Ultraviolet Lithography Equipment Manufacturing in 2025: Navigating Explosive Growth and Technological Disruption. Discover How Next-Gen Lithography is Shaping the Semiconductor Industry’s Future.

- Executive Summary & Key Findings

- Market Overview: Size, Segmentation, and 2025 Baseline

- Growth Forecast (2025–2030): CAGR, Revenue Projections, and Regional Hotspots

- Technology Landscape: EUV vs. DUV, Innovations, and R&D Pipelines

- Competitive Analysis: Leading Players, Market Shares, and Strategic Moves

- Supply Chain Dynamics and Key Component Trends

- End-User Demand: Semiconductor, Display, and Emerging Applications

- Regulatory Environment and Trade Impacts

- Investment Trends and M&A Activity

- Challenges: Technical Barriers, Cost Pressures, and Talent Shortages

- Future Outlook: Disruptive Technologies and Market Scenarios to 2030

- Appendix: Methodology, Data Sources, and Glossary

- Sources & References

Executive Summary & Key Findings

Ultraviolet (UV) lithography equipment manufacturing is a critical segment within the semiconductor fabrication industry, enabling the production of increasingly smaller and more complex integrated circuits. As of 2025, the sector is characterized by rapid technological advancements, robust demand driven by the proliferation of advanced electronics, and significant capital investment requirements. UV lithography, particularly deep ultraviolet (DUV) and extreme ultraviolet (EUV) technologies, remains essential for achieving the high-resolution patterning necessary for sub-7nm semiconductor nodes.

Key industry players, such as ASML Holding N.V., Canon Inc., and Nikon Corporation, continue to dominate the global market, leveraging proprietary technologies and extensive R&D capabilities. The competitive landscape is shaped by the race to develop more efficient, precise, and cost-effective lithography systems, with EUV technology representing the forefront of innovation. The adoption of EUV lithography has accelerated, particularly among leading foundries and integrated device manufacturers, as it enables further scaling in line with Moore’s Law.

Key findings for 2025 include:

- Global demand for UV lithography equipment is projected to grow, fueled by the expansion of data centers, 5G infrastructure, and artificial intelligence applications.

- ASML Holding N.V. maintains a technological lead in EUV systems, with increasing shipments to major semiconductor manufacturers worldwide.

- Supply chain resilience and access to critical components, such as high-precision optics and light sources, remain strategic priorities for manufacturers.

- Environmental and energy efficiency considerations are influencing equipment design, with industry initiatives focused on reducing the carbon footprint of lithography processes.

- Collaboration between equipment manufacturers, chipmakers, and research institutions is intensifying to address technical challenges and accelerate next-generation lithography solutions.

In summary, the ultraviolet lithography equipment manufacturing sector in 2025 is marked by technological leadership, strong end-market demand, and ongoing innovation. The industry’s trajectory will be shaped by continued investment in R&D, strategic partnerships, and the ability to navigate evolving supply chain and sustainability challenges.

Market Overview: Size, Segmentation, and 2025 Baseline

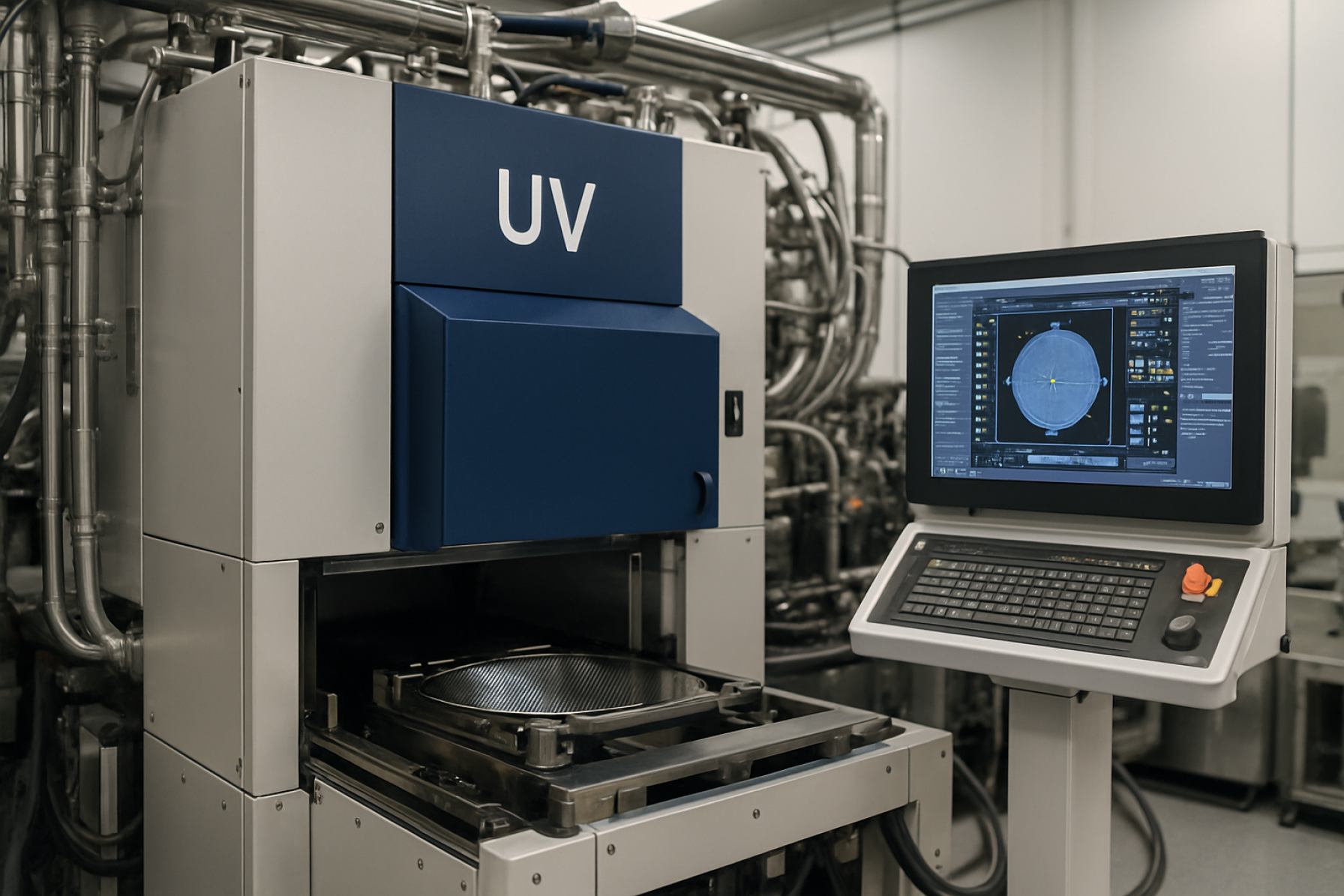

The ultraviolet (UV) lithography equipment manufacturing market is a critical segment within the semiconductor fabrication industry, providing the essential machinery for patterning integrated circuits on silicon wafers. As of 2025, the market is characterized by robust demand, driven by the ongoing miniaturization of semiconductor devices and the expansion of advanced manufacturing nodes. The global market size for UV lithography equipment is estimated to reach several billion USD, with growth propelled by both mature deep ultraviolet (DUV) and emerging extreme ultraviolet (EUV) technologies.

Segmentation within the market is primarily based on wavelength technology, application, and end-user. The two main technological segments are DUV lithography, which utilizes wavelengths around 193 nm, and EUV lithography, operating at 13.5 nm. DUV systems remain widely used for mature process nodes and specialty applications, while EUV is increasingly adopted for leading-edge nodes at 7 nm and below, particularly in logic and memory chip production. Key applications include foundry, integrated device manufacturing (IDM), and research institutions.

Geographically, the market is dominated by Asia-Pacific, led by countries such as Taiwan, South Korea, and China, which host major semiconductor fabs. North America and Europe also represent significant markets, supported by investments in domestic chip manufacturing and R&D. The customer base is concentrated among a handful of global semiconductor manufacturers, with Taiwan Semiconductor Manufacturing Company Limited, Samsung Electronics Co., Ltd., and Intel Corporation being the primary end-users.

On the supply side, the market is highly consolidated, with ASML Holding N.V. as the dominant supplier of EUV lithography systems, and Canon Inc. and Nikon Corporation as key players in DUV equipment. The high capital intensity and technical complexity of UV lithography equipment create significant barriers to entry, reinforcing the market positions of these established manufacturers.

Looking ahead to 2025, the baseline scenario anticipates continued growth in equipment shipments and revenues, underpinned by the global push for semiconductor self-sufficiency and the proliferation of advanced electronic devices. The transition to EUV lithography is expected to accelerate, with further investments in R&D and production capacity by both equipment manufacturers and semiconductor foundries.

Growth Forecast (2025–2030): CAGR, Revenue Projections, and Regional Hotspots

The ultraviolet (UV) lithography equipment manufacturing sector is poised for robust growth between 2025 and 2030, driven by escalating demand for advanced semiconductor devices and the ongoing miniaturization of integrated circuits. Industry analysts project a compound annual growth rate (CAGR) in the range of 7% to 9% during this period, with global market revenues expected to surpass $12 billion by 2030. This expansion is underpinned by the rapid adoption of next-generation UV lithography systems, including deep ultraviolet (DUV) and extreme ultraviolet (EUV) technologies, which are essential for fabricating chips at sub-7nm nodes.

Regionally, Asia-Pacific is anticipated to remain the dominant hotspot, accounting for over 60% of total market share by 2030. This leadership is fueled by aggressive investments in semiconductor manufacturing infrastructure in countries such as China, South Korea, and Taiwan. Major foundries and integrated device manufacturers in these regions, including Taiwan Semiconductor Manufacturing Company Limited and Samsung Electronics Co., Ltd., are expanding their production capacities and upgrading to advanced lithography tools to meet global chip demand.

North America is also expected to witness significant growth, bolstered by strategic initiatives to localize semiconductor supply chains and substantial funding for domestic chip manufacturing. The presence of leading equipment suppliers such as Applied Materials, Inc. and Lam Research Corporation further strengthens the region’s competitive position. Meanwhile, Europe is investing in research and development, with companies like ASML Holding N.V. at the forefront of EUV lithography innovation, supporting the region’s ambitions to capture a larger share of the global market.

Key growth drivers include the proliferation of artificial intelligence, 5G, and Internet of Things (IoT) applications, all of which require high-performance, energy-efficient chips. As device geometries shrink, the demand for precision UV lithography equipment will intensify, prompting manufacturers to accelerate innovation and scale production. Overall, the 2025–2030 period is set to be transformative for the UV lithography equipment manufacturing industry, with technological advancements and regional investments shaping the competitive landscape.

Technology Landscape: EUV vs. DUV, Innovations, and R&D Pipelines

The technology landscape of ultraviolet lithography equipment manufacturing in 2025 is defined by the ongoing evolution and competition between deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography, as well as a robust pipeline of innovations and research and development (R&D) efforts. DUV lithography, which utilizes wavelengths of 193 nm (ArF) and 248 nm (KrF), remains the workhorse for mature semiconductor nodes and certain advanced applications. However, the relentless drive for smaller feature sizes and higher transistor densities has propelled EUV lithography, operating at a wavelength of 13.5 nm, to the forefront for leading-edge logic and memory production.

EUV lithography systems are highly complex, requiring advanced light sources, reflective optics, and sophisticated photoresists. ASML Holding N.V. is the sole commercial supplier of EUV scanners, and its ongoing R&D focuses on increasing source power, improving throughput, and enhancing overlay accuracy. Innovations such as high-NA (numerical aperture) EUV systems, which promise sub-2 nm resolution, are in advanced development stages, with pilot tools expected to be deployed at major foundries by 2025. These high-NA systems demand new mask infrastructure and metrology solutions, driving collaboration across the supply chain.

Meanwhile, DUV lithography continues to see incremental improvements. Nikon Corporation and Canon Inc. remain key suppliers, focusing on multi-patterning techniques, higher throughput, and cost efficiency for both advanced and legacy nodes. DUV immersion lithography, in particular, is being optimized for specialty and trailing-edge applications, where cost and yield are critical.

R&D pipelines are also exploring alternative approaches, such as directed self-assembly (DSA), nanoimprint lithography, and advanced computational lithography, to complement or extend the capabilities of EUV and DUV. Industry consortia and research institutes, including imec and SEMI, play a pivotal role in pre-competitive research, fostering innovation in materials, optics, and process integration.

In summary, the ultraviolet lithography equipment sector in 2025 is characterized by the coexistence and co-evolution of EUV and DUV technologies, with a strong emphasis on R&D-driven innovation to meet the demands of next-generation semiconductor manufacturing.

Competitive Analysis: Leading Players, Market Shares, and Strategic Moves

The ultraviolet (UV) lithography equipment manufacturing sector is characterized by a concentrated competitive landscape, with a handful of global players dominating market share and technological innovation. As of 2025, the industry is primarily led by ASML Holding N.V., which holds a commanding position in both deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography systems. ASML’s technological leadership, particularly in EUV, is underpinned by its proprietary light source and optics technologies, enabling the production of advanced semiconductor nodes below 7nm. The company’s strategic partnerships with major chipmakers and consistent investment in R&D have solidified its market dominance.

Other significant players include Canon Inc. and Nikon Corporation, both of which maintain strong portfolios in DUV lithography equipment. While these Japanese manufacturers have seen their market shares in leading-edge nodes eroded by ASML’s EUV advances, they remain competitive in mature process nodes and specialty applications, such as MEMS and display manufacturing. Canon and Nikon have responded to market shifts by focusing on cost-effective, high-throughput DUV systems and expanding their service and support offerings.

In the Chinese market, domestic manufacturers such as SMEE (Shanghai Micro Electronics Equipment Co., Ltd.) are making strategic moves to reduce reliance on foreign suppliers. While SMEE’s current systems are limited to less advanced nodes, ongoing government support and increased investment in R&D signal a long-term ambition to close the technology gap. This is particularly relevant in the context of global supply chain uncertainties and export restrictions affecting the semiconductor industry.

Strategically, leading players are pursuing vertical integration, ecosystem partnerships, and customer co-development programs to secure their positions. For example, ASML collaborates closely with suppliers like Carl Zeiss AG for optics and with major chipmakers for system validation and process optimization. Meanwhile, all major manufacturers are investing in service, maintenance, and software upgrades to extend the lifecycle of installed equipment and generate recurring revenue streams.

Overall, the competitive dynamics in UV lithography equipment manufacturing are shaped by technological innovation, supply chain resilience, and the ability to address both leading-edge and legacy market segments. The next few years are likely to see continued consolidation at the top, with emerging players focusing on niche applications and regional markets.

Supply Chain Dynamics and Key Component Trends

The supply chain for ultraviolet (UV) lithography equipment manufacturing in 2025 is characterized by increasing complexity, driven by the demand for advanced semiconductor devices and the integration of cutting-edge technologies. UV lithography, particularly deep ultraviolet (DUV) and extreme ultraviolet (EUV) systems, relies on a global network of highly specialized suppliers for optics, light sources, precision mechatronics, and control systems. The industry’s leading manufacturers, such as ASML Holding N.V. and Canon Inc., depend on a small number of critical component suppliers, making the supply chain both highly efficient and vulnerable to disruptions.

Key component trends in 2025 include the continued miniaturization and precision of optical assemblies, such as mirrors and lenses, which are often produced by companies like Carl Zeiss AG. These components must meet stringent requirements for surface accuracy and material purity to enable the sub-10 nm patterning required by leading-edge chips. The light sources for EUV systems, typically high-power plasma-based generators, are another bottleneck, with Cymer, LLC (a subsidiary of ASML) being a primary supplier. The complexity of these sources, which require rare gases and advanced power modules, adds to the supply chain’s fragility.

In addition, the supply of ultra-pure materials, such as photoresists and pellicles, is tightly controlled by a handful of chemical and materials companies, including JSR Corporation and Dai Nippon Printing Co., Ltd.. These materials are critical for achieving the high resolution and yield demanded by semiconductor manufacturers. The trend toward vertical integration is evident, as major equipment makers seek to secure their supply of key components and materials through strategic partnerships or acquisitions.

Geopolitical factors and export controls continue to shape the supply chain landscape. Restrictions on the export of advanced lithography systems and components, particularly to certain regions, have prompted manufacturers to diversify their supplier base and invest in localizing production where feasible. This has led to increased collaboration with regional suppliers and the development of alternative sourcing strategies to mitigate risks.

Overall, the supply chain dynamics and component trends in UV lithography equipment manufacturing in 2025 reflect a balance between innovation, precision engineering, and risk management, as the industry strives to meet the demands of next-generation semiconductor fabrication.

End-User Demand: Semiconductor, Display, and Emerging Applications

End-user demand for ultraviolet (UV) lithography equipment in 2025 is shaped by the evolving requirements of the semiconductor, display, and emerging technology sectors. The semiconductor industry remains the primary driver, as chip manufacturers pursue ever-smaller process nodes to enhance performance and energy efficiency. Advanced UV lithography, particularly deep ultraviolet (DUV) and extreme ultraviolet (EUV) systems, are critical for fabricating integrated circuits at sub-7nm geometries. Leading foundries and integrated device manufacturers, such as Taiwan Semiconductor Manufacturing Company Limited and Intel Corporation, continue to invest heavily in next-generation lithography tools to meet the surging demand for high-performance computing, artificial intelligence, and 5G applications.

In the display sector, UV lithography equipment is essential for producing high-resolution panels used in smartphones, televisions, and emerging augmented/virtual reality devices. Manufacturers like Samsung Display Co., Ltd. and LG Display Co., Ltd. are leveraging advanced lithography to achieve finer patterning for OLED and microLED displays, enabling thinner bezels, higher pixel densities, and improved energy efficiency. The transition to next-generation display technologies is expected to sustain robust demand for UV lithography systems tailored to large-area substrates and novel materials.

Emerging applications are also influencing the UV lithography equipment market. The rapid growth of silicon photonics, MEMS sensors, and advanced packaging solutions requires precise patterning capabilities that UV lithography can provide. Additionally, the rise of quantum computing and biotechnology devices is prompting research institutions and specialized manufacturers to seek customized lithography solutions for prototyping and low-volume production. Companies such as ASML Holding N.V. and Canon Inc. are responding by expanding their product portfolios to address these niche but rapidly growing segments.

Overall, in 2025, end-user demand for UV lithography equipment is characterized by a dual focus: scaling up for mass production in semiconductors and displays, and scaling down for precision and flexibility in emerging applications. This dynamic is driving innovation in tool design, throughput, and process control, as equipment manufacturers strive to meet the increasingly complex requirements of their diverse customer base.

Regulatory Environment and Trade Impacts

The regulatory environment for ultraviolet (UV) lithography equipment manufacturing in 2025 is shaped by a complex interplay of international standards, export controls, and environmental regulations. As UV lithography is a critical technology in semiconductor fabrication, manufacturers must comply with stringent requirements set by both national and international bodies. For instance, the Semiconductor Industry Association and the SEMI (Semiconductor Equipment and Materials International) provide guidelines and best practices for equipment safety, interoperability, and performance. These standards are frequently updated to reflect advances in technology and evolving industry needs.

Trade impacts are particularly significant in this sector due to the strategic importance of semiconductor manufacturing equipment. Export controls, especially those imposed by the United States, the European Union, and Japan, play a pivotal role in shaping global supply chains. For example, the U.S. Department of Commerce’s Bureau of Industry and Security enforces export restrictions on advanced lithography equipment to certain countries, citing national security and intellectual property concerns. Similarly, the Dutch government, in coordination with the European Union, has implemented licensing requirements for the export of advanced photolithography systems, directly affecting leading manufacturers such as ASML Holding N.V..

Environmental regulations are another critical aspect, as UV lithography equipment manufacturing involves the use of hazardous chemicals and high-energy processes. Compliance with directives such as the European Union’s Restriction of Hazardous Substances (RoHS) Directive and the U.S. Clean Air Act is mandatory for manufacturers operating in or exporting to these regions. These regulations require the reduction or elimination of specific toxic substances in equipment components and mandate proper waste management practices.

In summary, the regulatory and trade landscape for UV lithography equipment manufacturing in 2025 is characterized by rigorous compliance requirements, export controls that influence global market access, and environmental mandates that drive innovation in cleaner manufacturing processes. Companies must remain agile and proactive in monitoring regulatory changes to maintain competitiveness and ensure uninterrupted participation in the global semiconductor supply chain.

Investment Trends and M&A Activity

The ultraviolet (UV) lithography equipment manufacturing sector is experiencing dynamic investment trends and notable merger and acquisition (M&A) activity as the semiconductor industry intensifies its pursuit of advanced chip production technologies. In 2025, the demand for more powerful and efficient integrated circuits—driven by artificial intelligence, 5G, and automotive electronics—continues to fuel capital inflows into UV lithography, particularly in deep ultraviolet (DUV) and extreme ultraviolet (EUV) segments.

Major equipment manufacturers such as ASML Holding N.V., Canon Inc., and Nikon Corporation are at the forefront of this trend, with significant investments in R&D to enhance throughput, resolution, and cost efficiency. ASML Holding N.V. remains the dominant supplier of EUV lithography systems, and its continued expansion of production capacity and supply chain partnerships reflects robust investor confidence. Meanwhile, Canon Inc. and Nikon Corporation are focusing on DUV advancements and niche applications, attracting strategic investments from both public and private sectors.

M&A activity in 2025 is characterized by both vertical and horizontal integration. Leading equipment makers are acquiring component suppliers and software firms to secure critical technologies and mitigate supply chain risks. For example, collaborations and acquisitions involving optics, light source, and metrology companies are increasingly common, as manufacturers seek to offer more integrated solutions. Additionally, partnerships between equipment manufacturers and semiconductor foundries, such as those with Taiwan Semiconductor Manufacturing Company Limited and Samsung Electronics Co., Ltd., are deepening, with joint ventures and co-investment in next-generation lithography R&D.

Geopolitical factors and government incentives are also shaping investment patterns. The United States, European Union, and East Asian governments are providing subsidies and policy support to bolster domestic lithography capabilities, prompting cross-border M&A and joint ventures. This environment encourages both established players and emerging startups to pursue strategic alliances, ensuring access to critical intellectual property and market share in a rapidly evolving landscape.

Overall, the UV lithography equipment manufacturing industry in 2025 is marked by robust investment, strategic consolidation, and a focus on technological leadership, as stakeholders position themselves for the next wave of semiconductor innovation.

Challenges: Technical Barriers, Cost Pressures, and Talent Shortages

The manufacturing of ultraviolet (UV) lithography equipment in 2025 faces a complex array of challenges, primarily centered on technical barriers, escalating cost pressures, and persistent talent shortages. As the semiconductor industry pushes toward ever-smaller process nodes, the technical demands on UV lithography systems—especially in the deep ultraviolet (DUV) and extreme ultraviolet (EUV) regimes—have intensified. Achieving the necessary precision in optics, light sources, and stage control systems requires continuous innovation and significant capital investment. For instance, the development of high-power EUV light sources and defect-free photomasks remains a formidable hurdle, with only a handful of companies, such as ASML Holding N.V., able to deliver production-ready EUV lithography systems.

Cost pressures are another significant concern. The R&D and manufacturing expenses for state-of-the-art UV lithography equipment have soared, with a single EUV scanner costing upwards of $150 million. This high capital requirement limits the number of potential manufacturers and customers, concentrating market power and increasing the risk for supply chain disruptions. Additionally, the need for ultra-clean manufacturing environments and advanced materials further drives up operational costs. Suppliers such as Carl Zeiss AG and Cymer LLC (a subsidiary of ASML) play critical roles in providing the specialized components required, but their own production constraints can ripple through the entire industry.

Talent shortages compound these technical and financial challenges. The expertise required to design, build, and maintain advanced UV lithography equipment spans multiple disciplines, including optics, materials science, precision engineering, and software development. However, the global pool of engineers and scientists with relevant experience is limited, and competition for this talent is fierce. Industry leaders such as Taiwan Semiconductor Manufacturing Company Limited (TSMC) and Intel Corporation have invested heavily in workforce development, but the pace of technological advancement often outstrips the rate at which new talent can be trained.

In summary, the UV lithography equipment manufacturing sector in 2025 is characterized by high technical complexity, substantial cost barriers, and a critical need for specialized talent. Overcoming these challenges will require coordinated efforts across the supply chain, sustained investment in R&D, and robust strategies for talent development and retention.

Future Outlook: Disruptive Technologies and Market Scenarios to 2030

The future of ultraviolet (UV) lithography equipment manufacturing is poised for significant transformation as the industry approaches 2030. Disruptive technologies, evolving market demands, and global supply chain dynamics are set to reshape the competitive landscape. One of the most notable trends is the continued advancement of extreme ultraviolet (EUV) lithography, which enables the production of ever-smaller semiconductor nodes. Leading manufacturers such as ASML Holding N.V. are investing heavily in next-generation EUV systems, aiming to improve throughput, reduce cost per wafer, and enhance patterning precision.

By 2030, the integration of artificial intelligence (AI) and machine learning into lithography equipment is expected to optimize process control, predictive maintenance, and defect detection. This digital transformation will likely be supported by collaborations between equipment manufacturers and technology firms, accelerating the pace of innovation. Additionally, the push for sustainability is prompting companies like Canon Inc. and Nikon Corporation to develop energy-efficient systems and explore alternative light sources that minimize environmental impact.

Geopolitical factors and regionalization of semiconductor supply chains are also influencing the market outlook. Governments in the United States, European Union, and East Asia are investing in domestic manufacturing capabilities, which may lead to the emergence of new players and partnerships in the UV lithography equipment sector. For instance, initiatives by the Semiconductor Industry Association and the SEMI are fostering innovation ecosystems and supporting workforce development to meet future demand.

Market scenarios to 2030 suggest a dual trajectory: established leaders will continue to dominate high-end EUV systems, while opportunities for niche and mid-range UV lithography equipment may arise in emerging markets and specialized applications such as advanced packaging and MEMS. The convergence of quantum computing, 3D integration, and new materials will further drive the need for flexible, adaptive lithography solutions. As a result, the sector is expected to experience both consolidation and diversification, with strategic investments in R&D and supply chain resilience shaping the competitive dynamics of the next decade.

Appendix: Methodology, Data Sources, and Glossary

This appendix outlines the methodology, data sources, and glossary relevant to the analysis of ultraviolet (UV) lithography equipment manufacturing for 2025.

Methodology

The research methodology integrates both primary and secondary data collection. Primary data was gathered through interviews with technical experts, engineers, and executives at leading UV lithography equipment manufacturers, as well as through direct communication with industry associations. Secondary data was sourced from annual reports, technical white papers, and regulatory filings from official company websites and industry bodies. Market sizing and trend analysis were conducted using a combination of bottom-up and top-down approaches, cross-verified with shipment data and financial disclosures from key players such as ASML Holding N.V. and Canon Inc.. Technological developments and patent activity were tracked using databases maintained by SEMI and SEMI International Standards.

Data Sources

- Official financial and technical reports from ASML Holding N.V., Canon Inc., and Nikon Corporation.

- Industry standards and market data from SEMI and SEMI International Standards.

- Technical publications and roadmaps from imec and IARPA.

- Patent and innovation tracking via United States Patent and Trademark Office (USPTO) and European Patent Office (EPO).

- Regulatory and safety guidelines from Occupational Safety and Health Administration (OSHA) and International Organization for Standardization (ISO).

Glossary

- UV Lithography: A photolithography process using ultraviolet light to transfer circuit patterns onto semiconductor wafers.

- Stepper/Scanner: Equipment that projects and moves the photomask image onto the wafer in UV lithography.

- Photoresist: Light-sensitive material used to form a patterned coating on a surface during lithography.

- Resolution: The smallest feature size that can be reliably printed using lithography equipment.

- Throughput: The number of wafers processed per hour by a lithography tool.

Sources & References

- ASML Holding N.V.

- Canon Inc.

- Nikon Corporation

- imec

- SMEE (Shanghai Micro Electronics Equipment Co., Ltd.)

- Carl Zeiss AG

- JSR Corporation

- Samsung Display Co., Ltd.

- LG Display Co., Ltd.

- Semiconductor Industry Association

- Bureau of Industry and Security

- Restriction of Hazardous Substances (RoHS) Directive

- European Patent Office (EPO)

- International Organization for Standardization (ISO)