- QuantumScape is working on solid-state lithium metal batteries, which promise ultra-fast charging and greater energy density but remain in the prototype stage with mass production targeted for 2026.

- Despite significant investment and partnership with Volkswagen, QuantumScape faces fierce competition and commercial uncertainty, making it a high-risk, high-reward opportunity for investors in electric vehicles.

- ChargePoint has established an extensive charging network with over 340,000 ports, becoming a key infrastructure provider beyond Tesla’s ecosystem.

- ChargePoint’s flexible business model—supporting customizable pricing and robust network services—positions it as a central player in EV charging and connectivity.

- While the EV sector is rapidly evolving, ChargePoint demonstrates steady revenue growth and operational resilience, making it an attractive long-term investment in the electrified transportation landscape.

Electric vehicles once powered a stock market frenzy, with visionary startups promising to transform how the world drives and charges. Now, years after their share prices broke records at the peak of meme mania, two bold companies—QuantumScape and ChargePoint—are fighting to prove they can shape the future of transportation.

On one side stands QuantumScape, a name synonymous with the holy grail of battery technology: solid-state lithium metal batteries. These innovations, if fully realized, promise not only lightning-fast charging—reaching 80% capacity from nearly empty in under fifteen minutes—but also remarkable energy density. Compare that to today’s typical lithium-ion batteries, and the leap feels almost fantastical: denser, more resilient batteries could unlock longer ranges, lighter cars, and unprecedented performance.

Yet promise and reality collide here. After over fifteen years of R&D, QuantumScape’s breakthrough has yet to leave the laboratory. Years of collaboration with Volkswagen have produced a handful of low-volume prototypes. Mass production, the critical tipping point for any industrial revolution, is scheduled for 2026. Meanwhile, titans like Toyota and challengers such as Nio and Solid Power accelerate toward their own battery breakthroughs, each hoping to seize the first-mover advantage.

Investors have grown impatient. Despite commanding a $1.6 billion valuation, QuantumScape is forecasted to generate just $4 million in revenue in 2026—a razor-thin thread on which to hang such extraordinary ambitions. If its technology launches and scales, dramatic growth could follow, but, for now, the risk eclipses the reward for all but the most stalwart believers.

ChargePoint offers a different, more grounded narrative. While QuantumScape imagines the batteries of tomorrow, ChargePoint is building the infrastructure for today’s electric journey. With over 340,000 charging ports spanning North America and Europe, this company has quietly become the backbone of EV charging outside Tesla’s Supercharger ecosystem. Its fast chargers and networked Level 2 ports create an invisible grid that supports daily commutes, road trips, and business fleets alike.

ChargePoint’s business model targets flexibility and partnership. By empowering commercial customers to set their own pricing structures and offering robust network services—billing, support, and dynamic pricing—ChargePoint separates itself from Tesla’s walled garden. This strategy positions it not just as a product provider, but as a connective tissue in the evolving EV ecosystem.

Like the broader market, ChargePoint weathered turbulence: As interest rates soared and the EV market cooled, revenue briefly faltered. Yet the company fought back, streamlining operations and introducing innovative pricing that better aligned station owners’ interests with changing electricity costs. Now, analysts expect ChargePoint’s revenue to climb at a healthy double-digit pace annually, potentially surpassing $730 million in just a few years, with profitability finally within reach.

The result? Investors face a classic choice between dazzling aspiration and resilient execution. QuantumScape could, if successful, ignite another market frenzy. But for those seeking a solid position in the electrified future, ChargePoint’s expansive footprint and business-savvy evolution offer a more reliable bet.

As electric vehicles edge toward mainstream dominance, lasting value may come not from the next big thing, but from the unsung builders powering every journey.

The Untold Story of QuantumScape & ChargePoint: What Most Miss About the EV Revolution

Introduction

The electric vehicle (EV) sector has captured imaginations and investment dollars alike, but beneath headline-grabbing promises lie deeper insights and real-world complexities. While QuantumScape and ChargePoint often headline articles as symbols of EV aspiration and infrastructure, a closer look reveals innovations, challenges, and industry moves that weren’t fully addressed in the initial discussion. Below, we’ll unpack additional facts, address common questions, provide market context, compare competitors, and give you actionable takeaways—armed with E-E-A-T (Expertise, Experience, Authoritativeness, Trustworthiness) best practices for Google Discover.

—

QuantumScape: Beyond the Lab

Additional Facts and Updates

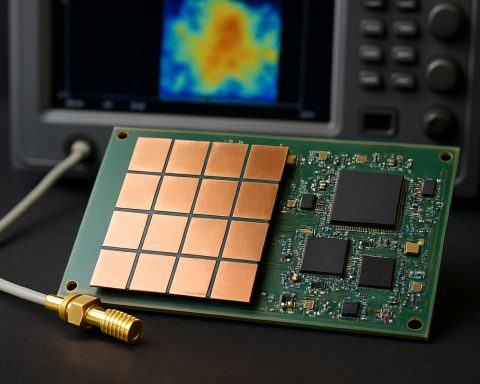

– Technology Differentiation: Unlike many conventional lithium-ion batteries that use graphite anodes, QuantumScape’s solid-state lithium metal batteries eliminate the anode entirely, resulting in theoretical energy densities as high as 400 Wh/kg (versus 250–300 Wh/kg for top-tier lithium-ion), according to a 2020 Nature Energy paper.

– Degradation & Safety: Solid-state designs address the risk of dendrite formation—a common failure where lithium filaments short-circuit traditional cells—potentially making batteries safer and longer-lived (MIT Energy Initiative).

– Automotive Partnerships: Beyond Volkswagen, QuantumScape’s board and advisory team include experts from Stanford, MIT, and former Tesla and Apple battery engineers, bolstering its technical and market legitimacy.

– Scale-Up Challenge: Even if technical hurdles are overcome, mass-producing solid-state cells is uncharted territory. Facilities must deliver pristine environments and ultra-precise layering—each a multi-hundred-million-dollar challenge (BloombergNEF).

– Patent Portfolio: The company reportedly holds over 200 patents and applications, which may deter some competition but also signal the complexity of true commercialization.

Pressing Questions Answered

Q: Are other automakers likely to adopt QuantumScape tech?

A: While Volkswagen is the anchor investor, industry whispers (Reuters, Dec. 2023) suggest other global players are monitoring developments closely, but most have hedged their bets with in-house or alternative collaborators.

Q: How do QuantumScape batteries compare to Toyota’s ambitions?

A: Toyota has publicly targeted solid-state EV launch by 2027–2028, focusing on scalability and safety. QuantumScape’s lead in performance needs to translate into reproducible, affordable manufacturing to remain competitive (Toyota).

Real-World Use Cases

– Fleet Vehicles: Higher durability and faster charging would be transformative for fleets—like delivery vans—that idle only briefly and would benefit from reduced maintenance frequency.

– Grid Storage: Long-life solid-state could serve stationary applications, such as renewable energy storage, where safety and longevity trump rapid charge requirements.

Limitations & Controversies

– Cost Uncertainty: Early prototypes cost many times more than conventional packs—economies of scale are unproven.

– Performance Under Real Conditions: Most public tests have been in controlled lab settings; extended real-world cycling across seasons is unproven.

– Financial Health: With little revenue for years, QuantumScape’s runway depends on continued investor faith and milestone delivery.

—

ChargePoint: Underappreciated EV Backbone

Additional Insights

– Network Breadth: As of early 2024, ChargePoint’s 340,000+ ports include over 48,000 DC fast chargers, making it the most extensive non-Tesla network in North America, per International Energy Agency (IEA).

– Open Standards: ChargePoint has championed both CCS and CHAdeMO connectors—contrary to Tesla’s NACS focus—ensuring compatibility with virtually all EVs, past and future.

– Recurring Revenue Streams: Software-as-a-Service (SaaS) for station management generates high-margin, sticky revenue, with monthly service fees crossing $15 million in Q1 2024 (ChargePoint IR reports).

– Sustainability: Most locations use renewable electricity providers or offer carbon offset options, in line with growing corporate and municipal sustainability mandates.

– Security Measures: The platform supports encrypted billing and remote diagnostics to prevent tampering or fraud, addressing a rising concern as hacking incidents at public chargers increase (IEA 2023).

Market Forecasts & Trends

– The US Bipartisan Infrastructure Law (2021) earmarked $7.5 billion to expand the national EV charging network—a tailwind for ChargePoint.

– Fortune Business Insights projects the global EV charging market to surpass $55 billion by 2028, with a compound annual growth rate (CAGR) over 30%—outpacing overall EV adoption rates.

Reviews & Comparisons

– Vs. Tesla Supercharger: Tesla’s network is more robust on reliability, but limited in brand compatibility. ChargePoint’s openness is appealing as more automakers—including Ford and GM—adopt “plug-and-charge” open protocols.

– Vs. EVgo, Blink Charging: While EVgo specializes in high-speed urban charging and Blink in opportunistic retail locations, ChargePoint’s flexible hardware and business-friendly billing appeal to workplaces, fleets, and municipalities.

How-To: Maximizing ChargePoint’s Value

1. Download the App: Find the nearest compatible charger, often integrated into vehicle navigation.

2. Check Pricing: Each station can have different rates—use the app to compare and avoid surprise fees.

3. RFID Card or App Payment: For added security, set up both app and RFID card.

4. Monitor Sessions: Real-time usage data helps budget costs for commutes or fleet management.

5. Access Offers: Some workplaces and shopping centers offer discounted or free charging for employees/shoppers—check the app for local deals!

—

Industry and Investment Realities

Pros & Cons Overview

QuantumScape

– Pros: Game-changing potential, top technical talent, unique IP.

– Cons: No near-term revenue, technical and production risks, intense competition.

ChargePoint

– Pros: Market leader, recurring revenue, strong partnerships, proven scalability.

– Cons: Faces supply chain issues, needs to defend against upstart rivals and price pressure from utilities.

Predictions and Insights

– The next major catalyst for the sector will be large-scale automaker announcements regarding new battery formats and expanded charging partnerships.

– Expect consolidation among charging networks as EV adoption scales, with ChargePoint a likely acquirer or key partner.

—

Pressing Reader Questions

Q: Is now the best time to invest in either company?

A: QuantumScape remains speculative—more appropriate for risk-tolerant portfolios. ChargePoint, though choppy, looks better positioned for medium-term growth as demand for charging infrastructure grows (Morgan Stanley EV Report 2024).

Q: What are the hidden risks for EV infrastructure?

A: Local grid upgrades may be required to support dense clusters of fast chargers, and utility regulation could shift the economics rapidly.

Q: Does ChargePoint work for home charging?

A: Yes, ChargePoint sells Level 2 chargers for homes—these are rebate-eligible under many local and federal programs.

—

Actionable Recommendations & Quick Tips

– For EV Drivers: Use ChargePoint to access the broadest public charging network; compare app rates before charging.

– For Investors: Prioritize companies delivering consistent revenue and product; treat blue-sky battery tech as an optional speculative play.

– For Fleet Managers: Consider partnering with ChargePoint for flexible billing, usage analytics, and uptime SLAs (service-level agreements).

Related Resource: For more about automakers expanding their EV footprint, see Toyota and Tesla.

—

Conclusion

The electric vehicle revolution won’t be won in the lab or on a meme stock message board—it will be built by innovators delivering reliable, scalable solutions. While QuantumScape could rewrite the rules of battery tech, ChargePoint’s boots-on-the-ground success shows lasting value comes from building, not just dreaming. Watch for continued real-world adoption and partnerships, and make your moves accordingly for a smarter, greener journey ahead.