Wide-Bandgap Semiconductor Device Fabrication in 2025: Unleashing Unprecedented Efficiency and Power for the Next Five Years. Explore How SiC and GaN Technologies Are Reshaping the Electronics Landscape.

- Executive Summary: 2025 Market Outlook and Key Drivers

- Technology Overview: SiC, GaN, and Emerging Wide-Bandgap Materials

- Fabrication Process Innovations and Yield Optimization

- Major Players and Strategic Partnerships (e.g., cree.com, infineon.com, onsemi.com)

- Market Size, Segmentation, and 2025–2030 CAGR Projections

- Application Trends: Automotive, Power Electronics, and Renewable Energy

- Supply Chain Dynamics and Raw Material Sourcing

- Regulatory Standards and Industry Initiatives (e.g., ieee.org, semiconductors.org)

- Challenges: Cost, Scalability, and Reliability

- Future Outlook: Disruptive Opportunities and Investment Hotspots

- Sources & References

Executive Summary: 2025 Market Outlook and Key Drivers

The wide-bandgap (WBG) semiconductor device fabrication sector is poised for robust growth in 2025, driven by accelerating demand for high-efficiency power electronics across automotive, industrial, and renewable energy applications. WBG materials such as silicon carbide (SiC) and gallium nitride (GaN) are enabling devices with superior voltage tolerance, thermal stability, and switching speeds compared to traditional silicon, positioning them as critical enablers for next-generation electrification and energy conversion systems.

In 2025, the automotive industry remains a primary catalyst, with electric vehicle (EV) manufacturers increasingly integrating SiC-based power modules to enhance drivetrain efficiency and extend driving range. Leading automotive suppliers and semiconductor manufacturers, including Infineon Technologies AG, STMicroelectronics, and onsemi, are expanding their SiC device portfolios and ramping up fabrication capacity to meet surging OEM demand. For instance, Infineon Technologies AG has announced significant investments in new SiC wafer production lines, while STMicroelectronics is scaling up its vertically integrated SiC supply chain to secure long-term growth.

In parallel, GaN device fabrication is gaining momentum, particularly in fast-charging consumer electronics, data centers, and emerging 5G infrastructure. Companies such as NXP Semiconductors and ROHM Semiconductor are advancing GaN-on-silicon and GaN-on-SiC technologies, targeting higher power densities and improved energy efficiency. The ongoing transition to 200mm wafer processing for both SiC and GaN is expected to further drive down costs and improve device yields, with major foundries and IDMs investing in new fabrication lines and process optimization.

Supply chain resilience and material availability remain key challenges in 2025, as the industry contends with limited substrate production and the need for high-purity, defect-free wafers. To address these constraints, companies like Wolfspeed, Inc. are expanding their crystal growth and wafer fabrication capabilities, while partnerships between device manufacturers and substrate suppliers are intensifying to secure long-term supply agreements.

Looking ahead, the outlook for WBG semiconductor device fabrication is highly positive, with industry bodies such as the Semiconductor Industry Association highlighting continued investment in R&D, process innovation, and ecosystem collaboration. As electrification and digitalization trends accelerate globally, WBG device fabrication is set to play a pivotal role in enabling more efficient, compact, and reliable power electronics across multiple sectors through 2025 and beyond.

Technology Overview: SiC, GaN, and Emerging Wide-Bandgap Materials

Wide-bandgap (WBG) semiconductor device fabrication is at the forefront of power electronics innovation, driven by the superior material properties of silicon carbide (SiC), gallium nitride (GaN), and emerging compounds such as gallium oxide (Ga2O3) and aluminum nitride (AlN). As of 2025, the industry is witnessing rapid scaling of both SiC and GaN device manufacturing, with significant investments in new fabrication facilities, process optimization, and supply chain expansion.

SiC device fabrication has matured considerably, with leading manufacturers such as Wolfspeed, STMicroelectronics, and onsemi ramping up production of 200 mm SiC wafers. Wolfspeed, for example, has inaugurated the world’s largest SiC materials facility in North Carolina, dedicated to 200 mm wafer production, which is expected to significantly increase device yields and reduce costs through economies of scale. The transition from 150 mm to 200 mm wafers is a pivotal event, enabling higher throughput and supporting the surging demand from electric vehicles (EVs), renewable energy, and industrial sectors.

GaN device fabrication, while leveraging some legacy silicon infrastructure, presents unique challenges due to lattice mismatch and thermal management. Companies like Infineon Technologies and NXP Semiconductors are advancing GaN-on-silicon and GaN-on-SiC processes, focusing on high-frequency and high-efficiency applications such as 5G base stations, data centers, and fast chargers. Infineon, for instance, has expanded its GaN manufacturing capacity in Austria, targeting both discrete and integrated power solutions.

Emerging WBG materials are also gaining traction. Gallium oxide (Ga2O3) and aluminum nitride (AlN) offer even wider bandgaps and higher breakdown fields than SiC and GaN, promising next-generation devices with unprecedented voltage and efficiency ratings. While commercial device fabrication is still in early stages, research and pilot lines are being established by industry players and consortia, with expectations for initial market entry in the latter half of the decade.

Looking ahead, the next few years will see continued investment in advanced epitaxy, wafering, and device packaging technologies. Vertical integration, as pursued by Wolfspeed and STMicroelectronics, is expected to enhance supply chain resilience and accelerate innovation. The industry’s focus is shifting toward higher voltage classes, improved reliability, and scalable manufacturing, positioning WBG semiconductors as the backbone of future power electronics.

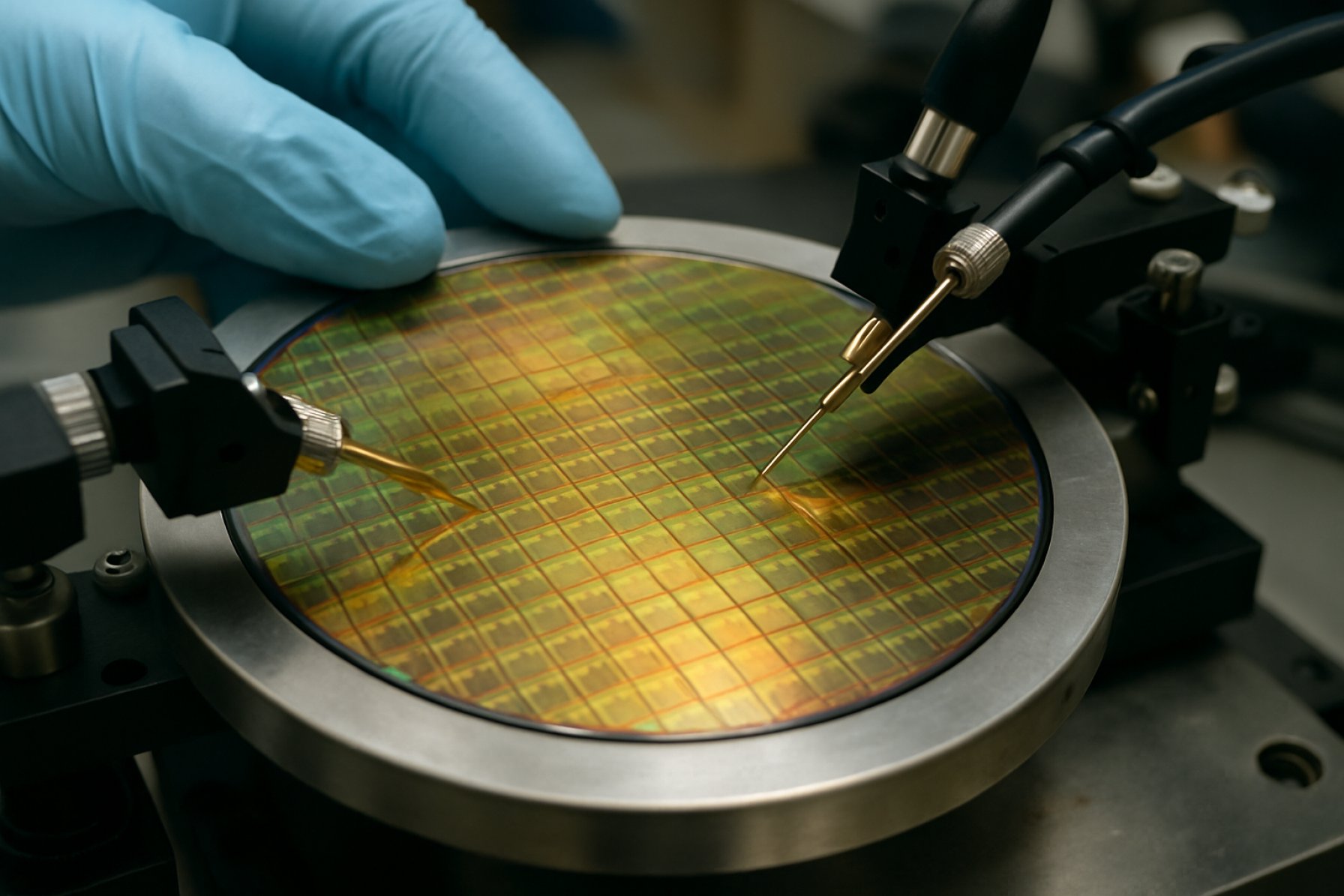

Fabrication Process Innovations and Yield Optimization

The fabrication of wide-bandgap (WBG) semiconductor devices—primarily silicon carbide (SiC) and gallium nitride (GaN)—is undergoing rapid innovation in 2025, driven by surging demand for high-efficiency power electronics in automotive, industrial, and renewable energy sectors. Key process advancements are focused on improving material quality, scaling wafer sizes, and optimizing device yields to meet both performance and cost targets.

A major trend is the transition from 150 mm to 200 mm SiC wafers, which promises significant cost-per-die reductions and higher throughput. Leading manufacturers such as Wolfspeed and onsemi have announced volume production of 200 mm SiC wafers, with Wolfspeed operating the world’s largest dedicated 200 mm SiC fab in New York. This scale-up is enabled by improvements in crystal growth techniques, such as physical vapor transport (PVT), and advanced wafering processes that reduce defect densities and enable higher device yields.

In GaN device fabrication, innovations in epitaxial growth—especially metal-organic chemical vapor deposition (MOCVD)—are enhancing material uniformity and reducing dislocation densities. Companies like Infineon Technologies and NXP Semiconductors are investing in proprietary buffer layer technologies and substrate engineering to further improve device reliability and manufacturability. The adoption of GaN-on-silicon substrates is also gaining traction, as it leverages existing silicon fabs and enables cost-effective scaling.

Yield optimization remains a central challenge, given the sensitivity of WBG devices to crystalline defects and process variations. Advanced in-line metrology and inspection systems are being deployed to detect and mitigate yield-limiting defects early in the process. Advanced Micro-Fabrication Equipment Inc. and KLA Corporation are among the suppliers providing critical process control tools tailored for WBG materials. Additionally, process integration strategies—such as optimized ion implantation, annealing, and surface passivation—are being refined to minimize device variability and maximize performance.

Looking ahead, the next few years will see further automation and digitalization of WBG device fabs, with artificial intelligence and machine learning increasingly applied to process control and yield management. Collaborative efforts between device manufacturers, equipment suppliers, and material producers are expected to accelerate, aiming to standardize processes and further drive down costs. As a result, WBG device fabrication is poised for significant gains in both scale and efficiency, supporting the broader electrification and decarbonization trends across industries.

Major Players and Strategic Partnerships (e.g., cree.com, infineon.com, onsemi.com)

The wide-bandgap (WBG) semiconductor device fabrication sector is experiencing rapid evolution in 2025, driven by surging demand for high-efficiency power electronics in automotive, renewable energy, and industrial applications. The market is shaped by a handful of major players, each leveraging unique technological strengths and forging strategic partnerships to accelerate innovation and scale.

A leading force in silicon carbide (SiC) device manufacturing is Wolfspeed, Inc. (formerly Cree, Inc.), which operates the world’s largest SiC materials and device fabrication facilities. Wolfspeed’s 200mm Mohawk Valley Fab, operational since 2022, is ramping up production in 2025 to meet the exponential growth in electric vehicle (EV) and industrial demand. The company has secured multi-year supply agreements with major automotive OEMs and tier-1 suppliers, including Mercedes-Benz Group AG and ZF Friedrichshafen AG, to deliver SiC power devices for next-generation EV platforms.

Another dominant player, Infineon Technologies AG, is expanding its SiC and gallium nitride (GaN) device portfolio, with significant investments in its Kulim, Malaysia, and Villach, Austria fabs. Infineon’s strategic partnerships with automotive and industrial leaders, such as Hyundai Motor Company and Siemens AG, are focused on integrating WBG devices into e-mobility and smart grid solutions. In 2025, Infineon is also collaborating with equipment suppliers to optimize 200mm wafer processing, aiming to reduce costs and improve device yields.

onsemi is aggressively scaling its SiC device production, having acquired and expanded its own SiC boule growth and wafer fabrication capabilities. The company’s vertically integrated supply chain is a key differentiator, enabling tighter quality control and supply assurance. onsemi’s partnerships with global automotive manufacturers, including Honda Motor Co., Ltd., are accelerating the adoption of SiC MOSFETs and diodes in EV powertrains and charging infrastructure.

Other significant contributors include STMicroelectronics, which is investing in both SiC and GaN device fabrication, and ROHM Co., Ltd., which is expanding its SiC wafer and device production capacity in Japan and Malaysia. Both companies are engaged in collaborations with automotive and industrial partners to co-develop application-specific WBG solutions.

Looking ahead, the next few years will see intensified collaboration between device manufacturers, automotive OEMs, and equipment suppliers. The focus will be on scaling 200mm wafer technology, improving device reliability, and reducing costs to enable mass-market adoption of WBG semiconductors. Strategic partnerships and supply agreements will remain central to securing market share and driving innovation in this dynamic sector.

Market Size, Segmentation, and 2025–2030 CAGR Projections

The global market for wide-bandgap (WBG) semiconductor device fabrication is poised for robust growth between 2025 and 2030, driven by surging demand in electric vehicles (EVs), renewable energy systems, industrial automation, and high-frequency communications. WBG materials—primarily silicon carbide (SiC) and gallium nitride (GaN)—enable devices with higher efficiency, greater power density, and superior thermal performance compared to traditional silicon-based semiconductors.

In 2025, the WBG device fabrication market is expected to surpass $3 billion in annual revenue, with SiC power devices accounting for the largest share, particularly in automotive and industrial power modules. The market is segmented by material (SiC, GaN, others), device type (power transistors, diodes, RF devices), end-use (automotive, industrial, consumer electronics, energy, telecom), and geography. SiC MOSFETs and Schottky diodes are seeing rapid adoption in EV inverters and charging infrastructure, while GaN HEMTs are gaining traction in 5G base stations and fast chargers.

Key industry players are expanding their fabrication capacities to meet escalating demand. Wolfspeed (formerly Cree) is ramping up its 200mm SiC wafer fab in New York, aiming to significantly increase output by 2025. onsemi is investing in vertically integrated SiC production, including crystal growth and device fabrication, to secure supply for automotive and industrial customers. STMicroelectronics is expanding its SiC device manufacturing in Italy and Singapore, targeting both automotive and energy markets. In GaN, Infineon Technologies and NXP Semiconductors are scaling up GaN-on-silicon device production for RF and power applications.

Geographically, Asia-Pacific leads in both demand and manufacturing capacity, with significant investments from companies such as ROHM Semiconductor (Japan) and Toshiba (Japan), as well as Chinese entrants expanding domestic SiC and GaN fabrication. North America and Europe are also increasing investments, driven by EV adoption and energy transition policies.

Looking ahead, the WBG semiconductor device fabrication market is projected to grow at a compound annual growth rate (CAGR) of 20–25% from 2025 to 2030. This expansion is underpinned by aggressive electrification targets, grid modernization, and the proliferation of high-efficiency power electronics. As fabrication technologies mature and economies of scale are realized, WBG devices are expected to penetrate broader applications, further accelerating market growth.

Application Trends: Automotive, Power Electronics, and Renewable Energy

Wide-bandgap (WBG) semiconductor device fabrication is rapidly advancing in 2025, driven by surging demand in automotive, power electronics, and renewable energy sectors. Silicon carbide (SiC) and gallium nitride (GaN) are the leading WBG materials, offering superior efficiency, higher voltage operation, and thermal stability compared to traditional silicon devices. These advantages are critical for next-generation electric vehicles (EVs), fast-charging infrastructure, and grid-tied renewable energy systems.

In the automotive sector, the shift toward electrification is accelerating the adoption of SiC-based power modules for traction inverters and onboard chargers. Major automotive OEMs and Tier 1 suppliers are collaborating with semiconductor manufacturers to secure WBG device supply and co-develop application-specific solutions. For example, Infineon Technologies AG has expanded its SiC device production capacity and is supplying SiC MOSFETs for leading EV platforms. Similarly, onsemi has ramped up its vertically integrated SiC supply chain, including wafer production, device fabrication, and module assembly, to meet growing automotive demand.

In power electronics, WBG devices are enabling more compact, efficient, and reliable power conversion systems. Industrial motor drives, data center power supplies, and high-voltage DC transmission are increasingly adopting SiC and GaN transistors to reduce energy losses and system size. Wolfspeed, Inc. (formerly Cree) is a key player, operating one of the world’s largest SiC wafer fabs and supplying discrete devices and power modules for industrial and renewable energy applications. ROHM Semiconductor is also expanding its SiC device portfolio, targeting both automotive and industrial markets.

Renewable energy systems, particularly solar inverters and wind turbine converters, are leveraging WBG semiconductors to boost conversion efficiency and power density. This trend is expected to intensify as global renewable energy installations accelerate. Companies like STMicroelectronics are investing in both SiC and GaN device fabrication, with a focus on high-efficiency power conversion for solar and energy storage systems.

Looking ahead, the next few years will see continued investment in WBG device fabrication capacity, with several new 200mm SiC wafer fabs coming online. Industry leaders are also working to improve wafer quality, yield, and cost-effectiveness, which will further drive adoption across automotive, power electronics, and renewable energy sectors. As WBG device manufacturing matures, the technology is poised to become mainstream in high-performance, energy-critical applications worldwide.

Supply Chain Dynamics and Raw Material Sourcing

The supply chain dynamics and raw material sourcing for wide-bandgap (WBG) semiconductor device fabrication are undergoing significant transformation as the industry scales up to meet surging demand in electric vehicles, renewable energy, and high-frequency communications. WBG materials, primarily silicon carbide (SiC) and gallium nitride (GaN), require specialized substrates and precursors, making their supply chains more complex and sensitive compared to traditional silicon-based semiconductors.

In 2025, the SiC supply chain is characterized by a limited number of vertically integrated players who control the entire process from crystal growth to wafer fabrication. Wolfspeed (formerly Cree) is a global leader in SiC materials and devices, operating the world’s largest SiC materials facility in North Carolina. The company is expanding its capacity with a new 200mm SiC wafer fab, aiming to address the acute shortage of high-quality SiC substrates. Similarly, onsemi has invested heavily in SiC boule growth and wafer processing, acquiring facilities in the US and Czech Republic to secure its supply chain and support automotive and industrial customers.

On the GaN front, the supply chain is more distributed, with key players such as Infineon Technologies and NXP Semiconductors focusing on GaN-on-silicon and GaN-on-SiC technologies for RF and power applications. These companies source GaN epitaxial wafers from specialized suppliers and have established partnerships to ensure a stable flow of high-purity raw materials. The availability of high-quality GaN substrates remains a bottleneck, prompting investments in new crystal growth techniques and recycling processes.

Raw material sourcing for both SiC and GaN is challenged by the need for ultra-high purity precursors such as silane, ammonia, and specialty gases. Suppliers like Air Liquide and Linde are expanding their specialty gas production and purification capabilities to support the growing WBG market. Additionally, geopolitical factors and export controls on critical minerals (e.g., gallium, which is subject to export restrictions from China) are prompting manufacturers to diversify sourcing and invest in domestic supply chains.

Looking ahead, the next few years will see continued vertical integration, capacity expansion, and strategic partnerships as companies seek to secure reliable access to WBG materials. The industry is also exploring recycling and circular economy approaches to mitigate raw material risks and reduce environmental impact. As demand for WBG devices accelerates, robust and resilient supply chains will be essential to support the next wave of semiconductor innovation.

Regulatory Standards and Industry Initiatives (e.g., ieee.org, semiconductors.org)

The regulatory landscape and industry initiatives surrounding wide-bandgap (WBG) semiconductor device fabrication are rapidly evolving as these materials—primarily silicon carbide (SiC) and gallium nitride (GaN)—move into mainstream power electronics, automotive, and industrial applications. In 2025, the focus is on harmonizing standards, ensuring supply chain security, and fostering innovation while addressing environmental and safety concerns.

Key industry bodies such as the IEEE and the SEMI are at the forefront of developing and updating technical standards for WBG device fabrication. The IEEE continues to expand its portfolio of standards, including those for reliability testing, qualification procedures, and performance metrics specific to SiC and GaN devices. These standards are critical for ensuring interoperability and safety as WBG devices are increasingly adopted in electric vehicles (EVs), renewable energy systems, and high-frequency communications.

SEMI, representing the global electronics manufacturing supply chain, has intensified its focus on WBG materials through its International Standards Program. In 2024 and 2025, SEMI has prioritized the development of consensus-based standards for wafer specifications, cleanliness, and traceability for SiC and GaN substrates. These efforts aim to reduce variability in device performance and improve yields, which are essential for scaling up production and meeting the surging demand from automotive and industrial sectors.

On the regulatory front, governments in the United States, Europe, and Asia are implementing policies to secure domestic WBG semiconductor supply chains and encourage local manufacturing. The Semiconductor Industry Association (SIA) has been actively advocating for increased federal investment in WBG R&D and manufacturing incentives, citing the strategic importance of these materials for energy efficiency and national security. In parallel, environmental regulations are being updated to address the unique waste streams and chemical processes associated with SiC and GaN fabrication, with industry groups collaborating to develop best practices for recycling and safe disposal.

Industry alliances, such as the PowerAmerica Institute, are also playing a pivotal role by bringing together manufacturers, academic institutions, and government agencies to accelerate the commercialization of WBG technologies. These initiatives are expected to yield new guidelines for device qualification and reliability, further supporting the adoption of WBG devices in mission-critical applications.

Looking ahead, the next few years will see continued convergence of international standards, increased regulatory scrutiny, and deeper collaboration across the WBG value chain. These efforts are poised to enhance device reliability, streamline global trade, and ensure that the rapid growth of WBG semiconductor fabrication proceeds in a safe, sustainable, and secure manner.

Challenges: Cost, Scalability, and Reliability

The fabrication of wide-bandgap (WBG) semiconductor devices—primarily those based on silicon carbide (SiC) and gallium nitride (GaN)—faces persistent challenges in cost, scalability, and reliability as the industry moves through 2025 and into the coming years. These challenges are central to the broader adoption of WBG devices in automotive, industrial, and renewable energy sectors.

Cost remains a significant barrier. The production of high-quality SiC and GaN substrates is inherently more expensive than traditional silicon due to complex crystal growth processes and lower material yields. For example, SiC wafers require high-temperature sublimation and precise defect control, leading to higher costs per wafer. Leading manufacturers such as Wolfspeed and onsemi have invested heavily in expanding 200mm SiC wafer production, aiming to reduce costs through economies of scale. However, as of 2025, the price gap between SiC/GaN and silicon devices remains substantial, though incremental reductions are expected as manufacturing capacity increases and yields improve.

Scalability is closely tied to cost. The transition from 150mm to 200mm wafers is underway, with companies like STMicroelectronics and Infineon Technologies ramping up 200mm SiC wafer production lines. This shift is critical for meeting the surging demand from electric vehicle (EV) and industrial power markets. However, scaling up introduces new challenges, such as maintaining low defect densities and uniformity across larger wafers. The industry is also investing in advanced epitaxy and wafering technologies to address these issues, but full maturity and widespread availability of high-quality, large-diameter wafers are not expected until the latter half of the decade.

Reliability is another key concern, especially for automotive and grid applications where device failure can have severe consequences. WBG devices are susceptible to unique failure mechanisms, such as gate oxide degradation in SiC MOSFETs and dynamic on-resistance in GaN HEMTs. Companies like ROHM Semiconductor and NXP Semiconductors are actively developing new device architectures and packaging solutions to enhance reliability, including advanced passivation layers and robust gate structures. Industry-wide qualification standards are also evolving, with organizations such as JEITA and AEC updating guidelines to reflect the specific needs of WBG technologies.

Looking ahead, the outlook for WBG device fabrication is cautiously optimistic. While cost, scalability, and reliability challenges persist, ongoing investments by major industry players and the rapid expansion of manufacturing infrastructure are expected to drive steady improvements. The next few years will be pivotal as the industry seeks to balance performance gains with manufacturability and affordability, ultimately enabling broader adoption of WBG semiconductors across critical applications.

Future Outlook: Disruptive Opportunities and Investment Hotspots

The future of wide-bandgap (WBG) semiconductor device fabrication is poised for significant disruption and investment, driven by the accelerating demand for high-efficiency power electronics in electric vehicles (EVs), renewable energy, and advanced industrial applications. As of 2025, the industry is witnessing a rapid transition from traditional silicon-based devices to those utilizing silicon carbide (SiC) and gallium nitride (GaN), both of which offer superior performance in terms of breakdown voltage, thermal conductivity, and switching speed.

Key players such as Wolfspeed and onsemi are expanding their SiC wafer and device manufacturing capacities, with Wolfspeed’s 200mm SiC wafer fab in New York and onsemi’s investments in both the US and Czech Republic marking major milestones. These expansions are expected to alleviate supply constraints and enable broader adoption of SiC MOSFETs and diodes in automotive and industrial sectors. Infineon Technologies is also scaling up its WBG production, focusing on both SiC and GaN, and has announced new facilities in Malaysia and Austria to meet surging demand.

In the GaN segment, NXP Semiconductors and STMicroelectronics are investing in high-volume GaN-on-silicon device fabrication, targeting fast-charging, data center, and 5G infrastructure markets. STMicroelectronics, in particular, has entered into strategic partnerships to secure GaN epitaxy and wafer supply, aiming to scale up production for automotive-grade devices.

Investment hotspots are emerging in regions with strong government support and established semiconductor ecosystems. The United States, Europe, and East Asia are leading, with public-private initiatives to localize WBG supply chains and incentivize advanced manufacturing. For example, the US CHIPS Act and the European Chips Act are catalyzing new fabs and R&D centers, while countries like Japan and South Korea are supporting domestic champions and joint ventures.

Looking ahead, disruptive opportunities are expected in vertical integration—where companies control the entire value chain from substrate to finished device—and in the development of 200mm and larger wafers, which promise lower costs and higher yields. Additionally, advances in epitaxial growth, defect reduction, and packaging technologies will be critical for scaling WBG devices into mainstream automotive, grid, and consumer applications. As the ecosystem matures, collaborations between device makers, equipment suppliers, and end-users will accelerate, making WBG semiconductor fabrication a focal point for strategic investment and innovation through the late 2020s.

Sources & References

- Infineon Technologies AG

- STMicroelectronics

- NXP Semiconductors

- ROHM Semiconductor

- Wolfspeed, Inc.

- Semiconductor Industry Association

- Advanced Micro-Fabrication Equipment Inc.

- KLA Corporation

- ZF Friedrichshafen AG

- Hyundai Motor Company

- Siemens AG

- Toshiba

- Air Liquide

- Linde

- IEEE

- JEITA