Unlocking the Full Potential of Ocean Wave Energy Optimization in 2025: How Advanced Technologies and Market Forces Are Shaping the Next Wave of Renewable Power. Discover the Innovations and Strategies Driving Sustainable Growth.

- Executive Summary: The State of Ocean Wave Energy Optimization in 2025

- Global Market Forecasts and Growth Projections Through 2030

- Key Technology Innovations: From Advanced Turbines to Smart Control Systems

- Leading Players and Industry Collaborations (e.g., oceanenergy.ie, orpc.co, emec.org.uk)

- Policy, Regulation, and Incentives Impacting Wave Energy Deployment

- Integration with Power Grids: Storage, Reliability, and Hybrid Solutions

- Cost Reduction Strategies and Levelized Cost of Energy (LCOE) Trends

- Environmental Impact, Sustainability, and Community Engagement

- Challenges: Technical, Economic, and Regulatory Barriers

- Future Outlook: Emerging Opportunities and Roadmap to Commercial Scale

- Sources & References

Executive Summary: The State of Ocean Wave Energy Optimization in 2025

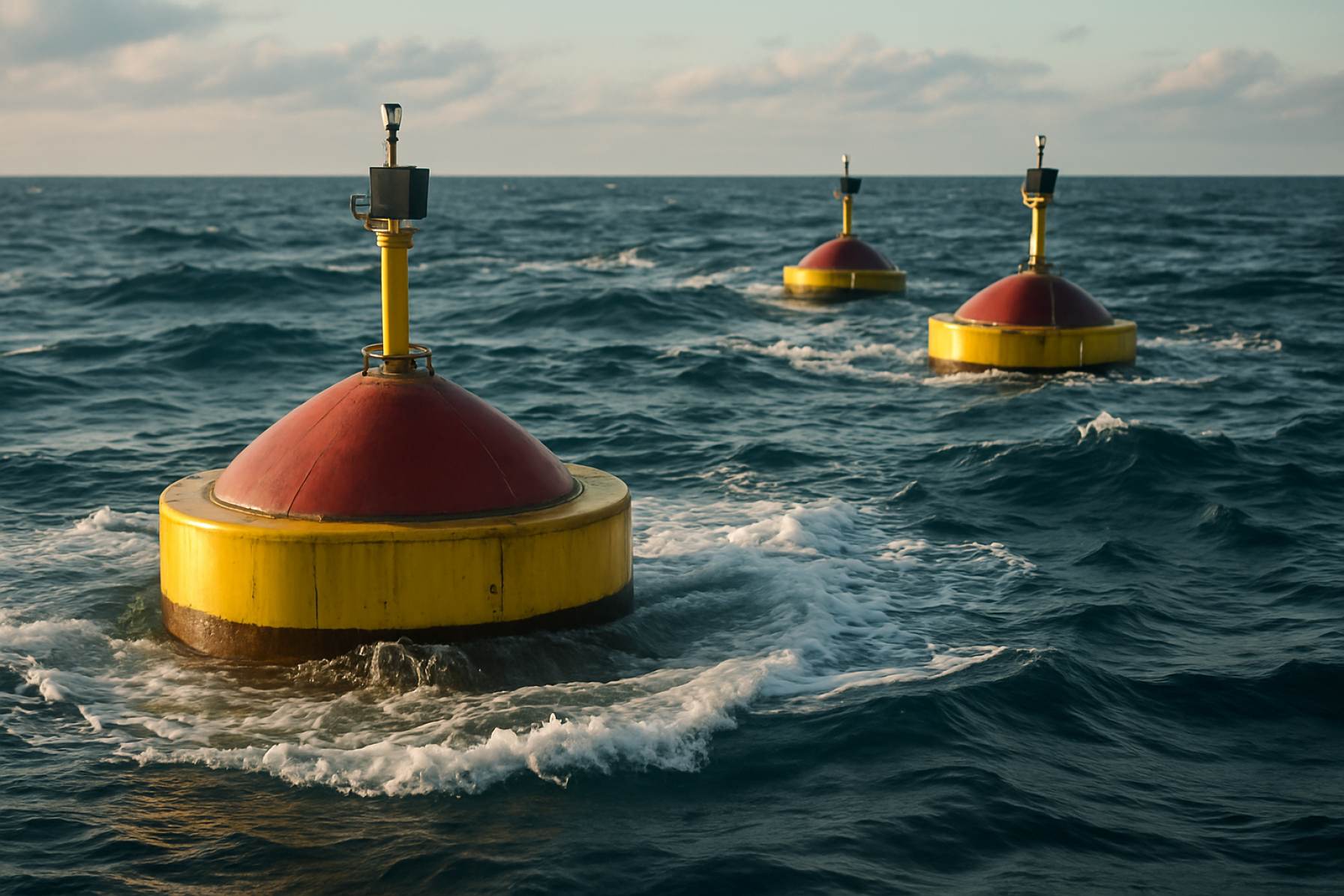

Ocean wave energy optimization has reached a pivotal stage in 2025, marked by significant technological advancements, increased pilot deployments, and growing policy support. The sector, while still emerging compared to wind and solar, is demonstrating tangible progress in efficiency, reliability, and scalability of wave energy converters (WECs). This progress is driven by a combination of improved device designs, advanced digital monitoring, and integrated hybrid systems.

Key industry players are leading the charge in optimizing wave energy extraction. Pelamis Wave Power—a pioneer in the field—has continued to refine its articulated attenuator technology, focusing on real-time control systems that maximize energy capture from variable sea states. Ocean Power Technologies has advanced its PowerBuoy platform, integrating machine learning algorithms to optimize power output and survivability, while also expanding commercial deployments in North America and Europe. CorPower Ocean has made notable strides with its resonant WECs, achieving higher capacity factors and demonstrating grid-connected performance in multi-device arrays.

Recent demonstration projects underscore the sector’s momentum. In 2024, AW-Energy deployed its WaveRoller device in Portugal, reporting improved conversion efficiencies and robust grid integration. Meanwhile, Seabased has focused on modular, scalable wave parks, with ongoing projects in the North Sea and the Mediterranean. These deployments are supported by collaborative initiatives such as the European Union’s Horizon Europe program, which funds optimization research and cross-border demonstration sites.

Optimization efforts are increasingly data-driven. The use of digital twins, real-time sensor networks, and predictive maintenance is reducing downtime and operational costs. Hybridization with offshore wind and solar is also gaining traction, as seen in projects by Siemens Gamesa Renewable Energy, which is exploring integrated platforms to maximize ocean resource utilization.

Looking ahead, the outlook for ocean wave energy optimization is promising. The International Energy Agency projects that, with continued innovation, wave energy could become a mainstream contributor to renewable energy portfolios by the early 2030s. Policy frameworks in the UK, EU, and Australia are providing targeted support for commercialization and grid integration. As device reliability and cost-competitiveness improve, the sector is poised for accelerated growth, with multi-megawatt wave farms expected to move from pilot to pre-commercial scale within the next few years.

Global Market Forecasts and Growth Projections Through 2030

The global market for renewable ocean wave energy is poised for significant growth through 2030, driven by technological advancements in wave energy conversion, increasing policy support for decarbonization, and the urgent need for diversified renewable energy sources. As of 2025, the sector remains in a pre-commercial or early-commercial phase, but several pilot projects and demonstration arrays are scaling up, signaling a transition toward broader deployment.

Key industry players such as Pelamis Wave Power, Ocean Power Technologies, and CorPower Ocean are actively developing and testing next-generation wave energy converters (WECs) with improved efficiency, survivability, and grid integration capabilities. For example, CorPower Ocean has launched its C4 device in Portugal, aiming to demonstrate commercial viability and pave the way for multi-megawatt arrays by the late 2020s.

According to industry data, the global installed capacity of wave energy remains below 1 GW as of 2025, but projections indicate a compound annual growth rate (CAGR) exceeding 20% through 2030, with cumulative capacity potentially reaching 3–5 GW by the end of the decade. This growth is expected to be concentrated in regions with strong wave resources and supportive regulatory frameworks, such as the United Kingdom, Portugal, Australia, and parts of Southeast Asia. The European Union, through initiatives like the Ocean Energy Europe platform, continues to provide funding and policy incentives to accelerate commercialization and grid integration of wave energy technologies.

Optimization efforts are increasingly focused on digitalization, real-time monitoring, and advanced control systems to maximize energy yield and reduce maintenance costs. Companies like Ocean Power Technologies are integrating smart sensors and remote diagnostics into their platforms, enabling predictive maintenance and operational optimization. Additionally, hybridization with other renewables (such as offshore wind) and the development of modular, scalable WECs are expected to enhance project bankability and attract new investment.

Looking ahead, the outlook for wave energy optimization is closely tied to continued cost reductions, successful demonstration of multi-device arrays, and the establishment of robust supply chains. If these milestones are achieved, wave energy could play a meaningful role in the global renewable energy mix by 2030, contributing to energy security and climate goals.

Key Technology Innovations: From Advanced Turbines to Smart Control Systems

The optimization of renewable ocean wave energy is experiencing a surge of technological innovation in 2025, driven by the need to enhance efficiency, reliability, and scalability. Key advancements are emerging across device design, materials, and digital control systems, with a focus on maximizing energy capture and minimizing maintenance in harsh marine environments.

One of the most significant trends is the evolution of advanced wave energy converters (WECs). Companies such as Pelamis Wave Power and CorPower Ocean are pioneering next-generation point absorber and attenuator devices. These systems utilize innovative mechanical architectures and hydrodynamic optimization to increase power output per unit and improve survivability during extreme weather events. For example, CorPower Ocean’s C4 device employs a phase control technology that synchronizes the device’s movement with incoming waves, significantly boosting energy absorption efficiency.

Material science is also playing a crucial role. The adoption of corrosion-resistant composites and advanced coatings is extending the operational lifespan of submerged components, reducing the frequency and cost of maintenance. AW-Energy, with its WaveRoller technology, integrates robust materials and modular construction, allowing for easier deployment and servicing.

Perhaps the most transformative innovation is the integration of smart control systems and real-time data analytics. These digital platforms leverage machine learning and predictive algorithms to dynamically adjust device parameters—such as damping, orientation, and power take-off settings—in response to changing sea states. OceanEnergy and Wavepiston are actively developing such systems, enabling their WECs to autonomously optimize performance and reduce downtime. The use of remote monitoring and automated diagnostics is further streamlining operations, allowing for predictive maintenance and rapid response to faults.

Grid integration is another area of focus. As wave energy projects scale up, technologies that enable smooth and reliable connection to onshore grids are being refined. Power electronics and energy storage solutions are being tailored to address the intermittency of wave resources, with companies like Seabased working on modular grid interface units that stabilize output and facilitate hybridization with other renewables.

Looking ahead, the next few years are expected to see continued convergence of mechanical innovation and digital intelligence, with pilot projects and pre-commercial arrays providing critical data for further optimization. As these technologies mature, the sector is poised to deliver more competitive and resilient renewable energy solutions from the world’s oceans.

Leading Players and Industry Collaborations (e.g., oceanenergy.ie, orpc.co, emec.org.uk)

The global push for decarbonization and the search for reliable renewable energy sources have brought ocean wave energy optimization to the forefront of innovation. In 2025, several leading organizations and industry collaborations are driving advancements in this sector, focusing on improving device efficiency, survivability, and grid integration.

One of the most prominent players is OceanEnergy, an Ireland-based company recognized for its OE35 device, one of the world’s largest floating wave energy converters. OceanEnergy has partnered with major utilities and research bodies to deploy and test its technology in real-sea conditions, notably at the U.S. Navy’s Wave Energy Test Site in Hawaii. Their ongoing collaborations aim to optimize power take-off systems and reduce maintenance costs, critical factors for commercial viability.

In the United States, ORPC (Ocean Renewable Power Company) is a key innovator, primarily known for its river and tidal energy systems but increasingly active in wave energy optimization. ORPC’s cross-sector partnerships with universities and government agencies focus on modular, scalable designs and digital monitoring to enhance energy capture and reliability. Their work is supported by U.S. Department of Energy initiatives to accelerate marine energy commercialization.

The European Marine Energy Centre (EMEC) in Orkney, Scotland, remains a global hub for wave energy testing and collaboration. EMEC provides grid-connected test berths and supports a range of technology developers, including both established firms and startups. In 2025, EMEC is facilitating multi-party projects to optimize device arrays, data analytics, and environmental monitoring, with the goal of reducing the levelized cost of energy (LCOE) for wave power.

Industry-wide collaborations are also central to progress. The Wave Energy Scotland program, funded by the Scottish Government, continues to unite technology developers, supply chain partners, and academic researchers. Their focus is on open innovation and shared learning, particularly in areas such as advanced materials, control systems, and survivability in harsh ocean conditions.

Looking ahead, these leading players and collaborative initiatives are expected to accelerate the path to commercialization. With increased public and private investment, and a growing emphasis on digital optimization and environmental integration, the next few years are likely to see pilot projects scale up and new business models emerge. The sector’s outlook is strengthened by supportive policy frameworks in Europe and North America, positioning wave energy as a vital component of the renewable energy mix by the late 2020s.

Policy, Regulation, and Incentives Impacting Wave Energy Deployment

Policy frameworks, regulatory clarity, and targeted incentives are increasingly shaping the trajectory of renewable ocean wave energy optimization as the sector moves into 2025 and beyond. Governments and supranational bodies are recognizing the potential of wave energy to contribute to decarbonization goals, energy security, and economic development, and are responding with a mix of supportive measures.

In the European Union, the European Union continues to lead with its ambitious offshore renewable energy strategy, which includes a target of 40 GW of ocean energy by 2050. The EU’s Innovation Fund and Horizon Europe programs are providing substantial grants and financial instruments to wave energy developers, supporting demonstration projects and technology optimization. The European Maritime and Fisheries Fund also offers co-financing for pilot deployments, while the European Commission is working to streamline permitting processes and cross-border grid integration.

The United Kingdom, through the UK Government and devolved administrations, has established dedicated funding streams such as the Contracts for Difference (CfD) scheme, which in Allocation Round 5 (2023) included a ring-fenced budget for tidal stream and wave energy projects. The UK’s Marine Energy Council is actively engaging with regulators to further reduce barriers and ensure that wave energy is included in future rounds, with a focus on optimizing cost reduction and grid access.

In the United States, the U.S. Department of Energy (DOE) is advancing wave energy through the Water Power Technologies Office, which funds R&D, demonstration, and testing at national facilities such as the PacWave test site in Oregon. The DOE’s “Waves to Water” prize and other initiatives are incentivizing innovation in device optimization and deployment. Regulatory agencies, including the Federal Energy Regulatory Commission (FERC), are working to clarify licensing pathways for marine energy projects, aiming to reduce project timelines and uncertainty.

Australia’s Australian Renewable Energy Agency (ARENA) is supporting wave energy optimization through targeted grants and partnerships, with a focus on integrating wave energy into microgrids and remote communities. The Western Australian government has also introduced streamlined permitting for marine renewables, aiming to accelerate demonstration and commercial-scale projects.

Looking ahead, the outlook for wave energy optimization is closely tied to the evolution of these policy and regulatory environments. Continued alignment of incentives, risk reduction measures, and grid integration policies will be critical to unlocking private investment and scaling up deployment. As governments refine their climate and energy strategies in the next few years, wave energy is expected to benefit from increased policy visibility and dedicated support mechanisms, driving further innovation and cost reductions across the sector.

Integration with Power Grids: Storage, Reliability, and Hybrid Solutions

The integration of renewable ocean wave energy into power grids is a critical focus for the sector in 2025 and the coming years, as stakeholders seek to address challenges related to storage, reliability, and hybridization with other renewable sources. The inherent variability of wave energy necessitates advanced solutions to ensure consistent power delivery and grid stability.

A key development is the deployment of grid-scale energy storage systems alongside wave energy converters (WECs). Technologies such as lithium-ion batteries, flow batteries, and emerging solutions like hydrogen production are being trialed to buffer the intermittent nature of wave power. For example, CorPower Ocean, a leading wave energy technology developer, is actively exploring integration with battery storage to smooth output and enable dispatchable renewable energy. Similarly, AW-Energy is investigating the coupling of its WaveRoller devices with onshore storage to enhance grid compatibility.

Reliability improvements are also being achieved through real-time monitoring, predictive maintenance, and digital twin technologies. These advancements, championed by companies like Pelamis Wave Power (legacy technology now influencing new entrants) and OceanEnergy, are reducing downtime and increasing the operational availability of wave farms. Enhanced reliability is crucial for meeting grid codes and ensuring that wave energy can be a dependable contributor to national energy mixes.

Hybrid renewable energy systems are gaining traction as a strategy to maximize resource utilization and grid stability. Projects are underway that combine wave energy with offshore wind and solar, leveraging the complementary generation profiles of these resources. Ocean Energy Europe, the industry association, highlights several pilot projects in Europe where wave and wind are co-located, sharing infrastructure and grid connections to reduce costs and improve reliability. Notably, SIMEC Atlantis Energy is advancing hybrid arrays that integrate tidal, wave, and wind energy, with plans for commercial-scale deployment in the next few years.

Looking ahead, the outlook for grid integration of wave energy is positive, with ongoing R&D and demonstration projects expected to yield commercially viable solutions by the late 2020s. The sector is poised to benefit from policy support, falling technology costs, and the growing imperative for flexible, low-carbon power systems. As storage technologies mature and hybrid models are refined, wave energy is set to play an increasingly important role in resilient, renewable-powered grids.

Cost Reduction Strategies and Levelized Cost of Energy (LCOE) Trends

Cost reduction and the pursuit of competitive Levelized Cost of Energy (LCOE) are central to the commercial viability of renewable ocean wave energy. As of 2025, the sector is witnessing a convergence of technological innovation, project scaling, and supply chain maturation, all aimed at driving down costs and improving the economic case for wave energy.

One of the most significant strategies for cost reduction is the standardization and modularization of wave energy converter (WEC) designs. Companies such as CorPower Ocean and OceanEnergy are advancing modular WECs that can be manufactured at scale, reducing bespoke engineering and enabling economies of scale. CorPower Ocean’s C4 device, for example, is designed for mass production and rapid deployment, targeting a significant reduction in both capital and operational expenditures.

Another key trend is the integration of digitalization and remote monitoring. Real-time data analytics and predictive maintenance, as implemented by AW-Energy and Wavepiston, are minimizing downtime and extending asset lifespans. These digital tools help optimize energy capture and reduce the frequency and cost of offshore interventions, which have historically been a major cost driver in marine energy projects.

Supply chain development and local content strategies are also contributing to cost reductions. By leveraging existing maritime infrastructure and local manufacturing, companies are reducing logistics costs and lead times. For instance, OceanEnergy has partnered with shipyards and fabrication facilities in Ireland and the US to streamline production and deployment.

In terms of LCOE, the sector is targeting a reduction from current estimates of €150–€250/MWh towards €100/MWh or lower by the late 2020s. This trajectory is supported by pilot projects and pre-commercial arrays, such as those led by CorPower Ocean in Portugal and AW-Energy in Finland, which are providing critical data to validate performance and cost assumptions. The European Commission and organizations like Ocean Energy Europe are supporting these efforts through funding and policy frameworks aimed at accelerating cost reduction and deployment.

Looking ahead, the next few years are expected to see further LCOE declines as more devices reach commercial scale, supply chains mature, and digital optimization becomes standard. The sector’s outlook is increasingly positive, with cost competitiveness on the horizon, especially in markets with high energy prices or strong policy support for renewables.

Environmental Impact, Sustainability, and Community Engagement

The environmental impact, sustainability, and community engagement aspects of renewable ocean wave energy optimization are increasingly central to the sector’s development as it moves into 2025 and beyond. Wave energy is widely recognized for its low carbon footprint and minimal emissions during operation, positioning it as a key contributor to decarbonization goals. However, the industry is also addressing concerns related to marine ecosystems, coastal communities, and long-term sustainability.

Recent deployments and pilot projects have demonstrated that, with careful site selection and adaptive design, wave energy converters (WECs) can coexist with marine life and local fisheries. For example, CorPower Ocean, a Swedish technology developer, has implemented environmental monitoring protocols at its installations in Portugal, working with local stakeholders to assess impacts on marine habitats and biodiversity. Early results indicate negligible disruption to benthic environments and migratory species, supporting the case for responsible scaling of wave energy projects.

Sustainability is further enhanced by the modular and recyclable nature of many modern WECs. Companies such as AW-Energy, known for its WaveRoller technology, emphasize the use of durable, low-impact materials and streamlined maintenance procedures to minimize lifecycle emissions and waste. These design choices are increasingly being codified in industry standards and best practices, as promoted by organizations like the Ocean Energy Europe association, which advocates for harmonized environmental assessment frameworks across the continent.

Community engagement is a critical pillar for project acceptance and long-term viability. Developers are prioritizing transparent communication, local job creation, and shared economic benefits. For instance, Pelamis Wave Power (legacy technology, with ongoing influence through successor projects) and Wavepiston have both engaged coastal communities in project planning, workforce training, and supply chain development. These efforts are designed to foster local stewardship and ensure that the transition to renewable ocean energy delivers tangible benefits to host regions.

Looking ahead, the sector is expected to see increased collaboration with environmental NGOs, fisheries, and indigenous groups, particularly as multi-use marine spaces become more common. The integration of real-time environmental monitoring and adaptive management strategies will be crucial for maintaining ecosystem health and social license. As wave energy optimization technologies mature, the industry’s commitment to sustainability and community partnership is likely to become a defining feature, supporting broader renewable energy and climate resilience objectives through 2025 and the years that follow.

Challenges: Technical, Economic, and Regulatory Barriers

The optimization of renewable ocean wave energy faces a complex array of challenges spanning technical, economic, and regulatory domains, particularly as the sector seeks to scale in 2025 and the coming years. Despite significant progress in prototype development and pilot deployments, several persistent barriers continue to hinder widespread commercialization and integration of wave energy technologies.

Technical Challenges: The harsh and unpredictable marine environment remains a primary obstacle. Wave energy converters (WECs) must withstand extreme weather, corrosion, and biofouling, all of which can reduce device lifespan and increase maintenance costs. Achieving high reliability and survivability while maintaining efficiency is a key focus for leading developers such as Pelamis Wave Power and Ocean Power Technologies. Furthermore, optimizing energy capture across varying wave conditions and improving power take-off systems are ongoing engineering hurdles. Grid integration also presents technical difficulties, as wave energy is inherently variable and often located far from existing transmission infrastructure.

Economic Barriers: The levelized cost of energy (LCOE) for wave power remains significantly higher than for more mature renewables like wind and solar. High capital expenditures for device manufacturing, deployment, and maintenance, combined with limited economies of scale, impede cost competitiveness. Companies such as CorPower Ocean and AW-Energy are working to address these issues through modular designs and streamlined installation processes, but large-scale commercial projects are still rare. Access to financing is further constrained by the perceived risks and long development timelines associated with wave energy projects.

Regulatory and Permitting Hurdles: Navigating the complex regulatory landscape is another significant barrier. Permitting processes for offshore energy projects are often lengthy and involve multiple agencies, with requirements for environmental impact assessments, stakeholder consultations, and marine spatial planning. This can delay project timelines and increase costs. Organizations such as the European Marine Energy Centre are actively collaborating with regulators to streamline permitting and establish best practices, but harmonization across jurisdictions remains a challenge.

Looking ahead, overcoming these barriers will require coordinated efforts between technology developers, policymakers, and investors. Advances in materials science, digital monitoring, and international standards are expected to gradually reduce technical and regulatory risks. However, without targeted policy support and continued investment, the pace of wave energy optimization may remain slower than that of other renewables in the near term.

Future Outlook: Emerging Opportunities and Roadmap to Commercial Scale

The future outlook for renewable ocean wave energy optimization is marked by accelerating technological innovation, increasing public and private investment, and a growing recognition of wave energy’s potential to contribute to global decarbonization goals. As of 2025, the sector is transitioning from pilot and demonstration projects toward pre-commercial and early commercial deployments, with several key players and consortia advancing the roadmap to large-scale adoption.

A major driver is the European Union’s ambitious targets for renewable energy integration, with wave energy identified as a strategic component in the Ocean Energy Europe roadmap. The EU’s Horizon Europe program continues to fund optimization research, focusing on improving device efficiency, survivability, and grid integration. Notably, the CorPower Ocean C4 device, deployed in Portugal, is demonstrating improved power capture and storm survivability, with plans for multi-device arrays in the coming years. Similarly, Wavepiston is advancing modular, scalable systems, aiming for cost-competitive energy by 2030.

In the UK, the European Marine Energy Centre (EMEC) remains a global hub for testing and optimizing wave energy converters (WECs), supporting companies like Pelamis Wave Power and Mocean Energy in refining their technologies. EMEC’s infrastructure and data-sharing initiatives are accelerating learning curves and reducing time-to-market for new designs.

Outside Europe, Australia’s Carnegie Clean Energy is optimizing its CETO technology, focusing on digital twin modeling and machine learning to maximize energy yield and minimize maintenance. In the United States, the Department of Energy’s Water Power Technologies Office is supporting projects at the Pacific Northwest National Laboratory and Sandia National Laboratories to develop advanced control systems and materials for WECs.

Key optimization trends for 2025 and beyond include the integration of real-time data analytics, adaptive control algorithms, and hybridization with offshore wind and storage. The emergence of digital twins and AI-driven predictive maintenance is expected to reduce operational costs and increase device uptime. Additionally, standardization efforts led by organizations such as DNV are streamlining certification and permitting, paving the way for commercial-scale projects.

Looking ahead, the sector’s roadmap envisions multi-megawatt wave farms by the late 2020s, with cost reductions driven by economies of scale, supply chain maturation, and continued R&D. Strategic partnerships between technology developers, utilities, and governments will be crucial to unlocking the full potential of wave energy as a reliable, grid-scale renewable resource.

Sources & References

- Pelamis Wave Power

- Ocean Power Technologies

- CorPower Ocean

- AW-Energy

- Ocean Energy Europe

- ORPC (Ocean Renewable Power Company)

- European Marine Energy Centre (EMEC)

- European Union

- UK Government

- Australian Renewable Energy Agency

- Ocean Energy Europe

- Carnegie Clean Energy

- Pacific Northwest National Laboratory

- Sandia National Laboratories

- DNV