Volumetric Video Compression Technologies Market Report 2025: In-Depth Analysis of Growth Drivers, Innovations, and Global Opportunities. Explore Key Trends, Forecasts, and Competitive Insights Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Volumetric Video Compression

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Adoption Rates

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges and Opportunities in Volumetric Video Compression

- Future Outlook: Emerging Applications and Investment Hotspots

- Sources & References

Executive Summary & Market Overview

Volumetric video compression technologies are at the forefront of enabling immersive media experiences, allowing the capture, transmission, and rendering of 3D spaces and objects in real time. Unlike traditional 2D video, volumetric video encodes spatial information, supporting applications in virtual reality (VR), augmented reality (AR), telepresence, and advanced entertainment. As of 2025, the market for volumetric video compression is experiencing rapid growth, driven by increasing demand for high-fidelity, interactive content across industries such as gaming, healthcare, education, and live events.

The global volumetric video market is projected to reach USD 7.6 billion by 2027, expanding at a CAGR of over 26% from 2022, with compression technologies playing a pivotal role in this expansion by addressing bandwidth and storage challenges (MarketsandMarkets). Key advancements in compression algorithms—such as point cloud compression (PCC), mesh-based compression, and hybrid approaches—are enabling more efficient transmission of volumetric data without significant loss of quality. The adoption of standards like MPEG’s V-PCC (Video-based Point Cloud Compression) and G-PCC (Geometry-based Point Cloud Compression) is accelerating interoperability and commercial deployment (MPEG).

Major technology providers and startups are investing heavily in R&D to optimize compression for real-time streaming and cloud-based rendering. Companies such as Microsoft, Intel, and 8i are pioneering solutions that balance compression efficiency with visual fidelity, targeting both consumer and enterprise markets. The proliferation of 5G networks and edge computing infrastructure is further catalyzing adoption by reducing latency and supporting higher data throughput (Ericsson).

- Entertainment and media companies are leveraging volumetric video compression to deliver next-generation live events and interactive experiences.

- Healthcare and education sectors are exploring volumetric video for remote diagnostics, surgical training, and immersive learning, where efficient compression is critical for real-time collaboration.

- Challenges remain in standardization, computational complexity, and ensuring cross-platform compatibility, but ongoing innovation is expected to address these barriers.

In summary, volumetric video compression technologies are a linchpin for the scalable deployment of immersive 3D content, with 2025 marking a period of accelerated market growth, technological maturation, and expanding commercial applications.

Key Technology Trends in Volumetric Video Compression

Volumetric video compression technologies are rapidly evolving to address the unique challenges of capturing, transmitting, and rendering three-dimensional (3D) video content. Unlike traditional 2D video, volumetric video represents scenes as dynamic 3D models, often using point clouds or meshes, which results in massive data sizes. As the demand for immersive experiences in augmented reality (AR), virtual reality (VR), and mixed reality (MR) grows, efficient compression becomes critical for practical deployment and scalability.

One of the most significant trends in 2025 is the adoption of advanced point cloud compression standards. The ISO/IEC MPEG group’s Point Cloud Compression (PCC) standards—specifically Video-based PCC (V-PCC) and Geometry-based PCC (G-PCC)—are gaining traction. V-PCC leverages existing 2D video codecs to compress 3D data by projecting point clouds onto 2D planes, achieving compression ratios of up to 300:1 with minimal perceptual loss. G-PCC, on the other hand, directly compresses the geometry and attributes of point clouds, offering flexibility for diverse volumetric content types.

Machine learning and AI-driven approaches are also reshaping volumetric video compression. Companies like Microsoft and Google are investing in neural compression techniques that learn optimal representations for 3D data, outperforming traditional algorithms in both efficiency and quality. These methods adaptively allocate bits based on scene complexity, enabling real-time streaming of high-fidelity volumetric content over bandwidth-constrained networks.

- Hybrid Compression Architectures: Combining mesh, point cloud, and texture compression to optimize for different content types and use cases.

- Edge Processing: Offloading parts of the compression pipeline to edge devices reduces latency and network load, a trend supported by Ericsson and other telecom leaders.

- Standardization Efforts: Ongoing work by ITU-T and 3GPP aims to harmonize volumetric video formats and compression protocols for interoperability across devices and platforms.

In summary, 2025 sees volumetric video compression technologies advancing through standardization, AI integration, and hybrid architectures, paving the way for scalable, high-quality 3D content delivery in next-generation immersive applications.

Competitive Landscape and Leading Players

The competitive landscape for volumetric video compression technologies in 2025 is characterized by rapid innovation, strategic partnerships, and a mix of established tech giants and specialized startups. As volumetric video gains traction in applications such as immersive entertainment, telepresence, and industrial training, the demand for efficient compression solutions has intensified. This has led to a dynamic market where differentiation is driven by compression efficiency, real-time processing capabilities, and compatibility with emerging hardware and platforms.

Leading the market are companies like Microsoft, whose Azure Mixed Reality Capture Studios have pioneered end-to-end volumetric video workflows, including proprietary compression algorithms optimized for cloud streaming and edge delivery. Intel is another key player, leveraging its RealSense technology and collaborating with partners to develop codecs that balance quality and bandwidth for volumetric data. Google has also entered the space, focusing on scalable compression for WebXR and cloud-based volumetric streaming, building on its expertise in video codecs and cloud infrastructure.

Specialized firms such as 8i and Volograms are notable for their proprietary compression pipelines tailored for mobile and AR/VR applications. These companies emphasize real-time encoding and adaptive streaming, enabling volumetric content to be delivered efficiently to consumer devices with limited processing power. Holoxica and Arcturus are also recognized for their innovations in point cloud compression and mesh-based encoding, targeting both entertainment and enterprise markets.

- Moving Picture Company and Dimension Studio are leveraging proprietary and third-party compression technologies to support high-profile volumetric productions for film, sports, and live events.

- Qualcomm is investing in hardware-accelerated volumetric compression, aiming to integrate efficient codecs into next-generation XR chipsets for mobile and wearable devices.

- MPEG (Moving Picture Experts Group) is driving standardization efforts, with the MPEG-I and V-PCC (Video-based Point Cloud Compression) standards gaining adoption among both hardware and software vendors.

The competitive environment is further shaped by ongoing research collaborations between academia and industry, as well as open-source initiatives that seek to democratize access to volumetric compression tools. As the market matures, interoperability and adherence to emerging standards are expected to become key differentiators among leading players.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Adoption Rates

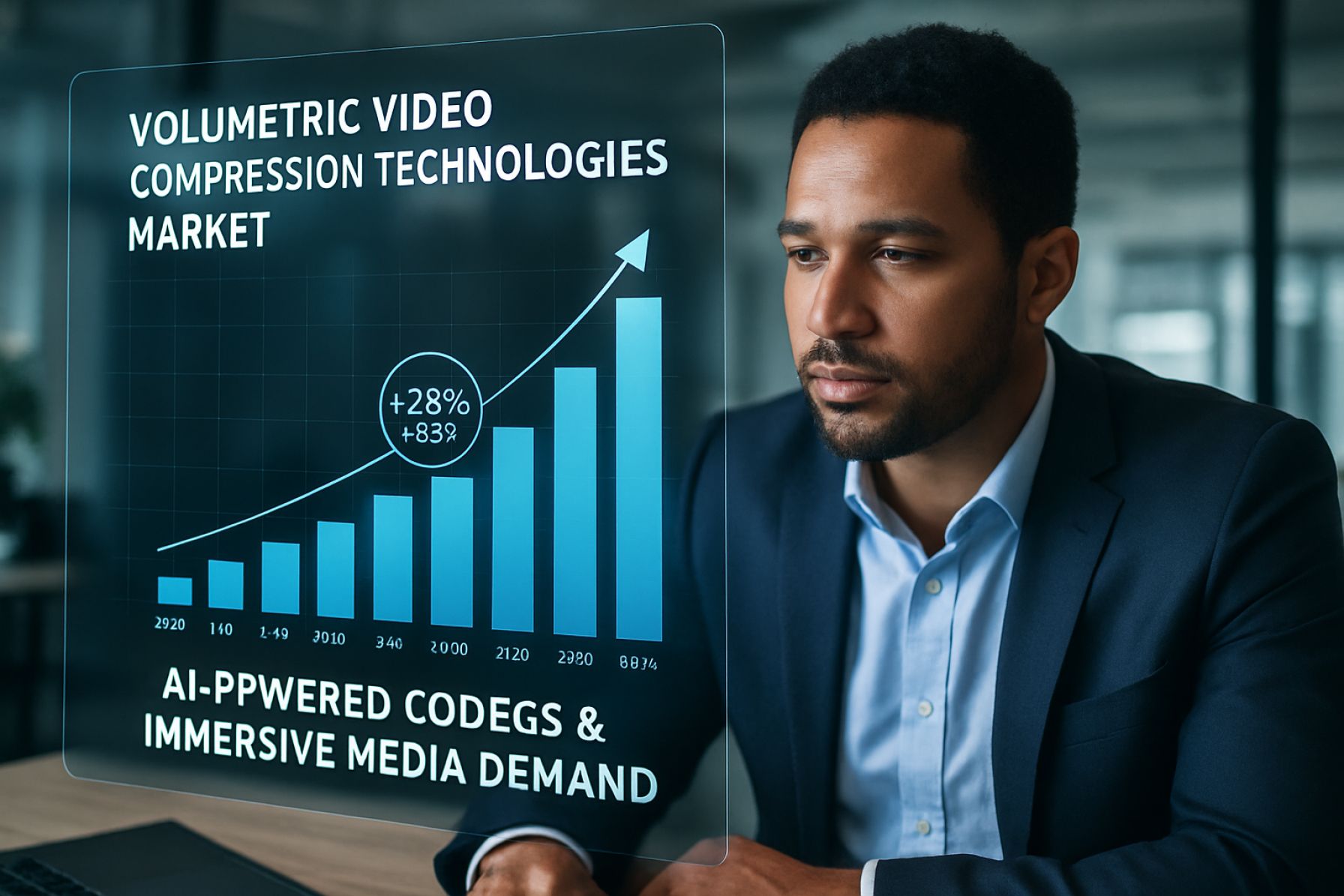

The volumetric video compression technologies market is poised for robust growth between 2025 and 2030, driven by escalating demand for immersive media experiences in sectors such as entertainment, gaming, telepresence, and industrial training. According to projections by MarketsandMarkets, the global volumetric video market—which is heavily reliant on advanced compression technologies—is expected to achieve a compound annual growth rate (CAGR) of approximately 28% during this period. This surge is attributed to the increasing adoption of 3D and holographic content, which necessitates efficient compression solutions to manage the vast data volumes generated by volumetric capture systems.

Revenue forecasts indicate that the volumetric video compression segment will contribute significantly to the overall market, with estimates suggesting that the market could surpass $5 billion by 2030. This growth is underpinned by ongoing advancements in codec development, such as MPEG’s V-PCC (Video-based Point Cloud Compression) and G-PCC (Geometry-based Point Cloud Compression) standards, which are being rapidly adopted by industry leaders to enable real-time streaming and storage of high-fidelity volumetric content. International Telecommunication Union (ITU) and ISO/IEC MPEG are actively standardizing these technologies, further accelerating market adoption.

Adoption rates are expected to climb sharply across North America, Europe, and Asia-Pacific, with North America leading due to early investments by major technology firms and content creators. By 2027, it is anticipated that over 40% of AR/VR content providers in these regions will integrate volumetric video compression solutions into their production pipelines, according to IDC. The proliferation of 5G networks and edge computing infrastructure will further catalyze adoption, enabling seamless delivery of volumetric content to end-users on a variety of devices.

- CAGR (2025–2030): ~28%

- Projected Market Revenue (2030): $5+ billion

- Key Adoption Drivers: AR/VR expansion, 5G rollout, standardization of codecs

- Regional Leaders: North America, followed by Europe and Asia-Pacific

In summary, the period from 2025 to 2030 will see volumetric video compression technologies transition from niche applications to mainstream adoption, underpinned by technological innovation and expanding use cases across multiple industries.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for volumetric video compression technologies in 2025 is shaped by varying levels of technological maturity, infrastructure, and market demand across North America, Europe, Asia-Pacific, and the Rest of World. Each region demonstrates unique drivers and challenges influencing the adoption and advancement of these technologies.

- North America: North America, particularly the United States, leads in volumetric video compression innovation, driven by robust investments in immersive media, gaming, and enterprise applications. Major technology firms and research institutions are actively developing advanced codecs and real-time streaming solutions to support applications in entertainment, telepresence, and healthcare. The region benefits from widespread 5G deployment and edge computing infrastructure, enabling low-latency volumetric content delivery. According to Grand View Research, North America accounted for the largest share of the global volumetric video market in 2024, a trend expected to continue through 2025.

- Europe: Europe is characterized by strong regulatory frameworks and collaborative R&D initiatives, particularly in Germany, the UK, and France. The European Union’s focus on digital sovereignty and data privacy influences the development of compression standards and interoperability protocols. European broadcasters and cultural institutions are piloting volumetric video for live events and heritage preservation, driving demand for efficient compression to manage bandwidth and storage constraints. The European Commission has funded several projects under Horizon Europe to advance volumetric media technologies, fostering cross-border innovation.

- Asia-Pacific: The Asia-Pacific region, led by China, Japan, and South Korea, is experiencing rapid growth in volumetric video adoption, propelled by government-backed digital transformation initiatives and a thriving consumer electronics sector. Local companies are investing in proprietary compression algorithms optimized for mobile and AR/VR platforms. The proliferation of 5G networks and smart devices accelerates the deployment of volumetric content in entertainment, education, and e-commerce. According to Mordor Intelligence, Asia-Pacific is projected to register the highest CAGR in the volumetric video market through 2025.

- Rest of World: In regions such as Latin America, the Middle East, and Africa, adoption remains nascent due to limited infrastructure and high costs. However, pilot projects in education and tourism are emerging, often supported by international partnerships and technology transfers. As connectivity improves, these markets are expected to gradually increase their uptake of volumetric video compression solutions.

Challenges and Opportunities in Volumetric Video Compression

Volumetric video compression technologies are at the heart of enabling scalable, high-quality immersive experiences in applications such as virtual reality (VR), augmented reality (AR), and mixed reality (MR). As volumetric video captures three-dimensional spaces and objects, the resulting data volumes are orders of magnitude larger than traditional 2D or even 360-degree video, presenting unique challenges and opportunities for compression in 2025.

Challenges:

- Data Volume and Bandwidth: Volumetric video streams can require bandwidths exceeding several gigabits per second in raw form, making real-time transmission and storage a significant hurdle. Even with advanced codecs, achieving sufficient compression without perceptible quality loss remains a technical challenge, especially for consumer-grade networks and devices (Intel).

- Complexity of 3D Data: Unlike 2D video, volumetric content involves point clouds, meshes, and texture maps, each with distinct data structures. Efficiently compressing these heterogeneous elements while maintaining spatial and temporal coherence is a non-trivial task (MPEG).

- Standardization: The lack of universally adopted standards for volumetric video compression leads to fragmentation, interoperability issues, and increased development costs. While organizations like MPEG and ITU are working on standards such as V-PCC (Video-based Point Cloud Compression) and G-PCC (Geometry-based Point Cloud Compression), widespread adoption is still evolving.

- Real-Time Processing: Many applications, especially in live events and telepresence, require real-time encoding and decoding. The computational demands of volumetric compression algorithms can strain even high-end hardware, limiting scalability (Microsoft).

Opportunities:

- AI-Driven Compression: Machine learning techniques are being integrated to optimize compression efficiency, predict perceptual importance, and reduce artifacts. This can lead to significant bandwidth savings and improved user experiences (NVIDIA).

- Edge Computing: Offloading compression tasks to edge devices can reduce latency and bandwidth requirements, enabling more responsive and scalable volumetric streaming (Ericsson).

- Emerging Standards: The maturation of standards like V-PCC and G-PCC is expected to drive interoperability, lower costs, and accelerate adoption across industries, from entertainment to telemedicine (ISO).

- Hardware Acceleration: Advances in GPUs and dedicated hardware accelerators are making real-time volumetric video compression more feasible, opening doors for mass-market applications (Qualcomm).

In 2025, the interplay between these challenges and opportunities will shape the trajectory of volumetric video compression technologies, influencing their adoption and impact across digital media landscapes.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for volumetric video compression technologies in 2025 is shaped by rapid advancements in both hardware and software, as well as the expanding range of applications across industries. As volumetric video becomes increasingly central to immersive experiences in augmented reality (AR), virtual reality (VR), and mixed reality (MR), the demand for efficient compression solutions is intensifying. This is particularly crucial given the massive data sizes associated with volumetric content, which can reach several gigabits per second in raw form.

Emerging applications are driving innovation in compression algorithms. In entertainment and media, volumetric video is enabling next-generation live performances, sports broadcasting, and interactive storytelling, where real-time streaming and low-latency playback are essential. Companies such as Microsoft and Intel are investing in capture studios and end-to-end pipelines that rely on advanced compression to deliver high-fidelity experiences to consumer devices.

Healthcare is another emerging hotspot, with volumetric video supporting remote surgery, medical training, and patient monitoring. Efficient compression is critical for transmitting 3D medical scans and real-time procedural footage over limited bandwidth networks. The adoption of standards such as MPEG’s Video-based Point Cloud Compression (V-PCC) and Geometry-based Point Cloud Compression (G-PCC) is accelerating, with organizations like ISO/IEC MPEG leading the way in standardization efforts.

In the enterprise sector, volumetric video is being used for remote collaboration, digital twins, and industrial training. The need for scalable, interoperable compression solutions is prompting investment in AI-driven codecs and edge computing architectures. Startups and established players alike are exploring neural compression techniques and hardware acceleration to reduce latency and storage costs, as highlighted in recent analyses by IDC and Gartner.

- Investment hotspots in 2025 include cloud-based volumetric streaming platforms, edge compression hardware, and AI-powered codec development.

- Asia-Pacific and North America are leading regions for R&D and commercialization, driven by strong AR/VR ecosystems and government support.

- Strategic partnerships between technology vendors, telecom operators, and content creators are expected to accelerate market adoption.

Overall, the future of volumetric video compression technologies is marked by a convergence of technical innovation and expanding commercial opportunities, with 2025 poised to see significant breakthroughs in both application breadth and investment intensity.

Sources & References

- MarketsandMarkets

- MPEG

- Microsoft

- 8i

- ISO/IEC MPEG

- ITU-T

- 3GPP

- Volograms

- Arcturus

- Moving Picture Company

- Dimension Studio

- Qualcomm

- IDC

- Grand View Research

- European Commission

- Mordor Intelligence

- NVIDIA