers. The presence of leading manufacturers, strong reimbursement frameworks, and ongoing clinical trials further reinforce North America’s dominant position.

Europe is witnessing steady growth, with increasing adoption in countries such as Germany, the United Kingdom, and France. The region’s regulatory environment, governed by the European Medicines Agency (EMA) and national health authorities, has facilitated the entry of robotic systems, though at a more measured pace compared to the U.S. Both the Ion and Monarch systems have achieved CE marking, enabling their commercialization across the European Union. European hospitals are focusing on integrating these technologies into multidisciplinary lung cancer care pathways, with a particular emphasis on minimally invasive diagnostics and early intervention.

Asia-Pacific is emerging as a high-potential market, propelled by rising lung cancer incidence, expanding healthcare investments, and growing awareness of advanced surgical technologies. Japan, South Korea, and Australia are at the forefront, with leading academic centers piloting robotic endobronchial platforms. China is also making significant strides, with domestic companies beginning to develop and commercialize their own robotic bronchoscopy systems, supported by government initiatives to modernize healthcare infrastructure. The region’s diverse regulatory landscape presents both opportunities and challenges for multinational and local manufacturers.

Emerging markets in Latin America, the Middle East, and parts of Southeast Asia are in the early stages of adoption. While limited by resource constraints and lower rates of lung cancer screening, these regions are beginning to explore robotic endobronchial systems through pilot programs and partnerships with global manufacturers. As awareness grows and healthcare infrastructure improves, gradual uptake is anticipated over the next several years.

Overall, the outlook for robotic endobronchial surgery systems is positive across all regions, with North America and Europe leading in clinical integration, Asia-Pacific rapidly expanding, and emerging markets poised for future growth as access and affordability improve.

Challenges and Barriers: Adoption, Training, and Cost Considerations

The adoption of robotic endobronchial surgery systems is accelerating in 2025, yet several significant challenges and barriers remain. These include high capital and operational costs, the need for specialized training, and integration into existing clinical workflows. As the market matures, stakeholders are addressing these hurdles, but their impact continues to shape the pace and breadth of adoption.

Cost Considerations

Robotic endobronchial platforms, such as the Intuitive Surgical Ion Endoluminal System and Johnson & Johnson (through its subsidiary Auris Health) Monarch Platform, require substantial upfront investment. The acquisition cost for these systems can exceed $500,000, with additional annual service contracts and disposable instrument expenses. Hospitals and ambulatory centers must weigh these costs against potential benefits, such as improved diagnostic yield and reduced complication rates. Reimbursement pathways for robotic bronchoscopy procedures are still evolving, and in many regions, lack of clear or adequate reimbursement remains a barrier to broader adoption.

Training and Learning Curve

The complexity of robotic navigation and manipulation in the bronchial tree necessitates comprehensive training for pulmonologists and thoracic surgeons. Both Intuitive Surgical and Johnson & Johnson have developed dedicated training programs, including simulation modules and proctored cases, to facilitate safe and effective use. However, the learning curve remains steep, particularly for centers with limited prior experience in advanced bronchoscopy. Ensuring consistent procedural quality across diverse clinical settings is an ongoing challenge, and the need for credentialing and continuous education adds to the resource burden for healthcare institutions.

Integration and Workflow Disruption

Integrating robotic endobronchial systems into established operating room or bronchoscopy suite workflows can be disruptive. These systems require additional space, specialized staff, and coordination with anesthesiology and pathology teams. Workflow adjustments, such as scheduling and room turnover, may initially reduce procedural throughput. Furthermore, interoperability with existing imaging and navigation technologies is not always seamless, necessitating further investment in compatible infrastructure.

Outlook

Despite these barriers, ongoing technological advancements and increasing clinical evidence are expected to drive adoption in the coming years. Both Intuitive Surgical and Johnson & Johnson are investing in next-generation platforms with improved ergonomics, automation, and integration capabilities. As procedural volumes grow and training programs expand, economies of scale may help reduce per-procedure costs. However, addressing reimbursement and workflow challenges will remain critical to achieving widespread adoption of robotic endobronchial surgery systems through 2025 and beyond.

Future Outlook: Disruptive Trends and Long-Term Opportunities

The landscape of robotic endobronchial surgery systems is poised for significant transformation in 2025 and the following years, driven by rapid technological advancements, regulatory milestones, and expanding clinical adoption. The sector is currently dominated by a handful of pioneering companies, each pushing the boundaries of minimally invasive pulmonary interventions.

A major disruptor is the integration of advanced imaging, artificial intelligence (AI), and enhanced navigation capabilities into robotic platforms. Intuitive Surgical, renowned for its da Vinci system, has entered the bronchoscopy market with the Ion Endoluminal System, which leverages shape-sensing technology for precise navigation of peripheral lung nodules. The Ion system received FDA clearance in 2019 and has since seen growing adoption in leading U.S. centers, with ongoing studies expected to further validate its diagnostic yield and safety profile through 2025.

Another key player, Johnson & Johnson (through its subsidiary Auris Health), offers the Monarch Platform, which combines flexible robotics with real-time vision and computer-assisted navigation. Monarch has been cleared for use in both diagnostic and therapeutic bronchoscopic procedures, and its integration with AI-driven lesion targeting is anticipated to improve outcomes and expand indications in the near future.

Emerging competitors are also shaping the field. Medtronic has developed the Hugo robotic-assisted surgery system and is actively investing in endoluminal applications, while Olympus Corporation continues to innovate in endoscopic imaging and navigation, with partnerships and R&D focused on next-generation robotic bronchoscopes.

Looking ahead, several disruptive trends are expected to define the market:

- AI-Driven Decision Support: Integration of AI for real-time lesion detection, navigation, and procedural planning is likely to become standard, reducing operator variability and improving diagnostic accuracy.

- Therapeutic Expansion: Beyond biopsy, robotic systems are being adapted for localized therapies, such as ablation, drug delivery, and even early-stage tumor resection, broadening their clinical utility.

- Global Market Penetration: As regulatory approvals expand in Europe, Asia, and other regions, adoption is expected to accelerate, particularly as cost-effectiveness data emerges and reimbursement pathways are established.

- Interoperability and Data Integration: Seamless integration with hospital information systems and imaging archives will enable more personalized, data-driven care.

By 2025 and beyond, the convergence of robotics, AI, and advanced imaging is set to make robotic endobronchial surgery systems a mainstay in pulmonary medicine, with ongoing innovation from leaders like Intuitive Surgical, Johnson & Johnson, Medtronic, and Olympus Corporation driving the field toward safer, more effective, and less invasive lung interventions.