Terahertz Spectroscopy Equipment Manufacturing in 2025: Disruptive Technologies and Market Expansion Set to Redefine the Industry. Explore the Innovations and Forecasts Shaping the Next Five Years.

- Executive Summary: Key Insights for 2025 and Beyond

- Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

- Technological Advancements in Terahertz Spectroscopy Equipment

- Major Manufacturers and Industry Leaders (e.g., thzsystems.com, menlosystems.com)

- Emerging Applications: Healthcare, Security, and Materials Science

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Competitive Landscape and Strategic Partnerships

- Supply Chain and Manufacturing Innovations

- Regulatory Environment and Industry Standards (e.g., ieee.org)

- Future Outlook: Opportunities, Challenges, and Investment Trends

- Sources & References

Executive Summary: Key Insights for 2025 and Beyond

The terahertz (THz) spectroscopy equipment manufacturing sector is poised for significant growth and technological advancement in 2025 and the coming years. This momentum is driven by increasing demand for non-destructive testing, security screening, pharmaceutical quality control, and advanced materials research. The global push for miniaturization, higher sensitivity, and integration with artificial intelligence is shaping the competitive landscape, with established players and innovative startups alike investing in R&D and production capacity.

Key industry leaders such as TOPTICA Photonics AG, Menlo Systems GmbH, and Bruker Corporation (through its terahertz division) are expanding their product portfolios to address a broader range of applications. TOPTICA Photonics AG continues to innovate in compact, high-power THz sources and detectors, while Menlo Systems GmbH is recognized for its turnkey time-domain terahertz systems, which are increasingly adopted in both academic and industrial settings. Meanwhile, Bruker Corporation leverages its global distribution and support network to accelerate adoption in pharmaceutical and chemical analysis.

Recent years have seen a surge in collaborative efforts between equipment manufacturers and end-users, particularly in the semiconductor and automotive industries, where THz spectroscopy is used for quality assurance and defect detection. The integration of THz systems with robotics and automated production lines is expected to become more prevalent, as manufacturers seek to enhance throughput and reliability. Additionally, the adoption of fiber-coupled and portable THz devices is expanding the reach of these technologies into field-based and in-line industrial applications.

On the supply chain front, manufacturers are investing in vertical integration and strategic partnerships to secure critical components such as photoconductive antennas, femtosecond lasers, and advanced detectors. This is partly in response to ongoing global supply chain uncertainties and the need for greater control over quality and lead times. Companies like TOPTICA Photonics AG and Menlo Systems GmbH are notable for their in-house development of key subsystems, which positions them well for resilience and innovation.

Looking ahead, the outlook for terahertz spectroscopy equipment manufacturing remains robust. Market expansion is anticipated in Asia-Pacific, particularly in China, Japan, and South Korea, where government initiatives and industrial modernization are fueling demand. The sector is also expected to benefit from increased funding for quantum technologies and advanced materials research, further driving the need for high-performance THz instrumentation. As a result, the next few years will likely see accelerated product development cycles, greater standardization, and a broader adoption of THz spectroscopy across diverse industries.

Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

The global market for terahertz (THz) spectroscopy equipment is poised for robust growth between 2025 and 2030, driven by expanding applications in pharmaceuticals, security screening, materials science, and semiconductor inspection. As of 2025, the market is estimated to be valued in the low hundreds of millions USD, with leading manufacturers reporting increased demand for both time-domain and frequency-domain THz systems. The compound annual growth rate (CAGR) for the sector is widely projected to be in the range of 18–25% through 2030, reflecting both technological advancements and broader adoption across industries.

Key players in the terahertz spectroscopy equipment manufacturing space include TOPTICA Photonics AG, a German company recognized for its high-precision THz sources and detectors, and Menlo Systems GmbH, which specializes in femtosecond laser-based THz systems. Both companies have reported double-digit annual growth in their THz product lines, citing increased orders from research institutions and industrial clients. Advantest Corporation, a major Japanese manufacturer, has also expanded its THz system offerings, targeting the semiconductor and electronics testing markets.

In North America, Bristol Instruments, Inc. and Laser-export Co. Ltd. are notable for their development of compact, turnkey THz spectrometers, with a focus on ease of integration into existing laboratory and production environments. Meanwhile, TESAT-Spacecom GmbH & Co. KG in Europe is investing in THz technology for aerospace and communications applications, signaling diversification beyond traditional scientific markets.

The market outlook for 2025–2030 is shaped by several factors: ongoing miniaturization of THz components, improved signal-to-noise ratios, and the emergence of cost-effective, high-throughput systems. These advances are expected to lower barriers to entry for new users in quality control, non-destructive testing, and medical diagnostics. Additionally, government and industry funding for THz research—particularly in the EU, US, and Japan—continues to stimulate innovation and commercialization.

By 2030, annual global revenues for terahertz spectroscopy equipment are forecast to approach or exceed USD 1 billion, with Asia-Pacific and North America representing the largest regional markets. The sector’s high CAGR is underpinned by both replacement cycles in established laboratories and greenfield adoption in emerging application areas. As manufacturers like TOPTICA Photonics AG and Menlo Systems GmbH scale up production and expand their product portfolios, the competitive landscape is expected to intensify, further accelerating innovation and market penetration.

Technological Advancements in Terahertz Spectroscopy Equipment

The manufacturing landscape for terahertz (THz) spectroscopy equipment is undergoing significant transformation in 2025, driven by rapid technological advancements and increasing demand across sectors such as pharmaceuticals, security, and materials science. The focus is on improving system sensitivity, miniaturization, and integration with complementary technologies, which is reshaping both the capabilities and accessibility of THz spectroscopy solutions.

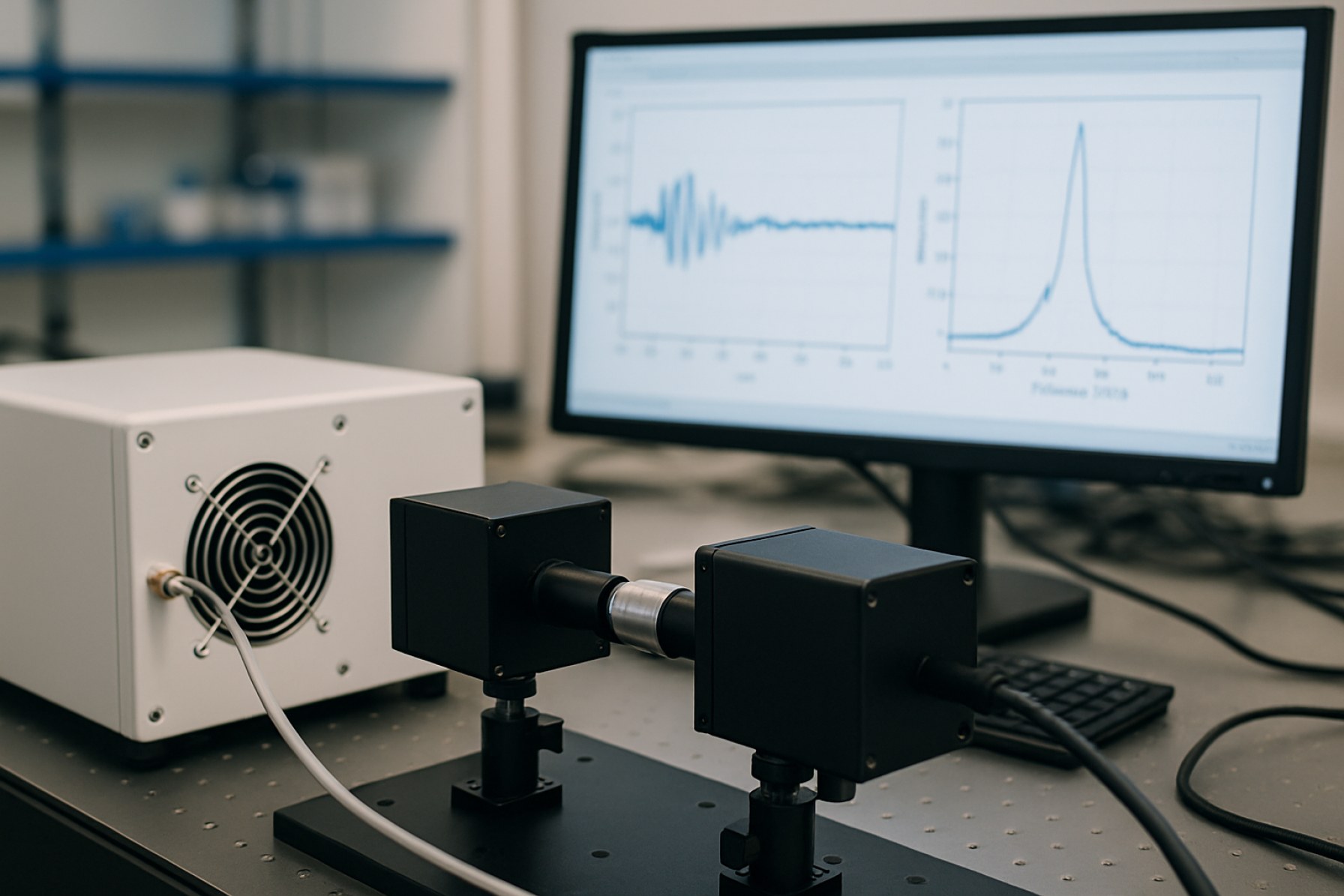

A key trend is the shift from bulky, laboratory-bound systems to more compact, portable, and user-friendly devices. Leading manufacturers such as TOPTICA Photonics and Menlo Systems are at the forefront, leveraging advances in femtosecond laser technology and photoconductive antenna design to deliver higher signal-to-noise ratios and broader spectral coverage. These improvements are enabling real-time, in-field analysis for applications like non-destructive testing and quality control.

Another major development is the integration of THz spectroscopy modules with advanced data processing and artificial intelligence (AI) algorithms. Companies like TOPTICA Photonics are incorporating AI-driven software to automate spectral interpretation, reduce analysis time, and enhance detection limits. This is particularly relevant for pharmaceutical and security screening, where rapid, accurate identification of substances is critical.

On the component level, the adoption of new materials and fabrication techniques is enhancing the performance and reliability of THz sources and detectors. For instance, Menlo Systems and TOPTICA Photonics are investing in the development of robust photoconductive switches and nonlinear crystals, which are essential for generating and detecting broadband THz pulses. These innovations are expected to lower costs and improve scalability, making THz spectroscopy more accessible to a wider range of industries.

The outlook for the next few years points to continued growth and diversification in THz spectroscopy equipment manufacturing. As more industries recognize the unique capabilities of THz analysis—such as its ability to probe molecular structures without damaging samples—demand for tailored, application-specific systems is expected to rise. Manufacturers are responding by expanding their product portfolios and forming strategic partnerships with end-users and research institutions to accelerate innovation and address emerging market needs.

In summary, 2025 marks a pivotal year for terahertz spectroscopy equipment manufacturing, characterized by technological breakthroughs, increased integration, and a focus on portability and user experience. Companies like TOPTICA Photonics and Menlo Systems are setting the pace, ensuring that THz spectroscopy continues to evolve as a powerful tool for scientific and industrial applications.

Major Manufacturers and Industry Leaders (e.g., thzsystems.com, menlosystems.com)

The terahertz (THz) spectroscopy equipment manufacturing sector is characterized by a select group of specialized companies that have established themselves as industry leaders through technological innovation, global reach, and robust product portfolios. As of 2025, the market is witnessing increased demand from applications in pharmaceuticals, security screening, materials science, and semiconductor inspection, driving both established and emerging manufacturers to expand their capabilities.

Among the most prominent players is Menlo Systems, a German company renowned for its precision photonics and terahertz time-domain spectroscopy (THz-TDS) systems. Menlo Systems is recognized for its turnkey THz platforms, which are widely used in research and industrial quality control. The company’s focus on femtosecond laser technology and frequency combs has positioned it at the forefront of high-resolution THz spectroscopy solutions.

Another key manufacturer is TeraView, based in the United Kingdom, which specializes in terahertz imaging and spectroscopy instruments. TeraView’s systems are deployed in pharmaceutical analysis, non-destructive testing, and semiconductor inspection, reflecting the growing industrial adoption of THz technologies. The company’s proprietary emitter and detector technologies enable high sensitivity and broad spectral coverage, making their equipment a benchmark in the sector.

In the United States, Bristol Instruments is notable for its development of high-precision THz spectrometers and related photonics instrumentation. Their solutions cater to both academic research and industrial process monitoring, with a focus on reliability and ease of integration into existing workflows.

Japan’s Hamamatsu Photonics is a global leader in optoelectronic components and systems, including THz sources and detectors. Hamamatsu’s extensive R&D and manufacturing capabilities allow it to supply both discrete components and complete THz spectroscopy systems, supporting a wide range of scientific and industrial applications.

Other significant contributors include TOPTICA Photonics (Germany), which offers advanced THz generation and detection modules, and Laser-export Co. (Russia), known for its custom THz solutions for research institutions.

Looking ahead to the next few years, these manufacturers are expected to invest further in miniaturization, automation, and integration of artificial intelligence for data analysis. The competitive landscape is likely to intensify as new entrants and established photonics companies seek to capitalize on the expanding THz spectroscopy market, particularly in Asia-Pacific and North America. Strategic partnerships, product innovation, and expansion into emerging application areas will be key factors shaping the industry’s trajectory through 2025 and beyond.

Emerging Applications: Healthcare, Security, and Materials Science

The manufacturing landscape for terahertz (THz) spectroscopy equipment is rapidly evolving in 2025, driven by surging demand from emerging applications in healthcare, security, and materials science. Terahertz spectroscopy, which exploits electromagnetic waves in the 0.1–10 THz range, is increasingly recognized for its non-destructive, label-free, and high-resolution analytical capabilities. This has prompted established photonics and instrumentation companies, as well as innovative startups, to expand their manufacturing capacities and diversify their product portfolios.

In healthcare, the push for non-invasive diagnostic tools is accelerating the adoption of THz spectroscopy systems. Manufacturers such as TOPTICA Photonics and Menlo Systems are at the forefront, offering turnkey THz time-domain spectroscopy (TDS) platforms tailored for biomedical imaging and pharmaceutical quality control. These systems are being refined for higher throughput and integration with AI-driven analysis, addressing the needs of clinical and research laboratories. The trend is further supported by collaborations between equipment makers and medical device companies, aiming to bring THz-based cancer detection and tissue characterization closer to routine clinical use.

Security screening is another major driver, with airports, customs, and critical infrastructure seeking advanced solutions for concealed threat detection. Companies like Advantest Corporation and Baker Hughes (through its inspection technologies division) are scaling up production of compact, robust THz imaging systems. These devices are designed for rapid, contactless screening of people and parcels, leveraging the unique spectral fingerprints of explosives, narcotics, and other hazardous materials. The focus in 2025 is on miniaturization, ruggedization, and compliance with evolving international security standards.

In materials science, THz spectroscopy is gaining traction for characterizing polymers, semiconductors, and advanced composites. TOPTICA Photonics and Menlo Systems are expanding their offerings to include modular, customizable systems for research and industrial quality assurance. These platforms enable real-time monitoring of material properties such as thickness, density, and chemical composition, supporting sectors from electronics manufacturing to aerospace.

Looking ahead, the outlook for THz spectroscopy equipment manufacturing is robust. Industry players are investing in automation, supply chain resilience, and R&D to meet the growing demand for high-performance, application-specific systems. The next few years are expected to see further cost reductions, improved user interfaces, and broader adoption across healthcare, security, and materials science, solidifying terahertz spectroscopy’s role as a transformative analytical technology.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global landscape for terahertz (THz) spectroscopy equipment manufacturing in 2025 is marked by dynamic regional developments, with North America, Europe, and Asia-Pacific emerging as the principal hubs of innovation, production, and market adoption. Each region demonstrates unique strengths, shaped by local research ecosystems, industrial demand, and government support.

North America remains a leader in terahertz technology, driven by robust R&D infrastructure and a concentration of pioneering manufacturers. The United States, in particular, is home to key players such as Terasense Group and TYDEX (with significant North American distribution), both of which are advancing the commercialization of THz spectroscopy systems for applications in security screening, pharmaceuticals, and materials science. The region benefits from strong collaborations between universities, national laboratories, and industry, fostering rapid prototyping and deployment of new THz solutions. Ongoing investments in semiconductor and photonics research are expected to further enhance the capabilities and affordability of THz equipment through 2025 and beyond.

Europe is characterized by a vibrant ecosystem of specialized manufacturers and research consortia. Germany, the United Kingdom, and France are at the forefront, with companies such as Menlo Systems and TOPTICA Photonics leading the development of high-precision THz spectroscopy instruments. European Union initiatives, including Horizon Europe, continue to fund collaborative projects aimed at expanding THz applications in non-destructive testing, biomedical imaging, and quality control. The region’s emphasis on industrial automation and advanced manufacturing is expected to drive further adoption of THz spectroscopy equipment, particularly in automotive and aerospace sectors.

Asia-Pacific is witnessing rapid growth, fueled by increasing investments in photonics and semiconductor industries, especially in China, Japan, and South Korea. Chinese manufacturers such as TOPTICA Photonics (with a strong presence in Asia) and local innovators are scaling up production to meet domestic and export demand. Japan’s established electronics sector, with companies like Hamamatsu Photonics, is integrating THz spectroscopy into quality assurance and research applications. Regional governments are supporting THz research through funding and policy incentives, positioning Asia-Pacific as a key growth engine for the global market through the late 2020s.

Rest of World regions, including Latin America and the Middle East, are at earlier stages of adoption. However, increasing awareness of THz technology’s potential in security, agriculture, and industrial inspection is prompting pilot projects and partnerships with established manufacturers. As global supply chains diversify, these regions may see gradual increases in local assembly and customization of THz spectroscopy equipment.

Overall, the outlook for 2025 and the following years points to continued regional specialization, with North America and Europe focusing on high-end, research-grade systems, and Asia-Pacific driving volume manufacturing and broader market penetration. Cross-regional collaborations and technology transfer are expected to accelerate innovation and expand the global footprint of terahertz spectroscopy equipment manufacturing.

Competitive Landscape and Strategic Partnerships

The competitive landscape of terahertz (THz) spectroscopy equipment manufacturing in 2025 is characterized by a blend of established photonics leaders, innovative startups, and strategic collaborations aimed at accelerating commercialization and expanding application domains. The sector is witnessing intensified activity as demand grows in pharmaceuticals, security screening, semiconductor inspection, and materials science.

Key players such as TOPTICA Photonics AG and Menlo Systems GmbH continue to dominate the market with robust portfolios of THz time-domain and frequency-domain spectrometers. TOPTICA Photonics AG has maintained its leadership through continuous product innovation, including compact, turnkey THz systems and advanced femtosecond laser sources, while Menlo Systems GmbH leverages its expertise in frequency comb technology to deliver high-precision THz solutions for both research and industrial users.

In the United States, TOPTICA Photonics, Inc. (the US subsidiary) and Bristol Instruments, Inc. are notable for their focus on integrating THz modules into broader spectroscopy and metrology platforms. Meanwhile, TESAT-Spacecom GmbH & Co. KG in Germany is advancing THz technology for aerospace and satellite communications, reflecting the sector’s diversification.

Strategic partnerships are a defining feature of the current landscape. For example, TOPTICA Photonics AG has entered collaborations with leading research institutes and industrial partners to co-develop application-specific THz systems, particularly for non-destructive testing and quality control in manufacturing. Similarly, Menlo Systems GmbH has partnered with semiconductor manufacturers to tailor THz inspection tools for wafer and device analysis.

Asian manufacturers, including Hamamatsu Photonics K.K. and Advantest Corporation, are increasing their presence, leveraging strong photonics and electronics manufacturing capabilities. Hamamatsu Photonics K.K. is expanding its THz component offerings, while Advantest Corporation is integrating THz modules into semiconductor test systems, reflecting a trend toward vertical integration.

Looking ahead, the competitive environment is expected to intensify as more companies enter the market and as existing players form alliances to address technical challenges such as system miniaturization, cost reduction, and real-time data processing. The next few years will likely see further consolidation, increased cross-sector partnerships, and a focus on scalable manufacturing to meet the growing demand for THz spectroscopy equipment across diverse industries.

Supply Chain and Manufacturing Innovations

The manufacturing landscape for terahertz (THz) spectroscopy equipment in 2025 is characterized by rapid innovation, supply chain adaptation, and increasing industrialization. As demand for non-destructive testing, security screening, and advanced material characterization grows, manufacturers are scaling up production and refining processes to meet stringent performance and reliability requirements.

Key players in the sector, such as TOPTICA Photonics, Menlo Systems, and Bruker, are investing in both vertical integration and strategic partnerships to secure critical components, including femtosecond lasers, photoconductive antennas, and high-frequency electronics. These companies are also focusing on modular system architectures, enabling easier customization for end-users in pharmaceuticals, semiconductor inspection, and academic research.

Supply chain resilience has become a central concern, especially in light of recent global disruptions. Manufacturers are diversifying their supplier base for key elements such as indium phosphide (InP) and gallium arsenide (GaAs) substrates, which are essential for high-performance THz emitters and detectors. Companies like Hamamatsu Photonics and TeraView are reported to be increasing in-house fabrication capabilities and establishing closer relationships with specialty semiconductor foundries to mitigate risks associated with material shortages and logistics delays.

Automation and digitalization are also reshaping production lines. The adoption of advanced robotics, precision alignment systems, and real-time quality monitoring is reducing assembly times and improving yield rates. For example, TOPTICA Photonics has announced investments in automated optical assembly and calibration, aiming to support higher throughput and consistent product quality as order volumes rise.

Looking ahead, the next few years are expected to see further integration of artificial intelligence (AI) and machine learning in both manufacturing and supply chain management. Predictive analytics are being deployed to optimize inventory, forecast demand, and preempt equipment maintenance needs. Additionally, sustainability is gaining traction, with manufacturers exploring eco-friendly packaging, energy-efficient production processes, and recycling of rare materials.

Overall, the terahertz spectroscopy equipment manufacturing sector in 2025 is marked by a drive toward scalability, flexibility, and resilience. As the technology matures and applications diversify, ongoing innovations in supply chain management and manufacturing processes will be critical to maintaining competitiveness and meeting the evolving needs of global markets.

Regulatory Environment and Industry Standards (e.g., ieee.org)

The regulatory environment and industry standards for terahertz (THz) spectroscopy equipment manufacturing are evolving rapidly as the technology matures and finds broader applications in sectors such as pharmaceuticals, security, and materials science. In 2025, the landscape is shaped by a combination of international standards, safety guidelines, and ongoing efforts to harmonize technical specifications across regions.

A cornerstone of standardization in the THz domain is the work of the IEEE, which has established several working groups focused on THz frequencies, including the IEEE 802.15.3d standard for 100 Gbps wireless communications in the 252–325 GHz band. While this standard primarily addresses communications, its technical definitions and measurement protocols influence the design and calibration of THz spectroscopy equipment. The IEEE’s ongoing activities in 2025 include the development of further standards for device interoperability, measurement accuracy, and electromagnetic compatibility, which are critical for manufacturers seeking to ensure global market access.

In parallel, the International Electrotechnical Commission (IEC) and the International Organization for Standardization (ISO) are collaborating on safety and performance standards for THz devices. These efforts are particularly relevant for spectroscopy equipment, as they address issues such as permissible exposure limits, electromagnetic interference, and device labeling. The IEC’s Technical Committee 86 (Fibre optics) and ISO’s Technical Committee 172 (Optics and photonics) are both engaged in updating guidelines to reflect the unique properties of THz radiation and its interaction with biological tissues and materials.

Manufacturers such as Bruker and Menlo Systems, both leading suppliers of THz spectroscopy systems, are actively participating in these standardization processes. Their involvement ensures that new equipment aligns with emerging regulatory requirements and industry best practices. For example, Bruker’s THz spectrometers are designed to comply with both European and North American safety directives, while Menlo Systems emphasizes traceable calibration and conformity with international measurement standards.

Looking ahead, the regulatory outlook for 2025 and beyond points to increased harmonization of standards, particularly as THz technology is adopted in regulated industries such as pharmaceuticals and food safety. Manufacturers are expected to invest in compliance infrastructure and certification processes to meet the stringent demands of these sectors. Additionally, as THz equipment becomes more widely used in security screening and medical diagnostics, further regulatory scrutiny is anticipated, with agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) likely to issue specific guidance for THz-based devices.

In summary, the regulatory and standards environment for terahertz spectroscopy equipment manufacturing in 2025 is characterized by active international collaboration, increasing alignment with safety and performance benchmarks, and growing engagement from both industry leaders and regulatory bodies. This dynamic landscape is expected to foster innovation while ensuring the safe and effective deployment of THz technologies across diverse applications.

Future Outlook: Opportunities, Challenges, and Investment Trends

The outlook for terahertz (THz) spectroscopy equipment manufacturing in 2025 and the following years is shaped by a convergence of technological advancements, expanding application domains, and evolving investment patterns. As industries increasingly recognize the unique capabilities of THz spectroscopy—such as non-destructive testing, high-resolution imaging, and material characterization—demand for robust, scalable, and cost-effective equipment is expected to rise.

Key manufacturers, including TOPTICA Photonics, Menlo Systems, and Bruker, are intensifying R&D efforts to improve system sensitivity, miniaturization, and integration with automation and AI-driven analytics. TOPTICA Photonics continues to expand its portfolio of femtosecond lasers and THz time-domain spectrometers, targeting both academic and industrial users. Menlo Systems is focusing on turnkey THz platforms with enhanced stability and user-friendly interfaces, aiming to lower the barrier for adoption in quality control and pharmaceutical analysis.

The semiconductor, pharmaceutical, and security sectors are anticipated to be primary growth drivers. For instance, the ability of THz spectroscopy to detect polymorphic forms in drugs or to inspect semiconductor wafers without contact is attracting significant attention. In 2025, manufacturers are expected to collaborate more closely with end-users to develop application-specific solutions, particularly as regulatory standards for non-destructive testing and quality assurance become more stringent.

Investment trends indicate a growing influx of venture capital and strategic partnerships, especially in Europe, North America, and East Asia. Companies such as TOPTICA Photonics and Menlo Systems have reported increased funding for expanding production capacity and accelerating product development cycles. Additionally, government-backed initiatives in the EU and Japan are supporting the commercialization of THz technologies, further stimulating market growth.

However, challenges remain. High equipment costs, technical complexity, and the need for skilled operators continue to limit widespread adoption. Manufacturers are responding by investing in modular designs, plug-and-play systems, and comprehensive training programs. The next few years will likely see intensified competition, with new entrants and established players alike racing to deliver more affordable and versatile THz spectroscopy solutions.

Overall, the terahertz spectroscopy equipment manufacturing sector is poised for robust growth through 2025 and beyond, driven by technological innovation, expanding applications, and increasing investment. Companies that can balance performance, usability, and cost will be best positioned to capitalize on emerging opportunities in this dynamic field.

Sources & References

- TOPTICA Photonics AG

- Menlo Systems GmbH

- Bruker Corporation

- Advantest Corporation

- Bristol Instruments, Inc.

- TESAT-Spacecom GmbH & Co. KG

- Hamamatsu Photonics

- Baker Hughes

- Terasense Group

- TYDEX

- TeraView

- IEEE

- International Organization for Standardization (ISO)

- Bruker

- Menlo Systems