Ultraviolet Lithography Equipment Manufacturing Industry Report 2025: In-Depth Analysis of Market Growth, Technology Shifts, and Competitive Dynamics. Explore Key Drivers, Forecasts, and Strategic Opportunities Shaping the Sector.

- Executive Summary & Market Overview

- Key Technology Trends in Ultraviolet Lithography Equipment

- Competitive Landscape and Leading Manufacturers

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Innovation, Investment, and Market Expansion

- Challenges and Opportunities: Supply Chain, Regulation, and Emerging Applications

- Sources & References

Executive Summary & Market Overview

Ultraviolet (UV) lithography equipment manufacturing is a critical segment within the semiconductor fabrication industry, enabling the production of increasingly smaller and more complex integrated circuits. As of 2025, the market for UV lithography equipment is experiencing robust growth, driven by the relentless demand for advanced chips in applications such as artificial intelligence, 5G, automotive electronics, and high-performance computing. UV lithography, particularly deep ultraviolet (DUV) and extreme ultraviolet (EUV) technologies, remains at the forefront of enabling Moore’s Law, allowing chipmakers to achieve finer patterning and higher transistor densities.

The global UV lithography equipment market is dominated by a few key players, with ASML Holding NV maintaining a leading position, especially in EUV systems, which are essential for sub-7nm process nodes. Other significant manufacturers include Canon Inc. and Nikon Corporation, both of which focus on DUV lithography systems. According to Gartner, the semiconductor equipment market rebounded strongly in 2024, setting the stage for continued investment in lithography tools in 2025.

Market analysts project the UV lithography equipment sector to reach a valuation of over $20 billion by 2025, with a compound annual growth rate (CAGR) exceeding 8% from 2023 to 2025, as reported by SEMI. This growth is underpinned by aggressive capacity expansions by leading foundries such as TSMC, Samsung Electronics, and Intel Corporation, all of which are investing heavily in next-generation lithography to maintain technological leadership.

- Rising demand for advanced nodes (5nm, 3nm, and below) is accelerating the adoption of EUV lithography.

- Supply chain constraints and the complexity of EUV systems continue to challenge equipment manufacturers, leading to long lead times and high capital expenditures.

- Geopolitical factors, including export controls and regionalization of semiconductor supply chains, are influencing investment patterns and technology transfers.

In summary, the UV lithography equipment manufacturing market in 2025 is characterized by strong growth prospects, technological innovation, and strategic investments, positioning it as a linchpin in the global semiconductor value chain.

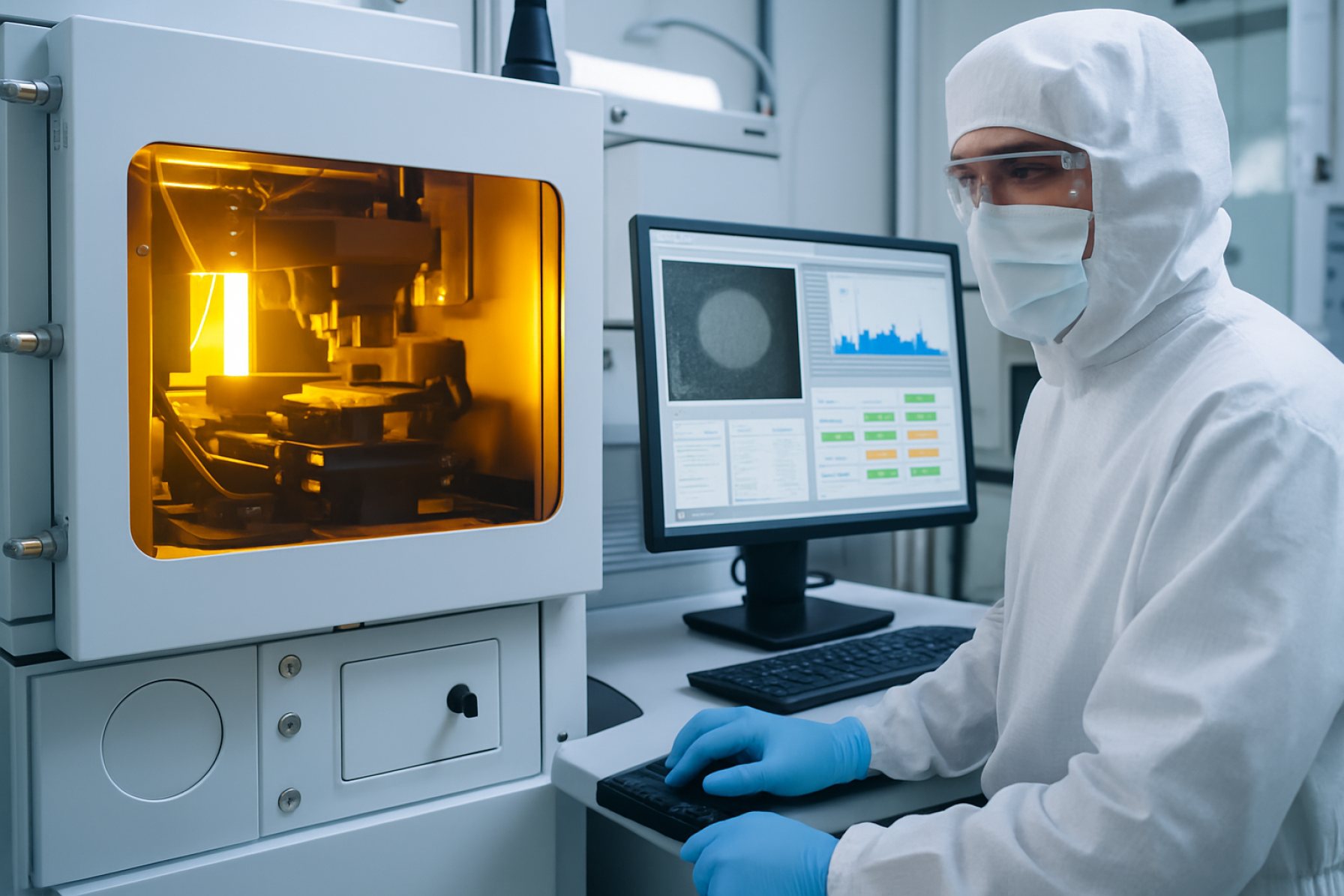

Key Technology Trends in Ultraviolet Lithography Equipment

Ultraviolet (UV) lithography equipment manufacturing is undergoing significant transformation in 2025, driven by the relentless demand for smaller, more powerful semiconductor devices. Key technology trends are shaping the competitive landscape and influencing the direction of research and development in this sector.

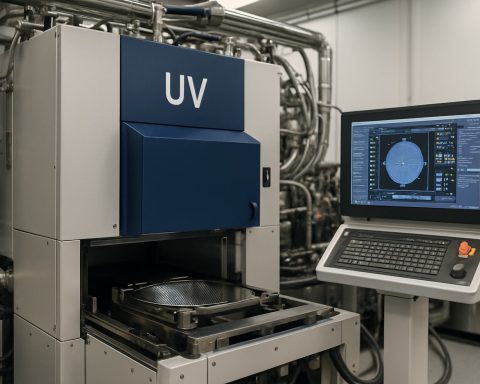

One of the most prominent trends is the advancement of deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography systems. While DUV remains widely used for mature process nodes, EUV is increasingly critical for sub-7nm fabrication, offering shorter wavelengths (13.5 nm) that enable finer patterning and higher transistor densities. Leading manufacturers are investing heavily in EUV tool development, with ASML Holding maintaining its dominance in EUV system supply, and ongoing efforts to improve source power, throughput, and uptime.

Another trend is the integration of advanced optics and light source technologies. Innovations in high-numerical-aperture (High-NA) optics are pushing the resolution limits of EUV lithography, with the first High-NA EUV scanners expected to enter pilot production in 2025. These systems, featuring larger lenses and mirrors with nanometer-level precision, are designed to support next-generation chip architectures and further scaling.

Automation and artificial intelligence (AI) are also transforming UV lithography equipment manufacturing. Smart manufacturing solutions, including predictive maintenance and process optimization algorithms, are being embedded into lithography tools to enhance yield, reduce downtime, and lower operational costs. Tokyo Electron and Canon Inc. are among the companies leveraging AI-driven analytics to improve tool performance and process control.

Materials innovation is another area of focus. The development of new photoresists and pellicles compatible with high-energy EUV photons is essential for maintaining pattern fidelity and minimizing defects. Collaborative efforts between equipment makers and materials suppliers are accelerating the commercialization of these advanced materials, as highlighted by partnerships involving JSR Corporation and Dow Inc..

Finally, sustainability is emerging as a key consideration. Manufacturers are prioritizing energy-efficient designs and the reduction of hazardous chemical usage in lithography processes, aligning with broader industry goals for greener semiconductor manufacturing. These trends collectively underscore the dynamic and innovation-driven nature of UV lithography equipment manufacturing in 2025.

Competitive Landscape and Leading Manufacturers

The competitive landscape of the ultraviolet (UV) lithography equipment manufacturing sector in 2025 is characterized by a concentrated group of global players, intense R&D investment, and strategic collaborations. The market is primarily driven by the ongoing demand for advanced semiconductor devices, with UV lithography remaining a critical technology for patterning at sub-micron and nanometer scales.

Leading the market are established equipment manufacturers such as ASML Holding NV, which dominates the high-end segment with its deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography systems. ASML’s technological leadership is underpinned by its proprietary light source and optics technologies, as well as its extensive partnerships with semiconductor foundries and integrated device manufacturers (IDMs). In 2024, ASML accounted for over 60% of the global lithography equipment market share, with its DUV systems remaining in high demand for both advanced and mature node production Gartner.

Other significant players include Canon Inc. and Nikon Corporation, both of which maintain strong positions in the DUV lithography segment. Canon’s focus on i-line and KrF systems caters to specialty and legacy semiconductor applications, while Nikon continues to innovate in ArF immersion and dry lithography tools. Both companies are leveraging their optical engineering expertise to retain market share, particularly in Asia-Pacific, where demand for mature node manufacturing remains robust SEMI.

Emerging competitors from China, such as SMEE (Shanghai Micro Electronics Equipment Co., Ltd.), are making strategic investments to localize UV lithography tool production. While their systems currently lag behind in terms of resolution and throughput, government support and increased R&D spending are expected to narrow the technology gap over the next few years IDC.

Overall, the UV lithography equipment market in 2025 is marked by high entry barriers, a reliance on precision optics and materials, and a trend toward vertical integration. Strategic alliances between equipment makers, materials suppliers, and chip manufacturers are expected to intensify, as the industry seeks to address both technological and supply chain challenges.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The ultraviolet (UV) lithography equipment manufacturing market is poised for robust growth between 2025 and 2030, driven by escalating demand for advanced semiconductor devices and the ongoing miniaturization of integrated circuits. According to projections from Gartner and SEMI, the global UV lithography equipment market is expected to register a compound annual growth rate (CAGR) of approximately 7.5% during this period. This growth is underpinned by the increasing adoption of deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography technologies, which are essential for fabricating sub-7nm and sub-5nm nodes in semiconductor manufacturing.

Revenue forecasts indicate that the market size, valued at around USD 12.8 billion in 2025, could reach nearly USD 18.5 billion by 2030. This expansion is attributed to both capacity expansions by leading foundries and the entry of new players investing in advanced lithography tools. The Asia-Pacific region, led by China, Taiwan, and South Korea, is anticipated to dominate market share, accounting for over 60% of global revenue by 2030, as per IC Insights. This regional dominance is fueled by aggressive investments in semiconductor fabrication plants and government-backed initiatives to localize chip production.

In terms of volume, the annual shipment of UV lithography systems is projected to grow from approximately 1,200 units in 2025 to over 1,700 units by 2030. The surge in volume is largely driven by the proliferation of consumer electronics, automotive electronics, and the expansion of 5G and AI infrastructure, all of which require advanced chips manufactured using UV lithography processes. Notably, the demand for EUV lithography systems, which command higher average selling prices, is expected to outpace that of traditional DUV systems, contributing disproportionately to overall market revenue growth.

Key market players such as ASML Holding, Canon Inc., and Nikon Corporation are expected to maintain their technological leadership, with ongoing R&D investments aimed at improving throughput, resolution, and cost efficiency. The competitive landscape is also likely to see increased collaboration between equipment manufacturers and semiconductor foundries to accelerate the adoption of next-generation UV lithography solutions.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The ultraviolet (UV) lithography equipment manufacturing market exhibits distinct regional dynamics across North America, Europe, Asia-Pacific, and the Rest of the World, shaped by technological leadership, semiconductor industry concentration, and government initiatives.

North America remains a pivotal region, driven by the presence of leading semiconductor manufacturers and robust R&D investments. The United States, in particular, benefits from the activities of major players such as Applied Materials and Lam Research, as well as government-backed initiatives to bolster domestic chip production. The Semiconductor Industry Association projects continued growth in UV lithography equipment demand, fueled by the CHIPS Act and the push for advanced node manufacturing. However, supply chain constraints and talent shortages remain challenges for the region.

Europe is characterized by its technological leadership in lithography, with ASML headquartered in the Netherlands serving as the world’s dominant supplier of advanced UV and EUV lithography systems. The region’s market is further supported by collaborative R&D programs and a focus on maintaining sovereignty in semiconductor manufacturing. According to SEMI, European equipment sales are expected to grow steadily through 2025, underpinned by investments in new fabs and the European Chips Act.

Asia-Pacific is the largest and fastest-growing market for UV lithography equipment, accounting for over 60% of global semiconductor fabrication capacity. Countries such as Taiwan, South Korea, Japan, and increasingly China, are home to leading foundries and memory manufacturers, including TSMC, Samsung Electronics, and Micron Technology (with significant operations in the region). The SEMI Equipment Market Data report forecasts continued double-digit growth in equipment demand in Asia-Pacific through 2025, driven by aggressive capacity expansions and government incentives.

- Taiwan: Dominates advanced node production, with TSMC’s ongoing investments in UV lithography for sub-5nm processes.

- South Korea: Focuses on memory chip production, with Samsung and SK Hynix expanding UV lithography adoption.

- China: Accelerates domestic equipment development amid trade restrictions, with state-backed funding for local manufacturers.

Rest of World markets, including Israel, Singapore, and select Middle Eastern countries, are smaller but strategically important, often specializing in niche applications or serving as regional hubs for multinational equipment suppliers. Growth in these regions is typically tied to foreign direct investment and technology transfer agreements.

Future Outlook: Innovation, Investment, and Market Expansion

The future outlook for ultraviolet (UV) lithography equipment manufacturing in 2025 is shaped by rapid innovation, robust investment, and strategic market expansion. As semiconductor device geometries continue to shrink, the demand for advanced lithography solutions—particularly deep ultraviolet (DUV) and extreme ultraviolet (EUV) systems—remains strong. Leading manufacturers are intensifying R&D efforts to enhance resolution, throughput, and cost-efficiency, with a focus on enabling sub-5nm and even sub-3nm process nodes.

Innovation is centered on improving light source power, mask technology, and resist materials. For instance, EUV systems are being developed with higher wattage sources to boost wafer output per hour, addressing the throughput bottleneck that has challenged mass production. Companies such as ASML Holding are at the forefront, investing heavily in next-generation EUV platforms and collaborating with chipmakers to refine process integration. Additionally, advances in multi-patterning DUV techniques are extending the lifespan of existing equipment, providing a bridge for foundries not yet ready to fully transition to EUV.

Investment trends indicate a surge in capital expenditure by both equipment manufacturers and semiconductor fabs. According to SEMI, global fab equipment spending is projected to reach new highs in 2025, driven by capacity expansions in Asia and the United States. This is further supported by government incentives and strategic initiatives, such as the U.S. CHIPS Act and similar programs in the EU and China, which are catalyzing domestic manufacturing and supply chain resilience.

Market expansion is also evident in the diversification of end-user applications. While logic and memory remain primary drivers, emerging sectors such as automotive electronics, 5G infrastructure, and artificial intelligence are fueling demand for advanced lithography. Equipment makers are responding by tailoring solutions for specialty nodes and heterogeneous integration, broadening their customer base beyond traditional foundries and integrated device manufacturers (IDMs).

- Continued innovation in EUV and DUV technologies is expected to lower cost-per-wafer and improve yield.

- Strategic investments and public-private partnerships are accelerating capacity buildouts and technology adoption.

- Geopolitical factors and supply chain localization are prompting manufacturers to diversify production footprints.

In summary, the ultraviolet lithography equipment manufacturing sector in 2025 is poised for significant growth, underpinned by technological breakthroughs, increased capital flows, and expanding market opportunities across both established and emerging semiconductor applications.

Challenges and Opportunities: Supply Chain, Regulation, and Emerging Applications

The ultraviolet (UV) lithography equipment manufacturing sector in 2025 faces a complex landscape shaped by supply chain vulnerabilities, evolving regulatory frameworks, and the rapid emergence of new application domains. These factors collectively present both significant challenges and promising opportunities for industry stakeholders.

Supply Chain Dynamics: The global semiconductor supply chain remains under pressure due to geopolitical tensions, raw material shortages, and logistical disruptions. Key components for UV lithography systems—such as high-precision optics, specialized light sources, and advanced photoresists—are often sourced from a limited pool of suppliers, increasing the risk of bottlenecks. The ongoing push for supply chain resilience has prompted manufacturers to diversify sourcing strategies and invest in regional production hubs. For instance, leading players like ASML and Canon Inc. are expanding their supplier networks and collaborating with local partners to mitigate risks and ensure continuity of supply.

Regulatory Environment: Regulatory scrutiny is intensifying, particularly around export controls and intellectual property protection. The United States, European Union, and China have all introduced or tightened regulations governing the export of advanced lithography equipment, especially those capable of producing sub-7nm nodes. These measures are designed to safeguard national security interests but can restrict market access and complicate cross-border collaborations. Compliance with environmental standards, such as the EU’s RoHS and REACH directives, also requires ongoing investment in greener manufacturing processes and materials, adding to operational complexity and cost.

- Export Controls: The U.S. Department of Commerce’s Bureau of Industry and Security has expanded its list of controlled technologies, directly impacting the shipment of advanced UV lithography systems to certain markets (Bureau of Industry and Security).

- Environmental Compliance: Stricter emissions and waste management regulations are prompting manufacturers to innovate in energy efficiency and chemical recycling (European Commission Environment).

Emerging Applications: Beyond traditional semiconductor manufacturing, UV lithography is finding new applications in advanced packaging, MEMS, photonics, and biomedical device fabrication. The proliferation of AI, IoT, and 5G technologies is driving demand for more complex and miniaturized components, expanding the addressable market for UV lithography equipment. Companies that can adapt their platforms for these emerging uses—while navigating supply and regulatory hurdles—are well-positioned for growth in 2025 and beyond (SEMI).

Sources & References

- ASML Holding NV

- Canon Inc.

- Nikon Corporation

- JSR Corporation

- SMEE (Shanghai Micro Electronics Equipment Co., Ltd.)

- IDC

- IC Insights

- Semiconductor Industry Association

- Bureau of Industry and Security

- European Commission Environment